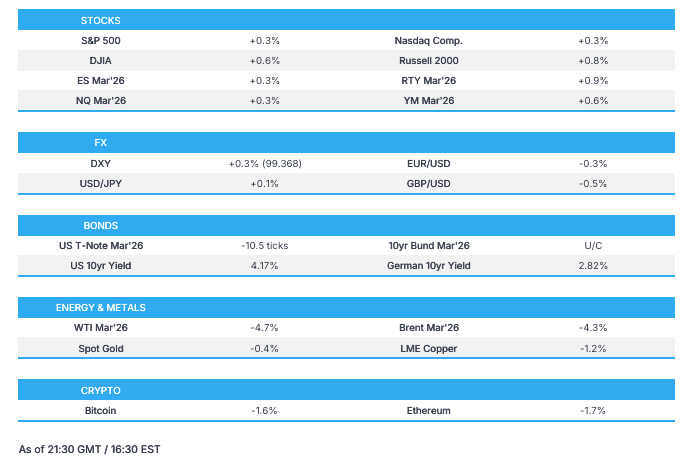

US stocks saw gains, albeit coming off highs through the US afternoon and into close - Newsquawk Asia-Pac Market Open

- US stocks saw gains, albeit coming off highs through the US afternoon and into close, as an initial stellar report from TSMC provided tailwinds to the tech sector and broader semiconductor names; peak gains were not sustained.

- The Dollar was firmer as hot US claims data added to existing gains from overnight trade. Initial claims unexpectedly fell to their second-lowest reading in two years, with continuing claims also falling beneath forecasts.

- T-note curve flattened with front-end yields rising on the strong data, as it reduces the need for near-term rate cuts.

- The crude complex was distinctly lower, paring some of the recent geopolitically induced strength after Trump said Iran has "no plan" to kill protestors.

- Looking ahead, highlights include Weekly Japanese Investments and supply from Australia.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks saw gains, albeit coming off highs through the US afternoon and into close, as an initial stellar report from TSMC provided tailwinds to the tech sector and broader semiconductor names; peak gains were not sustained.

- Despite the pullback seen in the US afternoon, Tech still saw strength, and sectors saw an upside bias. Utilities and Industrials outperformed, while Energy and Health lagged.

- SPX +0.26% at 6,944, NDX +0.32% at 25,547, DJI +0.60% at 49,442, RUT +0.86% at 2,675.

NOTABLE US HEADLINES

- White House Press Secretary said US President Trump will lay out housing initiatives in the Davos speech.

- Fitch said 10% US credit card APR cap would materially reduce ABS loss cushion.

- American Express Card Data (Dec): USCS Card Member loans 30 days past due 1.3%, net write-off rate 2.1%; US small business card member loans 30 days past due 1.7%, net write-off rate 2.7%.

- Top Republican on the House China Committee Moolenaar sends a letter seeking more info on the memory chip shortage and asked about NVIDIA (NVDA) H200 chips. Moolenaar said that tight memory chip supplies will constrain the number of US export licenses for Nvidia to sell its H200 AI processors to Chinese customers.

- European partners of Venezuela’s state-run PDVSA, including Repsol (REP SM) and Maurel & Prom, are applying for US licenses and authorisations to export Venezuelan oil, according to reports.

- BlackRock (BLK) CEO Fink said there's good justification for lowering rates if you believe the power of AI - CNBC. The US will grow above trend over the next few years.

- US President Trump threatens to institute the insurrection act if corrupt politicians of Minnesota do not obey the law and stop those attacking ICE workers.

- Punchbowl reported that there is currently no sign US Senators are moving towards a compromise on the main issues regarding enhanced Obamacare subsidies.

TARIFFS/TRADE

- US President Trump to lower tariffs to 15% on goods from Taiwan; Taiwan pledges USD 250bln each in chip investment and credit guarantees.

- US Commerce Secretary Lutnick said TSMC (TSM) can bring in more semiconductors and wafers while building US capacity; if companies don't build in US, tariffs likely to be 100%; Trump visit to China in April still on.

- US Commerce Secretary Lutnick said not concerned that China trade talks will be derailed by Taiwan trade deal or tariffs on goods from countries doing business with Iran.

- USTR Greer said US and Honduras intend to launch negotiations of a bilateral agreement on reciprocal trade as soon as possible.

- German Chemical Industry Lobby Group said reopening the Suez Canal would lower shipping rates.

