US stocks faded some of the prior day's gains, although futures found some reprieve after hour post-NVIDIA earnings - Newsquawk Asia-Pac Market Open

- US stocks were mildly pressured and the major indices all finished lower to give back some of this week's gains, while there were some headwinds from US-China frictions with pressure seen in the likes of Cadence Systems and Synopsys after it was reported that US President Trump ordered US chip designers to stop selling to China, while a US Commerce spokesperson said the US is reviewing exports of strategic significance to China and has suspended some export license while review takes place. Nonetheless, futures pared some of the losses after-hours following NVIDIA's earnings which beat on top and bottom lines despite incurring a USD 4.5bln charge in Q1.

- USD extended on recent gains in which the DXY climbed to just shy of the 100.00 level despite there being very little in the way of fresh macro catalysts from the US and with a lack of fireworks from the FOMC Minutes which reinforced the wait-and-see message and noted that staff cited tariff policies as implying a larger drag on activity than policies they had assumed in their prior forecast. Nonetheless, there were several trade-related headlines including the Trump administration ordering US chip designers to stop selling to China, while US and EU trade officials are to conduct talks.

- Looking ahead, highlights include New Zealand ANZ Business Confidence, Australian Private Capital Expenditure, BoK Rate Decision.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include New Zealand ANZ Business Confidence, Australian Private Capital Expenditure, BoK Rate Decision.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks were mildly pressured and the major indices all finished lower to give back some of this week's gains, while there were some headwinds from US-China frictions with pressure seen in the likes of Cadence Systems and Synopsys after it was reported that US President Trump ordered US chip designers to stop selling to China, while a US Commerce spokesperson said the US is reviewing exports of strategic significance to China and has suspended some export license while review takes place. Nonetheless, futures pared some of the losses after-hours following NVIDIA's earnings which beat on top and bottom lines despite incurring a USD 4.5bln charge in Q1.

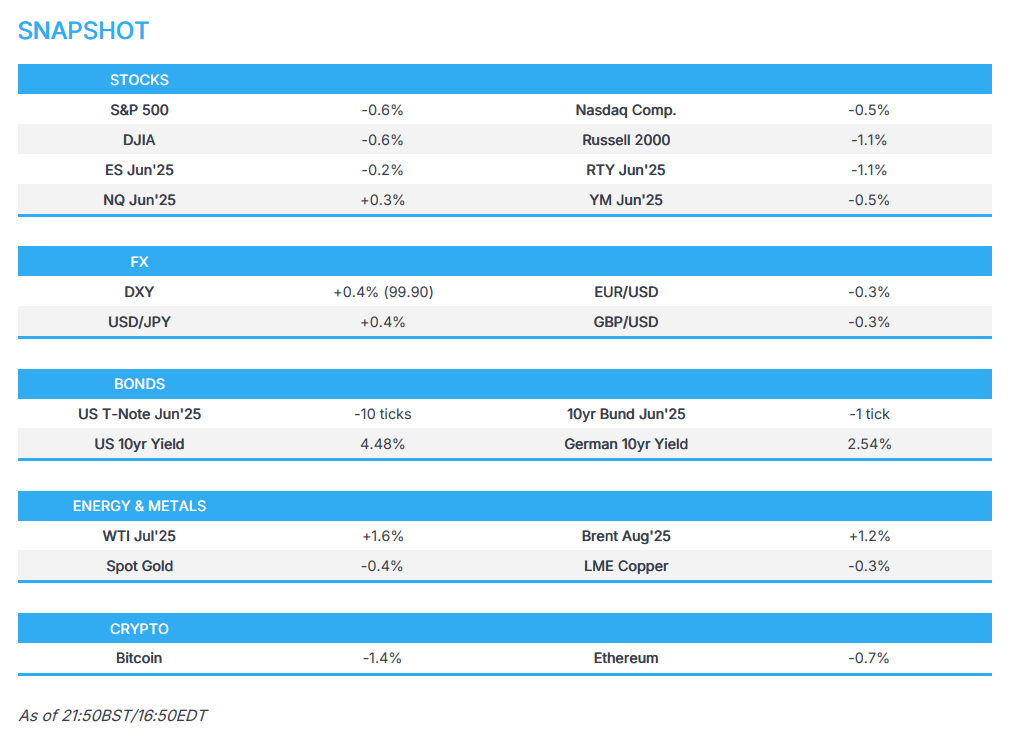

- SPX -0.56% at 5,889, NDX -0.45% at 21,318, DJI -0.58% at 42,099, RUT -1.08% at 2,068.

