US stocks clawed back early losses despite ongoing trade uncertainty and soft data - Newsquawk Asia-Pac Market Open

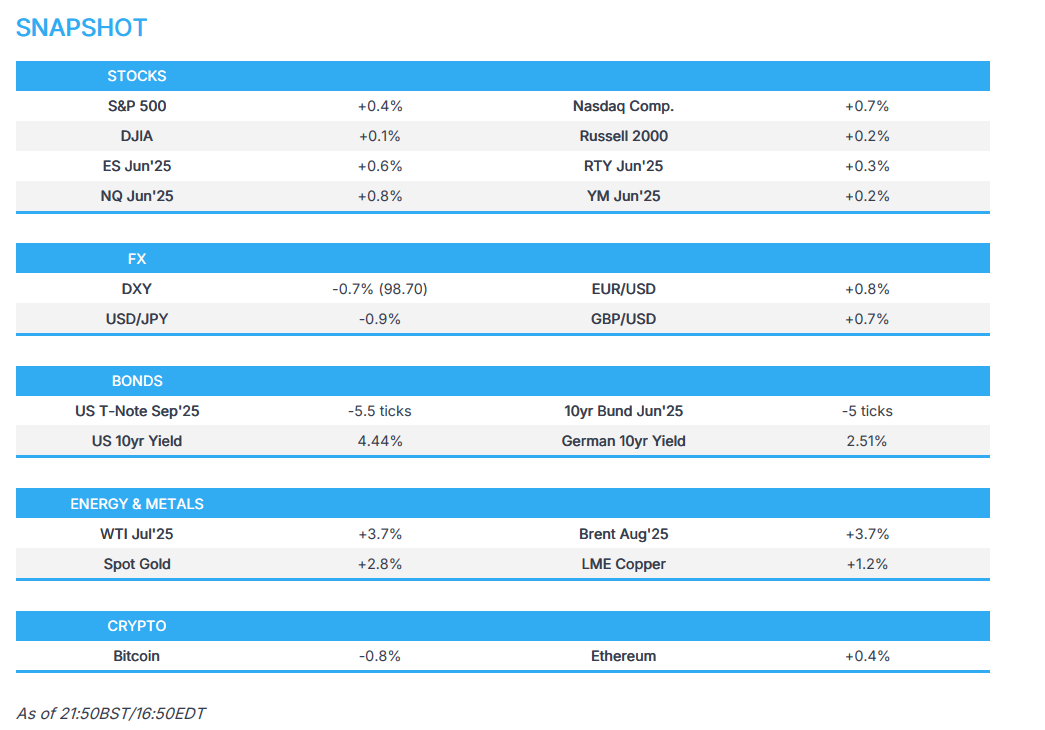

- US stocks ultimately closed the session in the green with the Nasdaq leading the gains as outperformance in the tech sector kept indices bid once cash equity trade was underway, while energy stocks were also supported following the OPEC+ 8 decision and geopolitical escalation over the weekend including Ukraine's strike on Russian bombers with drones well inside of Russia and Iran dismissing the US proposal for a nuclear deal as "imaginary".

- USD saw hefty losses to start the week on continued trade uncertainty following the punchy rhetoric seen between the US and China since Friday, alongside Trump upping the blanket steel and aluminium tariffs to 50% from 25%. On the data footing, ISM Mfg. largely underwhelmed while Construction Spending also disappointed, although the Atlanta Fed GDPNow was upgraded to 4.6% from 3.8%.

- Looking ahead, highlights include South Korean CPI, Japanese Monetary Base, Australian Current Account & Net Exports Contribution, Chinese Caixin Manufacturing PMI, RBA Minutes, Supply from Australia & Japan, South Korean Markets are Closed for the Presidential Election.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include South Korean CPI, Japanese Monetary Base, Australian Current Account & Net Exports Contribution, Chinese Caixin Manufacturing PMI, RBA Minutes, Supply from Australia & Japan, South Korean Markets are Closed for the Presidential Election.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks ultimately closed the session in the green with the Nasdaq leading the gains as outperformance in the tech sector kept indices bid once cash equity trade was underway, while energy stocks were also supported following the OPEC+ 8 decision and geopolitical escalation over the weekend including Ukraine's strike on Russian bombers with drones well inside of Russia and Iran dismissing the US proposal for a nuclear deal as "imaginary".

- SPX +0.41% at 5,936, NDX +0.71% at 21,492, DJI +0.08% at 42,305, RUT +0.19% at 2,070.

- Click here for a detailed summary.

TARIFFS/TRADE

- US reportedly extends tariff pause on some Chinese goods to August 31st, according to Bloomberg.

- US President Trump's administration wants countries' "best offer" by Wednesday in tariff talks, according to Reuters citing a draft of the request.

- White House Press Secretary said US President Trump and Chinese President Xi will likely talk this week, while she also commented that the EU came to the table due to President Trump's tariff threat.

- EU Trade Commissioner Sefcovic to meet USTR Greer in Paris on Wednesday, according to a spokesperson.

- EU restricts Chinese medical devices in retaliation against ‘Made in China’, in which the bloc voted to exclude China’s bidders from contracts worth more than EUR 5mln for the next 5 years, according to FT.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said so far they've had excellent inflation reports and surprisingly little direct impact of tariffs and don't know if that will remain true in the next 1-2 months. Furthermore, he said he is a little gun-shy about arguing that tariffs will have a transitory effect on inflation and noted that the recent PCE inflation print may have been the 'last vestige' of pre-tariff impact.

