US equity futures point to a mixed open with NQ lagging following AVGO earnings; Markets await Fed dissenters - Newsquawk US Market Open

- US President Trump said they would help on security with Ukraine, and he thought they were close to a deal.

- US President Trump said that it is going to start on land soon regarding Venezuela; the US is reportedly preparing to seize more ships transporting Venezuelan oil.

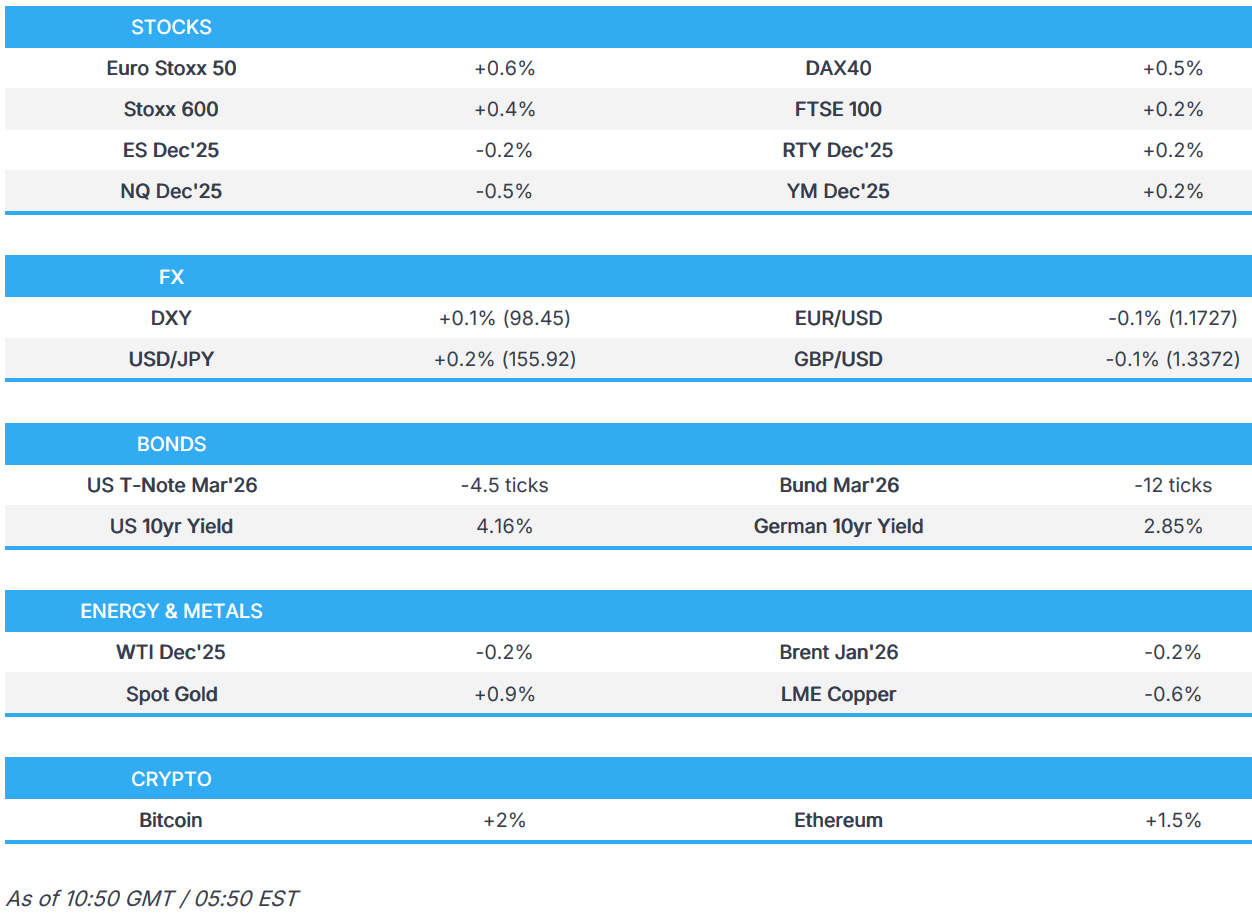

- European bourses are in the green whilst US equity futures are mixed, and with underperformance in the tech-heavy NQ as Broadcom falls 4.9% in post-earnings.

- DXY is a little firmer, GBP incrementally pressured on a poor UK GDP report.

- Global bonds are mildly pressured, scaling back recent upside.

- XAU continues to trend higher above USD 4300/oz; Copper pulling back from another ATH.

- Looking ahead, highlights include Fed's Paulson, Hammack, Goolsbee, Schmid & Miran.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- Indian PM Modi said he had a call with US President Trump on Thursday as New Delhi seeks relief from 50% US tariffs on some of the country's key exports to punish India for its Russian oil purchases.

- Indonesia's chief negotiator to the US said they agree to conclude what had been agreed in July, and Indonesia hopes to conclude tariff negotiations with the US by year-end, while Indonesia will send a delegation to Washington to continue tariff talks soon.

- South Korea's Trade Ministry said rare earth trade talks with China will continue.

- Chinese Commerce Ministry announces export licenses for some steel products, with the license to kick in from January 2026.

