US stocks ended with heavy selling despite the lack of fresh catalyst - Newsquawk Asia-Pac Market Open

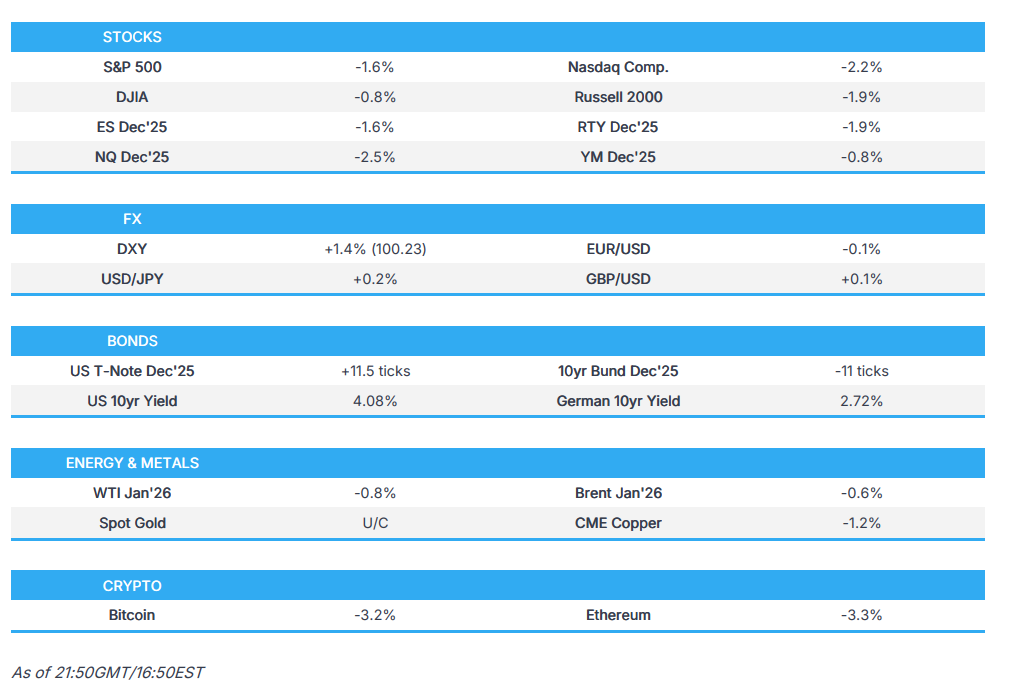

- US stocks ended with heavy selling despite the lack of fresh catalysts, with AI valuation still a concern and Goldman Sachs warning of equity sales from trend-following hedge funds.

- Dollar saw marginal gains amid the broad risk-off trade, although the moves in FX were somewhat contained in comparison to other asset classes, particularly US equities and crypto.

- Japan may intervene before USD/JPY reaches 160, according to Bloomberg, citing a government panellist.

- US Non-Farm Payrolls (Sep) 119.0k vs. Exp. 50.0k (Prev. 22.0k, Rev. -4k); Two month net revisions: -33k (prev. -21k).

- Looking ahead, highlights include New Zealand Trade Balance, Australian and Japanese S&P Global Flash PMIs, Japanese CPI, Japanese Trade Balance, UK GfK Consumer Confidence, Indian HSBC Flash PMIs, Speakers include Fed's Miran, Fed's Paulson, Supply from Australia

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks ended with heavy selling. Initially, markets saw notable risk on sentiment, with US indices seeing extensive gains, high beta FX outperforming, and the crude complex strengthening, which came after a stellar NVIDIA (NVDA) report and guidance. Thereafter, markets turned, although the risk-off had no fresh driver. AI valuations remain a concern, even after the strong NVDA report, while Goldman Sachs warned Wednesday of USD 39bln in equity sales from trend-following hedge funds after the SPX fell to sub 6,725 on Monday.

- SPX -1.56% at 6,539, NDX -2.38% at 24,054, DJI -0.84% at 45,752, RUT -1.82% at 2,305.

- Click here for a detailed summary.

TARIFFS/TRADE

- European Commission will, on Monday, present a list of sectors it wishes to be exempt from US tariffs to US Commerce Secretary Lutnick and USTR Greer, via Politico citing sources; includes medical devices, wines, spirits, beers & pasta.

- US President Trump signed an order modifying the scope of tariffs on Brazil, according to the White House.

NOTABLE HEADLINES

- Fed’s Goolsbee (2025 voter) said part of the Fed’s job is to be the steady hand, noting that the Fed set a 2% inflation target and that 3% inflation is too high, calling the 2% goal a sacred promise. He said inflation seems to have stalled and that he is a little uneasy about inflation, uneasy about front-loading rate cuts, and uneasy about relying on “transitory” inflation. He said official data is a mess because “the lights went out,” and that in the dark he was more paranoid about inflation due to less available information. Goolsbee noted a notable slowdown in job creation but said he is dubious that the payroll slowdown points to recession; he described the current low-hiring, low-firing environment as a sign of uncertainty. He said the boom in data centers makes it harder to gauge the business cycle, warned that AI investment raises concerns about a possible bubble, and said 50-year mortgage rates could reduce the impact of monetary-policy decisions, according to Reuters.

