US stocks extended on gains as the tech recovery remained intact - Newsquawk Asia-Pac Market Open

- US stocks continued to gain on Monday, with tech leading the moves once again as semis largely outperformed and Nvidia (NVDA) shares rallied, seemingly continuing to benefit from the hiked CapEx plans announced alongside recent earnings from AMZN, META and GOOGL. As such, the Nasdaq led the advances, but the Dow lagged, while the sectors were predominantly firmer, although Consumer Staples and Healthcare underperformed.

- USD was heavily sold on Monday, to the benefit of global peers, with pressure initially stemming from broad yen strength post-election and after Bloomberg also reported that China is urging banks to curb UST exposure amid market risk. Whilst these two catalysts hindered the Greenback, with the latter particularly reviving the “Sell America” theme, the broader risk-on sentiment also weighed.

- Looking ahead, highlights include Australian Westpac Consumer Sentiment & NAB Business Confidence, Japanese Money Supply & Machine Tool Orders, Singapore GDP, Supply from Australia & Japan.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Australian Westpac Consumer Sentiment & NAB Business Confidence, Japanese Money Supply & Machine Tool Orders, Singapore GDP, Supply from Australia & Japan.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks continued to gain on Monday, with tech leading the moves once again as semis largely outperformed and Nvidia (NVDA) shares rallied, seemingly continuing to benefit from the hiked CapEx plans announced alongside recent earnings from AMZN, META and GOOGL. As such, the Nasdaq led the advances, but the Dow lagged, while the sectors were predominantly firmer, although Consumer Staples and Healthcare underperformed.

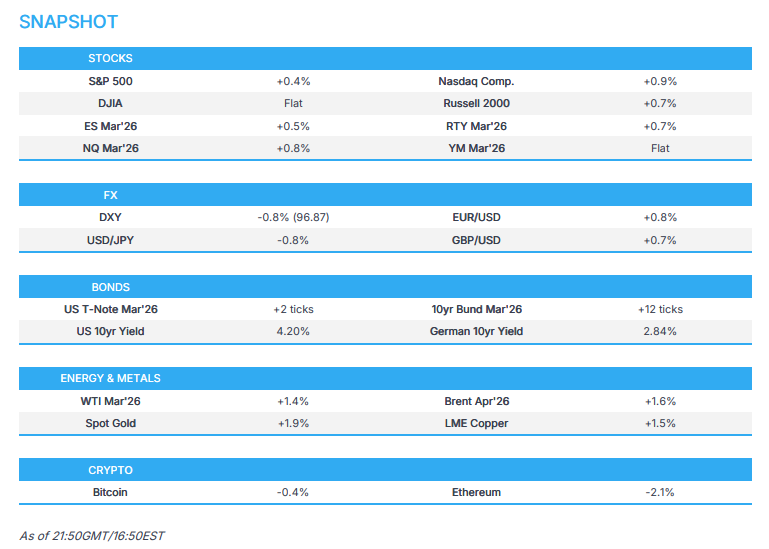

- SPX +0.42% at 6,961, NDX +0.77% at 25,268, DJI +0.04% at 50,136, RUT +0.68% at 2,689.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump and Chinese President Xi’s summit is set for the first week of April, and could be the first of four meetings this year between the two leaders, according to POLITICO.

- White House said the US and Bangladesh have agreed to an agreement on reciprocal trade in which the US will reduce reciprocal tariffs to 19% on goods originating in Bangladesh, while the US commits to establishing a mechanism that will allow for certain textile and apparel goods from Bangladesh to receive a zero percentage reciprocal tariff rate. It was also reported that the Bangladesh chief adviser said the US is committed to establishing a mechanism for certain textile and apparel goods from Bangladesh to receive zero reciprocal tariff in the US.

- US House Democrats may move to overturn Canada tariffs and may force a vote on Canada tariffs on Wednesday, according to Punchbowl.

- Mexican President Sheinbaum said no critical minerals deal has been signed with the US, but has agreed to begin talks on a deal.

NOTABLE HEADLINES

- Fed's Miran (voter, dove) said tax law changes will benefit the economy and monetary policy should be attuned to the business cycle, while he stated that Fed independence leads to better policy but added that there is no 100% central bank independence and that the Fed should keep a distance from topics that are not monetary policy. Furthermore, he said there are reasons to think fiscal dominance won't be a big issue, and he is not worried that tariffs will impair the value of the dollar.

- US President Trump intends to narrow the legal route for fired Federal workers to return to their roles, and proposes ending the workers' right to appeal to an independent board.

- NEC Director Hassett said they got inflation way down from the Biden era, while he added that they should expect slightly lower job numbers, but it should not trigger panic.

DATA RECAP

- US Consumer Inflation Expectations (Jan) 3.1% (Prev. 3.4%)

- NY Fed Survey of Consumer Expectations (Jan): 1-yr ahead inflation expectations 3.1% (prev. 3.4% in December), 3-yr ahead 3% (prev. 3%), and 5-yr ahead 3% (prev. 3%)

FX

- USD was heavily sold on Monday, to the benefit of global peers, with pressure initially stemming from broad yen strength post-election and after Bloomberg also reported that China is urging banks to curb UST exposure amid market risk. Whilst these two catalysts hindered the Greenback, with the latter particularly reviving the “Sell America” theme, the broader risk-on sentiment also weighed.

- EUR benefitted from the dollar's demise and edged higher throughout the day to reclaim the 1.1900 status, while there were several comments from ECB speakers which continued to point to a lack of willingness to adjust policy in the near-term.