- US President Trump's administration is expected to finalise 2026 biofuel blending quotas by early March, according to sources. Administration is weighing a range of 5.2-5.6bln gallons for bio-based diesel volumes (exp. 6.6bln). Expected to keep biofuel blending quotas roughly in line with current proposal. Expected to drop plan to penalise imports of renewable fuel and feedstocks.

- US exporters sell 204k tonnes of soybeans to China.

- Mexico Economy Minister Ebrard said Mexico is already reviewing USMCA and "have to finish by July 1st".

DATA RECAP

- US Continuing Jobless Claims (Jan/03) 1884K vs. Exp. 1890K (Prev. 1914K, Rev. 1903K).

- US Initial Jobless Claims (Jan/10) 198K vs. Exp. 215K (Prev. 208K, Rev. 207K).

- US Jobless Claims 4-week Average (Jan/10) 205.00K vs. Exp. 215.0K (Prev. 211.50K, Rev. 211.75K).

- US NY Empire State Manufacturing Index (Jan) 7.70 vs. Exp. 1 (Prev. -3.70, Rev. -3.90).

- US January PCE and Personal income report rescheduled for March 13th; February PCE and Personal income report rescheduled for April 9th.

- US 15-Year Mortgage Rate (Jan/15) 5.38% (Prev. 5.46% ).

- US 30-Year Mortgage Rate (Jan/15) 6.06% (Prev. 6.16% ).

- US 8-Week Bill Auction 3.600% (Prev. 3.540% ).

- US 4-Week Bill Auction 3.595% (Prev. 3.550% ).

- US Import Prices YoY (Nov) Y/Y 0.1% vs. Exp. 0.4%.

- US Export Prices YoY (Nov) Y/Y 3.3% vs. Exp. 2.3%.

- US Philly Fed Employment (Jan) 9.7 (Prev. 13.0, Rev. 12.9).

- US Philadelphia Fed Manufacturing Index (Jan) 12.6 vs. Exp. -2 (Prev. -8.8, Rev. -10.2).

- US Philly Fed Business Conditions (Jan) 25.5 (Prev. 38.1, Rev. 41.6).

- US Philly Fed New Orders (Jan) 14.4 (Prev. 5.7, Rev. 5.0).

- US Philly Fed CAPEX Index (Jan) 30.30 (Prev. 29.10, Rev. 30.30).

- US Philly Fed Prices Paid (Jan) 46.90 (Prev. 49.30, Rev. 43.60).

- Canadian Manufacturing Sales MoM Final (Nov) M/M -1.2% vs. Exp. -1.1% (Prev. -1.0%, Rev. -1%).

- Canadian Wholesale Sales MoM Final (Nov) M/M -1.8% vs. Exp. 0.1% (Prev. 0.1%).

NOTABLE US EQUITY HEADLINES

- Goldman Sachs (GS) Q4 2025 (USD): EPS 14.01 (exp. 11.70), Revenue 13.45bln (exp. 14.52bln); raises quarterly dividend to 4.50 (prev. 4). Key Metrics: Provision for credit losses was net benefit USD 2.12bln. FICC sales and trading revenue 3.11bln (exp. 2.95bln). Equities trading revenue 4.31bln (exp. 3.65bln). Commentary: Continue to see high levels of client engagement across franchise and expect momentum to accelerate in 2026.

- Morgan Stanley (MS) Q4 2025 (USD): EPS 2.68 (exp. 2.43), revenue 17.9bln (exp. 17.7bln). Revenue breakdown. Wealth Management 8.43bln (exp. 8.34bln). Investment Management 1.72bln (prev. 1.64bln Y/Y). FICC 1.76bln (exp. 1.92bln). Equities sales and trading revenue 3.67bln (exp. 3.55bln). Institutional Investment Banking revenue 2.41bln (exp. 2bln). Other metrics. Non-interest expenses 12.11bln (exp. 12.27bln). Provision for credit losses 18mln (exp. 81.1mln). Compensation expenses 7.06bln (exp. 7.24bln). Total deposits 415.52bln (exp. 411.36bln).

- BlackRock Inc. (BLK) Q4 2025 (USD): adj. EPS 13.16 (exp. 12.27), Revenue 7.01bln (exp. 6.76bln). Q4 AUM USD 14.04tln (exp. 13.94tln). Q4 Net Inflows USD 341.7bln (exp. 287.5bln). Q4 base fees and securities lending sales USD 5.3bln (Exp. 5.31bln). Q4 long-term inflows USD 267.8bln. Q4 equity inflows USD 126.1bln. Q4 fixed income net inflows USD 83.8bln. COMMENTARY: CEO said it enters 2026 with accelerating momentum across the entire platform, coming off the strongest year and quarter of net inflows in its history. Raises quarterly dividend +10% to USD 5.73/shr.

