US stocks rose on Wednesday after President Trump ruled out military action to acquire Greenland - Newsquawk Asia-Pac Market Open

- US stocks rose on Wednesday after President Trump ruled out military action to acquire Greenland, easing market fears, though gains were capped after Denmark rejected Trumpʼs demand to negotiate a US takeover of the island.

- Later, Trump said that after meeting NATO Secretary General Rutte, a framework for a future deal on Greenland had been formed and that he would therefore not impose tariffs scheduled to take effect on 1st February.

- The Dollar strengthened on US President Trump announcing he has reached a framework for a deal on Greenland with NATO's Rutte.

- T-notes gained as US-EU tensions eased after Trump walked back tariff threats on the EU.

- Looking ahead, highlights include South Korean GDP, Japanese Trade Balance (Dec), Weekly Investment Data, Australian Employment Report (Dec), and supply from Australia.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks rose on Wednesday after President Trump ruled out military action to acquire Greenland, easing market fears, though gains were capped after Denmark rejected Trump’s demand to negotiate a US takeover of the island.

- Later, Trump said that after meeting NATO Secretary General Rutte, a framework for a future deal on Greenland had been formed and that he would therefore not impose tariffs scheduled to take effect on 1st February.

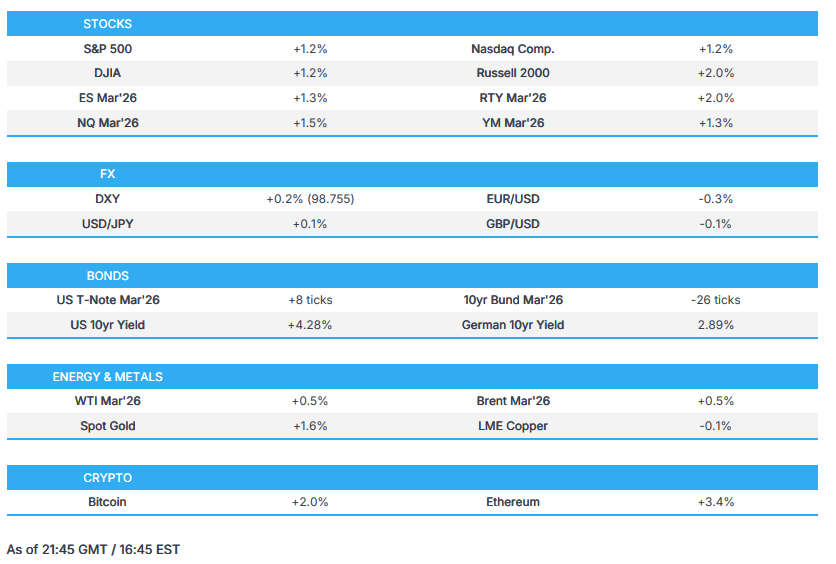

- SPX +1.16% at 6,876, NDX +1.36% at 25,327, DJI +1.21% at 49,077, RUT +2.00% at 2,698.

TARIFFS/TRADE

- US President Trump said he had a very productive meeting with NATO's Rutte, and has formed a framework for a future deal; will not be imposing the tariffs that were scheduled to go into effect on February 1st.

- EU MEP Lange posted the EU-US deal is "on ice indefinitely", added "Our sovereignty & territorial integrity are at stake. Business as usual is impossible".

- EU is delaying the vote on ratifying the US trade agreement.

- France has reportedly delayed the G7 meeting to discuss US tariff threats, according to Bloomberg; meeting has been pushed back to next week, citing WEF scheduling conflicts.

- UK Chancellor Reeves said nothing can be ruled out, when asked if a US tariff retaliation is possible. However, Reeves stresses that the goal is a reduction in trade barriers. She adds that she is confident we can stick with the trade deal secured with the US last year, via a Channel 4 interview.

- European Parliament has voted to send the EU-Mercosur deal to the ECJ.

- US Treasury Secretary Bessent said during his meeting this week with Vice Premier He Lifeng of China, we held a positive discussion regarding the implementation of the economic agreement between President Trump and President Xi. He looks forward to meeting with the Vice Premier again soon.

- Final trade talks between the US and Switzerland will reportedly commence in February, according to sources.

- USTR Greer said EU trade agreement focuses on trade rather than national security; however, relationship with EU negotiator remains great. Are in a good spot with China. It is important to talk with Congress on export controls.

- US Treasury Secretary Bessent said there are no US-UK talks scheduled at the moment.

NOTABLE US HEADLINES

- US President Trump said he will commence land strikes over drugs, will "knock it all out".

