US stocks predominantly closed lower on Wednesday; Iran headlines in focus - Newsquawk Asia-Pac Market Open

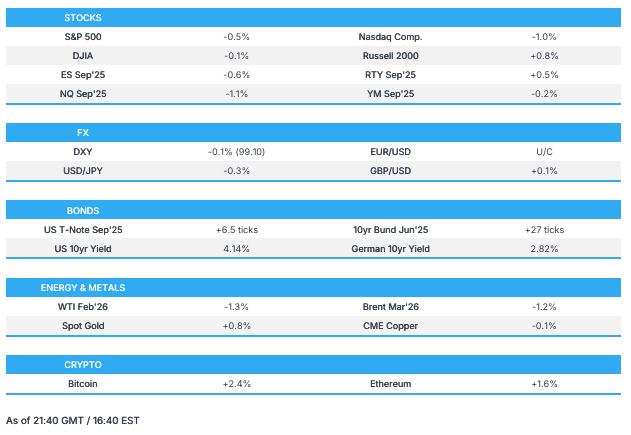

- US stocks predominantly closed lower on Wednesday, with heavy-cap tech stocks plummeting, leading indices lower, with the Nasdaq underperforming, while the Russell and Equal Weight S&P closed green.

- The Dollar was little changed mid-week as lagging US data did little to spur a reaction across markets. Retail Sales topped expectations in November, while the US PPI was mixed across October and November.

- T-notes bull flattened on geopolitical developments and mixed US data.

- Crude futures wiped out any gains post-settlement as Trump said he was informed by an Iranian source that they will stop killings and there are no plans for execution, which largely reduces the probability of a US attack on Iran.

- Looking ahead, highlights include South Korean Unemployment Rate, Japanese PPI, Australian MI Inflation Expectations, UK RICS House Price Balance, South Korean Trade Balance, and the BOK Announcement.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks predominantly closed lower on Wednesday with heavy-cap tech stocks plummeting, leading indices lower, with the Nasdaq underperforming, while the Russell and Equal Weight S&P closed green.

- Sectors were mixed with outperformance in Energy, Consumer Staples and Real Estate, while Consumer Discretionary, tech and Communications lagged. Energy stocks had outperformed, tracking crude prices higher throughout the majority of the day, seeing benchmarks settle well in the green. However, futures wiped out any gains post-settlement as Trump said he was informed by an Iranian source that they will stop killings and there are no plans for execution, which largely reduces the probability of a US attack on Iran. The news also hit gold prices (remains well in the green) and helped lift equity indices into the closing bell, given several reports throughout the day suggested Trump could attack Iran within 24 hours.

- SPX -0.53% at 6,927, NDX -1.07% at 25,466, DJI -0.09% at 49,150, RUT -0.52% at 2,652

NOTABLE US HEADLINES

- US-China AI race extends to space-based data centres, via Nikkei.

- US Treasury Secretary Bessent met with Australian Treasurer to discuss critical minerals opportunities, as well as mutual concerns of economic and national security interest.

- US Senate Republican leader Thune said he is not sure if he has the necessary votes to stop the War Powers act coming to a vote today.

- US Supreme Court (SCOTUS) did not rule on tariffs today.

- US President Trump reiterates that effective Feb 1st, no more payments will be made by the government to states for sanctuary cities.

- US Rep. Cuellar (D) has outlined that negotiators are nearing an agreement on the Homeland Security package, seek to release text over the weekend for that and three other funding bills, Punchbowl reported citing sources.

TARIFFS/TRADE

- US President Trump ordered the Commerce Dept. and USTR to negotiate agreements with foreign suppliers to reduce US reliance on imported processed critical minerals, citing national security risks.

- The White House says that in the near future, US President Trump may impose broader tariffs on semiconductor imports and their derivative products.

- The White House says President Trump imposed a 25% tariff on certain advanced computing chips, such as NVIDIA (NVDA) H200 and AMD (AMD) MI325X chips. Depending on the outcome of negotiations, President Trump may consider alternative remedies in the future, including minimum import prices for specific types of critical minerals. The Secretary and the trade representative should consider price floors for trade in critical minerals and other trade-restricting measures. The US chip tariff will not apply to chips imported for US technology supply.

- USITC institutes Section 337 investigation of certain wearable devices.

