US stocks declined amid continued tech woes and weak labour market metrics - Newsquawk Asia-Pac Market Open

- US stocks were sold on Thursday with the majority of sectors red, primarily led by consumer discretionary, materials and technology. Big tech valuations remain a key concern this earnings season, with Amazon (AMZN) pressured heading into its earnings after-hours, while Google (GOOGL) was sold after boosting its CapEx view, albeit the stock did close well off its earlier lows. Furthermore, Microsoft (MSFT) slumped after a downgrade at Stifel, and software names continued to decline after Anthropic announced the Claude Opus 4.6 AI model, adding more pressure to the recently beaten-up sector. Aside from tech woes, risk sentiment was also weighed on by weak labour market data in the US.

- USD was broadly firmer against peers and continued to nurse some of its YTD weakness as the rebound following the Warsh Fed Chair nomination persists, although gains were capped following a slew of weaker-than-expected labour market metrics for the US.

- Looking ahead, highlights include Japanese Household Spending, RBI Rate Decision, Comments from US President Trump, RBA Governor Bullock & RBI Governor Malhotra, Supply from Australia, New Zealand Holiday Closure.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Japanese Household Spending, RBI Rate Decision, Comments from US President Trump, RBA Governor Bullock & RBI Governor Malhotra, Supply from Australia, New Zealand Holiday Closure.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks were sold on Thursday with the majority of sectors red, primarily led by consumer discretionary, materials and technology. Big tech valuations remain a key concern this earnings season, with Amazon (AMZN) pressured heading into its earnings after-hours, while Google (GOOGL) was sold after boosting its CapEx view, albeit the stock did close well off its earlier lows. Furthermore, Microsoft (MSFT) slumped after a downgrade at Stifel, and software names continued to decline after Anthropic announced the Claude Opus 4.6 AI model, adding more pressure to the recently beaten-up sector. Aside from tech woes, risk sentiment was also weighed on by weak labour market data in the US.

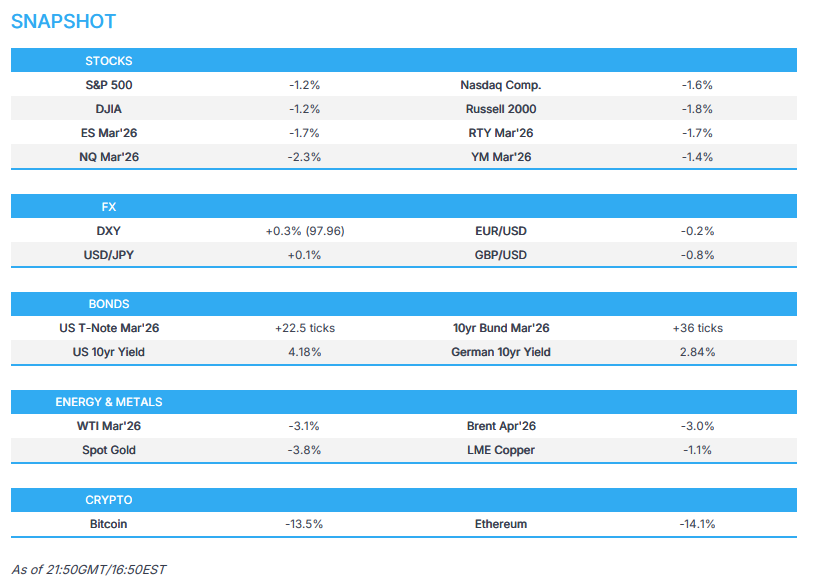

- SPX -1.23% at 6,798, NDX -1.38% at 24,549, DJI -1.20% at 48,909, RUT -1.79% at 2,578.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Treasury Secretary Bessent said he will 'absolutely not' be supporting lowering tariffs on Canadian goods, following their trade deal with China.

- China's Foreign Ministry said it opposes any country forming small groups to disrupt the international economic and trade order.

- NVIDIA (NVDA) warned the Trump administration that recently released rules governing chip exports to China are too strict and would destroy demand, according to WSJ.

- UK and US signed an MoU on critical minerals on 4th February 2026, announcing a partnership to drive investment in critical minerals supply chains.

- US is to scrap reciprocal tariffs on 1,675 Argentine products.

NOTABLE HEADLINES

- Fed's Bostic said inflation is too high for too long, and it is important to keep policy moderately restrictive. Bostic added that if the Fed is going to do its job well, it has to think about issues over the long run and that other officials, such as those in Congress, have shorter horizons.

- US Treasury Secretary Bessent said whether to sue Warsh over Fed interest rate policy is up to US President Trump, while he added that Warsh is highly qualified to be Fed Chair. Bessent also said it is undesirable to eliminate inflation completely, but desirable to get it back to the Fed's 2% target.

- US President Trump is planning to announce the launch of TrumpRx on Thursday night, which is the website that he and his aides have touted for months as a platform aimed at lowering prescription drug prices.

