US stocks mostly gained as markets shrugged off trade uncertainty ahead of earnings and the Fed - Newsquawk Asia-Pac Market Open

- US stocks closed higher on Monday as sentiment recovered ahead of a busy and important week of earnings (MSFT, META, TSLA, AAPL, ASML). Futures had initially dipped on Sunday, with downside sparked by Trump's threat of 100% tariffs on Canada over recent trade ties with China, as well as the potential for a partial government shutdown following disagreement over ICE funding after a Minneapolis shooting on the weekend, but then gradually recouped the losses throughout APAC and EU trade. Sector performance was led by Communications and Tech, but Consumer Discretionary lagged and was the sole sector in the red, while Microsoft gained after it announced the Maia 200 chip, in the latest challenge to NVIDIA, which resulted in modest losses in NVDA shares.

- USD was sold against major peers (ex-CAD) as continued trade conflict left the de-dollarisation trade intact after US President Trump threatened Canada with 100% tariffs over PM Carney looking to increase trade with China, while CAD unsurprisingly lagged as an optimistic outcome of USMCA negotiations appears unlikely. Other newsflow was light and lagged November Durable goods data did little to sway participants' outlooks, while the attention this week looms on the Fed rate decision on Wednesday (exp. to hold), a possible Fed Chair announcement from Trump, US-EU trade relations, and any geopolitical updates surrounding Iran or Ukraine/Russia. Furthermore, Barclays' month-end rebalancing model indicated no strong USD directional bias vs most majors, with a weak USD buying signal vs the EUR.

- Looking ahead, highlights include Japanese Services PPI & BoJ Core CPI, Australian NAB Business Confidence, Philippines Trade Data, Chinese Industrial Profits, Supply from Australia.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Japanese Services PPI & BoJ Core CPI, Australian NAB Business Confidence, Philippines Trade Data, Chinese Industrial Profits, Supply from Australia.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks closed higher on Monday as sentiment recovered ahead of a busy and important week of earnings (MSFT, META, TSLA, AAPL, ASML). Futures had initially dipped on Sunday, with downside sparked by Trump's threat of 100% tariffs on Canada over recent trade ties with China, as well as the potential for a partial government shutdown following disagreement over ICE funding after a Minneapolis shooting on the weekend, but then gradually recouped the losses throughout APAC and EU trade. Sector performance was led by Communications and Tech, but Consumer Discretionary lagged and was the sole sector in the red, while Microsoft gained after it announced the Maia 200 chip, in the latest challenge to NVIDIA, which resulted in modest losses in NVDA shares.

