US equity futures point to slightly modest gains ahead of the December jobs report and the potential tariff decision by SCOTUS - Newsquawk US Market Open

- US President Trump cancels a second attack on Venezuela, suggesting the two countries “are working well together”.

- US President Trump said companies will spend at least USD 100bln in Venezuela, and he will be meeting oil executives today.

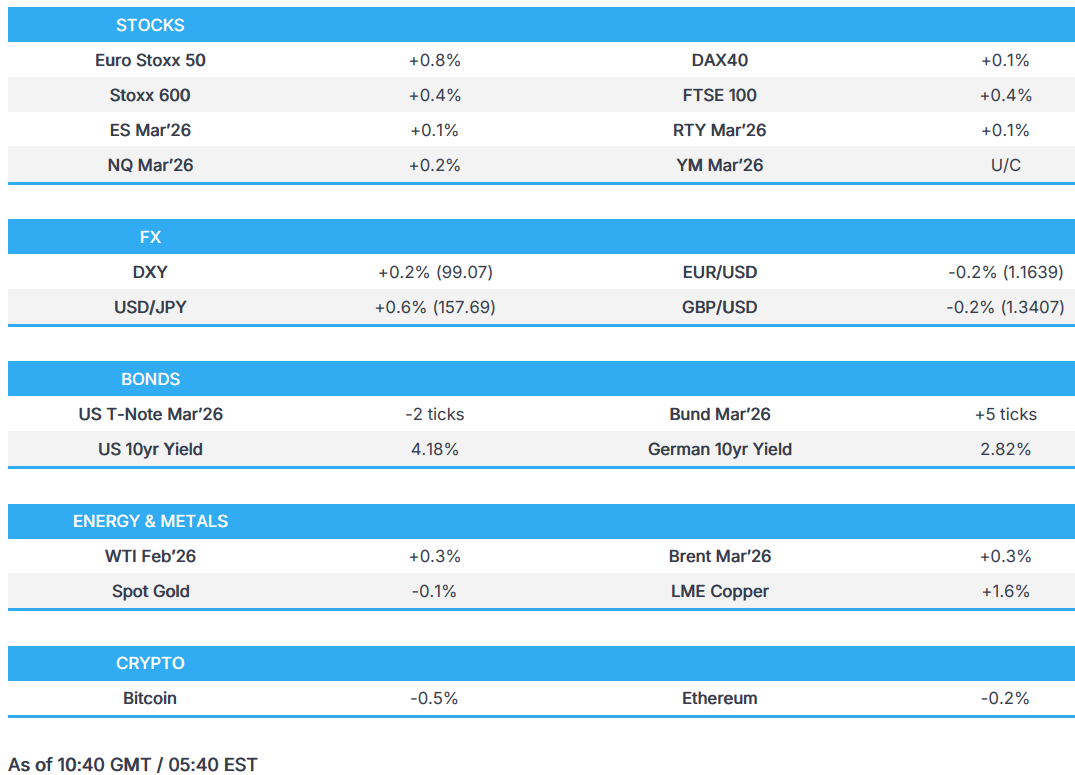

- European equities open firmer; Rio Tinto (-2%) & Glencore (+8%) resume merger talks; US equity futures trade tentatively ahead of NFP.

- DXY moves higher whilst USTs trade steady ahead of key US data; JPY underperforms.

- Crude pares back some of Thursday's gains as Trump cancels a second wave of attacks in Venezuela; spot gold trades sideways.

- Looking ahead, highlights include US Jobs Report (Dec), Potential SCOTUS tariff decision, University of Michigan Sentiment Prelim (Jan), Canadian Jobs Report (Dec), Speakers include ECB's Lane, Fed's Kashkari & Barkin.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 +0.4%) have opened mostly on a strong footing, tracking tailwind from APAC which finished higher after tentative trade during most part of the session.

