Putrid Payrolls: Job Growth Collapses To Just 22K, Unemp Rate Rises To 4.3% Putting 50bps Rate Cut In Play

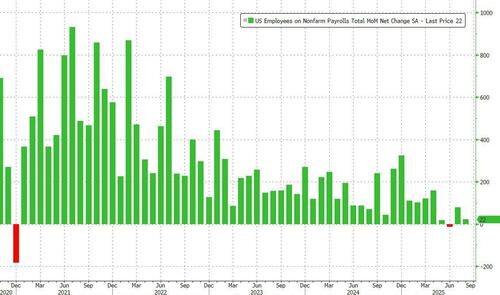

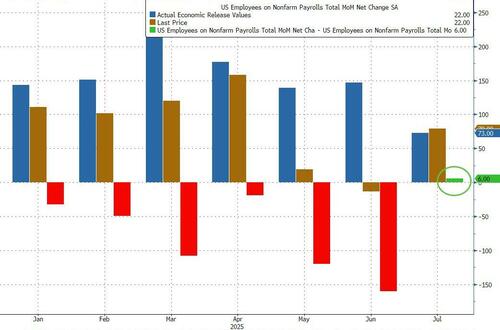

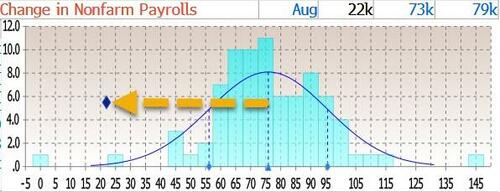

Ahead of today's jobs report, consensus was that a print between 40K and 100K is largely priced in and greenlighting a 25bps rate cut by the Fed in two weeks, and that we would need a real outlier number for the Fed to either cut 50bps... or not hike. Well, we got a real outlier when moments ago the BLS reported that in August the US added only 22K jobs, a big drop from the upward revised 79K (from 73K previously) but more importantly June was revised from 27K to -13K, ushering in the first negative jobs print since 2020.

With these revisions, employment in June and July combined is 21,000 lower than previously reported, continuing to trend of negative revisions into a labor market slowdown.

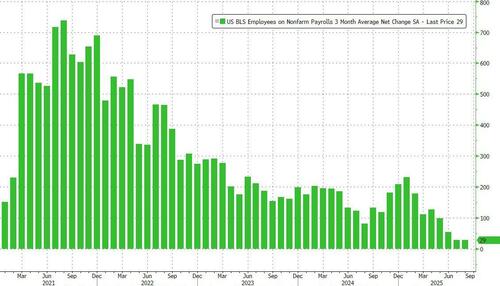

The revisions pushed the 3-month average jobs print to just 29K, which however was a tiny improvement from the 28K in July.

Just as importantly, the payrolls number came in far below Wall Street estimates of a 75K print. In fact, it was higher than just one of the 80 estimates provided to Bloomberg.

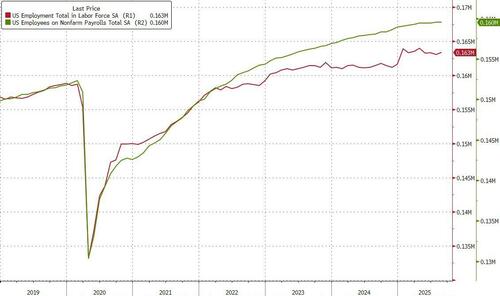

The household survey was not quite so bad, and in fact the number of employed workers rose by 288K to 163.394MM, the biggest increase since April.

Yet despite the modest improvement in the Household survey measure of Employed workers, the number is still below the April 2025 high.

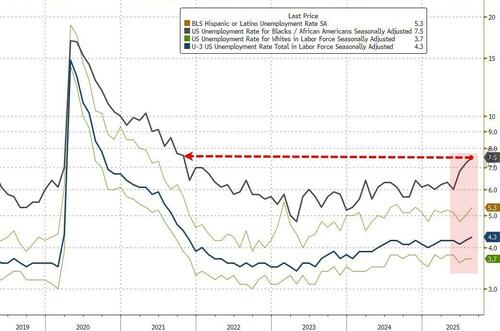

The number of unemployed workers also increased, rising from 7.236MM to 7.384MM, and with the labor force increasing to 170.778MM, it meant the unemployment rate also rose to 4.3% (4.324% to be precise) from 4.2%, in line with expectations. Among major groups, the unemployment rates for blacks rose to 7.5%, the highest since 2021; All other unemployment rates also rose modestly: Whites (3.7 percent), Asians (3.6 percent), and Hispanics (5.3 percent).

At the same time, the participation rose modestly to 62.3% from 62.2%, reversing last month's drop to the lowest level in three years; the employment-population ratio was unchanged at 59.6 percent. Both measures have declined by 0.4 percentage point over the year.