FX

- The Dollar was firmer as hot US claims data added to existing gains from overnight trade. Initial claims unexpectedly fell to its second lowest reading in two years, with continuing claims also falling beneath forecasts. Ahead of the Fed blackout this weekend, many officials were present. Schmid (2028 voter) unsurprisingly remains a hawk, cautioning against high inflation and a December reading that implies inflation "close to 3%"; Governor Barr views current rates at the right level, equally balancing risks to inflation and the job market.

- G10 FX was generally lower against the buck, with AUD the exception, posting decent strength. GBP underperformed despite a GDP beat in November (Act: 0.3% M/M, exp. 0.1%), leaving Cable at around 1.3363 lows. CHF and EUR also underperformed.

- The Japanese Yen was marginally weaker, with Bloomberg reports likely limiting downside. The BoJ is reportedly likely to keep rates steady in January; some officials are said to be concerned over the economic impact of a weak JPY. USD/JPY hit highs of 158.88 before paring to ~158.53.

FIXED INCOME

- T-note curve flattened with front-end yields rising on the strong data as it reduces the need for near-term rate cuts. The highlight was the jobless claims data, which fell to sub 200k, only the third print to do so in the last two years, which helped quell some labour market concerns.

COMMODITIES

- The crude complex was distinctly lower, paring some of the recent geopolitically induced strength after Trump said Iran has "no plan" to kill protestors.

- US Energy Secretary Wright said US is getting a 30% higher price for Venezuelan oil than three weeks ago; Venezuela's oil production will drive the price of oil down.

- Colombian President Petro said will begin to lower the price of gasoline.

- Russia's President Putin said Russia and Saudi Arabia in OPEC+ help with stabilising the oil market.

- US EIA Natural Gas Stocks Change (Jan/09) -71Bcf vs. Exp. -90Bcf (Prev. -119Bcf, Rev. -119Bcf).

CENTRAL BANKS

- White House Press Secretary Leavitt said US President Trump is in the decision-making phase on the Fed chair, Trump will make decision in the next couple of weeks, but he likes a few people for Fed Chair.

- Fed's Paulson (2026 voter) is comfortable holding rates steady at next Fed meeting; labour market risks a little bit higher than risks of sticky inflation. “I want monetary policy restrictiveness to be playing a role to get us all the way back to 2%.”

- Fed's Schmid (2028 voter) said little reason to cut rates; prefer to keep monetary policy modestly restrictive; inflation is too hot. Cutting rates could worsen inflation without helping employment much.

- Fed's Schmid (2028 voter) said full employment likely between 3.5-4.5%.

- Fed's Daly (2027 voter) said projections for growth are solid; incoming data looks promising. There is still a lot of uncertainty, with risks to both sides of our mandated goals.

- NY Fed RRP op demand at USD 2bln (prev. 3.2bln) across 6 counterparties (prev. 15).

- Fed's Barkin (2026 voter) said today the economy has two engines: AI and the rich; hard to put weight on data in the past three months.

- Fed Governor Barr said DoJ probe is an assault on the independence of the Fed; Fed is acting only for economic reasons and according to its congressional mandate. Barr said benchmark interest rates are at the right level, equally balancing risks to inflation and the job market.

- Fed's Bostic (2027 Voter) said he expects GDP to grow upward of 2% in 2026. Expects inflationary pressure to continue in 2026. Many businesses are still incorporating tariffs into prices.

- Fed's Goolsbee (2028 Voter) said he's not surprised by low initial jobless claims numbers; Chicago Fed data showed stability in the labour market. Low-hiring, low-firing environment does highlight business uncertainty. Growth has been pretty solid, driven by AI and consumer spending. Reiterates that the most important thing is getting inflation back to 2%.

- US Republican Hill spoke to Fed's Powell after subpoenas; Fed and House Financial Services Committee working on data of Powell semi-annual testimony.

- BoE announces that the PRA is to streamline supervision as part of 2026 priorities. From 1 March larger firms will begin to move to this two-year cycle, while maintaining a regular cadence for discussion of important matters, alongside ad hoc supervisory meetings. This will result in firms having a more proportionate and efficient set of engagements with the PRA.

