US stocks rallied on return from the holiday weekend as participants digested data and Trump's EU tariff deadline delay - Newsquawk Asia-Pac Market Open

- US stocks rallied on Tuesday after returning from the long weekend as markets reacted to US President Trump delaying his 50% tariff threat to the EU to 9th July from 1st June, which will allow more time for negotiations, while the heightened risk appetite was also facilitated by a decline in yields and a sharp rebound in US Consumer Confidence which topped even the most optimistic analysts' estimates.

- USD strengthened to the detriment of all G10 peers, albeit with headline drivers on the lighter side ahead of the FOMC Minutes and Nvidia (NVDA) earnings on Wednesday, while there were several data releases including Durable Goods which declined less than expected, but garnered little reaction, while Consumer Confidence impressed and surpassed the top end of the forecast range. Furthermore, there were comments from some Fed officials, but which had little impact with Kashkari noting he sees arguments against looking through tariff-induced inflation as more compelling and which support the Fed's stance of keeping rates on hold until there is more clarity.

- Looking ahead, highlights include Australian Monthly CPI & Construction Work Done, RBNZ Rate Decision & Press Conference, Comments from Fed's Williams & Waller, Supply from Japan.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Australian Monthly CPI & Construction Work Done, RBNZ Rate Decision & Press Conference, Comments from Fed's Williams & Waller, Supply from Japan.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks rallied on Tuesday after returning from the long weekend as markets reacted to US President Trump delaying his 50% tariff threat to the EU to 9th July from 1st June, which will allow more time for negotiations, while the heightened risk appetite was also facilitated by a decline in yields and a sharp rebound in US Consumer Confidence which topped even the most optimistic analysts' estimates.

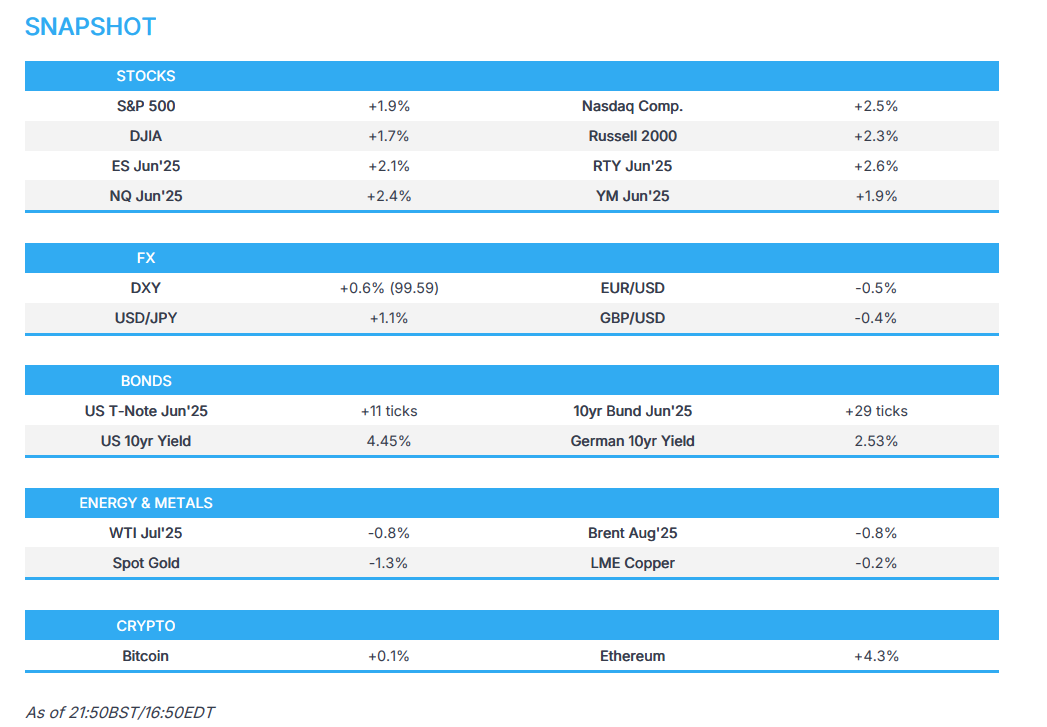

- SPX +1.90% at 5,913, NDX +2.14% at 21,364, DJI +1.67% at 42,297, RUT +2.33% at 2,087.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted that he was "extremely satisfied" with the EU 50% tariff allotment and was informed that the EU called quickly to establish meeting dates, which is positive and he hopes they will open for trade.