- Mexico's President said USMCA trade deal is working for both the US and Mexico.

- German Finance Minister said if threatened, then tougher trade measures must be considered.

- UK Chancellor Reeves met US Treasury Secretary Bessent on 12th January; critical minerals were among the talking points.

- Canada's Foreign Minister announced that Canola talks with China have been productive.

- German Government Spokesperson said the government will examine its trade volume with Iran closely.

- US President Trump ordered the Commerce Dept. and USTR to negotiate agreements with foreign suppliers to reduce US reliance on imported processed critical minerals, citing national security risks.

DATA RECAP

- US Retail Sales MoM (Nov) M/M 0.6% vs. Exp. 0.4% (Prev. 0.0%, Rev. 0%).

- US Current Account (Q3) -226.4B vs. Exp. -238.4B (Prev. -249.2B, Rev. -251.3B).

- US Retail Sales Ex Autos MoM (Nov) M/M 0.5% vs. Exp. 0.4% (Prev. 0.2%, Rev. 0.4%).

- US Retail Sales Ex Gas/Autos MoM (Nov) M/M 0.4% vs. Exp. 0.1% (Prev. 0.4%, Rev. 0.5%).

- US Retail Sales Control Group MoM (Nov) M/M 0.4% vs. Exp. 0.4% (Prev. 0.6%, Rev. 0.8%).

- US PPI MoM (Nov) M/M 0.2% vs. Exp. 0.2% (Prev. 0.1% ).

- US PPI MoM (Oct) M/M 0.1% vs. Exp. 0.3% (Prev. 0.6% , Rev. 0.3% ).

- US Retail Sales YoY (Nov) Y/Y 3.3% vs. Exp. 3.0% (Prev. 3.3% , Rev. 3.5% ).

- US PPI PCE Components (Oct, Nov 2025). Portfolio Management PPI: 1.44% (prev. 3.75%). Passenger Airline Services: -0.25% (prev. -0.06%). Physician Care: 0.08% (prev. 0.07%). Home Health and Hospice Care: 0.12% (prev. -0.16%). Hospital Outpatient Care: 0.53% (prev. 0.05%). Hospital Inpatient Care: 0.23% (prev. 1.27%). Nursing Home Care: 0.22% (prev. 0.31%).

- US PPI Ex Food, Energy and Trade MoM (Nov) M/M 0.2% vs. Exp. 0.2% (Prev. 0.7% ).

- US Core PPI MoM (Oct) M/M 0.3% vs. Exp. 0.2% (Prev. 0.1% ).

- US PPI Ex Food, Energy and Trade MoM (Oct) M/M 0.7% vs. Exp. 0.2% (Prev. 0.2% , Rev. 0.1% ).

- US PPI YoY (Oct) Y/Y 2.8% vs. Exp. 2.7% (Prev. 2.7% ).

- US Core PPI YoY (Oct) Y/Y 3.4% vs. Exp. 2.6% (Prev. 2.6% ).

- US PPI Ex Food, Energy and Trade YoY (Oct) Y/Y 3.4% vs. Exp. 2.9% (Prev. 3.0% , Rev. 2.9% ).

- US Business Inventories MoM (Oct) M/M 0.3% vs. Exp. 0.2% (Prev. 0.2%).

- US Existing Home Sales (Dec) 4.35M vs. Exp. 4.21M (Prev. 4.14M, Rev. 4.13M). Inventory of homes for sale 1.18mln units, 3.3 months' worth (prev. 4.2 months). Median home price for existing homes USD 405,400, +0.4% Y/Y.

- US Existing Home Sales MoM (Dec) M/M 5.1% vs. Exp. -1.6% (Prev. 0.7%, Rev. 0.5%).

- US PPI Ex Food, Energy and Trade YoY (Nov) Y/Y 3.5% vs. Exp. 2.8% (Prev. 3.4% ).

- US MBA 30-Year Mortgage Rate (Jan/09) 6.18% (Prev. 6.25% ).

- US MBA Purchase Index (Jan/09) 184.6 (Prev. 159.3).

- US MBA Mortgage Market Index (Jan/09) 348 (Prev. 270.8).

- US MBA Mortgage Refinance Index (Jan/09) 1313.1 (Prev. 937).

- US MBA Mortgage Applications (Jan/09) 28.5% (Prev. 0.3% ).

