US PMIs Plunge To 6-Month Lows In December

With 'soft' survey data slumping during (and after) the government shutdown...

...this morning's preliminary December PMIs are not helping as both S&P Global's Manufacturing and Services surveys disappointed.

US Manufacturing PMI fell from 52.2 to 51.8 (worse than the 52.1 expected) - 5 month low

US Services PMI fell from 54.1 to 52.9 (worse than the 54.0 expected) - 6 month low

And all that in spite of 'solid' hard data...

Source: Bloomberg

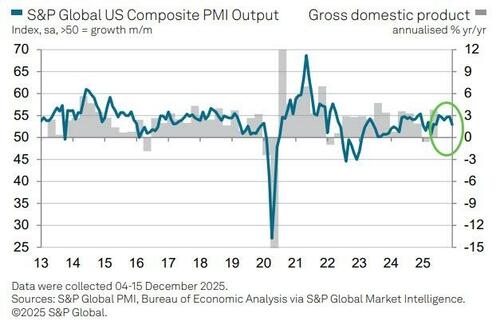

The headline S&P Global US PMI Composite Output Index fell to 53.0 in December from 54.2 in November, according to the 'flash' reading (based on about 85% of usual survey responses).

“The flash PMI data for December suggest that the recent economic growth spurt is losing momentum," says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Although the survey data point to annualized GDP expansion of about 2.5% over the fourth quarter, growth has now slowed for two months."

The latest reading was the lowest since June, though continues to indicate robust economic growth. Output has now risen continually for 35 months.

Despite the decline, US PMIs remain well above the rest of the world...

With new sales growth waning especially sharply in the lead up to the holiday season, Williamson notes that "economic activity may soften further as we head into 2026."

The signs of weakness are also broad-based, with a nearstalling of inflows of work into the vast services economy accompanied by the first fall in factory orders for a year.

"While manufacturers continue to report higher output, lower sales point to unsustainable production levels which will need to be lowered unless demand revives in the new year.

Service providers reported one of the slowest months for sales growth since 2023. "

Firms have also lost some confidence in the outlook and have restricted their hiring in December in accordance with the more challenging business environment.

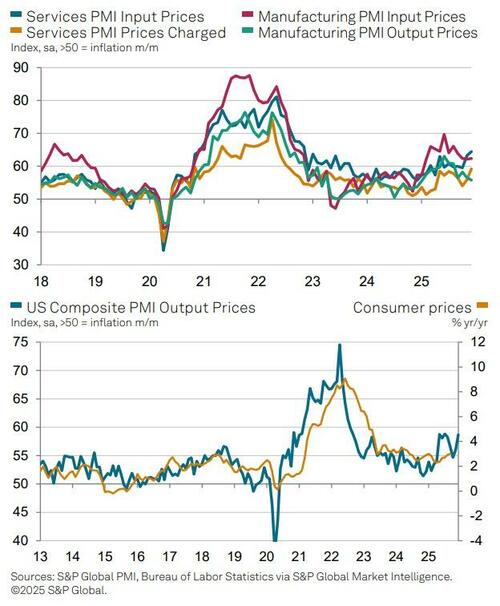

"A key concern is rising costs, with inflation jumping sharply to its highest since November 2022, which fed through to one of the steepest increases in selling charges for the past three years. "

Higher prices are again being widely blamed on tariffs, according to Williamson, with an initial impact on manufacturing now increasingly spilling over to services to broaden the affordability problem.