US stocks lower, NQ underperforming due to NVIDIA and Oracle updates; Metals continues Friday's slump - Newsquawk US Market Open

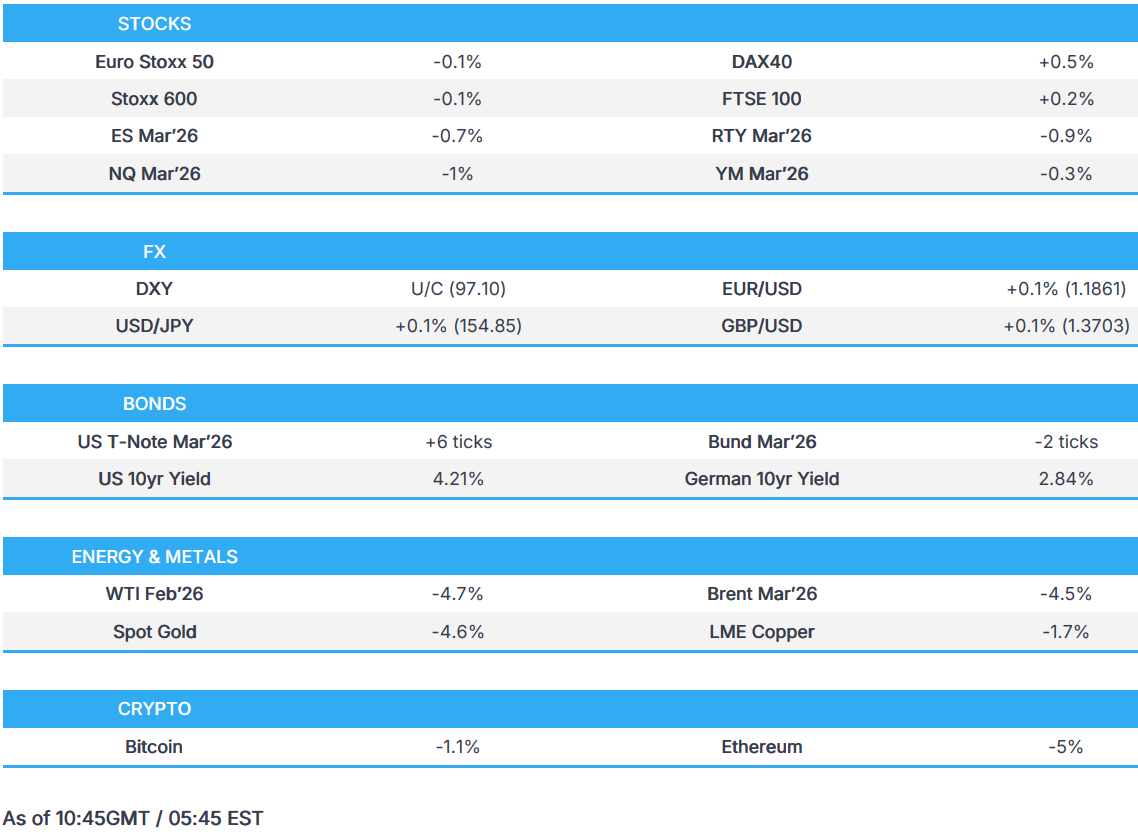

- European bourses opened lower but now display a mixed picture; US equity futures are entirely in the red with the NQ leading losses, focus on NVIDIA/Oracle.

- DXY is flat, Aussie initially underperformed as metals got hit but now CHF lags as the risk-tone improves. JPY digests Takaichi comments and new polling which places LDP in a strong position.

- Fixed initially bid given the risk tone, but pulling back as sentiment turns mixed in Europe.

- Precious metals hit in a continuation of Friday’s losses; WTI dips below USD 62/bbl as US-Iran tensions ease, with talks in Turkey this week looming.

- Looking ahead, highlights include US Final Manufacturing PMIs (Jan), ISM Manufacturing PMI (Jan), Speakers including BoE’s Breeden & Fed’s Bostic, Treasury Refunding Announcement, Earnings from Palantir & NXP Semiconductors.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) opened broadly on the backfoot, but have since gradually moved higher to display a mixed picture.

- European sectors are mixed. Insurance leads whilst Basic Resources and Energy are the clear laggards, driven by significant pressure across the underlying commodities space.