- US White House Economic Adviser Hassett said they will be seeing a few more deals as soon as this week and that tariffs could go to 10%, or less for some countries, while he added that lower tariffs will be for nations with good offers and India is among the deals close to the finish line. Furthermore, he said EU-US negotiations have been difficult due to there being so many nations which disagree on the priorities for talks and it is appropriate there is a little bit more time for the Europeans to work it out, so we can get back to the table and make progress.

- EU is set to focus on critical sectors in a bid to avoid US tariffs and EU Trade Commissioner Sefcovic will lead political negotiations on industries such as steel and aluminium, autos, pharma, semiconductors and aircraft, while talks will happen in parallel with technical discussions on tariffs and non-tariff barriers, according to Bloomberg sources.

NOTABLE HEADLINES

- Fed's Kashkari (2026 voter) said there is a healthy debate amongst FOMC members over whether to "look through" the inflationary impact of new tariffs and he personally finds arguments against looking through tariff-induced inflation more compelling. Furthermore, he stated these arguments support the Fed's stance of keeping rates on hold until there is more clarity on the path for tariffs and their effects.

- Fed's Barkin (2027 voter) said data shows the economy is on the same trajectory as last year or two, while low unemployment and inflation is moving towards the target and will have to see how consumers react to price changes. Barkin added they are seeing lots of hiring freezes and that businesses are still largely pulling to the sidelines.

- A new highly infectious COVID strain that has led to a spike in hospitalisations in China has now been detected in the US, including cases in New York City, according to a report in NY Post citing the CDC.

DATA RECAP

- US Consumer Confidence (May) 98.0 vs. Exp. 87.0 (Prev. 86.0)

- US Durable Goods (Apr) -6.3% vs. Exp. -7.8% (Prev. 9.2%, Rev. 7.6%)

- US Non-defence Cap Ex-Air (Apr) -1.3% vs. Exp. -0.1% (Prev. 0.1%, Rev. 0.3%)

- US Monthly Home Price MM (Mar) -0.1% (Prev. 0.1%)

- US Monthly Home Price YY (Mar) 3.7% (Prev. 3.9%)

- US CaseShiller 20 MM SA (Mar) -0.1% vs. Exp. 0.3% (Prev. 0.4%)

- US CaseShiller 20 YY NSA (Mar) 4.1% vs. Exp. 4.5% (Prev. 4.5%)

FX

- USD strengthened to the detriment of all G10 peers, albeit with headline drivers on the lighter side ahead of the FOMC Minutes and Nvidia (NVDA) earnings on Wednesday, while there were several data releases including Durable Goods which declined less than expected, but garnered little reaction, while Consumer Confidence impressed and surpassed the top end of the forecast range. Furthermore, there were comments from some Fed officials, but which had little impact with Kashkari noting he sees arguments against looking through tariff-induced inflation as more compelling and which support the Fed's stance of keeping rates on hold until there is more clarity.

- EUR trickled further beneath the 1.1400 handle amid the firmer buck, while participants also digested a slew of data and several ECB comments.

- GBP retreated to test the 1.3500 level to the downside where support held, while UK-specific newsflow was light.

- JPY underperformed following the recent drop in super-long JGB yields amid reports Japan is considering reducing such issuances.