- European sectors have opened slightly skewed to the green. Basic Resources is boosted by upside in Glencore (+8%) after the Co. and Rio Tinto (-2%) resumed talks on a mining megadeal. Elsewhere, ASML (+4.4%) jumps following strong Q4 TSMC (+0.7% pre-market) earnings, where its revenue jumped 20%.

- US equity futures are lower/flat in the premarket. The RTY (-0.1%) is slightly lower, whilst the NQ, YM and ES are flat. Not much news thus far in the early premarket hours. However, ahead, all eyes will be on the NFP data, a potential Supreme Court ruling and US Michigan Consumer Sentiment Preliminary.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY has been edging higher since APAC trade as traders position for the US jobs report, with the US data yesterday also pointing to no imminent meltdown in the labour market (with the 4-week initial claims average hitting its lowest level since April 2024, while Revelio estimated growth of 71k jobs). Headline nonfarm payrolls are expected to be relatively in line with the prior. Consensus looks for 60k nonfarm payrolls to be added to the economy vs the 64k in November.

- JPY is the laggard amid a double-whammy from the firmer USD alongside net-dovish BoJ sources, via Bloomberg, which suggests BoJ officials are set to keep rates on hold this month, and that officials have no pre-conceptions on the pace of hiking rates. USD/JPY looks set to test a couple of resistance levels (19th Dec high at 157.76 and the 20th Nov peak at 157.89) ahead of 158.00.

- Elsewhere, G10s are broadly lower with the antipodeans among the worst performers despite firmer copper prices and positive risk sentiment, but after Chinese CPI Y/Y missed forecasts. European FX are mildly pressured by the USD with region-specific catalysts on the lighter end. EUR/USD saw no reaction to above-forecast November Retail Sales or commentary from ECB’s newest member Radev, who joined as Bulgaria officially adopted the EUR.

- Click for NY OpEx Details

FIXED INCOME

- A contained session for fixed income as we count down to US NFP.

- Into that, USTs are holding in a narrow 112-05 to 112-12+ band. As it stands, markets ascribe around a 13% chance of a cut in January, with a move not implied until the June meeting, where there are c. 22% implied odds for a hold. For 2026 as a whole, pricing currently looks for the Fed Funds Rate to end the year in a 3.00-3.25% band vs the current 3.50-3.75%, according to CME FedWatch.

- Bunds are also rangebound. No move to the morning's very strong November Industrial Production, a series that was driven primarily by 7.8% M/M growth in autos. That aside, specifics for EGBs are a little light with all eyes on NFP. For the bloc, we await the EU-Mercosur deal vote; it should pass; however, the support of Italy is not guaranteed, but is needed to hit the 'qualified majority' rule. On that point, France is set to vote against the Mercosur deal, as things currently stand with the safeguards.

- China's Finance Ministry sold 10-year bonds with the yield at 1.8627%. Into this, the OAT-Bund 10yr yield spread remains steady around the 70bps mark.

- US FHFA Director Pulte said President Trump's USD 200bln mortgage bond order can be executed quickly and that Fannie Mae and Freddie Mac have cash to buy.

- US President Trump instructing representatives to buy USD 200bln in Mortgage Bonds to drive down mortgage rates and make cost of owning a home more affordable.

COMMODITIES

- Following Thursday’s bid higher, which saw WTI Feb return above USD 58/bbl and Brent Mar briefly topping beyond USD 62/bbl, benchmarks have fallen back lower at the start of Friday’s European session. WTI and Brent extended the lower bound of APAC’s USD 0.55/bbl range to trough at USD 57.62/bbl and USD 61.83/bbl respectively before rebounding to USD 58/bbl and USD 62.20/bbl.

- Spot XAU started the Asia-Pac session on the backfoot, slowly falling from USD 4484/oz to USD 4453/oz, before oscillating in a tight c. USD 25/oz band as the European morning continues as markets await the highly-anticipated NFP report and the potential SCOTUS tariff decision.