- US President Trump's administration finalises US civil services overhaul. It was separately reported that the Trump administration is planning to make it easier to fire career officials in senior positions, potentially affecting 50,000 workers.

- White House Press Secretary said regarding the DHS, that they are willing to discuss some of the Democrats' demands.

DATA RECAP

- US Challenger Job Cuts (Jan) 108.435K (Prev. 35.553K)

- US JOLTs Job Openings (Dec) 6.542M vs. Exp. 7.2M (Prev. 6.928M, Rev. From 7.146M)

- US Initial Jobless Claims (Jan/31) 231K vs. Exp. 212K (Prev. 209K, Low. 205K, High. 219K)

- US Continuing Jobless Claims (Jan/24) 1,844K vs. Exp. 1,850K (Prev. 1,819K, Rev. From 1,827K)

- Revelio Labs said US January Non-farm Jobs -13.3k M/M (prev. +71k in December)

FX

- USD was broadly firmer against peers and continues to nurse some of its YTD weakness as the rebound following the Warsh Fed Chair nomination continues, although gains were capped following a slew of weaker-than-expected labour market metrics for the US.

- EUR marginally softened with little reaction seen to an uneventful ECB meeting, where the central bank held rates as expected and largely stuck to its messaging, offering little clues for traders looking for a near-term policy signal.

- GBP underperformed following a dovish vote split by the BoE in which the central bank kept rates unchanged at 3.75% as expected, with 5 voting for hold and the remaining 4 voting for a 25bps cut (exp. 2 or 3 to cut).

- JPY was subdued despite the broad risk-off mood, with participants continuing to anticipate a strong LDP victory on Sunday.

- Banxico held rates at 7.00%, as expected, in a unanimous decision. Governing Board deemed it appropriate on this occasion to pause the rate-cutting cycle, consistent with the assessment of the current inflationary outlook. Looking ahead, the Board will evaluate additional reference rate adjustments (prev. Looking ahead, the Board will evaluate the timing for additional reference rate adjustments).

- Czech CNB Interest Rate Decision 3.50% vs. Exp. 3.5% (Prev. 3.50%, Rev. From 3.5%)

FIXED INCOME

- T-notes were higher and the curve bull steepened after soft labour metrics in which Challenger Layoffs surged in January to 108k from 36k, printing the highest January figure since 2009, while weekly claims report saw a notable jump to 231k from 209k, and JOLTS tumbled to 6.5mln from 6.9mln, which was well below the 7.2mln forecast.

COMMODITIES

- Oil prices were lower as price action continued to be influenced by the geopolitical climate, with the meeting between the US and Iran confirmed for Friday in Oman, while it was also reported that Saudi Arabia cut its OSPs to Asia and set the price to parity with the Oman/Dubai average.

- Saudi Arabia cut the price of its Arab Light grade to Asia by 30 cents a barrel to parity with Oman/Dubai for March, while it set the OSP to NW Europe at minus -USD 0.65/bbl to Ice Brent settlement and set the OSP to US at plus USD 2.10/bbl vs ASCI.

- Qatar set the March marine crude OSP at Oman/Dubai at USD -1.00/bbl and land crude OSP at Oman/Dubai at USD +0.80/bbl.

- Approximately 2mln barrels of Venezuelan crude are departing for Spain's Repsol (REP SM).

- China's Futures Exchange is to adjust price limits, margin ratios for copper, aluminium, gold, silver and other futures contracts, while the Shanghai International Energy Exchange is to raise limits, margin ratios for international copper futures contracts from the 9th of February closing settlement.

GEOPOLITICAL

MIDDLE EAST

- US President Trump said Iran is negotiating, and reiterates that the US have a large fleet near Iran.

- White House Press Secretary said diplomacy will be the focus in talks with Iran, and that Trump wants to see if a deal can be struck, although she also stated that they remind the Iranian regime that President Trump has many options besides diplomacy.

- Iranian army spokesperson said that their access to US bases is easy, increasing their vulnerability, while the spokesperson added that they're ready to defend themselves, and it is US President Trump who must choose between compromise or war.

- Iran deployed advanced long-range ballistic missile, Khorramshahr 4, at an underground facility, while the missile has a range of 2,000km and is capable of carrying a 1,500kg warhead, according to Iranian press.

- Iran's Revolutionary Guards detained two vessels in the gulf carrying over 1mln litres of smuggled fuel, while the crew of 15 foreigners referred to the judiciary, according to state media.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said the next round of talks with Russia is to take place in the near future, while he added that Ukraine is ready to swap drones for air defence missiles and MIG jets. Zelensky also said the next round of talks on Ukrainian settlement is likely to take place in the US.

- Ukrainian President Zelensky’s top aide said talks with Russia were really constructive, according to RBC Ukraine.