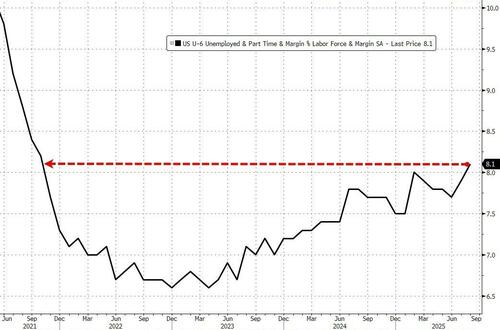

And while U3 unemployment came in line, U6 or underemployment was far worse, rising to 8.1%, the highest since Oct 2021

Looking at hourly earnings, while the sequential change came in as expected, increasing by 0.3%, same as last month and as expected, the annual increase of 3.7% was a drop from 3.9% last month and below the 3.8% estimate.

The average workweek for all employees on private nonfarm payrolls was 34.2 hours for the third month in a row. In manufacturing, the average workweek edged down to 40.0 hours, and overtime remained unchanged at 2.9 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.7 hours in August.

But to get to the ugliest component of today's jobs report one had to dig deeper, only then one would find that the number of full-time jobs tumbled by 357K, the second consecutive month of sharp full-time job losses... while part-time jobs surged by 597K, the biggest increase since February.

It gets worse: after making some modest improvements in recent months, the number of native born workers tumbled by 561K to 132.474 million; this was the biggest drop since August 2024. At the same time foreign born workers increased by 50K, the first increase since March.

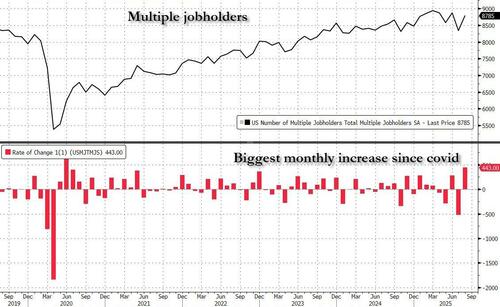

Last but not least, the number of multiple jobholders unexpectedly soared by over 443K to 8.785 million. This was the biggest monthly increase since Covid, and clearly yet another indication of just how bad the jobs report is.

Here are some more details about today's jobs report:

- Among the unemployed, the number of new entrants decreased by 199,000 in August to 786,000, largely offsetting an increase in the prior month. New entrants are unemployed people who are looking for their first job.

- The number of long-term unemployed (those jobless for 27 weeks or more) changed little at 1.9 million in August but has increased by 385,000 over the year. In August, the long-term unemployed accounted for 25.7 percent of all unemployed people.

- The number of people employed part time for economic reasons, at 4.7 million, changed little in August. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of people not in the labor force who currently want a job, at 6.4 million, changed little in August but was up by 722,000 over the year. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force changed little at 1.8 million in August. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, also changed little over the month at 514,000.

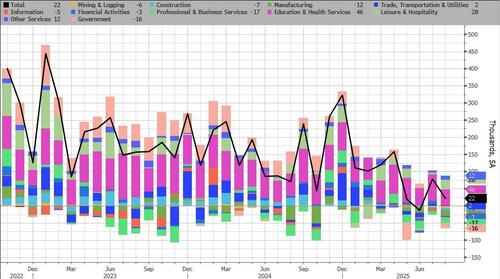

Finally, looking at the composition of the August jobs, the BLS notes that a modest gain in health care was partially offset by losses in federal government and in mining, quarrying, and oil and gas extraction.

- In August, health care added 31,000 jobs, below the average monthly gain of 42,000 over the prior 12 months. Employment continued to trend up over the month in ambulatory health care services (+13,000), nursing and residential care facilities (+9,000), and hospitals (+9,000).

- Employment in social assistance continued to trend up in August (+16,000), reflecting continued job growth in individual and family services (+16,000).

- Federal government employment continued to decline in August (-15,000) and is down by 97,000 since reaching a peak in January.

- In August, employment in mining, quarrying, and oil and gas extraction declined by 6,000, after changing little over the prior 12 months.

- Wholesale trade employment continued to trend down in August (-12,000) and has fallen by 32,000 since May.

- Manufacturing employment changed little in August (-12,000) but is down by 78,000 over the year. Employment in transportation equipment manufacturing declined by 15,000 over the month, in part due to strike activity.

- Employment showed little change over the month in other major industries, including construction, retail trade, transportation and warehousing, information, financial activities, professional and business services, leisure and hospitality, and other services.

And visually:

Putting it all together, this was easily the ugliest jobs report we have seen since covid (relative to expectations), and it seems to have had two intentions: i) kitchen-sink the jobs numbers (especially with next week's upcoming annual jobs revisions) and ii) cement a 25bps rate cut and put a 50bps rate cut in play. Judging by the market reaction...

Rate-Cut Odds Surge After Soft Labor Signals; Here's What Wall Street Thinks... https://t.co/5gzuYqgO7z

— zerohedge (@zerohedge) September 5, 2025

... it achieved both.