US stocks largely closed in the green as the initial downside seen in the wake of a deluge of US data pared - Newsquawk Asia-Pac Market Open

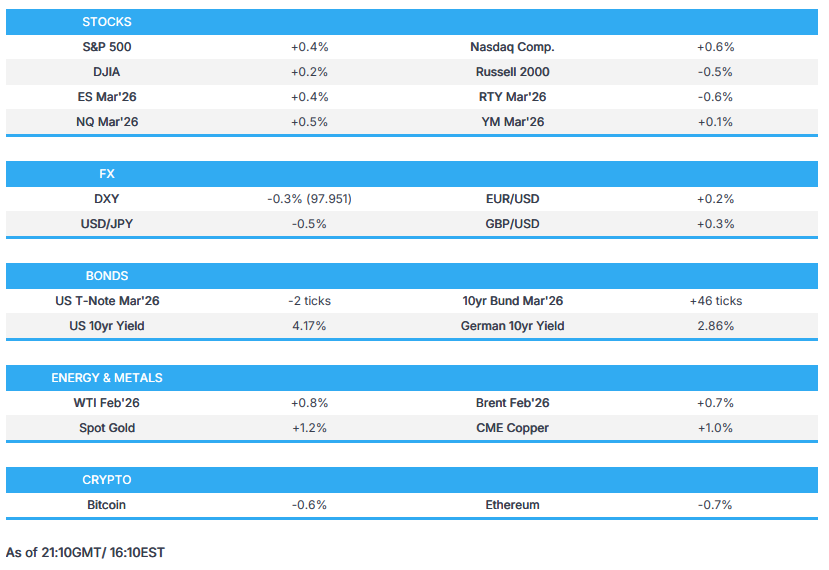

- US stocks largely closed in the green as the initial downside seen in the wake of a deluge of US data pared.

- The Dollar was weaker on Tuesday ahead of the upcoming Christmas break, G10 FX saw gains against the Dollar, with Antipodeans outperforming and buoyed by ongoing strength in metals prices.

- Treasury curve flattens after strong GDP data. The 5-year auction was decent but saw no reaction, and the 2-year FRN was solid.

- Oil prices were choppy, but in a very contained range, amid light energy-specific newsflow on Tuesday.

- Highlights include BoJ Minutes, Japanese Services PPI, Japanese Leading Indicator.

- Note: The desk will run until 18:05GMT/13:05EST on Wednesday 24th December. Normal service will resume at 0700GMT/02:00EST on Friday 2nd of January 2026 for the beginning of the European Session.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks largely closed in the green as the initial downside seen in the wake of a deluge of US data pared.

- SPX +0.46% at 6,910, NDX +0.50% at 25,588, DJI +0.16% at 48, 442, RUT -0.69% at 2,541.

NOTABLE US HEADLINES

- US President Trump posted on Truth said "The Financial News today was great — GDP up 4.2% as opposed to the predicted 2.5%"; "...Want my new Fed Chairman to lower Interest Rates if the Market is doing well, not destroy the Market for no reason whatsoever.. "

- White House Economic Adviser Hassett said GDP figure a great Christmas present for American people, via CNBC. Will see 100-150k monthly job gains if GDP growth stays in a 4% range. Consumer sentiment is pretty uncorrelated with hard economic numbers. When people are optimistic, that makes them more willing to spend. Fed is way behind curve on rate cuts. Trump will announce housing plan sometime in the New Year.

- US President Trump said "Q3 GDP came in at 4.3%, BLOWING PAST expectations of 3.2%. 60 of 61 Bloomberg Economists got it WRONG, but “TRUMP,” and some other Geniuses, got it right. The SUCCESS is due to Good Government, and TARIFFS...".

- US President Trump posted on Truth, in the context of him hosting the Trump Kennedy Honors on CBS and requesting feedback on his hosting performance, " If really good, would you like me to leave the Presidency in order to make “hosting” a full time job?".

- US President Trump said "The TARIFFS are responsible for the GREAT USA Economic Numbers JUST ANNOUNCED…AND THEY WILL ONLY GET BETTER! Also, NO INFLATION & GREAT NATIONAL SECURITY. Pray for the U.S. Supreme Court!!! President DJT".