- US equity futures (ES -0.6%, NQ -0.8%, RTY -0.9%) are entirely in the red. In the pre-market, NVIDIA (-1.6%) shares are lower as the WSJ flagged doubts related to the Co’s OpenAI deal. Nonetheless, CEO Huang attempted to push back on those claims, but some desks noted his remarks instead confirmed the piece. When asked about whether the OpenAI investment would be more than USD 100bln, he said “No, no, nothing like that”. Further fuelling the subdued sentiment is Oracle (-3.5%) announcing it is planning to raise USD 50bln to fund cloud infrastructure.

- NVIDIA's (NVDA) plan to invest USD 100bln in OpenAI was said to have stalled as discussions broke down amid concerns from within NVIDIA regarding the transaction, according to unidentified sources cited by WSJ. It was separately reported that NVIDIA CEO Huang said they will definitely invest in OpenAI, which will probably be their biggest investment, although he responded 'no, no, nothing like that' when asked if the investment would be over USD 100bln.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- The DXY is essentially flat and trades within a very narrow 92.17-97.29 range. Newsflow over the weekend has been light from a Dollar perspective, so attention will be on a data-packed week ahead (incl. ISMs, PMIs & jobs data) and on developments related to the current partial US government shutdown. On the latter point, lawmakers managed to work out a deal on Friday – the House is now set to vote on either Monday or Tuesday; House Speaker Johnson predicts the partial shutdown will end by Tuesday.

- G10s are mostly losing vs the USD (ex-GBP & EUR), which are currently incrementally firmer. Nothing is really driving things for the GBP this morning (PMIs were revised a touch higher). In Europe, EZ PMIs were broadly subject to mild upward revisions, and this was reflected in the EZ-wide figure – nonetheless, it still remains in contractionary territory. CHF initially flat, but now underperforms as the risk tone improves.

- Focus this morning has also been on the Aussie & Kiwi, which are currently posting mild losses vs the USD. Downside comes amidst the continuation of pressure seen in underlying metals prices; XAU -4.5% this morning. From a central banking perspective, the RBA is set to give a policy announcement on Tuesday. Markets currently price in a 76% chance of a 25bps hike, a recent shift from expectations of a pause – traders cite strong jobs data and inflation remaining above target.

- Volatile trade for USD/JPY. Initially gapped higher (154.84) and gradually rose towards a session peak (155.51) within an hour, before paring that move. Since, trade has been rangebound. The earlier bout of weakness in the JPY comes after Japanese press circulated comments via PM Takaichi, where she seemingly talked up the benefits of a weaker JPY – but this was later clarified by the PM. On the subject of Takaichi, recent polls suggest that the ruling LDP is likely on course for a landslide victory at the snap election this upcoming Sunday. In more detail, Asahi reported that the LDP-JIP coalition could “secure more than 300 seats”, far surpassing a simple majority of 233.

FIXED INCOME

- JGBs began the week on the backfoot, down to a 131.32 low, amid the latest election polling. Asahi's poll has the LDP on track for a standalone majority and, when combined with JIP, to over 300 seats and by extension within reach of the 310 super-majority level in the 465-seat Lower House. However, the pressure proved somewhat fleeting given the global risk-off move and as XAU remains for sale, fixed has benefited. Action that been sufficient to lift JGBs into the green with gains of c. 10 ticks and the 10yr yield below 2.25%; however, the 40yr yield remains firmer and holds at highs of 3.94%.

- USTs are being dictated by the risk tone. Just off a 112-02 peak, firmer by c. five ticks as things stand. The tone is driven by the continued pullback in metals, weak Chinese PMIs, NVIDIA reporting, the likely temporary US government shutdown and as we await the first remarks from Trump's Fed Chair pick and any potential SCOTUS update re. tariffs. While there is no schedule for the latter two points, today's docket does have the S&P Final Manufacturing PMI and then the ISM figure.

- EGBs are contained this morning. Bunds found haven allure overnight and got to a 128.36 peak, with gains of 20 ticks at best. However, the benchmark has gradually come off best into the European morning as the region's risk tone inches higher, and equities go from being well in the red to somewhat mixed. No move seen to Final Manufacturing PMIs. As it stands, Bunds are near-enough unchanged but around 10 ticks off their 128.04 trough.