- US President Trump said the US should have lower rates, hopes Treasury Secretary Bessent is listening.

- US President Trump said the stock market dip is "peanuts" and it will "double". Will make weapons even faster following the new defence rules, will not be allowing buybacks by defence firms anymore. Praises the F-47 jet, made by Boeing (BA) that is in development; though, he said if he does not like it he will take the name off.

- US Commerce Secretary Lutnick expects the US economy to grow by more than 5% in Q1, with a possible 6% growth in 2026 if the Fed cuts.

CENTRAL BANKS

- US President Trump said he likes keeping NEC Director Hassett where he is; down to two or three for Fed Chair; probably down to one in my mind. He added that Reider and Warsh are both good for the next Fed chair.

- Fed's Cook (voter) said as long as she is at the Fed, she will uphold the independence of the central bank.

- Punchbowl's Pederson writes in relation to the Cook case, "The Supreme Court hasn't been super jazzed about the White House's arguments this morning"..."Justice Alito is criticizing the process around Cook's removal".

- SCOTUSblog's Adam White writes that Justices raised concerns related to the circumstances around US President Trump's action vs Fed's Cook.

- Supreme Court appears wary of Trump's bid to fire Fed's Cook.

- ECB's Kocher said using trade policy threats as a tool for political pressure increases risk to the global economy for all parties involved in the medium and long term.

- ECB's Lagarde said monetary policy is in a "good place". Europe would be stronger if non-tariff barriers were removed within the region.

- SNB Chairman Schlegel said he has no plans to increase or decrease gold holdings.

- SNB Chairman Schlegel said that they could have negative inflation this year, which is not a problem in the short term, however geopolitical tensions remain a risk. Adds that the CHF has been stable over the last few months.

DATA RECAP

- US Pending Home Sales MoM (Dec) M/M -9.3% vs. Exp. -0.3% (Prev. 3.3%).

- US Construction Spending MoM (Sep) M/M -0.6% (Prev. 0.2%).

- US Pending Home Sales YoY (Dec) Y/Y -3.0% (Prev. 2.6%).

- US Construction Spending MoM (Oct) M/M 0.5% vs. Exp. 0.1%.

- US Redbook YoY (Jan/17) Y/Y 5.5% (Prev. 5.7%).

- US MBA 30-Year Mortgage Rate (Jan/16) 6.16% (Prev. 6.18%).

- US MBA Mortgage Applications (Jan/16) 14.1% (Prev. 28.5%).

FX

- The Dollar strengthened on US President Trump announcing he has reached a framework for a deal on Greenland with NATO's Rutte, which led to him cancelling the 1st February tariffs on the EU. The dollar started to reverse morning weakness after Trump ruled out military action against NATO to acquire Greenland, resulting in some faith being restored in Transatlantic relations.

- EUR and CHF, the best performers thus far this week on elevated geopolitical risks, walked back some of their gains. That said, Denmark has rejected Trump's proposal of negotiations, which leaves uncertainty elevated, given that the talks didn't include Denmark.

- AUD and NZD led G10 gains despite the turnaround in metal gains as geopolitical risks eased in the short term. CAD was flat while JPY and GBP saw modest losses. Cable was briefly weighed by the CPI December report as the slight acceleration in Services Y/Y may have been less than some had expected.

FIXED INCOME

- T-notes gained as US-EU tensions ease after Trump walked back tariff threats on the EU.

- US sold USD 13bln of 20yr bonds; stops through 1bps. WI 4.856%. High Yield: 4.846% (prev. 4.798%, six-auction avg. 4.739%). Tail: -1bps (prev. -0.1bps, six-auction avg. -0.5bps). Bid-to-Cover: 2.86x (prev. 2.67x, six-auction avg. 2.65x). Dealers: 6.2% (prev. 12.6%, six-auction avg. 10.9%). Directs: 29.1% (prev. 22.2%, six-auction avg. 25.7%). Indirects: 64.7% (prev. 65.2%, six-auction avg. 63.5%).

- Germany sold EUR 0.776bln vs exp. EUR 1.0bln 2.90% 2056 & EUR 0.786bln vs exp. EUR 1.0bln 2.60% 2041. EUR 776mln 2.60% 2041: b/c 2.61x (prev. 3.4x), average yield 3.23% (prev. 3.02%), retention 22.4% (prev. 15.4%). EUR 786mln 2.90% 2056: b/c 2.41x (prev. 2.1x), average yield 3.49% (prev. 3.45%), retention 21.4% (prev. 17.8%).

