US indices re-open in the red, hit by EU-US tensions - Newsquawk Newsquawk Asia-Pac Market Open

- US President Trump will not travel to Paris for the emergency G7 summit, according to a White House official.

- US Southern Command announced and published footage of its seventh boarding and seizure of a sanctioned crude oil tanker, reportedly the Liberian-flagged, in the Caribbean Sea.

- US indices saw losses as participants returned from the US market holiday, with sentiment continuing to be hit by the ever-growing EU-US tensions.

- JPY underperformed G10 currencies despite trade uncertainty diminishing USD attractiveness, as concerns grew over fiscal sustainability ahead of the upcoming snap election.

- Looking ahead, highlights include Australian Westpac Leading Index (Dec).

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US indices saw losses as participants returned from the US market holiday, with sentiment continuing to be hit by the ever-growing EU-US tensions, and how Trump wants Greenland. Trump threatened to impose 200% tariffs on French wines and champagne following France's intention to decline the invitation to join his 'Board of Peace’. Further, a White House official said the President will not travel to Paris for the emergency G7 summit. Davos World Economic Forum is currently ongoing with highlights on Wednesday, including several Trump appearances and NVIDIA CEO Huang.

- All sectors, aside from Staples, were in the red with mega-cap sectors Tech, Discretionary, and Communications the laggards, and all Mag-7 names in the red. Micron (MU) (+0.8%) was one of the sole points of green and seemingly buoyed by a couple of PT upgrades.

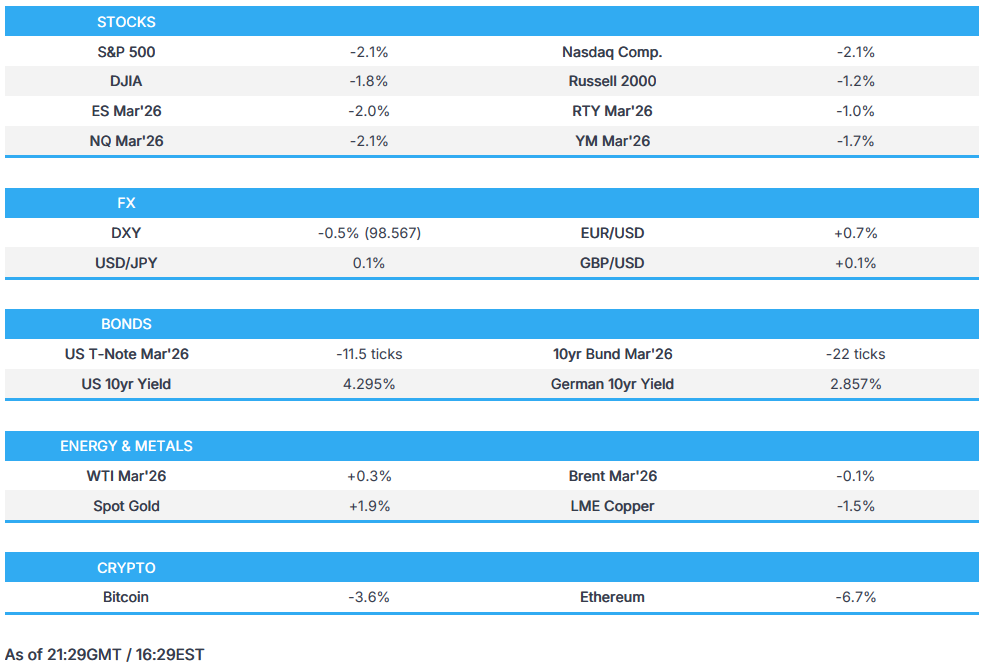

- SPX -2.06% at 6,797, NDX -2.12% at 24,988, DJI -1.76% at 48,489, RUT -1.21% at 2,645.

TARIFFS/TRADE

- US President Trump said the US will not have a trade deficit next year.

