US stocks reverse earlier gains, JPY bid following PM Takaichi's landslide victory, USTs hit on China report - Newsquawk US Market Open

- China is reportedly urging banks to curb USTs exposure amid market risk, Bloomberg reports, citing sources; guidance does not apply to China's state holdings of US Treasuries.

- Japanese PM Takaichi’s LDP party won a landslide victory at the snap election on Sunday, securing a super majority; JPY bid, JGBs lower and Nikkei 225 soars.

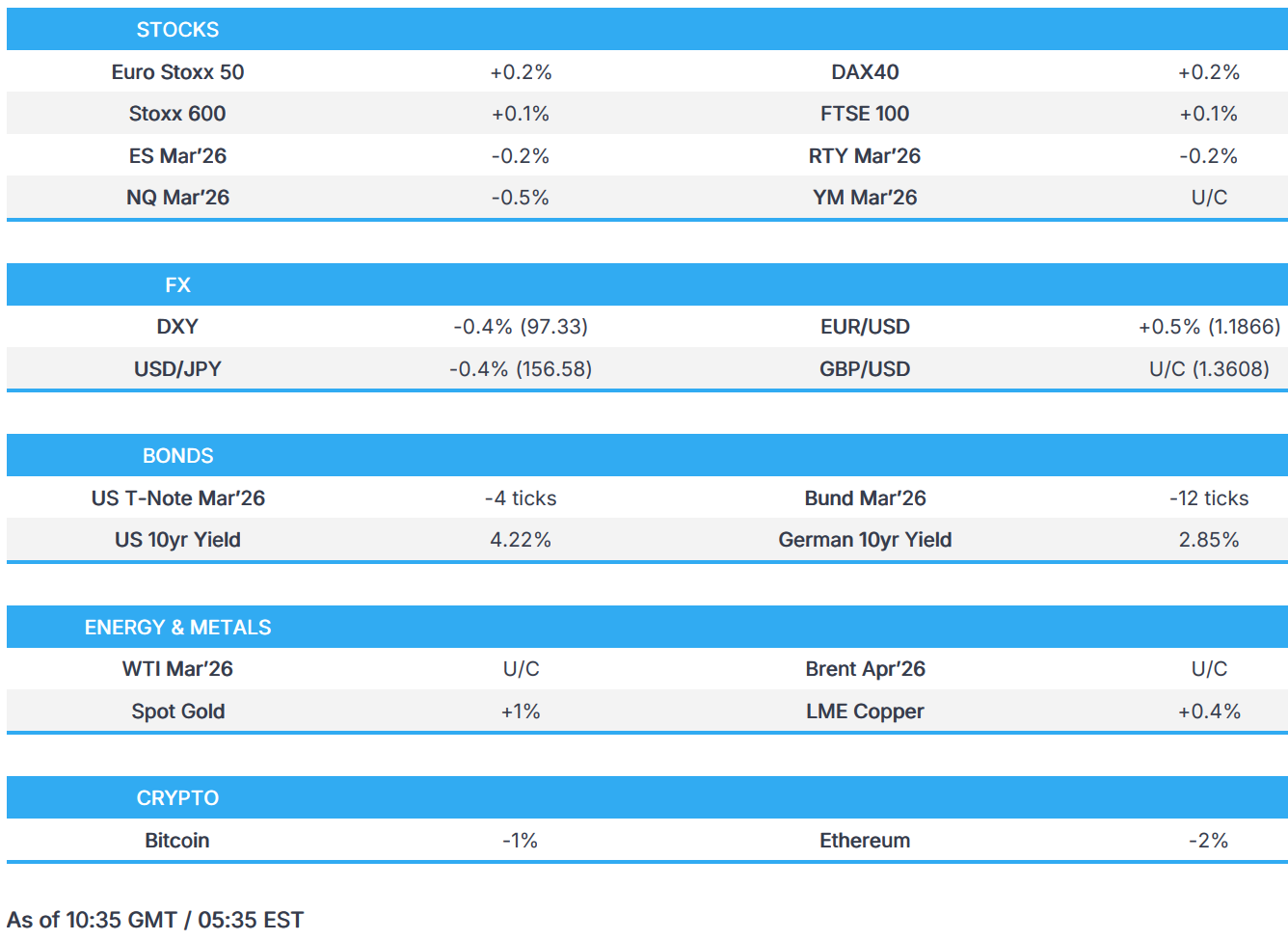

- European bourses are broadly firmer, whilst US equity futures move lower; Nikkei 225 soars post-LDP victory.