- US Treasury Secretary Bessent, on the November CPI, said he thinks it is a pretty accurate number; on Miran, said he will probably be back to CEA in February or March. He adds it would be better to make it a range centred around 2% but need to hit the target first. "Understands probably better than anybody what needs to be done", on the need to overhaul the Fed.

- US President Trump is reportedly mulling giving 775 acres of federal wildlife refuge to SpaceX, via NYT. SpaceX would give the Government some of its own property in exchange for the land.

- US Treasury Secretary Bessent said large paychecks will accompany hiring in the months ahead.

- US NEC Director Hassett says President Trump has "a bunch of great Fed chair candidates", via Fox Business; Precious metals are skyrocketing for good reason.

TARIFFS/TRADE

- France demands EU action to counter Chinese duties on dairy, via Bloomberg News.

- Indian Commerce Secretary Agrawal said India is deeply engaged with the US to close a trade deal.

- US President Trump said he had a wonderful call with the President of Kazakhstan and Uzbekistan; discussed the importance of bringing peace to conflicts and increased trade cooperation between nations.

- US tariff on China semiconductors at 0% until June 2027, via USTR; at which point tariffs will increase, rate to be announced not fewer than 30 days before June 23rd, 2027.

- China initiates disputes regarding Indian measures on solar cells and modules and IT goods, according to the WTO.

- USTR Greer said he is happy to have trade with China in non-sensitive areas.

DATA RECAP

- US GDP Advance (Q3) 4.3% vs. Exp. 3.3% (Prev. 3.8%). Data spurred pressure of around four ticks in USTs Mar’26 initially, and lifted the DXY. Thereafter, after the hawkish move extended, pressure was seen across US equity futures with the ES and NQ at lows while the Dollar advanced. Spot gold was pressured from peaks, but silver has held above USD 70/oz. The move lower in T-notes is weighing on global fixed income.

- US PCE Prices Advance (Q3) 2.8% vs. Exp. 2.8% (Prev. 2.1%).

- US GDP Sales Advance (Q3) 4.6% (Prev. 7.5%).

- US GDP Deflator Advance (Q3) 3.7% vs. Exp. 2.7% (Prev. 2.1%).

- US Core PCE Prices Advance (Q3) 2.9% vs. Exp. 2.9% (Prev. 2.6%).

- US GDP Cons Spending Advance (Q3) 3.5% (Prev. 2.5%).

- US PCE Svs Exl Eng & Hsg (A) (Q3) 3.4% (Prev. 2.4%).

- US Average Weekly Prelim Estimate ADP (4-week, w/e 6 Dec) +11.5k (Prev. +16.25k, Rev. +17.5k).

- US Rich Fed Mfg Shipments (Dec) -11.0 (Prev. -14.0).

- US Consumer Confidence (Dec) 89.1 vs. Exp. 91.0 (Prev. 88.7).

- US Rich Fed, Services Index (Dec) -6.0 (Prev. -4.0).

- US Rich Fed Comp. Index (Dec) -7.0 (Prev. -15.0).

- US Consumer Confidence (Dec) 89.1 vs. Exp. 91.0 (Prev. 88.7, Rev. 92.9).

- US Capacity Utilisation SA (Nov) 76.0% vs. Exp. 75.9% (Oct. 75.9%, Sept. 76.0%).

- US Manuf Output MM (Nov) 0.0% (prev. -0.4%).

- US Industrial Production MM (Nov) 0.2% vs. Exp. 0.1% (Oct -0.1%, Sept. 0.1%).

- US Redbook YY w/e 7.2% (Prev. 6.2%).

- US Corporate Profits Prelim (Q3) 4.4% (Prev. 0.2%).

- US Durables Ex-Transport (Oct) 0.2% vs. Exp. 0.3% (Prev. 0.6%, Rev. 0.7%).

- US Durable Goods (Oct) -2.2% vs. Exp. -1.5% (Prev. 0.5%, Rev. 0.7%).

- US Nondefe Cap Ex-Air (Oct) 0.5% vs. Exp. 0.4% (Prev. 0.9%, Rev. 1.1%).

- US Durables Ex-Defense MM (Oct) -1.5% (Prev. 0.1%).

- Visa (V) US Holiday Spending: +4.2%.

