US stocks closed in the green while the Treasury curve bear-steepened - Newsquawk Asia-Pac Market Open

- US stocks managed to close in the green, seeing gradual strength throughout the session, paring the weakness seen overnight.

- The Dollar Index was lower and seemingly weighed on by Fed independence concerns, given that Federal prosecutors have opened a criminal investigation into Chair Powell over the Fed’s renovation of its Washington HQ.

- Treasury curve bear steepened in response to the DoJ Fed probe.

- The crude complex saw marginal gains upon the return to trading, amid heightening Iran/US tensions.

- The White House is weighing a last-ditch Iranian offer to engage in diplomacy over curbing its nuclear programme, even as President Trump currently leans toward authorising fresh military strikes on Iran, WSJ reported, citing officials.

- Looking ahead, highlights include Australian Westpac Consumer Confidence, Japanese Bank Lending, UK BRC Retail Sales, Supply from Australia, and Comments from Fed's Williams.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks managed to close in the green, seeing gradual strength throughout the session, paring the weakness seen overnight.

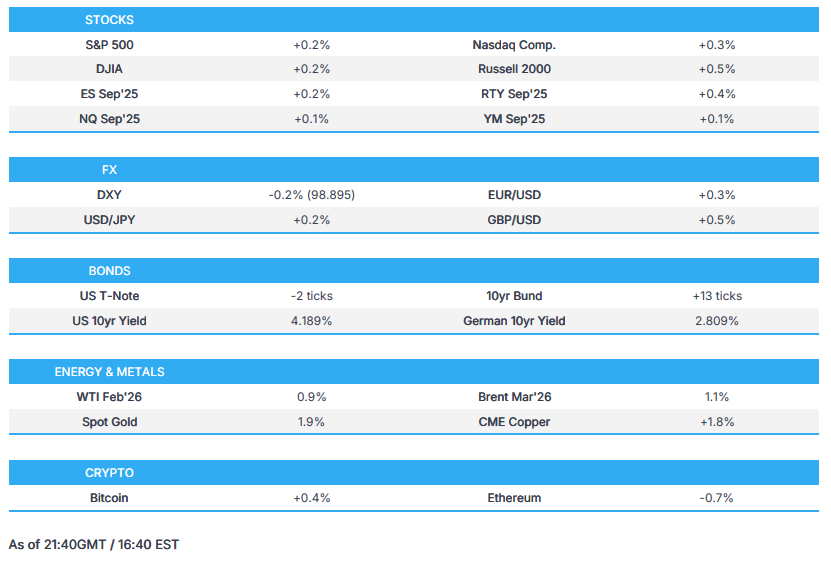

- SPX +0.16% at 6.977, NDX +0.08% at 25,788, DJI +0.17% at 49,590, RUT +0.44% at 2,636

TARIFFS/TRADE

- US President Trump posted on Truth "if Supreme Court rules against tariffs, we're screwed". Full Post:"The actual numbers that we would have to pay back if, for any reason, the Supreme Court were to rule against the United States of America on Tariffs, would be many Hundreds of Billions of Dollars, and that doesn’t include the amount of “payback” that Countries and Companies would require for the Investments they are making on building Plants, Factories, and Equipment, for the purpose of being able to avoid the payment of Tariffs. When these Investments are added, we are talking about Trillions of Dollars! It would be a complete mess, and almost impossible for our Country to pay. Anybody who said that it can be quickly and easily done would be making a false, inaccurate, or totally misunderstood answer to this very large and complex question. It may not be possible but, if it were, it would be Dollars that would be so large that it would take many years to figure out what number we are talking about and even, who, when, and where, to pay. Remember, when America shines brightly, the World shines brightly. In other words, if the Supreme Court rules against the United States of America on this National Security bonanza, WE’RE SCREWED!".

- Mexican President Sheinbaum said fentanyl trafficking from Mexico to the US has been halved within a year.