- USD hit on China-USTs report, JPY strengthens post-LDP, whilst GBP lags on regional political woes.

- JGBs set a bearish tone for global fixed income, with USTs also dragged on the China-USTs report; Gilts digest the McSweeney resignation and reports that PM Starmer faces further pressure to resign.

- WTI and Brent are flat. Precious metals continue to rebound as the PBoC buys gold for a 15th consecutive month.

- Looking ahead, highlights include US Consumer Inflation Expectations (Jan), BoC Market Participants Survey. Speakers include ECB’s Lane & Lagarde, Fed’s Waller & Bostic, Earnings from Apollo, Becton Dickinson, Loews, On Semiconductor & Cleveland-Cliffs.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.2%) are firmer across the board, as strength across APAC equities filters through into Europe.

- European sectors hold a positive bias. Travel & Leisure leads, followed closely by Healthcare and Banks whilst Optimised Personal Care and Retail lags. Healthcare is buoyed by gains in Novo Nordisk (+8.3%), which benefits after Hims & Hers said it will stop selling a copycat version of Novo Nordisk’s Wegovy weight-loss pill two days after launch.

- US equity futures (ES -0.2% NQ -0.4% RTY U/C) are broadly lower, but with underperformance in the NQ. The data docket is lacking today, but focus will be on a few Fed speakers dotted throughout the day.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is on the backfoot and trades at the bottom end of a 97.33-97.76 range; further pressure could see a test of last week’s trough at 97.00. Much of the pressure this morning can be associated with JPY strength (post-election, discussed below) and following a Bloomberg report which noted that China is urging banks to curb US Treasuries exposure amid market risk – whilst this piece pertains to USTs, it renews fears of a “sell America” theme. US data is lacking for the remainder of the day, so focus will be on Fed speak via Waller, Miran and Bostic. Note: Waller is to discuss “digital assets”, markets know what they expect from arch-dove Miran, and Bostic is set to retire. The docket picks up later in the week, where markets will await US NFP (Wed) and then CPI (Fri); as a reminder, recent jobs metrics have been pointing towards a weakening of the labour market.

- JPY is amongst the outperformers this morning. USD/JPY initially gapped higher at the open (157.47), edged lower a few moments later, before reversing back to highs of 157.65. Since, the JPY has been strengthening vs the USD, potentially on a) high expectations of an LDP victory, b) higher JGB yields, c) jaw-boning via Finance Minister Katayama, d) political stability, e) odds of a BoJ hike in April rising to circa. 60% (prev. 54%). For the latter, analysts at Barclays believe that LDP’s landslide victory may allow the BoJ to proceed with normalisation “somewhat” faster. As such, the bank brought forward its expectations of a 25bps hike to April (prev. saw July), and increased its terminal forecast to 1.5% (prev. 1.25%). This morning, PM Takaichi has provided commentary, has reiterated her vows of fiscal stability, noting that she “will not resort to debt to fund the suspension of food sales tax” – another factor which is likely helping the strength in the JPY this morning. [More details can be found on the Newsquawk headline feed at 07:40GMT/02:40ET]

- G10s are broadly stronger against the USD, with JPY, AUD, EUR, and CHF all firmer by around 0.5%. GBP is the laggard this morning, as domestic political woes remain for the PM. On Sunday, Chief of Staff McSweeney resigned from his role following the Mandelson scandal. Irrespective of this, risks remain, as members of the Cabinet are potentially set to call for the PM to resign, and if he doesn’t, they will possibly step down themselves.

FIXED INCOME

- JGBs gapped lower by 30 ticks from 131.42 to 131.12 at the open, and then continued to trundle lower to a 131.10 trough; there was then a brief bounce overnight, before gradually declining back to the APAC low. Action today can be characterised by concern around potential increased spending and fiscal instability fears, but overall, the response to Takaichi's LDP securing a super majority has been within recent levels - see the 07:40GMT post for more details and next steps.