NOTABLE US EQUITY HEADLINES

- OpenAI has struck a multi billion-dollar agreement to buy computing capacity from Cerebras Systems; deal is worth more than USD 10bln, WSJ reported, citing sources.

- Meta (META) lays off 1,500 people in Metaverse division, via WSJ.

- TSMC (TSM) can't make AI chips fast enough, according to The Information; Broadcom (AVGO) and Nvidia (NVDA) had asked for more chips in recent months, but TSM said it cannot give as much capacity as they wanted. Last November, NVIDIA (NVDA) CEO Huang said he had come to Taiwan to ask for more chips. Sources note Broadcom (AVGO) repeatedly asked TSMC for additional production capacity, according to sources. TSMC told both it could not give them as much capacity as they wanted, according to sources.

- Microsoft's (MSFT) spending on Anthropic AI is on pace to hit USD 500mln, The Information reported. Microsoft is incentivising Azure sales staff to sell Anthropic models. Microsoft is boosting spending on Anthropic AI models for its own internal use and products.

- Citigroup Inc. (C) Q4 2025 (USD): Adj. EPS 1.81 (exp. 1.68), Adj. Revenue 21bln (exp. 20.55bln),. Recorded c. USD 1.2bln hit in Q4 related to sale of Russia business. Key Metrics:. Credit losses provision 2.2bln, primarily consisting of net credit losses in US cards. FICC sales & trading revenue 3.46bln (exp. 3.29bln). Investment Banking fees 1.29bln. Guidance:FY26 NII ex-markets +5/6% Y/Y.

- Bank of America Corp (BAC) Q4 2025 (USD): EPS 0.98 (exp. 0.96), Revenue 28.4bln (exp. 27.56bln). Key Metrics:. Net interest income 15.75bln (exp. 15.48bln). Net interest income FTE 15.92bln. Revenue net of interest expense 28.37bln (exp. 27.78bln). Provision for credit losses 1.31bln (exp. 1.48bln). Revenue Breakdown:. Trading (ex-DVA) 4.53bln (exp. 4.33bln). FICC (ex-DVA) 2.52bln (exp. 2.62bln). Equities (ex-DVA) 2.02bln (exp. 1.89bln). Investment banking 1.67bln (exp. 1.66bln). Other Metrics:. Return on average equity 10.5% (exp. 10.2%).

- Wells Fargo & Company (WFC) Q4 2025 (USD): EPS 1.62 (exp. 1.66), Revenue 21.3bln (exp. 21.64bln). Net interest income USD 12.33bln (exp. 12.43bln). Consumer banking and lending total revenue USD 9.57bln. Corporate and investment banking revenue USD 4.62bln. Wealth & investment management total revenue USD 4.36bln. Net charge-offs USD 1.05bln (exp. 1.06bln). Non-interest expenses USD 13.73bln (exp. 13.6bln). Investment banking fees USD 716mln (exp. 795.2mln). Net interest margin 2.6% (exp. 2.64%). Non-performing assets USD 8.50bln (exp. 7.91bln).

FX

- The Dollar was little changed mid-week as lagging US data did little to spur a reaction across markets. Retail Sales topped expectations in November, while the US PPI was mixed across October and November.

- Yen was firmer, supported by jawboning from Japanese officials as well as reports that opposition parties (CDP and Komeito) have begun talks on forming a new party.

- G10 FX were generally firmer, albeit modestly against the dollar, with the EUR and AUD the laggards. Newsflow and data were light across the space, with remarks seen from policymakers. BoE's Taylor reiterated his view that policy is to normalise at neutral sooner rather than later. Meanwhile, ECB's de Guindos said inflation is in a good place.

- Treasury Secretary Bessent said excess volatility in the FX market is undesirable in a meeting with South Korea. Also discussed depreciation of KRW with South Korea.

FIXED INCOME

- T-notes bull flattened on geopolitical developments and mixed US data.

- Treasury Buyback (20-30year, liquidity support, max USD 2bln): Accepts USD 2bln of USD 25bln offers, accepts 5 of 35 eligible issues. Offer-to-cover: 12.5x.

- US sold 17-week bills at a high rate of 3.560%, B/C 3.00x.

- Around five potential issuers are looking to issue new US IG bonds on Wednesday, according to the Bloomberg Survey citing debt underwriters.

