US stocks closed in the red on Tuesday with the initial rally seen after the soft-leaning CPI faded - Newsquawk Asia-Pac Market Open

- US stocks closed in the red on Tuesday with the initial rally seen after the soft-leaning CPI faded.

- The downside in Financials was led by the big banks after JPM was hit post earnings, weighing on peers.

- T-notes bull steepened after the soft CPI report, but ultimately the report does little to change the Fed calculus

- Dollar Index saw gains on Tuesday and attempted to reclaim some of Monday’s weakness, despite seeing immediate weakness after the cooler-than-expected US CPI report.

- Crude saw gains as Iran/US rhetoric ramps up, with Trump suggesting Americans should evacuate Iran.

- Looking ahead, highlights include Australian House Approvals and Permits, Chinese Trade Balance. Supply from Australia and Japan.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

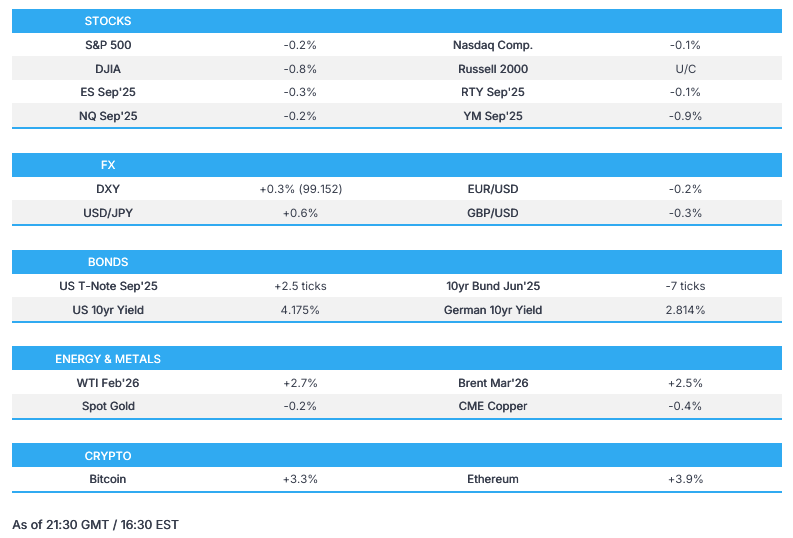

SNAPSHOT

US TRADE

- US stocks closed in the red on Tuesday with the initial rally seen after the soft-leaning CPI faded. Downside was led by the Dow, while Russell and Equal Weight S&P were flattish with SPX and NDX closing lower by 0.2%. Sectors were more mixed with Energy and Defensives leading the gains, whilst Financials and Consumer Discretionary lagged.

- The downside in Financials was led by the big banks after JPM was hit post earnings, weighing on peers - hence Dow underperformance, too, and also not the best start to the Q4 '25 earnings season. Meanwhile, the upside in Energy stocks largely tracked crude prices higher due to ongoing geopolitical concerns, mainly around Iran. President Trump has advised US citizens in Iran to "get out", whilst also telling Iranian protestors that "help is on its way".

- SPX -0.22% at 6,962, NDX -0.18% at 25,742, DJI -0.82% at 49,182, RUT -0.02% at 2,635.

NOTABLE US HEADLINES

- US President Trump reiterated 10% credit card rate cap proposal for one year. On housing, Trump said more affordability plans are coming in weeks. Housing policy details to be shared at Davos. Praises impact of the USD 200bln mortgage bond buy. Lowering mortgage rates would be easier if the Fed were helping. Powell will be out soon.

- US President Trump reiterated he wants the market to go up on good news, not go down; said growth potential is unlimited, wants a Fed Chair who lowers rates when the market goes up, said current Fed kills every rally. Will drive oil prices even lower.

- US lawmakers reportedly move again to revive Trump-supported credit card competition bill (CCCA).

- WH official said US President Trump's speech in Detroit will be about the economy, but there will likely be a mention of Iran.

- US President Trump said latest inflation numbers mean that Fed Chair Powell should cut rates meaningfully; if he doesn't he will just continue to be "TOO LATE!". Full post: Inflation numbers for the USA. That means that Jerome “Too Late” Powell should cut interest rates, MEANINGFULLY!!! If he doesn’t he will just continue to be, “TOO LATE!” ALSO OUT, GREAT GROWTH NUMBERS. Thank you MISTER TARIFF! President DJT.