- Click here for a detailed summary.

FOMC MINUTES

- FOMC Minutes stated participants agreed they were well positioned to wait for more clarity on the outlook and these participants noted that a durable shift in such correlations or a diminution of the perceived safe-haven status of US assets could have lasting implications for the economy. Participants saw uncertainty about their economic outlooks as unusually elevated and noted they may face ‘difficult trade-offs’ if inflation proved more persistent while outlooks for growth and employment weakened. Furthermore, almost all participants commented on the risk that inflation could prove more persistent than expected and participants agreed that uncertainty about the outlook had increased and it was appropriate to take a cautious approach to monetary policy.

TARIFFS/TRADE

- US President Trump ordered US chip designers to stop selling to China, according to FT. Trump administration told US companies that offer software used to design semiconductors to stop selling their services to Chinese groups, in the latest attempt to make it harder for China to develop advanced chips. Several people familiar with the move said the Commerce Department told Electronic Design Automation groups, which include Cadence, Synopsys and Siemens EDA, to stop supplying their technology to China and “In some cases, commerce has suspended existing export licenses or imposed additional license requirements while the review is pending”.

- US Commerce Department spokesperson said the US is reviewing exports of strategic significance to China and has suspended some export licenses while the review takes place.

- White House CEA Chair Miran said Canada is anxious for a trade deal with the US and said regarding the EU that he thinks they will come around.

- EU Trade Commissioner Sefcovic is to speak with US Commerce Secretary Lutnick and Trade Representative Greer on Thursday and then on every other day. Sefcovic also said they are in conversations with the US and are looking into tariff lines, as well as cooperation in fields such as aviation, semiconductors and steel. Furthermore, the EU Trade Commissioner said the UAE and EU launched talks for a trade deal.

- China may relax rare earth export controls for Chinese and European semiconductors and related firms, according to China Daily citing sources.

- China's Foreign Minister said they will offer more conveniences to Pacific Island nations to export products to China.

- China's magnet export curbs could halt Indian auto production by end-May or early June, according to the Indian auto industry body.

NOTABLE HEADLINES

- White House Trade Adviser Navarro said the bond market is wrong about US President Trump's bill, according to The Hill.

- NY Fed said it will start morning standing repo facility operations on June 26th with offerings to take place between 08:15-08:30ET and will maintain afternoon standing repo facility offerings.

DATA RECAP

- US Rich Fed Comp. Index (May) -9.0 (Prev. -13.0)

- US Rich Fed Mfg Shipments (May) -10.0 (Prev. -17.0)

- US Rich Fed Services Index (May) -11.0 (Prev. -7.0)

FX

- USD extended on recent gains in which the DXY climbed to just shy of the 100.00 level despite there being very little in the way of fresh macro catalysts from the US and with a lack of fireworks from the FOMC Minutes which reinforced the wait-and-see message and noted that staff cited tariff policies as implying a larger drag on activity than policies they had assumed in their prior forecast. Nonetheless, there were several trade-related headlines including the Trump administration ordering US chip designers to stop selling to China, while US and EU trade officials are to conduct talks.

- EUR remained subdued after slipping back beneath the 1.1300 handle owing to the dollar strength, while attention turns to trade talks as EU Trade Commissioner Sefcovic is to speak with US Commerce Secretary Lutnick and Trade Representative Greer on Thursday and then on every other day.

- GBP languished at the sub-1.3500 territory in the absence of any major fresh catalysts for the UK.

- JPY continued to weaken against the dollar as US yields edged higher which saw USD/JPY briefly reclaim the 145.00 status.

FIXED INCOME

- T-notes pared Tuesday gains on weak JGB auction, commentary from Fed's Williams and likely profit taking.

COMMODITIES

- Oil prices were firmer and edged higher throughout the US session albeit on little headline newsflow, while there was little from the OPEC+ meeting with markets focused on the Saturday meeting between the eight members conducting voluntary cuts.

- OPEC+ JMMC made no output policy recommendations, according to delegates. It was also reported that the OPEC+ meeting discussed the proposed mechanism for setting 2027 baselines, while separate talks on Saturday could agree on a further accelerated output hike for July. Furthermore, OPEC+ reportedly agreed to use 2025 oil output levels for the 2027 baseline.

- Iraqi Oil Minister urged commitment to agreements reached in the OPEC+ meeting and affirmed that unity of stance is crucial for the stability of oil markets, according to a statement.