- UK sold GBP 4.75bln 4.00% 2029 Gilt: b/c 3.66x (prev. 3.10x), avg. yield 3.821% (prev. 3.855%), tail 0.3bps (prev. 0.4bps).

COMMODITIES

- Oil prices were flat in a choppy session as Trump’s Davos appearances dominated the slate.

- US Private Inventory Data (bbls): Crude +3.0mln (exp. +1.8mln), Distillate -0.03mln (exp. -0.2mln), Gasoline +6.2mln (exp. +2.5mln), Cushing +1.2mln.

- US President Trump said they will sell Venezuelan oil at market prices and keep some.

- Russia's local fuel supplies up as repairs finish, TASS reported.

- India's Reliance reportedly set to get Russian oil in February after one-month pause.

- Kazakhstan's TengizChevroil has declared a force majeure on the Tengiz oil project; is not able to state how long it will last.

- Operations have reportedly resumed at four Libyan oil terminals.

- US Energy Secretary said Venezuela oil output can rise +30% vs current levels of around 0.9mln bpd in the short-to-medium term, according to sources.

- Chevron (CVX) reportedly aims to finalise the sale of its oil assets in Singapore in Q1, according to sources.

- IEA OMR: raises 2026 average oil demand growth forecast to 930k bpd (prev. forecast 860k bpd). Sees total world oil supply 3.69mln bpd higher than demand in 2026 in monthly report (prev. report 3.84mln bpd). Estimates OPEC+ supply growth at 1.3 mln b/d in 2025. Further decline in global oil supply in December continued to narrow surplus.

- Thai Central Bank Chief said they will introduce a daily cap on gold trading at 50mln or 100mln Baht from the 29th of January.

GEOPOLITICAL

MIDDLE EAST

- Israeli army raises its readiness for a possible US attack on Iran, according to local media.

- US President Trump said if Hamas does not agree to peace, it will be blown away.

- US envoy Witkoff said he does not have the sense from Iran just yet that they want to solve things in a diplomatic way, can have the conversation with them and come to a diplomatic solution when they are willing/if they want to.

- Iran's Foreign Minister warns Washington that any all-out confrontation with Iran would be fierce and engulf the entire region, Sky News Arabia reported.

RUSSIA-UKRAINE

- Russia's President Putin said he plans contact with US envoys Witkoff and Kushner on Thursday; will discuss the issue of possible use of frozen Russian assets with US envoys with Palestinian Authority President Abbas.

- US President Trump said we're getting close on the Ukraine war.

- US President Trump said negotiations on a deal with Ukraine are now close; believes that Ukraine-Russia can come together on a deal.

- Ukrainian President Zelensky intends to travel to Davos on Thursday for a meeting with US President Trump, Axios' Ravid reported.

- US President Trump said he is meeting with Ukrainian President Zelensky on "Wednesday". Trump said he is not sure if his allies, i.e. NATO, would defend the US in the event of a conflict, said the US would be there for them.

- US special envoy Witkoff reported significant progress on Ukraine and Russia in recent weeks. Adds that the land deal remains the sticking point. Scheduled to meet Putin on Thursday. Ukraine has made significant progress amid the ongoing conflict. Uncertain about finishing off final 10% of the deal in the coming weeks, but highlights progress. "The Russians have invited us to come and that’s a significant statement"; will travel to Russia on Thursday with Kushner.

- Russian Defence Ministry said Russian strategic bombers carried out patrol over Sea of Japan, according to Interfax.

GREENLAND

- US President Trump said it looks like we have the concept of a deal; great deal for everybody; outlines of the Greenland deal are everything we wanted.

- Denmark Foreign Minister said the day ends better than it started, positive that US President Trump says he will end his trade war; If what is happening today means that we can return to more normal channels than Truth Social then that is good. Added that President Trump saying he won't use force is a good signal but is still unclear whether Trump has an ambition we can't accommodate.

- Emergency EU leaders summit will go ahead as planned on Thursday.

- US President Trump, on Greenland, said nations can say "yes" and he will be "very grateful", or they can say "no" and the US "will remember".

- US President Trump said he won't use force against NATO. "All the US is asking for is a place called Greenland". Never got anything from NATO, despite paying for "100% of NATO", all he wants is Greenland and "ownership" of it, in order to defend it.

- US President Trump said he is seeking immediate negotiations to discuss the acquisition of Greenland. This is not a threat to NATO, it would enhance the alliance.