- Germany sold EUR 700.9mln vs exp. EUR 1bln 3.25% 2042 Bund, EUR 809mln vs exp. EUR 1bln 0.00% 2052 Bund, EUR 822mln vs exp. EUR 1bln 2.90% 2056 Bund & EUR vs exp. 3.25% 2042: b/c 1.1x (prev. 1.24x), average yield 3.23% (prev. 3.08%), retention 29.9% (prev. 26.7%). 0.00% 2052: b/c 1.5x (prev. 1.9x), average yield 3.45% (prev. 2.83%), retention 19.0 (prev. 25%). 2.90% 2056: b/c 2.1x (prev. 1.3x), average yield 3.45% (prev. 3.26%), retention 17.8% (prev. 24.0%).

- UK sold GBP 4.50bln 4.75% 2035 Gilt 4.75% 2035: b/c 3.26x (prev. 3.05x), average yield 4.456% (prev. 4.613%), tail 0.3bps (prev. 0.3bps).

COMMODITIES

- Oil prices saw gains on Wednesday, with the bulk of the upside seen in the European morning on heightened Iran/US tensions. However, futures wiped out any gains post-settlement as Trump said he was informed by an Iranian source that they will stop killings and there are no plans for execution, which largely reduces the probability of a US attack on Iran. The news also hit gold prices (remains well in the green) and helped lift equity indices into the closing bell, given several reports throughout the day suggested Trump could attack Iran within 24 hours, albeit these fears have now been quelled.

- Saudi's Aramco and Commonwealth LNG sign a long-term supply deal.

- US official said additional sales of Venezuelan oil are expected in the coming days and weeks.

- US President Trump signed an order to seek international supply chain of critical minerals; will allow the US to take in 25% on sale of chips.

- US authorizes certain transactions for Lukoil sale.

- Chile's Codelco said the government has approved extension of the Hales mine.

- Chevron (CVX) reportedly expected to receive expanded Venezuela license from the US this week, according to reports.

- The European Commission is set to allow member states to delay the switch-off of copper telecommunications networks to 2035, Bloomberg reported, citing people familiar with the matter.

- OPEC MOMR: 2026 world oil demand remains at 1.4mln BPD (unchanged from the Dec MOMR), 2027 world oil demand is forecast to grow by about 1.3mln BPD Y/Y. World Oil Supply:. 2026 non-DoC liquids production is forecast to grow by about 0.6mln BPD Y/Y, unchanged from last month’s assessment, with Brazil, Canada, the US, and Argentina as the main growth drivers. 2027 non-DoC liquids production is also forecast to grow by 0.6mln BPD, mainly driven by Brazil, Canada, Qatar, and Argentina.

- Goldman Sachs maintains forecast of roughly stable Iran 2026 crude production of 3.5MB/D following the announcement of the 25% tariff.

- Kazakhstan announced it held meetings with the EU and US after tanker attacks yesterday, via IFX.

Data Recap

- US EIA Crude Oil Imports Change (Jan/09) 0.710 (Prev. 0.563).

- US EIA Distillate Fuel Production Change (Jan/09) -0.019 (Prev. 0.081).

- US EIA Gasoline Production Change (Jan/09) 0.029 (Prev. -0.472).

- US EIA Gasoline Stocks Change (Jan/09) 8.977M vs. Exp. 4M (Prev. 7.702M).

- US EIA Crude Oil Stocks Change (Jan/09) 3.391M vs. Exp. -2.2M (Prev. -3.831M).

- US EIA Heating Oil Stocks Change (Jan/09) -0.745 (Prev. 0.672).

- EIA Weekly Crude Production 13.75M (prev. 13.8M); Change -58k, -0.01%.

- US EIA Refinery Crude Runs Change (Jan/09) 0.049M (Prev. 0.062M).

- US EIA Distillate Stocks Change (Jan/09) -0.029M vs. Exp. -0.2M (Prev. 5.594M).

- US EIA Cushing Crude Oil Stocks Change (Jan/09) 0.745 (Prev. 0.728).