- Gilts lead this morning. Catching up to the overnight bid seen in peers. Since, in limited newsflow but as the tone continues to recover, Gilts have pulled back from their 91.21 peak to just above the figure, though it continues to outperform with gains of c. 20 ticks. Not driving price action but a narrative to keep an eye on is a piece in The Telegraph that Labour's Rayner is constructing a war chest and has begun offering Cabinet roles to her supporters, as part of a plot to succeed PM Starmer.

COMMODITIES

- Crude benchmarks have slumped at the start of the new week following geopolitical headlines over the weekend that have eased rising tensions in recent weeks. Axios' Ravid reported that a US-Iran meeting could take place this week, after weeks of potential signs of a strike in Iran. US President Trump also told reporters that Iran was seriously talking with Washington. WTI and Brent began trade just shy of USD 65/bbl and USD 68/bbl, respectively, before steadily falling lower throughout the APAC session to a low of USD 61.44/bbl and USD 65.45/bbl as markets price out the potential of further escalation. Benchmarks have rebounded slightly but remain near session lows.

- Nat Gas futures continue to pare back the rise in prices following the Arctic storm, with Dutch TTF now trading below EUR 35/MWh after topping at EUR 43.38/MWh at the peak of the storm worries. Overnight, Russia announced that it will permit gasoline exports for fuel producers through to the end of July to avoid overstocking.

- Precious metals continue to slide, with spot gold and silver falling as much as 10% and 16%, respectively. The initial selloff was initiated early last Friday on the possibility (and then confirmation) of Kevin Warsh being announced as the new Fed Chair.

- During the APAC session, XAU steadily trended lower as Chinese participants took the opportunity to lock in profits, falling just shy of USD 4400/oz. As the European session continues, the yellow metal continues to rebound and is returning back to USD 4700/oz; but ultimately, remains lower by over 4%. Similarly, after falling to a trough of USD 71.40/oz, silver prices have rebounded to USD 80/oz.

- Alongside precious metals, 3M LME Copper gapped below USD 13k/t and drove to a low of USD 12.43k/t, weighed on by the broader risk-off tone and weak Chinese PMIs. Copper prices remain below USD 13k/t but have recently rebounded just shy of session highs of USD 12.95k/t.

- Turkey raises lower price limits on some gold and silver funds.

- OPEC Secretariat receives updated compensation plans from Iraq, the United Arab Emirates, Kazakhstan, and Oman.

- Eight OPEC+ members agreed on Sunday to maintain the pause in oil output hikes in March.

- US President Trump said he welcomes investment from China and India in Venezuelan oil, while he announced that they have already made a deal for India to buy Venezuelan oil.

- Russia will permit gasoline exports for fuel producers through to end-July to avoid overstocking, although it extended the ban on exports for non-producers, as well as the ban on diesel and other types of fuel for non-producers until end-July.

TRADE/TARIFFS

- US President Trump warned of a very substantial response if Canada enacts a trade agreement with China, while he added that the US does not want China to take over Canada, which would happen with the deal that they are looking to make.

- South Korean Industry Minister Kim said they will speed up the implementation of investment legislation after returning from talks with the US, which he said cleared up misunderstandings regarding tariffs.

- EU industry association said on Friday that China proposed final anti-subsidy duties on EU dairy products at lower levels than in provisional duties with the final Chinese anti-subsidy tariffs on EU dairy products to go up to 11.7% vs. a maximum 42.7% in provisional duties.

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer said the UK should consider re-entering talks for a defence pact with the EU, while he added that Europe needs to step up and do more to defend itself in certain times, according to The Guardian.

- UK and Japan agreed to deepen defence and security cooperation.

NOTABLE EUROPEAN DATA RECAP

- UK S&P Global Manufacturing PMI Final (Jan) 51.8 vs. Exp. 51.6 (Prev. 50.6).

- UK Nationwide Housing Prices YoY (Jan) Y/Y 1.0% vs. Exp. 0.7% (Prev. 0.6%).

- UK Nationwide Housing Prices MoM (Jan) M/M 0.3% vs. Exp. 0.3% (Prev. -0.4%).

- EU HCOB Manufacturing PMI Final (Jan) 49.5 vs. Exp. 49.4 (Prev. 48.8).