- GBP gained against the dollar to test the 1.3700 level to the upside, with support seen as several cabinet ministers voiced support for UK PM Starmer following calls for him to resign and news that his communication director resigned.

- JPY ultimately strengthened post-election owing to the rise in yields, jawboning by Finance Minister Katayama and rising BoJ April rate hike odds.

FIXED INCOME

- T-notes settled relatively flat despite early weakness on reports that China is to curb UST exposure, and with some pressure after Alphabet announced a 7-part issuance.

COMMODITIES

- Oil prices gained with the energy complex buoyed by the broader risk sentiment and dollar weakness, while it was also reported that Qatar pushed the start of its LNG expansion to the end of 2026 and that US forces seized an oil tanker departing from Venezuela.

- Venezuela's crude production nears 1mln BPD following an output cut reversal, according to reports.

- Pentagon announced that US forces seized an oil tanker departing from Venezuela, according to Al Arabiya.

- Mexican President Sheinbaum said Mexico's oil shipments to Cuba have halted at the moment.

- Qatar reportedly pushed the start of its LNG expansion to the end of 2026.

GEOPOLITICAL

MIDDLE EAST

- Iran's Atomic Chief Eslami said Tehran could dilute its highly enriched uranium if all sanctions are lifted, according to ISNA.

- US Maritime Administration said that ships flying the American flag should refuse Iranian orders unless it puts their safety at risk, and it advises them to stay away from Iranian territorial waters.

RUSSIA-UKRAINE

- EU is reportedly readying options to give Ukraine gradual membership rights, with the EU preparing a series of options to embed Ukraine’s membership in a future peace deal, according to people familiar with the matter. Options include providing Kyiv up front with the protection that comes with EU accession, as well as immediate access to some membership rights. At the same time, the bloc would give Ukraine a clear timeframe of steps that it needs to take to advance with the formal procedure, while other options on the table would entail continuing along the existing accession path or introducing a transition period and gradual membership to the process.

- EU has reportedly proposed including third-country ports in the latest sanctions package against Russia, which is the first time this has been proposed. EU reportedly proposed to list eight Russian oil refineries, including Tuapse, in the 20th sanctions package against Russia, according to an EEAS document.

ASIA-PAC

NOTABLE HEADLINES

- Japanese PM Takaichi said she has received a strong mandate for her policies, following the election, and confirmed a swift restart of the parliamentary session. Takaichi said discussions on the refundable tax credit will commence, and they will not resort to debt to fund the suspension of the food sales tax. Furthermore, they will submit a bill to establish national information and a committee on foreign investment in the next parliament, while they want to pursue a coalition expansion with the DPP if they are keen to do so.

- Chinese President Xi urged domestic technology self-reliance and innovations, according to Xinhua.

- China's Commerce Ministry held a meeting with executives from auto firms and is to optimise the trade-in scheme, while it is to bolster sales using both new and existing policies.

- French government advisory body issued a report on China, which recommends ways to neutralise competitiveness gaps, including implementation of a 30% general tariff, or a depreciation of the Euro by 20-30% vs the Renminbi.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer vowed to go on and made it clear he’s not resigning. It was later reported that PM Starmer told Labour MPs that he is "not prepared to walk away" from power or "plunge us into chaos" as previous prime ministers have done.

- UK Chancellor Reeves backs PM Starmer, and Housing Minister Reed announced support for UK PM Starmer. It was also reported that Deputy PM Lammy said that they shouldn't let anything distract them from their mission to change Britain, and noted the party still supports PM Starmer in doing that, while Health Secretary Streeting said PM Starmer does not need to resign, and former UK Deputy PM Rayner also announced support for PM Starmer.

- UK PM Starmer's communication director Tim Allan resigned, while Labour MP Sarwar called for PM Starmer to step down.

- BoE's Mann said import prices are a positive contribution to UK CPI with US tariffs driving Chinese export prices to the UK.

- ECB President Lagarde said she expects inflation to stabilise sustainably at the 2% target and noted that they are operating in a volatile global environment marked by heightened geopolitical tensions and persistent policy uncertainty. Lagarde said supply chains are becoming more fragmented, and industrial policies are reshaping global competition, but stated that despite the challenging environment, economic activity in the euro area has been resilient. Furthermore, she reiterated a data-dependent, meeting-by-meeting approach.

- ECB's Nagel said the update of the December 2025 projection confirms the inflation outlook, and that the ECB takes action when the medium-term inflation projection deviates sustainably and noticeably from 2%. Nagel said risks to inflation are currently roughly balanced and the inflation shortfall is short-term and small, while he stated the current interest rate level is appropriate. Nagel also commented that he is prepared to adjust in either direction if needed, but is unlikely to react to a short-lived slowdown in inflation, and noted that even if the inflation rate falls slightly below our target in the coming quarters, there is no immediate need for action.

- ECB's Kazmir said it would take a major departure from the baseline scenario for him to consider changing policy and stated the baseline is holding for now, but added the outlook is uncertain and fragile.

- ECB's Kocher said inflation expectations are fully anchored, and FX movements are factored in, while Europe must prepare for a greater financial safe haven role. Kocher also stated that policy is appropriate, and it would require a change in the environment to move away from the current policy stance.

- ECB's Simkus said there's a 50/50 chance that their next move is a hike or cut, and noted that rates are at a neutral level with growth near potential.

- ECB's Villeroy is to step down as of 1st June 2026, and Emmanuel Moulin was touted as a potential successor, while ECB's Lagarde later confirmed that Villeroy will be stepping down from the ECB.