- Fed's Logan (2026 voter) said despite uncertainty and financial market volatility, the US economy is resilient, while she added that risks are balanced on both sides of the mandate and monetary policy is well-positioned to wait and be patient.

- Atlanta Fed GDPnow (Q2): 4.6% (prev. 3.8%).

DATA RECAP

- US S&P Global Manufacturing PMI Final (May) 52.0 (Prev. 52.3)

- US ISM Manufacturing PMI (May) 48.5 vs. Exp. 49.5 (Prev. 48.7)

- US ISM Manufacturing Prices Paid (May) 69.4 (Prev. 69.8)

- US ISM Manufacturing New Orders Index (May) 47.6 (Prev. 47.2)

- US ISM Manufacturing Employment Index (May) 46.8 (Prev. 46.5)

- US Construction Spending MM (Apr) -0.4% vs. Exp. 0.3% (Prev. -0.5%, Rev. -0.8%)

FX

- USD saw hefty losses to start the week on continued trade uncertainty following the punchy rhetoric seen between the US and China since Friday, alongside Trump upping the blanket steel and aluminium tariffs to 50% from 25%. On the data footing, ISM Mfg. largely underwhelmed while Construction Spending also disappointed, although the Atlanta Fed GDPNow was upgraded to 4.6% from 3.8%.

- EUR benefitted from the dollar's demise and the single currency climbed above the 1.1400 level, while Eurozone PMI figures were somewhat mixed and participants also await the ECB meeting on Thursday.

- GBP held on to its initial gains although further upside was capped with price action choppy during US trade, while there was little reaction to comments from BoE's Mann who noted that extra cuts to short rates to compensate for QT could run counter to the need to purge structural rigidities in the UK labour and product markets.

- JPY was among the top performers amid the softer US dollar coupled with ongoing trade uncertainty amid Trump upping steel and aluminium tariffs and back-and-forth commentary between the US and China.

FIXED INCOME

- T-notes were choppy amid trade uncertainty and soft data, while a revision higher to the Atlanta Fed GDPNow keeps the curve pressured.

COMMODITIES

- Oil prices gained after Ukraine/Russia tensions escalated over the weekend, OPEC8 agreed to lift output, and following a few updates from Iran.

GEOPOLITICAL

MIDDLE EAST

- US nuclear deal offer allows Iran to enrich uranium at low levels and doesn't include full dismantlement of the nuclear facilities, according to Axios.

- Iran's senior diplomat said it is drafting a 'negative response' to the US nuclear proposal and the response could be considered as a rejection of the 'completely one-sided' offer.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine and Russia agreed to exchange 1000 military servicemen each and there could be an additional swap of 200 each, while Ukraine and Russia are to exchange lists for the POW exchange this week.

- Ukrainian President Zelenskiy's Chief of Staff said Russia is doing everything possible to continue the war and urges new sanctions now.

- Ukrainian Defence Minister said Russia handed over a memorandum to Ukraine at talks in Istanbul and Kyiv will review the document. It was later reported that Russia sees the beginning of a complete withdrawal of Ukrainian troops from Russian territory, including Donetsk, Luhansk, Zaporizhzhia and Kherson regions, as one of the options for establishing a ceasefire, according to Interfax citing the memorandum. The first part of the Russian memorandum envisages the lifting of all existing and the rejection of new economic sanctions and restrictive measures between Russia and Ukraine, while Russia proposes recognition of Crimea, Luhansk, Donetsk, Zaporizhzhia, and Kherson regions as part of Russia and complete withdrawal of Ukrainian military units from these territories.

ASIA-PAC

NOTABLE HEADLINES

- BoJ Bond Market Meeting Minutes (May 20th-21st) stated that in the super-long-term zone, supply and demand conditions deteriorated markedly, and interest rates rose significantly. It noted that market participants have been particularly concerned about the significant decline in market liquidity in the super-long-term zone, and a sort of market fragmentation has occurred between the short- to long-term zone and the super-long-term zone. Furthermore, the Bank should consider making flexible responses for this zone by, for example, suspending the reduction in its JGB purchases, increasing the amount of its JGB purchases, and consolidating the maturity segments for JGBs with residual maturities of (a) more than 10 years and up to 25 years and (b) more than 25 years.

EU/UK

NOTABLE HEADLINES

- BoE's Mann said must consider interactions of QT and rate decisions, while she added that the BoE cannot exactly offset high long-term rates caused by QT by cutting the bank rate further and extra cuts to short rates to compensate for QT could run counter to the need to purge structural rigidities in the UK labour and product markets. Furthermore, she expects these issues will be part of MPC considerations before the September QT decision.

DATA RECAP

- UK S&P Global Manufacturing PMI (May) 46.4 (Prev. 45.1)

- French HCOB Manufacturing PMI (May) 49.8 vs. Exp. 49.5 (Prev. 49.5)

- Italian HCOB Manufacturing PMI (May) 49.2 vs. Exp. 49.5 (Prev. 49.3)

- German HCOB Manufacturing PMI (May) 48.3 vs. Exp. 48.8 (Prev. 48.8)

- EU HCOB Manufacturing Final PMI (May) 49.4 vs. Exp. 49.4 (Prev. 49.4)