- German HCOB Manufacturing PMI Final (Jan) 49.1 vs. Exp. 48.7 (Prev. 47.0).

- German Retail Sales YoY (Dec) Y/Y 1.5% (Prev. 1.1%).

- German Retail Sales MoM (Dec) M/M 0.1% vs. Exp. -0.2% (Prev. -0.6%).

- French HCOB Manufacturing PMI Final (Jan) 51.2 vs. Exp. 51.0 (Prev. 50.7).

- Italian HCOB Manufacturing PMI (Jan) 48.1 vs. Exp. 48.1 (Prev. 47.9).

- Spanish HCOB Manufacturing PMI (Jan) 49.2 vs. Exp. 49.9 (Prev. 49.6).

- Swedish Swedbank Manufacturing PMI (Jan) 56.0 (Prev. 55.3).

CENTRAL BANKS

- BoJ's Summary of opinions noted that one member said financial conditions remain accommodative even after a rate hike in December. One member said no need to worry too much about impact on corporate profits as long as rate hike pace is not too fast. One member said appropriate to continue raising policy rate if economic and price projections materialise. A member said current financial conditions still significantly accommodative judging from economic strength and fallout from recent weak yen. A member said if overseas rate environments change this year, there is risk BOJ may unintentionally fall behind a curve. A member said that the bank has been examining response of economic activity and prices and financial conditions to each rate hike and has been raising the policy interest rate, while it is appropriate for the bank to continue to do so. One member said BoJ should raise the policy rate at intervals of a few months. One member said some indicators of long-term inflation expectations have already started to show stability.

- ECB SAFE: "Inflation expectations were broadly unchanged across horizons, with firms continuing to report upside risks to their long-term inflation outlook.". Firms reported a net tightening in bank loan interest rates and in other loan conditions related to both price and non-price factors. Financing needs rose modestly, accompanied by a small perceived decline in availability. Inflation expectations were broadly unchanged across horizons, with firms continuing to report upside risks to their long-term inflation outlook. The use of artificial intelligence is widespread among euro area firms, though most firms use it very infrequently or moderately.

NOTABLE US HEADLINES

- US President Trump in WSJ OP ED titled: My tariffs have brought America back.

- US President Trump said Fed Chair nominee Warsh may get Democrat votes, and he hopes that Warsh will lower interest rates. In relevant news, Trump said on Friday that Warsh did not commit to cutting rates and he will probably talk about cutting rates with Warsh, while Trump also stated that Warsh will cut rates without White House pressure.

- Fed’s Bowman (voter) said on Friday that she supported a rate pause as inflation remains elevated, while she added that downside risks to the labour market have not diminished and that policy is modestly restrictive. Bowman also said that they should not imply that they expect to maintain the current stance of policy for an extended period of time, and noted she projected three rate cuts for 2026 in the December SEPs.

- US Senate voted 71-29 to pass the USD 1.2tln government funding deal, and the House is expected to vote as soon as Monday on the plan after a brief government shutdown.

- US President Trump picked Brett Matusmoto to head the BLS, according to WSJ.

- US Commerce Secretary Lutnick was reported to have planned a visit to Epstein’s island with his family, according to the latest Epstein files released by the DoJ.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said that they have narrowed their differences on some issues with Ukraine but not on complex issues, next round of trilateral talks on Ukraine will take place in Abu Dubai on Wednesday and Thursday.

- Ukrainian President Zelensky said Ukraine is ready for substantive discussions and is interested in results, while he announced the next trilateral peace talks between the US, Russia and Ukraine will take place in Abu Dhabi on Feb. 4th-5th.

- US envoy Witkoff said he held constructive talks with Russian special envoy Dmitriev on Saturday in Florida as part of the US effort to end the war in Ukraine.

- Russia’s Medvedev said victory will come soon in the Ukraine war, but it is equally important to think about how to prevent new conflicts, while he also commented that US President Trump is an effective leader who seeks peace and that they never found the two nuclear submarines Trump spoke about deploying closer to Russia.

MIDDLE EAST

- Iranian Supreme Leader Khamenei warned that if the US launches a war, it won’t stay confined to Iran and would likely escalate into a broader regional conflict, according to Iran International. It was separately reported that Iran renewed its threat to strike Israel in which Iranian army chief Major-General Amir Hatami warned that “If the enemy makes a mistake, it will without doubt endanger its own security, the security of the region, and the security of the Zionist regime”.