- Kuwaiti Oil Minister affirmed support for efforts for the stability of global oil markets, according to the state news agency.

- US said it can do a "significant reduction" in Iranian petroleum.

- Cochilco raised the average copper price forecast for both 2025 and 2026 to USD 4.30/lb (prev. 4.25/lb), while the upward revision reflects a better global outlook after the US-China tariff agreement. Furthermore, it estimates Chile's copper production to grow 3% in 2025 and 2026 with output to reach 5.84mln tons in 2026.

GEOPOLITICAL

MIDDLE EAST

- US President Trump said they are having good Iran talks and warned Israeli PM Netanyahu against Iran action which he said is not appropriate. Furthermore, he wants to go into Iran with inspectors and said Iran wants to make a deal, while he noted a deal could happen over the next few weeks and he told Netanyahu that they are close to a solution.

- US Special Envoy to the Middle East Witkoff said they are on the precipice of sending out a new terms sheet and Trump is to review the terms sheet, while he added there are good feelings on a temporary ceasefire for Gaza.

- Iran may agree to pause nuclear enrichment work temporarily if the US recognises Tehran's right to enrich Uranium for civilian uses, while any temporary halt to nuclear activity under a "political agreement" would also require the US to release frozen Iranian funds, according to Reuters citing sources. However, it was later reported that Tehran denied a Reuters report of halting uranium enrichment for a year and said the continuation of enrichment in Iran is a non-negotiable principle, according to Iran International.

RUSSIA-UKRAINE

- US President Trump said "can't tell you if Putin wants to end the war" and will find out soon, while he added that they will respond differently if Putin is playing them and it will take about a week to find out. Trump added he is disappointed in what happened in Ukraine and will sit down with Zelenskiy and Putin if necessary.

- US State Department spokesman Bruce said the US is ready to do a maximum pressure framework on Russia, according to Fox.

- Ukraine's Defence Minister said he handed over the Ukrainian version of the memorandum to the head of the Russian delegation and Russia continues to delay the delivery of their version, while Ukraine is not opposed to further meetings but waits for a memorandum from the Russian side.

- Russian Foreign Minister Lavrov proposed that the next round of Russia-Ukraine talks take place on June 2nd in Istanbul, according to Interfax. It was separately reported that Lavrov informed US Secretary of State Rubio of the preparation of concrete proposals to resolve the Ukrainian conflict, while Lavrov told Rubio of the proposed new round of talks between Russia and Ukraine.

- Russia’s Kremlin said a meeting with Ukrainian President Zelenskiy should take place as an outcome of talks and there was no decision on the venue for the next round of discussions with Ukraine, while the Kremlin said German Chancellor Merz's remarks regarding Ukrainian long-range missile is nothing but a further provocation of the war.

- Russia's Medinskiy said Russia has offered Ukraine the exact date and venue for a second round of talks in the coming days to exchange a memorandum on the peace settlement, according to TASS.

OTHER

- NATO is to ask Germany to provide 7 additional brigades or 40k troops for the Alliance's defence and will increase the target for a total number of brigades allies must provide in the future to 120-130.

- China's most advanced bombers were reportedly seen on a disputed South China Sea island, according to Reuters.

- EU's Kallas said cyberattacks linked to China targeting EU member states have increased in the past year.

ASIA-PAC

NOTABLE HEADLINES

- Chinese Vice Premier He met with a Morgan Stanley (MS) executive in China and welcomes US financial institutions to deepen cooperation with China.

- US President Trump said TikTok is different than Nippon and would need China's approval on TikTok, while he thinks they can save TikTok and he has a warm spot for TikTok.

EU/UK

NOTABLE HEADLINES

- ECB's Lagarde reportedly discussed stepping down as ECB President early in order to chair the WEF, according to the FT citing WEF founder Schwab. However, an ECB spokesperson said Lagarde is determined to complete her term at the ECB.

- ECB's Knot said near-term growth and inflation risks are to the downside but added that the medium-term inflation outlook is more ambiguous.

- ECB's Villeroy said he does not see inflation picking up in Europe.

DATA RECAP

- German Unemployment Change SA (May) 34.0k vs. Exp. 10.0k (Prev. 4.0k)

- German Unemployment Rate SA (May) 6.3% vs. Exp. 6.3% (Prev. 6.3%)

- German Import Prices MM (Apr) -1.7% vs. Exp. -1.4% (Prev. -1.0%)

- German Import Prices YY (Apr) -0.4% vs. Exp. 0.1% (Prev. 2.1%)