- US Commerce Secretary Lutnick doesn't see the European trade deal changing and can disagree with allies, but that doesn’t make them non-allies, speaking to CNBC. Rates are hundreds of basis points too high and if US cut rates 100bps or more, you're going to see the US grow 6% or more.

- USTR Greer announces that he might meet with Chinese officials before Trump's trip to Beijing. On Greenland, he said that Trump's Greenland-related tariff threat is an appropriate use of tariffs. Trump may be setting the stage for negotiations over Greenland. European Union has done nothing to implement the US trade deal. The EU trade deal does not fix US agricultural and regulatory complaints about Europe.

- US Supreme Court does not rule on Trump tariffs today.

- EU's von der Leyen said the EU is close to reaching a historical free trade agreement with India, however there's still room for further negotiations.

NOTABLE US HEADLINES

- US President Trump will not travel to Paris for the emergency G7 summit, according to a White House official.

- US Treasury Secretary Bessent said the NATO alliance has never been more secure; on the way to cutting deficit to 3% of GDP by end of Trump's term; unlikely that SCOTUS will strike down the President's signature economic policies. Rare earths are flowing, as expected and must get out from China's grasp on rare-earths. China has done everything they said they would do. US economy is very strong and growth likely accelerating.

- US Secretary of State Rubio to host inaugural critical minerals meeting on February 4th.

CENTRAL BANKS

- US Treasury Secretary Bessent on new Fed chair said they are four excellent candidates and that an announcement could come as soon as next week.

- ECB's Nagel said German government was right launching large fiscal package; close to price stability target.

- ECB’s Villeroy, speaking at the Davos conference, said the EU should remain calm amid escalating trade tensions, though he stressed that tariffs are bad news for activity. Expects muted inflation effect in Europe. Downside risks in prices are at least as big as the upside. In relation to France, said, recent political developments are a significant step with respect to the deficit but not the whole way.

NOTABLE US EQUITY HEADLINES

- Netflix (NFLX) Q4 2025 (USD): EPS 0.56 (exp. 0.55), Revenue 12.05bln (exp. 11.97bln); to pause buybacks to fund pending Warner Bros. (WBD) deal. Guides Q1 revenue at 12.16bln (exp. 12.17bln) and EPS 0.76 (exp. 0.81). Guides FY26 revenue between 50.7-51.7bln (exp. 50.96bln) and operating margin at 31.5% (exp. 32.4%).

DATA RECAP

- US ADP Employment Change Weekly 8K (Prev. 11.75K).

FX

- Dollar weakness persisted as tensions grew between US President Trump and EU leaders. This time, Trump threatened France with 200% tariffs on its wine/champagne after French President Macron refused to join Trump's Gaza peace board.

- CHF and EUR were preferred liquidity alternatives to USD, with little domestic updates to report. A better-than-expected ZEW reading in Germany had little bearing on EUR/USD, but did see some pressure in Bunds.

- JPY underperformed G10 currencies despite trade uncertainty diminishing USD attractiveness. Concerns grew over fiscal sustainability as participants prepared for the upcoming snap election and commentary surrounding fiscal plans. The move was most present in JGBs, which were slammed. USD/JPY hovered around 158.20

- South Korea is reportedly to hold off on USD 20bln worth of US trade investment, due to KRW impact.

FIXED INCOME

- T-notes steepened as US-EU conflict worsens and JGB downside hit global debt.

- Fitch Ratings said the US credit outlook is broadly benign entering 2026, supported by AI-led capex, easing monetary policy and strong fiscal support.

- US sold USD 85bln of 6-week bills at high rate of 3.63%, B/C 2.42x; sold USD 50bln 52-week bills at high rate of 3.39%, B/C 3.42x.

- US sold USD 86bln of 3-month bills at high-rate 3.590%, B/C 2.84x; sold USD 77bln of 6-month bills at high-rate 3.520%, B/C 2.95x.

- 50k TYH6 contracts called at a 112.5 strike were purchased for 16 ticks vs TYH6 at 111-15+, Bloomberg reported citing traders; a trade that targets the US 10yr yield moving below 4.13%, expiry 20th February.