TARIFFS/TRADE

- US President Trump reiterates they will figure something out if they do not win the tariff case.

- US President Trump, on USMCA, said Canada wants it, but we don't need it.

- China is reportedly to offer Canada canola relief in the scenario that Canada reduces EV tariffs.

- US exporters sell 168k tonnes of soybeans to China.

- US posts licence review rule for chip exports to China and Macau.

DATA RECAP

- US Supercore Inflation (Dec): 2.7% (prev. 2.7%).

- US Inflation M/M 3dp (Dec): Headline 0.307% (prev. 0.204%), Core 0.239% (prev. 0.159%).

- US Core Inflation Rate MoM (Dec) 0.2% vs. Exp. 0.3%.

- US Inflation Rate MoM (Dec) 0.3% vs. Exp. 0.3%.

- US Inflation Rate YoY (Dec) Y/Y 2.7% vs. Exp. 2.7% (Prev. 2.7%).

- US Core Inflation Rate YoY (Dec) Y/Y 2.6% vs. Exp. 2.7% (Prev. 2.6%).

- US Monthly Budget Statement (Dec) -145.0B vs. Exp. -150B (Prev. -173.0B, Rev. -173B).

- US New Home Sales MoM (Sep) M/M 3.8% vs. Exp. -13.8% (Prev. 20.5% ).

- US New Home Sales (Sep) 0.738M vs. Exp. 0.72M (Prev. 0.8M ).

- US Redbook YoY (Jan/10) Y/Y 5.7% (Prev. 7.1%).

- US Building Permits Prel (Oct) 1.411M vs. Exp. 1.412M (Prev. 1.415M ).

- US Average Weekly Prelim Estimate ADP (4-week, w/e 20th Dec) +11.75k (Prev. +11.5k, Rev. +11k).

- US ADP Employment Change Weekly 11.75K (Prev. 11.5K ).

- US Building Permits MoM Prel (Oct) M/M -0.3% vs. Exp. 0.7% (Prev. 6.4% ).

- US NFIB Business Optimism Index (Dec) 99.5 vs. Exp. 99.5 (Prev. 99.0).

NOTABLE US EQUITY HEADLINES

- Amazon (AMZN) pushes suppliers for cuts ahead of Supreme Court tariff ruling, FT reported.

- Netflix (NFLX) weighs amending Warner Bros. (WBD) bid to make it all cash, Bloomberg reported.

- FBN's Gasparino posted on X that as far as Warner Bros. Discovery (WBD) is concerned Netflix (NFLX) is the winner, and for it to reopen Paramount (PSKY) need to pay more money (USD 2-4 on top of its USD 30 all cash).

- Trump Administration appears to have ended its US trade probe into pharmaceutical imports, according to End Point News. The Department of Commerce appears to have concluded its Section 232 investigation into pharmaceutical imports, according to a new document reviewed by Endpoints News.

- Microsoft (MSFT) said its data centres won't burden locals and pledges to pay its electricity bills and minimise water use, according to Axios.

- JPMorgan (JPM) Q4 2025 (USD) EPS 4.63 (exp. 4.97), Revenue 45.8bln (exp. 46.11bln). Results included USD 2.2bln credit reserve established for forward purchase of AAPL credit card portfolio. Credit loss provisions for credit losses USD 4.66bln. FICC revenue 5.38bln (exp. 5.27bln). IB Revenue 2.55bln (exp. 2.665bln). Equity sales and Trading 2.86bln (exp. 2.7bln). CEO COMMENTARY:. "The US economy has remained resilient. While labour markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy.". "These conditions could persist for some time, particularly with ongoing fiscal stimulus, the benefits of deregulation and the Fed’s recent monetary policy. However, as usual, we remain vigilant, and markets seem to underappreciate the potential hazards—including from complex geopolitical conditions, the risk of sticky inflation and elevated asset prices.”. GUIDANCE:. Affirms FY26 NII (ex-markets) USD 95bln (prev. 95bln). Sees 2026 NII about USD 103bln (exp. 100.38bln).

- JPMorgan (JPM) CEO Dimon reiterates that he has great respect for Fed Chair Powell, adding that he believes in Fed's independence.

- JPMorgan (JPM) CFO said consumers and small business remains resilient and they are not seeing deterioration in consumer credit. said US President Trump's plan cap on interest rates on credit cards will be very bad for consumers.

- US Bancorp (USB) to acquire BTIG for USD 725mn.