- After 2 days of selling from its ATH at USD 13.39k/t, 3M LME Copper has started to rebound from Thursday’s trough of USD 12.52k/t and is currently trading at USD 12.92k/t as the European session continues. The recent selloff in red metal comes amid a selloff in the tech-heavy NQ, with copper being a much-needed material in the semiconductor space.

- Senior Thai Financial Official said they are looking into potential tax measures on gold trading and/or imports.

- US shale chiefs warned that Venezuelan oil will hobble US drillers and that the President’s effort to reduce crude prices will hurt the sector struggling to sustain production growth, according to FT.

- US President Trump said companies will spend at least USD 100bln in Venezuela and he is meeting with oil executives on Friday.

- Marathon Petroleum (MPC) reportedly interested in Venezuelan oil and plans to submit a bid.

- US Interior Secretary Burgum said the US is ending the discount on Venezuelan oil for China. Knocking Russia out of the Venezuelan oil market. Venezuela won't use Russian diluent anymore.

- Russian crude oil production came in at 9.33mln BPD in December, Bloomberg reports; over 100k BPD below November's level due to drone activity and the impact of sanctions.

TRADE/TARIFFS

- US GOP is reportedly pushing ahead to prevent China from getting access to US tech such as chips, via Axios.

- EU decision on Mercosur should come before 16:00GMT, Politico reported. Examination of the safeguard text will begin at around 10:00GMT. Italy is reportedly still weighing how much backlash it can absorb before agreeing to the deal, according to the diplomats cited. Italy continues to edge closer to supporting the agreement.

- Japan's Finance Minister Katayama will meet counterparts in Washington between January 11th to 14th on rare earth supplies.

- US President Trump posted that data shows the US has the lowest trade deficit since 2009, and is going even lower, adds GDP is predicted to come in at over 5%, and success of the country is due to tariffs.

- Japanese food and alcohol products are reportedly seeing customs delays in China, according to Nikkei.

- UK PM Starmer will exclude the City of London from his push for “closer alignment” with the EU, following lobbying by financial services firms against any return to Brussels rule, FT reported.

NOTABLE EUROPEAN DATA RECAP

- EU Retail Sales YoY (Nov) Y/Y 2.3% vs. Exp. 1.6% (Prev. 1.9%, Rev. 1.5%).

- EU Retail Sales MoM (Nov) M/M 0.2% vs. Exp. 0.1% (Prev. 0.3%, Rev. 0%).

- Italian Retail Sales YoY (Nov) Y/Y 1.3% vs. Exp. 1.5% (Prev. 1.3%).

- Italian Retail Sales MoM (Nov) M/M 0.5% vs. Exp. 0.3% (Prev. 0.5%).

- Spanish Industrial Production YoY (Nov) Y/Y 4.5% vs. Exp. 1.0% (Prev. 1.2%).

- French Industrial Production MoM (Nov) M/M -0.1% vs. Exp. 0% (Prev. 0.2%).

- French Household Consumption MoM (Nov) M/M -0.3% vs. Exp. 0.2% (Prev. 0.5%, Rev. 0.4%).

- Hungarian Retail Sales YoY (Nov) Y/Y 2.5% vs. Exp. 2.7% (Prev. 3.1%).

- Norwegian Inflation Rate MoM (Dec) M/M 0.1% vs. Exp. -0.2% (Prev. 0.1%).

- Norwegian Inflation Rate YoY (Dec) Y/Y 3.2% vs. Exp. 3% (Prev. 3.0%, Rev. 3%).

- Norwegian Core Inflation Rate YoY (Dec) Y/Y 3.1% vs. Exp. 3% (Prev. 3.0%, Rev. 3%).

- Norwegian Core Inflation Rate MoM (Dec) M/M 0.1% vs. Exp. -0.2% (Prev. -0.3%).

- Norwegian PPI YoY (Dec) Y/Y -11.4% vs. Exp. -8.6% (Prev. -8.1%).