- USTs are lower, given the above initially. More recently, pressure is a function of a Bloomberg report that China has urged banks to diversify exposure to US Treasuries amid heightened market risk, guidance that reportedly does not apply to state holdings. A report that pushed USTs to a 111-26 low. Fed speak ahead, though the individuals scheduled are, on face value, not particularly interesting. Reminder, the week ahead has NFP on Wednesday and CPI on Friday.

- Bunds followed the above. Interestingly, while they were initially hit by the Bloomberg report, the benchmark bounced off a 128.03 trough in short order. As the report is, potentially, a net-positive for EGBs long-term, as Chinese banks have to reposition their holdings.

- Gilts hit on the ongoing Mandelson/McSweeney fallout. In brief, while McSweeney has resigned, the pressure around Starmer hasn't abated. Action that saw Gilts gap lower by 42 ticks before slipping another two to a 90.21 base. Since, the benchmark has rebounded by around 30 ticks, but remains in the red by some 10 ticks. The Spectator highlights that some ministers are concerned that Starmer could stand down at any moment. More likely, we could see Cabinet Ministers, privately initially and then possibly publicly, call for the PM to resign, and then they themselves may resign from Starmer's cabinet if he does not comply.

- China is reportedly urging banks to curb US Treasuries exposure amid market risk, Bloomberg reported citing sources; guidance does not apply to China's state holdings of US Treasuries.

COMMODITIES

- WTI and Brent gapped lower but then traded with an upward bias as the morning progressed, to currently trade flat; Brent now trading around USD 68.20/bbl, with a recent bid higher led reports that Qatar is pushing the start of its LNG expansion to the end of 2026. US-Iran meetings last week lacked a material outcome, with the pair agreeing to further talks. For the next meeting, the Trump administration has told Iran to arrive with meaningful substance, following the "good meeting" on Friday.

- Precious metals have continued Friday's rebound, with spot gold regaining the USD 5k/oz handle. Over the weekend, the PBoC announced its 15th straight month of gold buying, which reinforces the key structural driver of major central bank buying of the gold bullion. The dollar has also weakened at the start of the European session, weighed on by the Bloomberg report that China is urging banks to limit USTs exposure. Silver has gradually bid higher as European trade continues, returning back above USD 80/oz and briefly topping above USD 82/oz.

- 3M LME Copper gapped higher but trades muted in a USD 13.02k-13.14k/t band, heading into the Chinese New Year celebrations.

- US Energy Secretary Wright intends to visit Venezuela soon to discuss the future of PDVSA, Politico reported; focussed on improving the management of the Co. Expects Venezuela to hold elections in 18-24 months.

- Vitol Group forecasts peak oil demand to be pushed back to the mid-2030s, with peak demand reaching around 112mln bpd.

- New Zealand energy minister said has shortlisted proposals related to building a first LNG import plant and facility could be operational by 2027 or early 2028.

- Qatar reportedly pushes the start of its LNG expansion to the end of 2026.

TRADE/TARIFFS

- Indian imports of Russian oil could nearly halve following the White House order, Bloomberg reported citing sources. Within the order, it stated that India has committed to stop directly or indirectly importing Russian oil or import tariffs will be raised.

- South Korea’s legislature approves creation of special US investment committee.

- Australia has imposed 10% tariffs on China's steel ceiling frames, following an investigation by the nation’s Anti-Dumping Commission, according to Bloomberg.

NOTABLE EUROPEAN DATA RECAP

- EZ Sentix Investor Confidence Index (Feb) 4.2 vs exp. 0 (prev. -1.8).

- Norwegian GDP Growth Rate YoY (Q4) Y/Y 2.2% (Prev. 2.1%).

- Norwegian PPI YoY (Jan) Y/Y -7.8% (Prev. -11.4%).

- Norwegian GDP Growth Mainland QoQ (Q4) Q/Q 0.4% vs. Exp. 0.4% (Prev. 0.1%).

- Norwegian GDP Growth Rate QoQ (Q4) Q/Q -0.3% (Prev. 1.1%).

CENTRAL BANKS

- ECB's Kocher said that inflation expectations are fully anchored and FX movements are factored in; Europe must prepare for a greater financial safe haven role. Policy is appropriate and it would require a change in the environment to change current policy stance.

- ECB's Simkus said there's a 50/50 chance that their next move is a hike or cut; rates are at neutral level with growth near potential. Economic environment is fragile.

NOTABLE US EQUITY HEADLINES

- EU Commission has notified Meta (META) of possible interim measures to reverse exclusion of third-party AI assistants from WhatsApp.