- US officials said a meeting between the US and Iran could take place in Turkey this week, according to Axios’s Ravid.

- Iran's foreign Ministry said US President Trump has not set a deadline for negotiations, via Alhadath on X.

- Iran announces it has summoned all the EU ambassadors in the Islamic Republic to protect the bloc's listing of the paramilitary Revolutionary Guard as a terror group.

- Persian Gulf states are warning US officials that Tehran's missiles program remains capable of inflicting significant damage to US interest in the region, via X.

CRYPTO

- Bitcoin is a little lower and trades around USD 77k whilst Ethereum underperforms, and now down to USD 2.3k.

APAC TRADE

- APAC stocks were pressured amid several recent bearish themes, including the partial US government shutdown and surprise contraction in Chinese official PMIs over the weekend, while sentiment was also not helped by the recent historic collapse in precious metals and with tech-related weakness after reports that NVIDIA's plan to invest USD 100bln OpenAI stalled.

- ASX 200 retreated with underperformance in the mining sector after a tumble in metal prices, including last Friday's biggest intraday drop for gold in four decades, while sentiment was not helped by wide consensus for a looming RBA rate hike.

- Nikkei 225 initially bucked the trend with early support from a weaker currency and with the Takaichi trade in play after a poll showed that the ruling LDP is likely on course for a landslide victory at the snap election this upcoming Sunday. However, the index gradually wiped out its gains and more alongside the broad risk-off mood across the region.

- Hang Seng and Shanghai Comp suffered after disappointing PMI data over the weekend, which showed official manufacturing and non-manufacturing PMI unexpectedly slipped into contraction territory, while the private sector RatingDog manufacturing PMI data matched estimates and continued to show an expansion, but failed to inspire risk sentiment. Furthermore, Chinese telecom names were among the worst performers after Beijing notified about raising telecom services VAT to 9% from 6%.

NOTABLE APAC HEADLINES

- Japanese PM Takaichi said in a speech on Saturday that the yen’s recent depreciation boosted exporters and returns from the government’s foreign exchange fund, while she failed to address concerns regarding the effect on consumer prices. However, she attempted to clarify on Sunday that she was referring solely to the need to build an economic structure that can withstand currency fluctuations, and not to stress the advantages of a weaker currency.

- Japan’s ruling LDP party is likely to win a landslide victory and exceed a majority of 233 seats, while the ruling bloc may win more than 300 seats in the 465-seat parliamentary snap election on February 8th, according to an Asahi survey.

- Chinese President Xi called for China’s renminbi to attain global reserve currency status, according to FT.

- India increased infrastructure spending in its annual budget with the capital spending target for the upcoming fiscal year lifted by around 9% to INR 12.2tln, while it proposed to boost manufacturing in strategic sectors including rare earths and semiconductors, as well as proposed a tax holiday up to 2047 for foreign cloud companies making data centre investments in India. Furthermore, it strongly emphasised fiscal restraint and targeted reducing the debt-to-GDP ratio to 50% (+/-1%) from 56% by 2030/2031 and estimates the fiscal deficit will decline to 4.3% from 4.4% of GDP, while it is to raise the Securities Transaction Tax on futures and options trading.

NOTABLE APAC DATA RECAP

- Indian HSBC Manufacturing PMI Flash (Jan) 55.4 vs. Exp. 56.8 (Prev. 55).

- Chinese RatingDog Manufacturing PMI (Jan) 50.3 vs. Exp. 50.3 (Prev. 50.1).

- Chinese Manufacturing PMI (Jan) 49.3 vs Exp. 50.1 (Prev. 50.1)

- Chinese Non-Manufacturing PMI (Jan) 49.4 vs Exp. 50.3 (Prev. 50.2)

- Chinese Composite PMI (Jan) 49.8 (Prev. 50.7)

- Australian ANZ-Indeed Job Ads MoM (Jan) M/M +4.4% (Prev. -0.8%, Rev. From -0.5%).

- Australian MI Inflation Gauge YY (Jan) 3.6% (Prev. 3.5%).

- Australian Manufacturing PMI (Jan F) 52.3 (Prelim. 52.4).