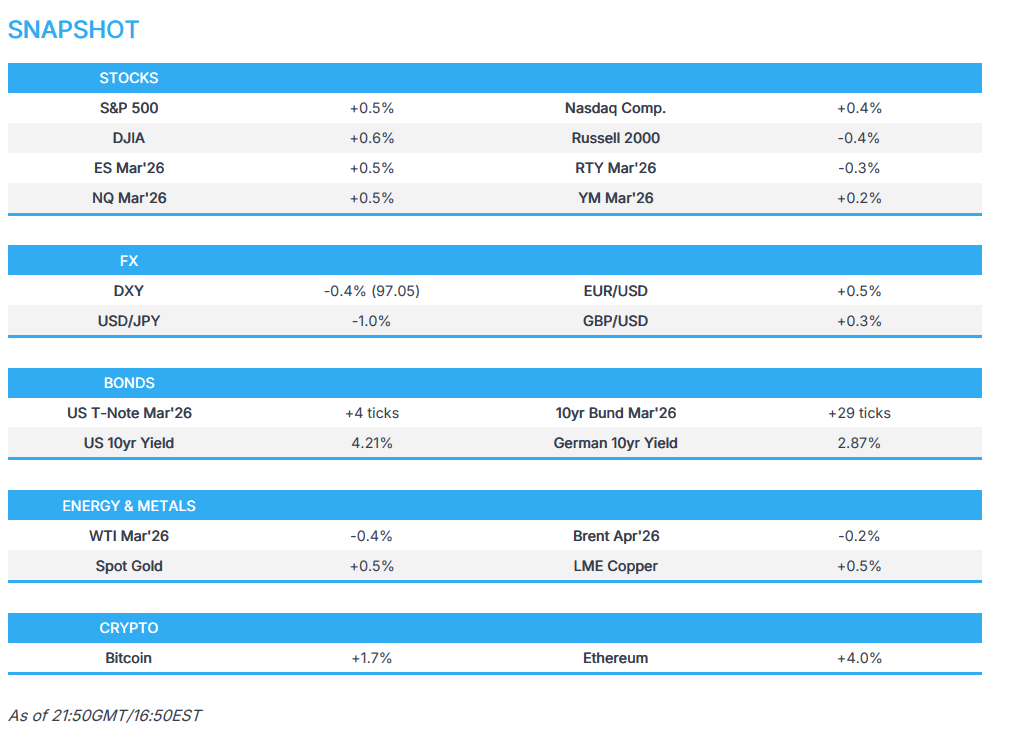

- SPX +0.5 at 6,950, NDX +0.4% at 25,713, DJIA +0.6% at 49,412, RUT -0.4% at 2,659.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted "Because the Korean Legislature hasn't enacted our Historic Trade Agreement, which is their prerogative, I am hereby increasing South Korean TARIFFS on Autos, Lumber, Pharma, and all other Reciprocal TARIFFS, from 15% to 25%".

- European Parliament International Trade Committee Chair Lange said there is no decision on the US-EU trade agreement vote, and the decision on moving ahead with the US trade agreement is delayed until February 4th.

- EU and India are reportedly to explore possibilities for India's participation in European defence initiatives, while it was separately reported that India’s Trade Secretary said India and the EU have concluded talks over a trade agreement and that the deal is to be announced on Tuesday.

- Canada's Internal Trade Minister LeBlanc said he had a productive discussion with USTR Greer and told Greer that Canada is not seeking a free trade deal with China.

- Chinese Commerce Ministry official said China and the US maintained communication at various levels following the leaders' summit in South Korea, while the official stated that China and the US are to manage differences and promote stable trade.

- Texas bans Alibaba (BABA), Temu, and TP-Link products from state employee devices.

NOTABLE HEADLINES

- US President Trump's admin proposes keeping the rates that Medicare pays insurers steady, according to WSJ citing officials from the CMS and the White House. Under the proposal, payments to the plans would increase by an estimated .09% on average in 2027, and the CMS is also proposing to eliminate a lucrative industry billing practice that has raised concerns with government watchdogs and was among the tactics examined in reporting by WSJ on Medicare insurers.

DATA RECAP

- US Durable Goods Orders MM (Nov) 5.3% vs. Exp. 3.7% (Prev. -2.1%, Rev. From -2.2%)

- US Durable Goods Orders Ex Transportation MM (Nov) 0.5% vs. Exp. 0.3% (Prev. 0.2%)

- US Dallas Fed Manufacturing Index (Jan) -1.2 (Prev. -11.3, Rev. From -10.9)

FX

- USD was sold against major peers (ex-CAD) as continued trade conflict left the de-dollarisation trade intact after US President Trump threatened Canada with 100% tariffs over PM Carney looking to increase trade with China, while CAD unsurprisingly lagged as an optimistic outcome of USMCA negotiations appears unlikely. Other newsflow was light and lagged November Durable goods data did little to sway participants' outlooks, while the attention this week looms on the Fed rate decision on Wednesday (exp. to hold), a possible Fed Chair announcement from Trump, US-EU trade relations, and any geopolitical updates surrounding Iran or Ukraine/Russia. Furthermore, Barclays' month-end rebalancing model indicated no strong USD directional bias vs most majors, with a weak USD buying signal vs the EUR.

- EUR climbed amid the dollar weakness, but with gains capped after failing to sustain a brief return to the 1.1900 handle.

- GBP edged higher and momentarily reclaimed the 1.3700 status before paring some of the gains in light UK newsflow.