- Mastercard (MA) SpendingPulse: US Holiday Retail Sales growth 3.9% Y/Y.

- Atlanta Fed GDPnow (Q4): 3.0%.

- Canadian Budget, Year-To-Date, C$ (Oct) -18.37B CA (Prev. -16.09B CA).

- Canadian Budget Balance, C$ (Oct) -2.28B CA (Prev. -5.02B CA).

- Canadian GDP MM (Oct) -0.3% vs. Exp. -0.2% (Prev. 0.2%).

- Canadian GDP MM (Oct) -0.3% vs. Exp. -0.2% (Prev. 0.2%); Nov. estimate +0.1%.

NOTABLE US EQUITY HEADLINES

- ServiceNow (NOW) is to acquire Armis for USD 7.75bln in cash.

FX

- The Dollar was weaker on Tuesday ahead of the upcoming Christmas break, as a data deluge took the headlines.

- G10 FX saw gains against the Dollar, with Antipodeans outperforming and buoyed by ongoing strength in metals prices.

- The Yen was once again much the talk of the town amid further jawboning from Finance Minister Katayama overnight.

- For the Loonie watchers, Canadian October GDP and BoC Minutes were the only things of note.

FIXED INCOME

- Treasury curve flattens after strong GDP data. The 5-year auction was decent but saw no reaction, the 2-year FRN was solid too.

- US sold USD 28bln of 2-year FRN's; high-discount margin 0.139%. High Discount Margin: 0.139% (prev. 0.17%, six-auction average 0.18%). B/C: 3.75x (prev. 3.03x, six-auction average 3.11x). Dealer: 30.0% (prev. 33.75%, six-auction average 35.31%). Direct: 0.7% (prev. 0.71%, six-auction average 0.93%). Indirect: 69.3% (prev. 65.54%, six-auction average 63.77%).

- US sold USD 70bln of 5-year notes; tails 0.1bps. Tail: 0.1bps (prev. 0.5bps, six-auction average 0.4bps); WI: 3.746%. High Yield: 3.747% (prev. 3.562%, six-auction average 3.747%). B/C: 2.35x (prev. 2.41x, six-auction average 2.36x). Dealer: 8.8% (prev. 11.0%, six-auction average 10.7%). Direct: 31.7% (prev. 27.6%, six-auction average 27.5%). Indirect: 59.5% (prev. 61.4%, six-auction average 61.8%).

- Treasury Buyback (10- to 30-year TIPS, max USD 500mln): Accepts USD 108mln of USD 1.19bln offers, accepts 4 out of 15 eligible issues; Offer to cover 11.02x.

- US sold 6-wk bills at high rate 3.580%, B/C 2.87x; sold 1yr bills at high rate 3.380%, B/C 3.74x.

- US to sell USD 80bln in 8-week bills, USD 80bln in 4-week bills and USD 69bln in 17-week bills on December 24th; to settle Dec 30th.

COMMODITIES

- Oil prices were choppy, but in a very contained range, amid light energy-specific newsflow on Tuesday.

- Venezuela assembly approved law allowing up to 20-year sentences for promoting piracy or blockades amid U.S. oil ship interceptions.

- Baker Hughes Rig Count: Oil +3 at 409, Nat Gas unch. at 127, Total +3 at 545.

- Exports of four key Nigerian crude oil grades to average 922k BPD in February (Prev. 786k BPD in January).

- Petrobras's production at Tupi field reaches a pace of 1mln BPD, according to sources by Reuters.

- North Sea Forties crude oil loadings set at 150k BPD across six cargoes in February (prev. 158k BPD M/M).

- Iraqi Electricity Ministry said Iranian gas supply has been fully halted.

CENTRAL BANKS

- ECB's Stournaras said the ECB must preserve optionality, via Econostream; being in a good place does not imply that rates are locked in. Expressed optimism on the EZ growth outlook, but highlighted risks.