- Argentina's Government confirms cut to export tax on grains and by-products, according to the Official Gazette.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.4%) opened mostly firmer and have continued to reside at highs throughout the morning.

- European sectors hold a strong positive bias. Travel & Leisure leads alongside Financial Services, whilst Healthcare lags. For Financials, UBS (+4.3%) shares have hit a 17-year high as traders continue to digest reports that Swiss lawmakers have floated a compromise on new capital rules for the bank.

- US equity futures are mixed, with clear underperformance in the NQ, which has been hampered by post-earnings losses in Broadcom (-4.9% pre-market). Investors were unsettled by the CEO’s comments on the call that the AI order backlog, while large, did not exceed market expectations for the pace and scale of AI revenue growth, according to Bloomberg.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- G10s are modestly mixed vs the Dollar this morning, with very slight underperformance in the JPY, where USD/JPY currently trades at the upper end of a 155.46 to 155.93 range.

- DXY is trading within narrow ranges after declines on Thursday. Today's US docket does not have too much to offer in terms of data; we expect FOMC voters Schmid, Miran and Goolsbee to provide reasoning to their dissents. Currently trades within 98.29-98.44 parameters, trading at session highs at the time of writing; there may be some resistance at its 100DMA at 98.64.

- Despite GDP figures signalling a contraction in growth for October, sterling trades a just touch lower against the USD. GDP data showed continued weakness in production and construction, with the ONS noting JLR was unable to spark a recovery after production was halted in November.

- Elsewhere, the Antipodeans were the outperformers in the G10 FX space amid higher commodity prices, but have since pulled back off their best levels as sentiment wanes a touch.

- PBoC set USD/CNY mid-point at 7.0638 vs exp. 7.0843 (Prev. 7.0686).

FIXED INCOME

- USTs have held a negative bias this morning, attempting to scale back from some of the strength seen post-FOMC, which also sparked a steepening of the curve. Today, US paper is trading at the lower end of a 112-09+ to 112-14 range; there is now a clear path towards the 112-00 mark, should the pressure continue, and then 111-29 thereafter. The data docket ahead is void of any pertinent data, but focus will be on scheduled Fed speak via Paulson, Hammack and Goolsbee – the latter, alongside Miran and Schmid, should release an explanation for their recent dissent also.

- Bunds are following USTs and have held a negative bias throughout the morning. Some modest upticks were seen following the softer-than-expected UK GDP figures, but this ultimately proved fleeting. For the EZ specifically, German/French CPIs were unrevised, whilst Spanish HICP Y/Y was revised a touch higher – no move was seen in the German benchmark, which currently hovers just shy of the 127.50 mark.

- Gilts initially gapped higher by around 11 ticks at open after the UK’s softer-than-expected GDP report, but have since waned following the negative bias seen across global peers. Currently trading at the lower end of a relatively narrow 91.38 to 91.63 range.

COMMODITIES

- Crude benchmarks continue to rebound following Thursday’s selloff on broader market optimism and rising geopolitical tensions between Venezuela and the US. WTI and Brent oscillate in a USD 57.85-58.19/bbl and USD 61.49-61.86/bbl band, respectively, as the European session gets underway. This comes following a bounce from their lows in nearly two months, as equities stateside began to rebound.

- Spot XAU continues to trend higher after breaking out of its 9-day range in Thursday’s session. After peaking at USD 4286/oz in Thursday’s session, XAU spent the APAC session fluctuating in a USD 4265-4284/oz range before extending higher as short positioning continues to unwind.

- 3M LME Copper peaked to another ATH of USD 11.94k/t in the latter part of the APAC session, but has failed to hold onto gains as the European session gets underway. The red metal rallied in Thursday’s session, in line with the broader risk tone, but has pulled back and is currently trading at USD 11.8k/t as participants take profit.

- India Minister says India to start coal export for the first time.

NOTABLE DATA RECAP

- UK GDP Estimate MM (Oct) -0.1% vs. Exp. 0.1% (Prev. -0.1%); GDP Estimate YY (Oct) 1.1% vs. Exp. 1.4% (Prev. 1.1%); Estimate 3M/3M (Oct) -0.1% vs. Exp. 0.0% (Prev. 0.1%)

- UK Services MM (Oct) -0.3% vs. Exp. 0.0% (Prev. 0.2%); UK Services YY (Oct) 1.4% vs. Exp. 1.7% (Prev. 1.7%)

- UK Goods Trade Balance GBP (Oct) -22.542B GB vs. Exp. -19.3B GB (Prev. -18.883B GB, Rev. -18.883B GB); Trade Bal. Non-EU (Oct) -10.255B GB (Prev. -6.816B GB, Rev. -6.816B GB)

- UK Manufacturing Output MM (Oct) 0.5% vs. Exp. 1.0% (Prev. -1.7%); Manufacturing Output YY (Oct) -0.8% vs. Exp. -0.1% (Prev. -2.2%)

- UK Industrial Output YY (Oct) -0.8% vs. Exp. -1.2% (Prev. -2.5%); Output MM (Oct) 1.1% vs. Exp. 0.7% (Prev. -2.0%)

- UK Construction O/P Vol MM (Oct) -0.6% (Prev. 0.2%); O/P Vol YY (Oct) 0.9% vs. Exp. 1.6% (Prev. 1.3%)

- German CPI Final YY (Nov) 2.3% vs. Exp. 2.3% (Prev. 2.3%); Final MM (Nov) -0.2% vs. Exp. -0.2% (Prev. -0.2%)

- Spanish CPI YY Final NSA (Nov) 3.0% vs. Exp. 3.0% (Prev. 3.0%); CPI MM Final NSA (Nov) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

NOTABLE EUROPEAN HEADLINES

- European Commission reportedly considers the second phase of the safe loan scheme for defence projects.