- Swedish Industrial Production YoY (Nov) Y/Y 4.2% vs. Exp. 6.0% (Prev. 5.9% ).

- Swedish Industrial Production MoM (Nov) M/M -0.1% vs. Exp. 4.5% (Prev. -6.8%, Rev. -6.6%).

- Swedish GDP MoM (Nov) M/M 0.9% vs. Exp. 0.2% (Prev. -0.3%).

- Swedish Construction Output YoY (Nov) Y/Y 1% vs. Exp. 3.0% (Prev. 3.6% ).

- German Industrial Production MoM (Nov) M/M 0.8% vs. Exp. -0.4% (Prev. 1.8%); driven mainly by autos.

- German Balance of Trade (Nov) 13.1B vs. Exp. 16.5B (Prev. 16.9B, Rev. 16.9B).

- German Imports MoM (Nov) M/M 0.8% vs. Exp. 0.2% (Prev. -1.2%).

- German Exports MoM (Nov) M/M -2.5% vs. Exp. 0% (Prev. 0.1%).

CENTRAL BANKS

- BoJ officials are set to keep rates on hold this month, Bloomberg reported citing sources; adds that officials have no preconceptions on the pace of hiking rates. Officials see little need to shift underlying inflation view. Will closely watch impact of weakening JPY. Likely to raise economic growth outlook on stimulus. The Bank is said to weigh downgrade of CPI outlook on government measures.

- ECB's Radev said the current level of rates is appropriate.

- TD is now expecting the RBA to raise rates by 25bps at its next meeting in February.

- Thai Central Bank Chief said gold trading has significant impact on Thai Baht.

NOTABLE US HEADLINES

- US President Trump, on Venezuela, posted "I cancelled the previously expected second Wave of Attacks, which looks like it will not be needed, however, all ships will stay in place for safety and security purposes". Adds at least USD 100bln will be invested in big oil, and will be meeting with those firms today.

- South Korean Finance Ministry said will allow around-the-clock FX trading from July. said: To explore the possibility of joining CPTPP. To bring in various improvements to stock and forex markets for MSCI upgrade. To prepare policy support for semiconductor defence, biopharmaceutical, petrochemical, steel and steel industries. To introduce digital asset spot ETFs. USD 350bln in US investment package is to bolster shipbuilding and nuclear energy sectors.

- US President Trump posted "I will be interviewed by Sean Hannity, NOW! FoxNews. President DJT".

- US Treasury Secretary Bessent said US won't force institutional investors to divest from home buying, also said lowering the suspicious activity report threshold to USD 3,000 and noted probe related to money services businesses in Minnesota.

- Majority of US House voted to support the bill to renew health insurance subsidies for three years.

GEOPOLITICS

RUSSIA-UKRAINE

- Russian drone attack on Kyiv causes explosions and triggers a fire, according to the mayor.

- US Interior Secretary Burgum said the US is ending discount on Venezuelan oil for China. Knocking Russia out of the Venezuelan oil market. Venezuela won't use Russian diluent anymore.

MIDDLE EAST

- Iran Supreme Leader Khamenei said US President Trump should focus on running his own country. Iran won't back down in the face of vandalism. Will not tolerate foreign-backed operatives.

- Iran's Supreme Leader Khamenei is to give a speech about protests momentarily, according to state media.

- Iranian state media claimed that terrorist agents from the US and Israel set fires and sparked violence on the streets amid unrest, according to Sky News.

- Palestinian media reported Israeli raids continue on various areas of the Gaza Strip, according to Sky News Arabia.

- Israel rejected Lebanon's claim that Hezbollah has been disarmed, saying the effort is far from sufficient and that the group is rearming with Iranian support.

OTHERS

- Iran Supreme Leader Khamenei said US President Trump should focus on running his own country. Iran won't back down in the face of vandalism. Will not tolerate foreign-backed operatives.

- China's Foreign Ministry, on US President Trump's remarks on Taiwan, said there is no room for any external interference and the issue is purely an internal matter.