COMMODITIES

- Oil prices was firmer and saw tailwinds from the temporary suspension of output at Kazakhstan’s oil fields. Kazakh oil producer Tengizchevroil said on Monday it had temporarily halted production at the Tengiz and Korolev oilfields after an issue.

- US President Trump said he is loving Venezuela; oil firms are preparing massive investments in Venezuela.

- US Southern Command announced and published footage of its seventh boarding and seizure of a sanctioned crude oil tanker, reportedly the Liberian-flagged, in the Caribbean Sea.

- Chevron's (CVX) Tengizchevroil cancels loading of five CPC blend oil cargoes scheduled for January to February, according to sources. Co.'s 10-year oil production reportedly remains shut for an additional 7-10 days amid power supply issues.

- NBP said to approve plan to increase gold holdings to 700 tonnes.

- Ports within Libya's oil crescent halted due to bad weather conditions.

- China's Shanghai Futures Exchange to adjust margin requirements and daily price limits for selected copper, aluminium, gold and silver futures contracts from the 22nd of January settlements.

- China’s Shanghai International Energy Exchange has announced plans to adjust margin requirements and price limits for international copper futures related contracts, effective from the January 22 closing settlement.

- China announces plans to expand high-level opening of non-ferrous metals future markets by steadily including eligible futures and options in foreign access.

- China raises both gas and diesel prices by CNY 85 per tonne from the 21st January.

GEOPOLITICAL

MIDDLE EAST

- Norway's PM said he won't join US President Trump's Gaza board of peace.

RUSSIA-UKRAINE

- US President Trump on Ukraine-Russia war, said when Ukraine is ready, Russia is not; when Russia is ready, Ukraine is not.

- Russian envoy Dmitriev said dialogue with US envoys was constructive, and more and more people understand the fairness of the Russian position.

- US Envoy Witkoff said talks with Russian Envoy Dmitriev were "very positive", RIA Novosti reported.

- USTR Greer said inflation's trajectory remains under control and will continue to decline. Europe's reliance on Russian oil is dissonant. US will be a great source of LNG for Europe.

- Ukraine's President Zelensky said there is no deadlock in US-Ukraine talks.

- European Commission President von der Leyen said the bloc's response will be united, proportional and unflinching. The territorial integrity of Greenland is non-negotiable and they will be working on wider Arctic security measures. More on EU-US relations on Greenland, she said that the EU will be working with the US and all partners on wider Arctic security. said she's in full solidarity with Greenland and Denmark, adding that the sovereignty and integrity of their territory is non-negotiable. On Russian frozen assets, she said they are permanently frozen, reserve the right to utilise them.

- Russian Foreign Minister Lavrov said there are no concrete contacts with the US on extending the New START arms treaty or a new deal. On Ukraine, he said they have yet to receive documents following recent US and European talks on Ukraine. He adds that they are ready for contact with the US on Balkans.

- Ukrainian President Zelensky might go to Davos if he has a bilateral meeting with Trump to sign "prosperity deal", via Axios' Ravid report.

- US President Trump posted "the United Kingdom, is currently planning to give away the Island of Diego Garcia..." adds that this "is another in a very long line of National Security reasons why Greenland has to be acquired."

EU-US

- US President Trump said they have lot of meeting scheduled on Greenland and thinks it will work out well. On EU-Greenland tariffs, he doubts EU investments are at risk

- US President Trump, when asked how far he is willing to go to acquire Greenland, said "you'll find out". He added that he gets along with leaders of UK and France; both countries have two problems, immigration and energy.

ASIA-PAC

NOTABLE HEADLINES

- Japanese Finance Minister reiterates that FX intervention remains an option and they are not conducting expansionary policy. Confidence future bond auctions will be successful. Government will engage with the BoJ and other parties to restore confidence in the market. Stabiliser measures have been taken in the last 4 months. Does not see Japan as a canary in the coal mine. Fiscal deficit is smaller amongst other G7 nations.