- Fed’s Cook (voter) said not all market volatility is problematic, adding that one major vulnerability is maturity mismatch in hedge-fund Treasury-securities trading strategies. Fed’s Cook said the US financial system is resilient and that she sees an increased likelihood of outsized asset-price declines, though she does not view this as a risk to the financial system, according to Reuters.

- Fed’s Hammack (2026 voter) said the jobs report is a bit stale but in line with expectations, telling CNBC the data was mixed and highlighting the challenges faced by monetary policy; she called it one data point but the “gold standard,” noted the low-hire/low-fire environment, and welcomed the BLS release. She said high inflation remains a real issue, that insight on inflation is coming on a delayed basis, and that firms are seeing softening demand with households stretching budgets. She said inflation expectations remain contained but district contacts report “really significant” inflation pressure and that many households have little left at month-end, while services inflation remains too high. On December, she said she goes into every meeting with an open mind, that both sides of the mandate must be balanced, and that policy needs to stay somewhat restrictive — adding policy is barely restrictive, if at all. On money markets, she expects fluctuations and would like to see more usage of the standing repo facility, according to CNBC.

- Fed’s Hammack (2026 voter) said easing monetary policy now could encourage financial risk-taking and that risk-management cuts could increase financial-stability risks, while cutting rates also risks prolonging high inflation. She said financial conditions are “quite accommodative,” the financial system is in good shape, banks are well capitalised, and household finances are in good shape, according to Reuters.

- Fed’s Goolsbee (2025 voter) reiterated he is uneasy about front-loading rate cuts before knowing whether the inflation uptick is transitory. He said he is not hawkish over the medium term and believes rates will ultimately settle well below current levels. After the Fed’s September cut he felt just one more cut would be needed for 2025, and when he voted for the October cut he assumed the job market was cooling gradually.

- Fed’s Barr said he is concerned that inflation is still at 3% and that monetary policy needs to be handled carefully to balance risks, according to Reuters.

- WSJ’s Timiraos says it is difficult to tell how the September jobs report will resolve divisions on a fractured Federal Reserve. For hawks, if the bar to cut was rapid or significant deterioration — which is not evident — they will still favour staying on hold, with little reason to change their outlook or reaction function. For doves, if they were looking for broad stabilisation to suggest another cut might not be needed, one month of data won’t suffice, especially given the rise in the unemployment rate and the pattern of initial prints being revised lower once more responses are collected. Two of the last five months have shown negative job growth after revisions: August was revised from +22,000 to -4,000 and June from +147,000 to -13,000, according to WSJ’s Timiraos.

- Morgan Stanley dropped its call for a December 2025 rate cut and now expects three cuts in 2026 — in January, April and June — saying stronger payrolls reduce the risk of rising unemployment; it maintained its terminal-rate view of 3.00–3.25%.

DELAYED DATA UPDATE

- The US Commerce Department said the US GDP and Personal Income reports originally scheduled for release on November 26th will be rescheduled, with the BEA yet to announce a new date; the affected reports include Q3 GDP (second estimate), Q3 corporate profits (preliminary), and October personal income and outlays, according to Reuters.

- Federal Reserve scheduled Industrial Production and Factory orders data for 3rd December at 09:15EST/14:15GMT.

DATA RECAP

- US Non-Farm Payrolls (Sep) 119.0k vs. Exp. 50.0k (Prev. 22.0k, Rev. -4k); Two month net revisions: -33k (prev. -21k)

- US Unemployment Rate (Sep) 4.4% vs. Exp. 4.3% (Prev. 4.3%).

- US Average Earnings YY (Sep) 3.8% vs. Exp. 3.7% (Prev. 3.7%, Rev. 3.8%); MM (Sep) 0.2% vs. Exp. 0.3% (Prev. 0.3%, Rev. 0.4%).

- US Initial Jobless Claims (15 Nov, w/e) 220k vs. Exp. 230k (Prev. 232k); Continuing Jobless Claims (22 Nov, w/e) 1.974M (Prev. 1.957M); 4-Week Average (15 Nov, w/e) 224.25k (Prev. 227.25k).

- US Philly Fed Business Index (Nov) -1.7 vs. Exp. 2.0 (Prev. -12.8).