- Cardinal Health (CAH) raises FY26 outlook; adj. EPS seen at least USD 10.00 (exp. 9.86, prev. 9.65-9.85). The company expects that its Specialty revenues will surpass USD 50bln in fiscal 2026, marking a 16% compounded annual growth rate (CAGR) over three years.

- Bank of New York Mellon Corp (BK) Q4 2025 (USD): EPS 2.02 (exp. 1.91), Revenue 5.19bln (exp. 5.14bln).

- Delta Air Lines Inc. (DAL) Q4 2025 (USD): Adj. EPS 1.55 (exp. 1.53), Revenue 16.0bln (exp. 14.72bln). FY26 EPS 6.50-7.50 (exp. 7.22).

FX

- The Dollar Index saw gains on Tuesday and attempted to reclaim some of Monday’s weakness, despite seeing immediate weakness after the cooler-than-expected US CPI report.

- G10 FX was exclusively lower vs. the Greenback, albeit to varying degrees, as CAD, EUR, GBP saw the shallowest losses while Antipodeans and the Yen lagged.

FIXED INCOME

- T-notes bull steepened after the soft CPI report, but ultimately the report does little to change the Fed calculus, with officials likely awaiting more reports and confirmation of inflation returning to target before cutting, unless there is a drastic downturn in the labour market.

- US sold USD 22bln of 30-year bonds; Stop through 0.8bps. High Yield: 4.825% (prev. 4.773%, six-auction avg. 4.759%): WI 4.833%. Tail: -0.8bps (prev. -0.1bps, six-auction avg. 0.5bps). Bid-to-Cover: 2.42x (prev. 2.36x, six-auction avg. 2.34x). Dealers: 11.9% (prev. 11.2%, six-auction avg. 12.4%). Directs: 21.3% (prev. 23.5%, six-auction avg. 23.9%). Indirects: 66.77% (prev. 65.4%, six-auction avg. 63.7%).

- US sold USD 6-week bills at a high rate of 3.585%, B/C 2.97x.

- Ireland Debt Agency to sell EUR-denominated 10yr bond via syndicate; seeking to raise around EUR 4bln from the issue.

- France is to create a new 20yr OAT, will be launched via syndication in the following days. Will be a 25th May 2046 OAT.

- Germany sold EUR 4.597bln vs exp. EUR 6bln 2.50% 2031 Bobl: average yield 2.47%, b/c 1.41x, retention 23.38%.

- Italy sold EUR 4bln vs exp. EUR 3.5-4bln 2.40% 2029 BTP: avg. yield 2.48%, b/c 1.45x.

- UK sold GBP 900mln 1.125% 2035 I/L Gilt: b/c 4.81x (prev. 3.09x) & real yield --% (prev. 1.673%).

- Colombia announced plans to sell USD bonds.

COMMODITIES

- The crude complex saw gains as Iran/US rhetoric ramps up, with Trump suggesting Americans should evacuate Iran.

- Metals were mixed with gold prices lower, albeit silver held onto gains as volatility continues.

- US Energy Secretary Wright said US would happily partner with Iran on oil if regime ends.

- President Trump said he would like the price of oil USD 53/bbl, via Fox's Ed Lawrence.

- Venezuela reportedly starts reversing oil output cuts as exports resume, according to reports.

- JPMorgan (JPM) and Citi (C) reportedly in talks to finance USD 1bln Argentina gas pipeline.

- EIA STEO: World Oil Demand 2026: 104.8mln bpd (prev. 105.2mln bpd); 2027: 106.1mln bpd. World Oil Production. 2026: 107.7mln bpd (prev. 107.4mln bpd). 2027: 108.2mln bpd. World Oil Demand. 2026: 104.8mln bpd (prev. 105.2mln bpd).

- Third oil supertanker about to depart from Venezuela, to carry crude to Caribbean storage, via shipping data.

- Kazakhstan confirms there was a temporary decline in oil shipments through the marine terminal in December via CPC due to drone attacks.

- Kazakhstan’s Ministry of Energy confirms tankers targeted by drone attacks were not carrying Kazakh oil, with no damage to the country’s energy resources.

- Chevron (CVX) confirms awareness of incidents involving vessels bound for Caspian loading facilities, including one Chevron-chartered tanker; all crew members safe, vessel remains stable and heading to a safe port and no impact reported on TCO ops.

- CME Group to launch 100 ounce of silver futures on 9th February.

- Venezuela's PDVSA begins ordering well reopenings to recover crude output, according to sources; readies internal audit following cyberattack and in preparation of new business and investments.