- Chinese President Xi said he wants to make domestic demand the primary driving force behind economic development.

- Japanese Finance Minister said optimism toward change in Japan is growing with the economy shifting to a growth-orientated one. Aims to invest JPY 330bln in AI and chips. Aims to maintain fiscal sustainability, whilst boosting spending. Should shift away from cost-cutting and instead increase investment to bring in more tax revenue.

- China's Vice Finance Minister said they will study further extension for consumer loan subsidies beyond 2026.

- Japan's Trade Minister Akazawa said Japan remains a buy with PM Takachi's policy.

- Japan's Chief Cabinet Secretary Kihara said long-term rate moves are to be determined by markets; are watching market moves including long-term rates.

- China's Ministry of Commerce guides orderly cross-border supply chains arrangement.

- India's Foreign Secretary signed long-term agreement with UAE for supply of 0.5mln T of LNG per annum and India and UAE to explore partnership in advanced civil nuclear tech. India and UAE aim to double bilateral trade to USD 200bln by 2032.

NOTABLE APAC EQUITY HEADLINES

- CK Hutchison (0001 HK) is in talks to sell its Irish mobile operator to Liberty Global, the FT reported citing sources.

- ByteDance is making a push into China's cloud market, trying to disrupt the industry that has been dominated by Alibaba (BABA / 9988HK) and others, the FT reported.

EU/UK

DATA RECAP

- EU ZEW Expectations (Jan) 40.8 vs Exp. 36.7 (prev. 33.7).

- EU ZEW Economic Sentiment Index (Jan) 40.8 vs. Exp. 35.2 (Prev. 33.7).

- EU Current Account (Nov) 12.6B (Prev. 33B, Rev. 32B).

- EU CPI Final (Dec) 129.54 vs. Exp. 129.56 (Prev. 129.33).

- EU Inflation Rate YoY Final (Dec) Y/Y 1.9% vs. Exp. 2% (Prev. 2.1%).

- EU Inflation Rate MoM Final (Dec) M/M 0.2% vs. Exp. 0.2% (Prev. -0.3%).

- EU Core Inflation Rate YoY Final (Dec) Y/Y 2.3% vs. Exp. 2.3% (Prev. 2.4%).

- German ZEW Economic Sentiment Index (Jan) 59.6 vs. Exp. 50 (Prev. 45.8).

- German ZEW Expectations (Jan) 59.6 vs. Exp. 50.0 (prev. 45.8).

- German ZEW Current Conditions (Jan) -72.7 vs. Exp. -75.5 (Prev. -81.0).

- German PPI MoM (Dec) M/M -0.2% vs. Exp. -0.2% (Prev. 0.0%).

- German PPI YoY (Dec) Y/Y -2.5% vs. Exp. -2.4% (Prev. -2.3%).

- Swiss Producer & Import Prices YoY (Dec) Y/Y -1.8% (Prev. -1.6%).

- Swiss Producer & Import Prices MoM (Dec) M/M -0.2% vs. Exp. 0.2% (Prev. -0.5%).

- UK Employment Change (Nov) 82K vs. Exp. 27K (Prev. -16K).

- UK Average Earnings incl. Bonus (3Mo/Yr) (Nov) 4.7% vs. Exp. 4.6% (Prev. 4.8%, Rev. 4.7%).

- UK Average Earnings excl. Bonus (3Mo/Yr) (Nov) 4.5% vs. Exp. 4.5% (Prev. 4.6%).

- UK Claimant Count Change (Dec) 17.9K vs. Exp. 15.6K (Prev. -3.3K, Rev. 20.1K).

- UK HMRC Payrolls Change (Dec) -43K (Prev. -38K).

- UK Unemployment Rate (Nov) 5.1% vs. Exp. 5% (Prev. 5.1%). ONS “the number of employees on payroll has fallen again…” and “Meanwhile unemployment remains at the rate reported last month, up on the quarter and the year”.