CENTRAL BANKS

- Fed's Bostic (2027 voter) said inflation still quite far from where we need to be; those are not characteristics that suggest to me a passive posture is appropriate, still need to be restrictive. As they go through 2026 the economy is likely to get stronger and could put more upward pressure on prices and that is something they have to watch. The labour market has weakened, but it is not clearly weak. In a difficult environment to see what might be coming in the economy and inflation. Should not expect there to be 100% consensus on everything.

- Fed's Kashkari (2026 Voter) said the economy is confusing and job market is showing signs of weakness; inflation is still too high but moving in the right way. Overall, the economy seems quite resilient. Economy has not slowed as much as expected, describes it as K-shaped. Wonders how tight monetary policy actually is. Has seen less tariff pass through than expected. Tariffs haven't been gut punch many feared, but long term story still playing out. 2% inflation remains target, remains committed to getting that level. Does not expect inflation to surge again. Current Fed balance sheet expansion is not QE. Sees pretty good growth, does not see need for Fed QE. Biggest barrier to housing market is supply.

- Fed's Kashkari (2026 voter) said to the NYT the Trump admin actions against the Fed are "really about monetary policy". On Powell, said “The escalation over the course of the past year is really about monetary policy”, “I thought the chairman explained that accurately.” Monetary policy: Does not see any impetus in rate cut in January. Sees economy showing resilience. With rates between 3.5-3.75%, said that puts the Fed in a “pretty good spot right now.”

- Fed Governor Miran reiterates need for 150bps of cuts this year; inflation is coming down and 'other stuff is just noise'.

- Fed's Miran said deregulation should reduce pressure on prices, which is another reason for the Fed to cut interest rates. Deregulation has been substantial and expects this trend to continue. Adds that 30% of regulation could be eliminated by 2030 and cutting inflation by half a percentage a year.

- Fed's Paulson (2026 Voter) said modest cuts are likely appropriate later this year if forecasts are met. Inflation should be around 2% run rate by the end of the year. Monetary Policy is a "little restrictive" right now. Baseline economic outlook is ‘pretty benign’. Cautiously optimistic on inflation moving back to target. Is seeking greater clarity on what’s driving job market in 2026. US likely to grow around 2% this year. Expects inflation to moderate and the job market to stabilise in 2026. Job market is bending but not breaking right now.

- Fed's Goolsbee (2027 Voter) said Central Bank independence is key to low prices. “One thing I’m looking for, is the consumer going to continue to be the driver of growth.”. “And then on the inflation side, is there evidence that we’re kind of putting this spike up in prices behind us.”

- Fed's Beige Book: Overall economic activity increased at a slight to modest pace in eight of the twelve Federal Reserve Districts, with three Districts reporting no change and one reporting a modest decline.

- NY Fed RRP op demand at USD 3.2bln (prev. 3.3bln) across 15 counterparties (prev. 5).

- NY Fed said desk plans to conduct ~USD 15.4bln in reinvestment purchases between January 15th to February 12th; plans an additional ~USD 40bln in reserve management purchases over the noted monthly period.

- Atlanta Fed GDP Now (Q4 2025): 5.3% (prev. 5.1%).

- EU's Economic Committee considers ECB's Kazaks and ECB's Centeno as preferred candidates for ECB's VP role.

- BoE Deputy Governor Ramsden said removing ring-fencing of banks would be a real challenge to UK financial stability framework. Key difference for policy this year is not looking for a hump in CPI. Wages will remain a key focus for him. Labour market is continuing to weaken. Latest ONS wage data is encouraging. Starting point is that the neutral rate is in the middle of 2-4% range. Unemployment and redundancies are picking up.

- BoE's Ramsden said "we are considering what failure arrangements are necessary for systemic stablecoins".

- CNB Vice Governor Zamrazilova said services inflation is preventing more rate cuts, via radio interview. Czech inflation structure is relatively unfavourable.

- NBP said it may intervene in the FX market.

GEOPOLITICAL

MIDDLE EAST

- US President Trump said he has been told killing in Iran is stopping, with no plans for executions.

- Iran's Foreign Minister said now there is calm, we are in full control, Fox News reported.

- US President Trump: "I was informed by sources on the other side" about the Iran killings, will watch and see what the process is and go from there.

- Israel and Iran secretly reassured each other via a Russian intermediary they would not attack each other, according to Washington Post.

- G7 remain prepared to impose additional restrictive measures if Iran continues to crack down on protests.