- Equinor (EQNR NO) CEO said co. will start production at the Eirin field this quarter.

- Norway Energy Minister said Aker BP (AKRBP NO) gets stakes in 22 permits, and Equinor (EQNR NO) in 35 permits.

- TotalEnergies (TTE FP) CEO said on Venezuela, we were there but were obliged to leave, we are always evaluating options; if you’re talking about adding 1mln barrels per day, it will cost USD 100bln.

- Commerzbank maintains year-end nickel price forecast of USD 16k per tonne.

- Kazakhstan's Energy Minister announces oil loadings at CPC Black Sea Terminal are proceeding, via SPM-1.

CENTRAL BANKS

- Fed Chair Powell reportedly sent senators details on USD 2.5bln Fed project following testimony, FT reported.

- Fed's Musalem (2028 voter) said he expects the economy to grow at or above potential in 2026.

- Senate Republican leader Thune said he hasn't seen the charges filed or brought upon Fed Chair Powell yet. Does not expect a Government shutdown.

- US President Trump said we have a bad Fed Chair; Fed Chair pick in the next few weeks.

- WSJ's Timiraos said "US CPI report isn't likely to change the Fed's wait-and-see posture, as officials will likely want to see more evidence that inflation is levelling off and then declining before cutting rates". "To resume rate cuts, Fed officials are likely to need to see either new evidence that job-market conditions are weakening or that price pressures are fading. It could take at least a couple more months of inflation reported for the latter to materialise.".

- Global central bankers issue a statement in support of Fed Chair Powell; incl. the BoE and ECB.

- RBI Governor said policy on INR is consistent and aim is to curb excessive volatility.

GEOPOLITICAL

MIDDLE EAST

- US President Trump when asked about help on the way to Iran, said you are going to find out; good idea if Americans evacuate from Iran.

- US President Trump said the US will take very strong action if Iran hangs protestors, CBS News reported; adds the endgame is to win.

- US Energy Secretary Wright said US would happily partner with Iran on oil if regime ends.

- Iran Defense Minister said they will respond to any US aggression.

- Canadian government urges its citizens to "leave Iran now".

- US President Trump's envoy secretly met Iran's exiled crown prince, Reza Pahlavi, to discuss the Iran protests; Pahlavi is trying to position himself to step in as a "transitional" leader if the regime falls, via Axios.

- Heads of Trump's National Security Council reportedly held talks today on topic of Iran, Trump did not participate, according to Axios.

- WH official said US President Trump's speech in Detroit will be about the economy, but there will likely be a mention of Iran.

- Russia's Foreign Minister said they condemn subversive and external interference in the internal political process of Iran.

- EU's Von Der Leyen said further sanctions against Iran will be swiftly proposed.

RUSSIA-UKRAINE

- G7 allies intend to meet with US President Trump at Davos regarding Ukraine, FT reported citing sources.

OTHERS

- Greenland mineral resources minister hopes for more clarity on US stance on Greenland from meeting with the US on Wednesday. Have no intention of becoming American, but want to work with America. Ban on uranium stands, the people of Greenland have spoken on this. Do not detect a threat from China and Russia, but no problem increasing its monitoring, is working together with the US for a peaceful solution.

ASIA-PAC

NOTABLE HEADLINES

- Canada's Trade Minister said they will be formally launching negotiations with India and the UAE in the near-term.

- World Bank Forecasts: China 2026 upgraded; 2026 global growth seen lower Y/Y amid tariffs impacting trade.

NOTABLE GLOBAL EQUITY HEADLINES

- Saks Global reportedly nears a USD 1.75bln financing deal led by Pentwater and BraceBridge ahead of its imminent bankruptcy, according to reports.

- Novo Nordisk (NOVOB DC) CEO expects some headwinds in international operations in 2026 - JPM conference. Loss of exclusivity in several markets in 2026 could result in Co. having a difficult year.

- The Chinese government this week told some tech companies it would only approve their purchases of NVIDIA's (NVDA) H200 AI chips under special circumstances, such as for university research and development labs, according to The Information.

- US FDA found no increased risk of suicidal behaviour or ideation linked to GLP-1s (LLY, NOVOB DC), according to Bloomberg; has asked companies to remove warnings about potential risk from the medicines' labels.

- Deutsche Bank (DBK GY) announces plans to expand support for PayPal (PYPL) in aims to strengthen global payment capabilities.