- US KC Fed Manufacturing (Nov) 18.0 (Prev. 15.0)

- US KC Fed Composite Index (Nov) 8.0 (Prev. 6.0)

- US Existing Home Sales (Oct) 4.1M vs. Exp. 4.08M (Prev. 4.06M, Rev. 4.05M)

- US Exist. Home Sales % Chg (Oct) 1.2% (Prev. 1.5%, Rev. 1.3%)

- US 30-year fixed rate mortgage (Nov 20th): 6.26% (prev. 6.24%)

FX

- The Dollar saw marginal gains amid the broad risk-off trade, although the moves in FX were somewhat contained in comparison to other asset classes, particularly US equities and crypto.

- G10 FX was broadly hit on the aforementioned risk environment, with AUD, CAD, and NZD lower, with the pairs trading at respective weakest levels.

- EUR ultimately moved at the whim of the USD and traded within a 1.1508-1.1549 range; German Producer Prices data printed more-or-less in line, and had limited impact, while newsflow for the GBP was light, as markets count down to next week’s budget.

- USD/JPY hit a peak of 157.89, but came off such levels on the change in risk sentiment, likely to the relief of some Japanese officials, as the verbal intervention is likely to continue in the coming days.

FIXED INCOME

- T-notes bull steepen on US jobs data and risk-off tone.

- US Treasury to sell USD 69bln of 2-year notes on November 24th, USD 70bln of 5-year notes on November 25th and USD 44bln of 7yr notes on November 26th; all to settle December 1st.

- Spain sells EUR 4.921bln vs exp. EUR 4.5-5.5bln 3.00% 2033, 3.20% 2035, 4.00% 2054 Bono.

- France sells EUR 12bl vs exp. EUR 10-12bln 2.40% 2028, 2.70% 2031, 1.50% 2031, 3.50% 2033 OAT.

COMMODITIES

- The crude complex was hit on positive Ukraine/Russia developments and broader risk-off sentiment.

- US EIA- Nat Gas, Change Bcf w/e -14.0bcf vs. Exp. -13.0bcf (Prev. 45.0bcf)

GEOPOLITICAL

RUSSIA-UKRAINE

- Ukraine’s President Zelensky said he agreed to work on the US draft plan to end the war and is ready to work with the US and Europe for peace, according to Reuters.

- The White House said it believes the Ukraine plan should be acceptable to both sides and that it is having good conversations with both regarding ending the war; Special Envoy Witkoff and Secretary of State Rubio met with Ukrainians this past week to discuss the plan, according to Reuters.

- Ukraine President Zelensky said he discussed the peace process with US Secretary of the Army Driscoll in Kyiv and that US and Ukrainian teams will work on points of the peace plan, according to Reuters.

- Russia’s President Putin said Russian forces are already fighting in Ukraine’s Kostiantynivka and that Ukrainian soldiers should have the opportunity to lay down their arms and surrender; he also said 15 Ukrainian battalions are blocked in the Kupyansk area. Russia’s Chief of General Staff Gerasimov said Russia took control of Kupyansk and over 80% of Vovchansk, according to Reuters.

OTHERS

- The White House said President Trump is interested in taking additional action against cartels, according to Reuters.

ASIA-PAC

NOTABLE HEADLINES

- Japan may intervene before USD/JPY reaches 160, according to Bloomberg citing a government panellist.

DATA

- South Korean PPI Growth YY (Oct) 1.5% (Prev. 1.2%, Rev. 1.2%)

- South Korean PPI Growth MM (Oct) 0.2% (Prev. 0.4%, Rev. 0.4%)

- New Zealand Annual Trade Balance (Oct) -2.28B (Prev. -2.25B, Rev. -2.39B)

- New Zealand Trade Balance (Oct) -1542.0M (Prev. -1355.0M, Rev. -1384M)

- New Zealand Imports (Oct) 8.04B (Prev. 7.18B, Rev. 7.17B)

- New Zealand Exports (Oct) 6.5B (Prev. 5.82B, Rev. 5.78B)

EU/UK

NOTABLE HEADLINES

- ECB’s Makhlouf said he is comfortable with the current policy stance and would need further evidence to change his view, adding that outcomes are in line with projections and new projections are unlikely to change. He said policymakers should be very cautious about reacting to small deviations in forecasts, noted that risks around the inflation outlook are balanced, and said he is completely relaxed about undershooting next year as inflation will come back.

DATA RECAP

- EU Consumer Confid. Flash * (Nov) -14.2 vs. Exp. -14.0 (Prev. -14.2)

- Swiss Trade (Oct) 4319.0M CH (Prev. 4073.0M CH, Rev. 3990M CH); Gold exports 128.2/T, -11%: Watch exports: CHF 2.2bln, -4.4% Y/Y.

- German Producer Prices MM (Oct) 0.1% (Exp. 0.0%, Prev. -0.1%); YY (Oct) -1.8% vs. Exp. -1.9% (Prev. -1.7%)

OTHERS

- South African Repo Rate (Nov) 6.75% vs. Exp. 6.75% (Prev. 7.0%).