- Strikes on Iran could take place within the next 24 hours as Donald Trump is said to have decided to intervene in the regime’s crackdown, according to The Telegraph.

- Russian official said US attack on Iran would be "gravest mistake".

- American Officials say an attack on Iran has become imminent, according to NYT cited by Al Arabiya; Note, NYT article itself said "attack is at least several days away". The Pentagon presented Trump with options for targets in Iran including its nuclear program and missile sites. Other options include potential cyber attack or strike on internal security agency.

- Iranian official remarked that Kurdish separatists have been trying to create instability within Iran, taking advantage of protest activity. Armed Kurdish groups attempted to cross from Iraq to Iran in recent sessions.

- All diplomatic contacts between the US and Iran have been suspended.

- Goldman Sachs maintains forecast of roughly stable Iran 2026 crude production of 3.5MB/D following the announcement of the 25% tariff.

- USA freezes visa processing for several countries including Russia, Iran and Brazil, according to Fox News. Visa processing should begin from 21st January and is to continue indefinitely.

- German Government Spokesperson said the government will examine its trade volume with Iran closely.

- An Egyptian source said Palestinian factions are meeting in Cairo to discuss power transfer in Gaza to technocrats; no American or Israeli objections.

- US Special Envoy Witkoff is announcing the launch of Phase 2 of Trump's 20 point plan to end the Gaza conflict.

RUSSIA-UKRAINE

- Denmark Foreign Minister said they came to the US following a number of remarkable comments about Greenland, said have committed additional funds for fighter jets, ships, and drones and are committed to do more. Eager to work with the US. Greenland is covered by Article 5. Had a frank, constructive discussion with US officials. Perspectives continue to differ. Still have a fundamental disagreement, will continue to talk. Ideas that do not respect the territorial integrity of Greenland are totally unacceptable. Not necessary for the US to acquire Greenland. There is not an instant threat from China or Russia that they can't accommodate. We didn't manage to change the US position on Greenland.

- Ukraine President Zelensky said State of Emergency will be declared for the energy sector after Russian strikes. Ukraine will significantly increase volume of electricity imports.

- Russian Foreign Minister Lavrov said, regarding reported that US ambassadors could visit Moscow, said President Putin is willing to have serious talks. Discussion of a Ukraine ceasefire is not serious.

- European Commission President von der Leyen said funding to Ukraine for the 2026-27 period will be EUR 90bln. To be split into EUR 60bln for military and EUR 30bln for fiscal support.

OTHERS

- US President Trump posted "NATO: Tell Denmark to get them out of here, NOW! Two dogsleds won’t do it! Only the USA can!!! Danish intel warned last year about Russian and Chinese military goals toward Greenland and Arctic".

- US President Trump said the US needs Greenland for National Security. "NATO should be leading the way for us to get it. IF WE DON’T, RUSSIA OR CHINA WILL, AND THAT IS NOT GOING TO HAPPEN!". "Militarily, without the vast power of the United States, much of which I built during my first term, and am now bringing to a new and even higher level, NATO would not be an effective force or deterrent - Not even close!".

ASIA-PAC

NOTABLE HEADLINES

- Beijing reportedly tells Chinese firms to stop using software from Crowdstrike (CRWD), Mandiant, Wiz, SentinelOne (S), McAfee, Rapid7 (RPD) and Cyber Ark (CYBR).

- Trump admin reportedly nearing trade and investment deal with Taiwan. Taiwan’s vice premier Cheng Li-chiun and trade representative Yang Jen-ni are expected to arrive late Wednesday or early Thursday, with plans to meet in the coming days.

- Japan opposition parties, CDP and Komeito, have started talks on forming a new party, according to Asahi.

- China will strengthen cost investigations and price monitoring for NEV, according to reports.

- China's State Administration for Market Regulation has commenced an investigation on Trip.com (TCOM) under anti-monopoly laws of PRC; Trip said it is cooperating, business operations remain normal.

- China held a State Council Party meeting.

NOTABLE APAC EQUITY HEADLINES

- Alibaba (BABA/9988 HK) is reportedly to invest in Montage's share sale in Hong Kong.

- Samsung Electronics (005930 KS) is reportedly to close one of its three 8inch foundry fabs in Giheung during H2-2026, Lec reported citing sources. Intention is to phase out low-profit legacy processes and concentrate resources on 12inch production.