- Iranian state media claimed that terrorist agents from the US and Israel set fires and sparked violence on the streets amid unrest, according to Sky News.

- South Korea's Blue House said President Lee and Japanese PM Takeichi are to discuss regional peace and stability and rapidly changing global politics, while the sides may discuss China-Japan disputes at their summit next week.

- US President Trump said they will start hitting cartels on land and he has asked Venezuela to free political prisoners.

- Palestinian media reported Israeli raids continue on various areas of the Gaza Strip, according to Sky News Arabia.

- Israel rejected Lebanon's claim that Hezbollah has been disarmed, saying the effort is far from sufficient and that the group is rearming with Iranian support.

- Russian drone attack on Kyiv causes explosions and triggers a fire, according to the mayor.

CRYPTO

- Bitcoin trades steady around the USD 90k mark.

APAC TRADE

- APAC stocks followed suit to the mixed performance on Wall Street with the regional bourses predominantly in the green, albeit with traders bracing for the US Non-Farm Payrolls report and a potential Supreme Court's ruling on tariffs.

- ASX 200 was ultimately flat as strength in energy and consumer stocks was offset by losses in financials, tech and mining, while Rio Tinto shares fell by more than 6% after reports that the Co. and Glencore revived merger talks.

- Nikkei 225 outperformed following the stronger-than-expected Household Spending data from Japan, which showed surprise Y/Y growth of 2.9% (exp. -0.9%), while the gains were led by index heavyweight Fast Retailing after it posted higher profits and upgraded its guidance.

- Hang Seng and Shanghai Comp were indecisive after mixed inflation data from China and the substantial weekly liquidity drain by the PBoC, while there was a mixed reaction in tech stocks following reports that China is to approve some NVIDIA (NVDA) H200 purchases as soon as this quarter.

NOTABLE ASIA-PAC HEADLINES

- Japan megabanks are to jointly lend USD 1.5bln to the Saudi government.

- Capital Economics said regarding China's inflation that the recent pickup in consumer inflation in China was driven by temporary factors like weather-related food price hikes and not successful policy measures. said:With these disruptions easing, headline inflation could turn negative again.

- South Korea's Blue House said President Lee and Japanese PM Takeichi are to discuss regional peace and stability and rapidly changing global politics, while the sides may discuss China-Japan disputes at their summit next week.

- China's Vice Premier Ding Xuexiang met with Disney's (DIS) CEO in Beijing and said they welcome companies to invest in China, according to Xinhua.

- Mediatek (2454 TT) 2025 Revenue +12.3% Y/Y.

- Acer (2353 TT) - FY25 (TWD): Revenue 28.5bln (prev. 24.5bln Y/Y).

- TSMC (2330 TT) December (TWD) rev. 335.0bln (prev. 343.6bln M/M), 2025 rev. rose 32% Y/Y to 3.81tln.

NOTABLE APAC DATA RECAP

- Japanese Coincident Index Prel (Nov) 115.2 vs. Exp. 116.2 (Prev. 115.9).

- Japanese Leading Economic Index Prel (Nov) 110.5 vs. Exp. 110.4 (Prev. 109.8).

- Japanese Foreign Exchange Reserves (Dec) 1369.8B (Prev. 1359.4B).

- Japanese Household Spending MoM (Nov) M/M 6.2% vs. Exp. 2.7% (Prev. -3.5%).

- Japanese Household Spending YoY (Nov) Y/Y 2.9% vs. Exp. -0.9% (Prev. -3.0%).

- Chinese Inflation Rate YoY (Dec) Y/Y 0.8% vs. Exp. 0.9% (Prev. 0.7%).

- Chinese Inflation Rate MoM (Dec) M/M 0.2% vs. Exp. 0.0% (Prev. -0.1%).

- Chinese PPI YoY (Dec) Y/Y -1.9% vs. Exp. -2% (Prev. -2.2%).