- NBP Governor Glapinksi said further easing could be before March, but also could be after; any cut will be 25bps. Doesn't rule out February rate cut, but do not confirm it either. Sees terminal level around 3.5%. There are MPC members who see terminal level lower than 3.5%.

- Riksbank's Bunge said inflation has moved closer to target and real economy has begun to recover.

GEOPOLITICAL

MIDDLE EAST

- US President Trump was reportedly told an attack on Iran would not guarantee the collapse of the regime and could spark a wider conflict, according to WSJ. Will monitor how Iran handles protestors before deciding on scope of potential attack.

- White House said Trump and his team have told Iran if killing continues, there will be grave consequences; 800 executions were halted in Iran; all options remain on the table for Iran.

- Israel PM Netanyahu reportedly asked US President Trump on Wednesday to delay an attack on Iran, according to NYT. "Prime Minister Benjamin Netanyahu of Israel asked the president to postpone any planned attack."

- US President Trump said "we've saved a lot of lives" as Iran signals it won't execute protesters and said no decision yet on action against Iran.

- EU Commission President von der Leyen said looking to deepen sanctions against Iran.

- US Treasury Department announces sanctions against the "architects of the Iranian regime’s brutal crackdown on peaceful demonstrators". "OFAC today is also taking action against the shadow banking networks that allow Iran’s elite to steal and launder revenue generated by the country’s natural resources."

- US Treasury Department imposes sanctions on Crystal Gas, Iran tied firms and some Iranian individuals.

- Iranian Official said US President Trump informed Iran he does not intend to attack, via Dawn.

- Semafor reported remarks from a US official on Wednesday, prior to the US President announcing that Iran has halted its killing of protestors, as saying that people "do not see diplomacy as a realistic option".

RUSSIA-UKRAINE

- Russia's Ministry Spokesperson said neither Russia nor China have stated any plan to occupy Greenland.

- Russian President Putin said international situation deteriorating.

- Russian Foreign Ministry Spokesperson said that Western forces deployed in Ukraine are legitimate targets for Moscow.

- EU's Russia crude oil price cap to be USD 44.10/bbl from February 1st.

- Russia's Kremlin on possible meeting with Kushner and Witkoff said they will proceed once a date is agreed. Agree on US President Trump's assessment of Ukrainian President Zelensky delaying peace deal. However they do agree on continued dialogue.

ASIA-PAC

NOTABLE HEADLINES

- China called on restart of China-Canada Agricultural Committee; China vows to strengthen agricultural cooperation with China.

- Chinese Commerce Minister announces plan to expand and diversify markets for trade, via Xinhua.

EU/UK

DATA RECAP

- EU Industrial Production YoY (Nov) Y/Y 2.5% vs. Exp. 2% (Prev. 1.7%, Rev. 2%).

- EU Balance of Trade (Nov) 9.9B vs. Exp. 15.2B (Prev. 17.9B, Rev. 18.4B).

- EU Industrial Production MoM (Nov) M/M 0.7% vs. Exp. 0.5% (Prev. 0.7%, Rev. 0.8%).

NOTABLE EUROPEAN EQUITY HEADLINES

- Equinor (EQNR NO) wins ruling to resume US wind project halted by Trump, Bloomberg reported.

- European Closes: Euro Stoxx 50 +0.60% at 6,041, Dax 40 +0.35% at 25,375, FTSE 100 +0.54% at 10,239, CAC 40 -0.21% at 8,313, FTSE MIB +0.44% at 45,850, IBEX 35 -0.30% at 17,643, PSI +0.40% at 8,602, SMI +0.22% at 13,495, AEX +1.43% at 1,011.

- German authorities search private properties in connection with Baywa (BYW GY), Sueddeutsche reported.

NOTABLE GLOBAL EQUITY HEADLINES

- US Trade Advisor Navarro criticises Ford (F) and BYD (002594 CH) battery deal talks in a post on X.

- US President Trump, with reference to the 'EU making more fines on US tech than tax from all of public European tech', said "This is very unfair for our Tech Companies, and for the United States of America!".

- Revolut, Visa (V) and Mastercard (MA) lose legal challenge over fee cap, FT reported.

- FDA delays review of two drugs under the commissioner's voucher programme amid safety and efficacy concerns; Eli Lilly (LLY) and Sanofi (SAN FP) targeted.

- UK CMA has launched a review of its approach to merger efficiencies.