- EU Commission Spokesperson said the Mercosur deal can be applied without being ratified by the European Parliament.

- Trump admin nears deal with Taiwan; trade deal would cut tariffs and include a commitment from TSMC (TSM) to build more manufacturing plants in the US. TSMC to build at least five more Arizona Semiconductor facilities under new US deal. US-Taiwan trade deal to reduce tariffs on the island's exports to 15%.

NOTABLE US EQUITY HEADLINES

- US GOP policymakers are reportedly getting behind a stock-trading clampdown which aims to alleviate concerns related to lawmakers profiting off insider information, via WSJ.

- House Republican leaders intend to put the next funding package up for a vote on Wednesday night, according to Politico citing sources.

FX

- The Dollar Index was lower and seemingly weighed on by Fed independence concerns, given that Federal prosecutors have opened a criminal investigation into Chair Powell over the Fed’s renovation of its Washington HQ.

- G10 FX, ex-Yen, were all firmer and profited off the flailing Buck. The Kiwi outperformed and saw NZD/USD print a high of 0.5769 as it remains buoyed by strength across the metals complex, where spot gold continued to make fresh ATHs.

- LatAm FX broadly benefited from the aforementioned Dollar weakness.

FIXED INCOME

- Treasury curve bear steepened in response to the DoJ Fed probe.

- US sold USD 86bln of 3-month bills at 3.570%, B/C 2.79x.

- US sold USD 39bln of 10-year note; stop-through 0.7bps. High Yield: 4.173% (prev. 4.175%, six-auction avg. 4.169%). WI: 4.180%. Tail: -0.7bps (prev. 0.0bps, six-auction avg. 0.1bps). Bid-to-Cover: 2.55x (prev. 2.55x, six-auction avg. 2.51x). Dealers: 5.9% (prev. 8.8%, six-auction avg. 9.9%). Directs: 24.5% (prev. 21.0%, six-auction avg. 20.6%). Indirects: 69.6% (prev. 70.2%, six-auction avg. 69.5%).

COMMODITIES

- The crude complex saw marginal gains upon the return to trading, amid heightening Iran/US tensions.

- US reportedly allows Mexico to provide oil to Cuba despite Trump's vow to cut off supply, according to CBS News.

- Interior Secretary Burgum thinks the US is seeing a historic shift where OPEC’s power is going to be diminished, via CNBC. "If we start seeing low oil prices, it is an opportunity to fill the SPR."

- Talks at Chilean copper mine Mantoverde remain stalled as strike continues to affect production.

- Chile's Codelco Chairman said 2026 copper production will reach 1.34mln tonnes (prev. 1.33mln tonnes in 2025).

- Trafigura and Vitol are reportedly in discussions with significant Chinese and Indian refiners re. the potential sale of Venezuelan crude, Bloomberg reported citing sources.

CENTRAL BANKS

- US Treasury Secretary Bessent reportedly told Trump late Sunday that Federal investigation into Powell "made a mess" and could be bad for financial markets, via Axios. Bessent didn't question need for a Powell investigation and wasn't defending Fed Chair in his talk with Trump. Bessent "thought that when the president named a new Fed chair, that Powell would go. But now that's not going to happen," another source said. "Now [Powell is] dug in. This really made a mess of things."

- Blackrock's Rick Rieder said stories on meeting with US President Trump on Fed role are reasonably accurate; thinks that the Fed seat is independent; Fed has to get rates down to 3%, via CNBC interview.

- House Speaker Johnson said he intends to let Fed Chair Powell investigation play out and not jump to any conclusions. Need to bring more natgas online producing electricity to help meet demand.

- White House said US President Trump supports Fed independence and did not direct DOJ officials to investigate Fed Chair Powell.

- US Senate Banking Committee Republican Cramer said Fed Chair Powell is no criminal, called for quick end to Fed probe to "restore confidence" in the Fed.