- US President Trump said, regarding Greenland, that he has respect for Greenland and Denmark. However, no nation/group of nations is in any position to secure Greenland, except for the US.

- NATO's Rutte said the allies must defend the Arctic region amid rising Chinese and Russian activity.

ASIA-PAC

NOTABLE HEADLINES

- 6.1 magnitude earthquake strikes Volcano Islands, Japan region, USGS reported.

- USTR Greer said a SCOTUS ruling against Trump's tariffs would be problematic, speaking on Fox; does not know if "we will get a comprehensive China trade deal"; adds that rare earths are flowing from China.

- Inter-regional trips are expected to be at record-breaking levels in China during the Spring Festival, Xinhua reports citing a government meeting.

- China's Finance Ministry announces plan to curb extremely low pricing in government purchases.

- Japan's JIP co-leader Fujita said markets appear to be concerned about aggressive fiscal policy, and Japan needs to cut back on subsidies but with minimal impact. Spending overhaul will provide savings in the trillions.

NOTABLE APAC EQUITY HEADLINES

- Toyota (7203 JT) and other Japan automakers to share chip data as supply risks grow, Nikkei reported.

- Chow Tai Fook (1929 HK) reported Q3 retail sales in Europe grew by 17.8% Y/Y and Mainland China sales grew by 21.4% Y/Y.

EU/UK

DATA RECAP

- UK CBI Industrial Trends Orders (Jan) -30 vs. Exp. -33 (Prev. -32).

- UK November ONS House Price Index 2.5% Y/Y (prev. 1.7% Y/Y).

- UK Services CPI (Dec) Y/Y 4.5% vs. Exp. 4.6% (prev. 4.4%).

- UK PPI Output MoM (Dec) M/M 0% vs. Exp. 0.1% (Prev. 0.1%).

- UK Core CPI YoY (Dec) Y/Y 3.2% vs. Exp. 3.2% (Prev. 3.2%, Low. 3.1%, High. 3.4%).

- UK Core CPI MoM (Dec) M/M 0.3% vs. Exp. 0.3% (Prev. -0.2%, Low. 0.2%, High. 0.5%).

- UK Retail Price Index YoY (Dec) Y/Y 4.2% vs. Exp. 4% (Prev. 3.8%, Low. 3.9%, High. 4.4%).

- UK Retail Price Index MoM (Dec) M/M 0.7% vs. Exp. 0.5% (Prev. -0.4%, Low. 0.4%, High. 0.9%).

- UK PPI Input YoY (Dec) Y/Y 0.8% (Prev. 1.1%).

- UK PPI Input MoM (Dec) M/M -0.2% vs. Exp. -0.1% (Prev. 0.5%, Rev. From 0.3%).

- UK PPI Core Output MoM (Dec) M/M -0.1% (Prev. 0.1%, Rev. From 0%).

- UK PPI Core Output YoY (Dec) Y/Y 3.2% (Prev. 3.6%, Rev. From 3.5%).

- UK PPI Output YoY (Dec) Y/Y 3.4% (Prev. 3.4%).

- UK CPI MoM (Dec) M/M 0.4% vs. Exp. 0.4% (Prev. -0.2%, Low. 0.1%, High. 0.6%).

- UK CPI YoY (Dec) Y/Y 3.4% vs. Exp. 3.3% (Prev. 3.2%); All Services 4.5% (prev. 4.4%). ONS. "Inflation ticked up a little in December, driven partly by higher tobacco prices, following recently introduced excise duty increases.""Airfares also contributed to the increase with prices rising more than a year ago, likely because of the timing of return flights over the Christmas and New Year period.""... partially offset by a fall in rents inflation and lower prices for a range of recreational and cultural purchases."

NOTABLE EUROPEAN EQUITY HEADLINES

- Deutsche Boerse (DB1 GY) agreed to buy Allfunds Group (ALLFG NA), in a deal worth EUR 5.3bln.

- Ubisoft (UBI FP) cuts FY forecasts as it announces restructuring; introduces 5 specialised creative houses as overhauls to regain creative leadership and agility.

- Continental (CON GY) prelim. FY25 based on Q4 results (EUR): Sales 19.7bln (guided 19.5-21bln), adj. EBIT margin 13.6% (guided 12.5-14%), ContiTech sales c. 6bln (guided 6-6.5bln), ContiTech adj. EBIT margin c. 4.9% (guided 6-7%). ContiTech: "The lower-than-expected earnings are mainly due to the lack of market recovery in the past quarter, transformation expenses, currency and valuation effects, and the deferral of certain earnings-safeguarding measures to subsequent quarters."