- US President Trump posted "Record Stock Market, and National Security, driven by our Great TARIFFS. I am predicting 100,000 on the DOW by the end of my Term. REMEMBER, TRUMP WAS RIGHT ABOUT EVERYTHING! I hope the United States Supreme Court is watching".

- US President Trump signs executive action on increasing certain types if beef imports.

GEOPOLITICS

RUSSIA-UKRAINE

- Indian imports of Russian oil could nearly halve following the White House order, Bloomberg reported citing sources. Within the order, it stated that India has committed to stop directly or indirectly importing Russian oil or import tariffs will be raised.

- Russia’s FSB said an attempted assassination of General Alexeyev was ordered by Ukraine with Poland’s participation, according to Interfax.

- US reportedly aims for a March peace deal in Ukraine, followed by quick elections, according to reported.

MIDDLE EAST

- Iran's advisor to Supreme Leader is to visit Oman on Tuesday, Tasnim reported.

- Iranian Parliament Speaker said they discussed defence and security in a secret session.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 69k, whilst Ethereum remains just above the USD 2k mark.

APAC TRADE

- APAC stocks began the week higher after last Friday's rally on Wall St, where the DJIA topped the 50k level for the first time, while the Nikkei 225 also hit a fresh record high after PM Takaichi's landslide election victory and supermajority.

- ASX 200 rallied with all sectors in the green and the advances being led by broad strength in tech, real estate, miners, materials and resources.

- Nikkei 225 rose to fresh record highs above the 57,000 level after the Japanese PM Takaichi's LDP won a supermajority in the lower house election, which would allow it to override the upper house in legislation, while the decisive win paves the way for the government to proceed with further stimulus and a sales tax cut.

- Hang Seng and Shanghai Comp conformed to the widespread upbeat mood across the region, while it was also reported late last week that China's Cabinet studied measures to promote effective investment and pledged to boost support for private investment.

NOTABLE ASIA-PAC HEADLINES

- Japan's PM Takaichi said that she has received strong mandate for her policies, following the election. Confirms a swift restart of of parliamentary session. Discussions on refundable tax credit will commence. Will not resort to debt to fund the suspension of food sales tax. Will summit bill to establish national information and committee on foreign investment in the next parliament. Want to pursue a coalition expansion with the DPP if they are keen to do so. Want to lay out interim finding at cross-party meeting on food sales tax suspension by around summer this year. Closely watching market moves, including FX.

- Japanese PM Takaichi said the potential of our alliance with the US is limitless and she is sincerely grateful to US President Trump for his warm words.

- US President Trump congratulates Japanese PM Takaichi and her coalition on a landslide election victory.

- Japanese Finance Minister Katayama said will not comment on FX levels, but noted that recent yen moves are somewhat rapid and one-sided.

- Hong Kong court sentences media tycoon Jimmy Lai to 20 years in jail.

- Japan's top currency diplomat Mimura said closely watching FX moves with a high urgency.

NOTABLE APAC DATA RECAP

- Japanese Eco Watchers Survey Outlook (Jan) 50.1. (Prev. 49.5., Rev. From 50.5.).

- Japanese Eco Watchers Survey Current (Jan) 47.6 vs. Exp. 49.1 (Prev. 48.6).

- Japanese 6-Month Bill Auction 0.8484% (Prev. 0.7697%).

- Japanese Current Account (Dec) 729B vs. Exp. 1060B (Prev. 3674B).

- Japanese Bank Lending YoY (Jan) Y/Y 4.5% vs. Exp. 4.5% (Prev. 4.4%).

- Japanese Overtime Pay YoY (Dec) Y/Y 0.9% (Prev. 1.2%).

- Japanese Average Cash Earnings YoY (Dec) Y/Y 2.4% vs. Exp. 3.0% (Prev. 0.5%).

- Japanese Real Cash Earnings YY (Jan) -0.1% vs Exp. 0.8% (Prev. -1.6%, Rev. from -2.8%).

- Australian Household Spending YoY (Dec) Y/Y 5.0% (Prev. 6.3%).

- Australian Household Spending MoM (Dec) M/M -0.4% vs. Exp. 0.2% (Prev. 1.0%).

- Chinese Foreign Exchange Reserves (Jan) 3.399T (Prev. 3.358T).