- Senate Majority Leader Thune said DoJ probe makes Fed Chair confirmation "challenging".

- Republican Senator Murkowski said if DoJ believes an investigation into Fed Chair Powell is warranted based on project cost overruns then congress needs to investigate the DoJ. Senator Tillis is right in blocking any Federal Reserve nominees until this is resolved. After speaking with Chair Powell this morning, it is clear the administration's investigation is nothing more than an attempt at coercion.

- Former Republican and Democratic-appointed Fed Chairs, Treasury and CEA Chair called the inquiry into Chair Powell investigation an "unprecedented" assault on Fed independence; names incl. Yellen, Bernanke and Greenspan.

- Former Fed Chair Yellen said "I find it extremely chilling for Fed independence; it seems to me that market should be concerned", via CNBC.

- NEC Director Hassett said respect independence of the Fed; Fed building renovation has dramatic cost overruns; plans look inconsistent with testimony, via CNBC. Economy not booming because of the Fed. Does not know whether Trump approved of Fed probe. Still interested in Fed Chair job. Has not spoken to Powell about him staying on the board.

- ECB's Villeroy said "fanciful" to think ECB could raise key rate this year and fall in Dollar possible if Fed independence challenged.

GEOPOLITICAL

MIDDLE EAST

- The White House is weighing a last-ditch Iranian offer to engage in diplomacy over curbing its nuclear programme even as President Trump currently leans toward authorising fresh military strikes on Iran, WSJ reported citing officials. Vance leading effort by some aides to persuade Trump to engage in negotiations with Tehran.

- US President Trump is leaning towards striking Iran to punish the regime for killing protesters, but hasn't made a final decision and is exploring Iranian proposals for negotiations, a White House official with direct knowledge told Axios.

- White House Press Sec Leavitt said air strikes one of many options for Iran and Trump has interest in exploring Iranian messages. Trump is not afraid to use military force on Iran, but wants diplomacy.

- White House said Iran's public statements differ from private messages sent to the US.

- Iran reportedly ships USD 2.7bln worth of missiles to Russia, according to Bloomberg.

- Iran's Foreign Minister and US Special Envoy Witkoff discussed a potential meeting soon, via Axios; potentially holding a meeting in the coming days. Outreach by Iran seemingly efforts to deescalate with the US, or perhaps buy some time, adds the piece.

- Iranian Foreign Minister Araqji confirmed in a conversation with Al Jazeera that he was in contact with US Envoy Witkoff and that they were discussing the possibility of a meeting; "There are all kinds of ideas and we are testing them", Axios reported.

- EU Commission Spokesperson said that they stand ready to propose new and more severe sanctions on Iran.

RUSSIA-UKRAINE

- Russian drones hit two foreign-flagged vessels near Ukraine's port of Chornomorsk on Monday, according to a source.

- Secretary General of NATO, Rutte said NATO's commitment to Ukraine still holds firm.

ASIA-PAC

NOTABLE HEADLINES

- Chinese President Xi called for advancing full and rigorous Party self-governance with higher standards and more concrete measures.

DATA RECAP

- New Zealand NZIER Capacity Utilization (Q4) 89.8% vs. Exp. 89.3% (Prev. 89.1%).

- Indian CPI Inflation YY (Dec) 1.33% vs. Exp. 1.5% (Prev. 0.71%).

EU/UK

NOTABLE HEADLINES

- Citi YouGov UK long-term CPI expectations at 3.8% (prev. 3.9%); 12-month ahead 3.6% (prev. 3.7%).

DATA RECAP

- German Current Account (Nov) 15.1B vs. Exp. 15.1B (Prev. 14.8B ).

NOTABLE EUROPEAN EQUITY HEADLINES

- BHP (BHP AT) is reportedly not planning a bid for Glencore (GLEN LN), Reuters reported citing sources; said to be waiting out Rio Tinto's (RIO LN) talks around Glencore.