- SNB Chair Schlegel said cannot rule out negative inflation in Switzerland in the coming months and price stability is the central contribution a central bank can make. Schlegel stated that trade uncertainties are currently enormous, related to tariffs from the US, while he added that focus is not on the current rate of inflation, but price stability over the mid-term.

FIXED INCOME

- T-notes bull flattened amid reports Japan's MoF is to consider cutting super-long JGB issuance and as US participants took their first opportunity to react to President Trump delaying the EU's 50% tariff deadline.

COMMODITIES

- Oil prices mildly declined with price action choppy as participants await the OPEC+ meeting.

- OPEC+ talks on Wednesday are set to begin at 14:00BST/09:00EDT, according to Reuters sources, while Kpler's Bakr suggested that talks will start at 14:30BST/ 09:30EDT.

- Dubai set its official crude differential to Oman for August at USD 0.10/bbl discount.

- DoE is reportedly weighing emergency authority to keep coal plants running, according to Axios.

GEOPOLITICAL

MIDDLE EAST

- Israel and Syria have held face-to-face meetings to contain security tensions, according to Reuters citing sources.

RUSSIA-UKRAINE

- US President Trump said what Russian President Putin does not realise, is that if it was not for him, lots of really bad things would have already happened to Russia, while he added that Putin is playing with fire.

- US President Trump could impose new Russia sanctions in the coming days as he vents frustration at Russian President Putin for his aerial assault on Ukraine over the weekend, according to CNN citing sources.

- Russia's Medvedev said regarding US President Trump's comment that Russian President Putin is "playing with fire" that "I only know of one really bad thing-WWIII".

- Russia's Kremlin said work on a Russia-US POW swap continues and commented regarding reports of possible US sanctions, that it is aimed at wrecking Ukraine peace talks, as well as stated that Ukrainian attacks on Russia do not facilitate the peace process.

- Russia began major navy drills in the Baltic Sea, according to Interfax.

- Air raid sirens sounded in Kyiv due to the threat of a ballistic missile strike, according to Kyiv Post.

OTHER

- EU Ministers approved the EUR 150bln Euro arms fund to give loans for defence projects, according to the Polish European Affairs Minister.

- South Korean Liberal Presidential Candidate Lee Jae-Myung said there is no need to antagonise China or Russia, while Conservative Presidential Candidate Kim Moon-Soo said he may consider nuclear armament if possible as part of a US alliance.

ASIA-PAC

NOTABLE HEADLINES

- Chinese Premier Li said the scale of China's fiscal spending will reach a record high this year and will continue to increase the intensity of counter-cyclical adjustment in accordance with changes in the environment.

EU/UK

NOTABLE HEADLINES

- ECB's Holzmann called for a pause in rate cuts until September amid trade tensions and argued that further cuts at this point would have no effect on EZ economic activity. Furthermore, Holzmann views the neutral rate between 2.5% and 3.0%, while he stated a "number of people" among the ECB decision-makers were also "sceptical" about additional rate cuts.

- ECB's Patsalides said a 50bp cut would only be justified if recession risks intensified, with stronger disinflation, while he stated that the disinflationary trend has strengthened the case for easing, though cutting is not the default option, according to Econostream via X.

- ECB's Villeroy said interest rate normalisation within the EZ is probably incomplete.

DATA RECAP

- EU Economic Sentiment (May) 94.8 vs. Exp. 94.0 (Prev. 93.6)

- EU Industrial Sentiment (May) -10.3 vs. Exp. -10.5 (Prev. -11.2)

- EU Services Sentiment (May) 1.5 vs. Exp. 1.0 (Prev. 1.4, Rev. 1.6)

- EU Consumer Confid. Final (May) -15.2 vs. Exp. -15.2 (Prev. -15.2)

- EU Selling Price Expectations (May) 7.9 (Prev. 11.0, Rev. 10.6)

- EU Cons Infl Expectations (May) 23.6 (Prev. 29.6, Rev. 29.4)

- EU Business Climate (May) -0.55 (Prev. -0.67, Rev. -0.66)