- BoC Minutes (Dec): Agreed to remain cautious in interpreting data given recent volatility; felt it was hard to predict whether the next move would be a hike or a cut. Policy Outlook: Ahead of Bank of Canada’s Dec 10 rate announcement, Governing Council felt it was hard to predict whether the next move would be a hike or a cut. Prepared to respond in case of a major new shock, or data showing the economy and inflation diverging materially from outlook. Trade: Despite the risk that higher costs from trade disruption could spill over into consumer prices, effects have been limited so far. Concluded that this could be because of slower growth in unit labor costs. Felt uncertainty leading up to and during USMCA talks would likely weigh on business investment. Agreed that upcoming review of USMCA trade treaty was a significant risk. Data: Volatility in recent quarterly GDP readings underlines how challenging it will be to judge underlying economic trends. Governing Council agreed to remain cautious in interpreting data given recent volatility.

- BCB sold USD 500mln in USD auctions with a repurchase deal.

- RBI to buy INR 2tln of bonds via OMO and to hold a USD 10bln swap auction, via Bloomberg.

GEOPOLITICAL

RUSSIA-UKRAINE

- Ukraine's President Zelensky said negotiators from Ukraine have "worked productively" with the US team in recent peace talks. Several draft documents have been prepared on security guarantees, recovery and peace framework.

OTHER

- US Envoy to UN said US will impose and enforce sanctions to deprive Venezuela's Maduro of resources to fund Cartel de Los Soles, including oil profits.

ASIA-PAC

NOTABLE HEADLINES

- Guangzhou Futures Exchange to adjust transaction fees, price limits and margin requirements for some platinum, palladium and lithium carbonate futures from 25th December.

NOTABLE APAC EQUITY HEADLINES

- SMIC (981 HK) reportedly raises prices 10% amid mature process market recovery, via DigiTimes. The Korean chip industry faces mounting pressure from escalating power prices.

DATA RECAP

- South Korean Consumer Sentiment Index (Dec) 109.9 (Prev. 112.4)

EU/UK

DATA RECAP

- Belgian CPI YY (Dec) 2.06% (Prev. 2.4%); MM (Dec) 0.07% (Prev. 0.56%).

NOTABLE EUROPEAN EQUITY HEADLINES

- European Closes: Euro Stoxx 50 +0.14% at 5,752, Dax 40 +0.22% at 24,337, FTSE 100 +0.24% at 9,889, CAC 40 -0.21% at 8,104, FTSE MIB +0.03% at 44,607, IBEX 35 +0.14% at 17,183, PSI -0.27% at 8,169, SMI +0.68% at 13,254, AEX -0.05% at 942.

- Novo Nordisk (NOVOB DC) CEO said the Co. is 'absolutely' interested in more M&A's.

- Campari's (CPR IM) Lagfin regains full availability of seized shares following the settlement with the Italian tax authorities.

NOTABLE GLOBAL EQUITY HEADLINES

- Japan's antitrust watchdog will launch an investigation into the search services of major domestic and foreign IT companies that use generative artificial intelligence, officials said Tuesday, citing possible violations of the antimonopoly law.

- BlackRock (BLK) and MSC considering walking away from a deal to buy the ports from CK Hutchison if Cosco were to insist on getting a majority stake, according to FT.

- US probes NVIDIA's (NVDA) biggest chip buyer in Southeast Asia, Megaspeed, for smuggling, according to Bloomberg.

LATAM

DATA RECAP

- Mexican Trade Balance SA (Nov) -0.274B (Prev. 1.411B, Rev. 1.530B).

- Brazilian IPCA-15 Mid-Month CPI (Dec) 0.25% vs. Exp. 0.27% (Prev. 0.2%).

- Brazilian IPCA-15 Mid-Month CPI YY (Dec) 4.41% vs. Exp. 4.43% (Prev. 4.5%).

- Mexican Trade Balance SA (Nov) -0.274B (Prev. 1.411B).

- Mexican Trade Balance, $ (Nov) 0.663B vs. Exp. -0.13B (Prev. 0.606B).

- Mexican 1st Half-Mth Core Infl MM (Dec) 0.31% vs. Exp. 0.4% (Prev. 0.04%).

- Mexican 1st Half-Mth Infl MM (Dec) 0.17% vs. Exp. 0.3% (Prev. 0.47%).

- Mexican 1st Half-Mth Core Infl YY (Dec) 4.34% vs. Exp. 4.43% (Prev. 4.32%).

- Mexican 1st Half-Mth Infl YY (Dec) 3.72% vs. Exp. 3.85% (Prev. 3.61%).