- JPY remained subdued but is off intraday lows after bouncing back from a brief dip beneath the 154.00 level following the recent intervention risks.

FIXED INCOME

- T-notes gained with strength seen across the curve as attention turns to the Fed and next Chair following a strong 2yr auction.

COMMODITIES

- Oil prices saw slight weakness with Kazakhstan set to resume production at its biggest oilfield, although there have been outages in the US due to Storm Fern.

- OPEC+ is likely to maintain its supply pause in March, according to Bloomberg citing delegates, while it was stated that there is no need to respond to the events in Venezuela and Iran, but a significant supply disruption would warrant a boost in output.

- Kazakhstan's Tengizchevroil is reportedly gradually restarting its Tengiz production.

- Russia's Energy Ministry proposed to lift the gasoline export ban ahead of schedule, according to IFX sources.

GEOPOLITICAL

MIDDLE EAST

- US President Trump said Iran wants a deal as the US "armada" arrives and the situation with Iran is "in flux" because he sent a "big armada" to the region, although he thinks Tehran genuinely wants to cut a deal, according to Axios. Sources with knowledge of the situation said that Trump hasn't made a final decision and will likely hold more consultations this week and be presented with additional military options, while he said diplomacy remained an option and that Iran wants to make a deal and wants to talk, and has called on numerous occasions.

- US aircraft carrier and warships reached the Middle East, according to the Washington Post, while it was also reported that a US official said Washington is "open for business" If Iran wishes to contact them.

- Iranian Foreign Minister Araghchi said they exchanged messages with US Special Envoy Witkoff, covering various issues.

- UAE said it will not allow its airspace, territory, or waters to be used for military actions against Iran.

- Saudi Foreign Minister said the UAE decided to leave Yemen and if that's the case, Saudi Arabia will assume responsibility.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said regarding talks with Russia that the primary discussions were about military issues. Zelensky also commented that the delegation discussed steps to end the war and its monitoring, while he added that a Ukraine-Russia meeting can happen on Sunday, but would be good if it is sooner and they need real results from diplomacy, not Russia once again postponing pressure.

OTHER

- NATO Secretary General Rutte announced two workstreams have been agreed on for Greenland and Arctic security, including NATO's responsibility in the region. Rutte said they are examining collective measures to prevent increased Russian and Chinese access to the Arctic region, while Denmark, Greenland and US will continue to discuss the second workstream.

ASIA-PAC

NOTABLE HEADLINES

- PBoC plans to develop the CNY offshore market in 2026, and it reiterated its call to expand and innovate the policy toolbox, while it will expand "macro-prudential" policy coverage.

- China's Commerce Ministry announced a plan to integrate an overseas service platform, offering one-stop support such as legal, tax, finance, logistics and trade services for firms looking to expand internationally.

- Chinese Commerce Ministry official said they will roll out new policies in a timely manner and will support foreign firms in boosting consumption and government procurement, while the official stated that there are still many favourable conditions for developing foreign trade and both opportunities and challenges coexist.

- China's Foreign Ministry warned citizens against travelling to Japan during the Chinese New Year holiday, according to Xinhua.

- China's Shanghai Futures Exchange is to adjust price limits, margin ratios for copper and aluminium futures contracts from the 28th January closing settlement.

- China's gaming regulator said it approved 177 domestic games in January, including five imported games, and one approval was a game by NetEase (9999 HK).

- Alibaba (BABA) released its latest AI reasoning model, Qwen 3-Max-Thinking.

EU/UK

NOTABLE HEADLINES

- UK government announced a GBP 11bln lending package to help them invest and expand abroad, while the lending comes from the balance sheets of various banks, including Barclays (BARC LN), HSBC (5 HK) and NatWest (NWG LN).

DATA RECAP

- German Ifo Business Climate (Jan) 87.6 vs. Exp. 88.1 (Prev. 87.6)

- German Ifo Current Conditions (Jan) 85.7 (Prev. 85.6)

- German Ifo Expectations (Jan) 89.5 (Prev. 89.7)