- US envoy Witkoff says that discussions between the US, Ukraine and Russia were productive but "significant work remains" and talks will continue, with additional progress anticipated in the coming weeks. Furthermore, he stated that Ukraine and Russia agreed to exchange 314 prisoners.

- Russian Envoy Dmitriev said Russia-US meetings in Abu Dhabi were positive and he noted progress on a peace deal despite pressure from the EU and UK, while active work is ongoing to restore Russia-US relations.

- Russia is reportedly open to international cooperation on the Zaporizhzhia nuclear plant, including with the US, but insists the facility must remain Russian, according to Tass.

- US President Trump said rather than extend the “NEW START”, we should have our nuclear experts work on a new, improved, and modernised treaty that can last long into the future.

- US and Russia have agreed to re-establish military-to-military talks, according to AP reports.

- US and Russia were reported to negotiate extensions to a New START nuclear pact, Axios reports citing sources. However, two of the sources cautioned that the draft plan still needed approval from both presidents, while an additional source confirmed that negotiations had been taking place over the past 24 hours in Abu Dhabi, but not that an agreement had been reached.

- Kremlin spokesperson said that Russia remains ready for discussions if the US responds to its proposal on extending nuclear arms limits.

ASIA-PAC

NOTABLE HEADLINES

- Japan’s LDP party is seen winning a majority by a large margin in the snap election on Sunday, according to TBS reports.

EU/UK

NOTABLE HEADLINES

- UK Labour MPs are privately urging Angela Rayner and Wes Streeting to launch a leadership challenge against Sir Keir Starmer over the Lord Mandelson scandal, according to The Telegraph on X. One minister said the situation had become “existential” for Sir Keir, claiming that “basically everyone is urging a leadership challenge” in private.

- BoE held rates at 3.75%, as expected; vote split 5-4 (exp. 7-2; Breeden, Dhingra, Taylor, Ramsden vote for cut to 3.5%). BoE stated that judgements on further easing ‘will become closer call’ and that slowing easing would provide space to assess the neutral rate. In terms of the BoE forecasts, it lowered inflation forecasts across the horizon and lowered the GDP forecast for Q1 26 and Q1 27.

- BoE Governor Bailey (post-meeting statement) said that there should be scope for some easing of policy, but risks remain, and based on current evidence, the Bank Rate is expected to be reduced further, which will depend on inflation outlook, and if inflation and the labour market evolve as expected. Furthermore, he said cutting too quickly or too much could lead to inflation pressures persisting, while waiting too long could come at the cost of a sharper downturn in activity and inflation.

- BoE Governor Bailey said in the Q&A on why they didn't cut today, that the MPC needs to see more evidence that inflation will sustainably return to target, while he reiterated that as they get closer to neutral, rate decisions become a closer call. Bailey also noted on market views of around two rate cuts this year, that the neutral rate is in the range of 2-4% and the market curve is a 'reasonable profile' to have right now, which fits with his thinking, but doesn't condition the timing or scale of moves. Furthermore, he said on possible rate hikes over the next few months, that the MPC did not discuss hiking rates at the meeting, and the question is about what scope there is to ease rates

- ECB kept rates unchanged as expected with the Deposit Rate maintained at 2.0%, Refinancing Rate at 2.15% and Lending Rate at 2.4%, while it reiterated it is not pre-committing to a particular rate path and that policy remains data-dependent and meeting-by-meeting. Furthermore, it stated that the decisions would hinge on the inflation outlook and surrounding risks, incoming economic and financial data, underlying inflation trends and the strength of monetary policy transmission.

- ECB President Lagarde (post-meeting statement) said the updated assessment confirms that inflation should stabilise at the target in the medium-term and the economy remains resilient despite challenges.

- ECB President Lagarde said today's decision was unanimous on rates and that risks are broadly balanced as some risks have ticked up, but others have ticked down. Lagarde also noted that the ECB statement no longer refers to the balance of risks and said that guidance was useful during COVID, while the ECB now lists upside and downside risk components. Furthermore, she said the ECB is not seeing a reduction in the range of risks, but equally, sentiment around the table is that it is broadly balanced, while she responded we are, and inflation is in a good place when asked if ECB policy is still in a good place.

DATA RECAP

- UK S&P Global Construction PMI (Jan) 46.4 vs. Exp. 42 (Prev. 40.1)

- German HCOB Construction PMI (Jan) 44.7 (Prev. 50.3)

- German Factory Orders MoM (Dec) M/M 7.8% vs. Exp. -2.2% (Prev. 5.6%)

- EU HCOB Construction PMI (Jan) 45.3 (Prev. 47.4)

- EU Retail Sales MoM (Dec) M/M -0.5% vs. Exp. -0.2% (Prev. 0.1%, Rev. From 0.2%)

- EU Retail Sales YoY (Dec) Y/Y 1.3% vs. Exp. 1.6% (Prev. 2.4%, Rev. From 2.3%)