- ECB said it will ask banks to describe what sort of political shock would reduce their CET1 by 300bps.

NOTABLE US HEADLINES

- Fed regional bank presidents were reappointed in a unanimous vote, with new five-year terms beginning March 1st.

- US President Trump posted that "Prices are coming down FAST, Energy, Oil and Gasoline, are hitting five-year lows, and the Stock Market today just hit an All Time High. Tariffs are bringing in Hundreds of Billions of Dollars.

- US President Trump signed an executive order on AI, according to the White House website. Furthermore, a Trump administration aide said the executive order is to make sure AI can operate within a single national framework and that they are taking steps for a single national standard on AI.

- US President Trump said the WSJ has another ridiculous story that China is dominating us, and the world, in the production of electricity related to AI.

- White House said President Trump signed an order to increase oversight of and take action to restore public confidence in the proxy adviser industry.

- US President Trump is expected to push the government to dramatically loosen federal restrictions on marijuana.

- US Treasury Department is reportedly planning more access to corporate tax breaks for R&D, and an announcement may come as soon as next week.

- The US government is to require AI vendors to measure political bias.

- Indiana's Republican-controlled Senate rejected the Congressional redistricting plan backed by President Trump.

GEOPOLITICS

MIDDLE EAST

- White House said a lot of quiet planning is underway for the next phase of the Gaza peace plan, and they will make announcements at an appropriate time.

RUSSIA-UKRAINE

- US President Trump said they would help on security with Ukraine, and he thought they were close to a deal, while he added that there is a meeting on Saturday, and they will attend if they think there is a good chance. Trump also commented that he has spoken to China and Russia about nuclear weapons.

- Kremlin Aide said the US will sooner or later discuss with Moscow the outcome of its discussion with Ukraine, via RIA. Moscow did not revise US proposals after discussing with Ukraine and may "not like a lot of things there".

- Russia's Kremlin, on Ukraine's referendum suggestion, said the whole of Donbass belongs to Russia

OTHER

- US President Trump said that it is going to start on land soon regarding Venezuela.

- US is reportedly preparing to seize more ships transporting Venezuelan oil, in which action would target tankers that may have transported other sanctioned crude such as Iranian, while the seizure has led to a suspension of at least three shipments, according to Reuters sources.

- US Treasury issued fresh Venezuela-related sanctions in which it was reported to have sanctioned Venezuelan President Maduro's nephews and six ships carrying Venezuelan oil.

- US President Trump said he will have to make a couple of phone calls regarding Thailand and Cambodia. It was later reported that Thailand's PM said a call with US President Trump is set for 21.20 local time 14:20GMT/09:20EST.

- China's Military said small Philippine aircraft "invaded" Scarborough Shoal airspace. Monitored, warned forcefully and drove away the aircraft.

CRYPTO

- Bitcoin is a little firmer today and holds just shy of USD 93k, with Ethereum also firmer and holds around USD 3.2k.

APAC TRADE

- APAC stocks were predominantly higher following on from the mostly positive handover from Wall St, where the S&P 500 and DJIA notched record closes, but the Nasdaq lagged on Oracle-related headwinds.

- ASX 200 rallied with mining, materials and financials leading the broad advances, with nearly all sectors in the green.

- Nikkei 225 advanced after Japan's Lower House recently approved the supplementary budget bill, with the index briefly returning to above the 51,000 level before fading some of the gains.

- Hang Seng and Shanghai Comp were somewhat mixed as the Hong Kong benchmark conformed to the upbeat mood in the region, although the mainland lagged despite the recent Central Economic Work Conference where it was stated that China is to make use of RRR and rate cuts flexibly, while China's pledge to implement an appropriately loose monetary policy, implement more proactive fiscal policy, and stabilise the property market with city-specific measures, failed to inspire.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama said they will review various special measures for corporate tax.

- BoJ is likely to maintain its pledge next week to keep raising rates at a pace dependent on how the economy reacts to each increase, according to Reuters sources. Will not release updated estimate on neutral rate, will not use it as the main communication tool on rate hike timing.

- China Industry Ministry said it issued a notice on optimising the import and export supervision measures of lithium thionyl chloride batteries.

- A Japanese Finance Ministry Official said participants at today's primary dealers meeting said a sale reduction of super long JGBs is desirable.

- China prepares as much as USD 70bln in chip sector incentives, according to Bloomberg sources.