US stocks sold off led by tech weakness amid concerns about valuations and AI race with China - Newsquawk Asia-Pac Market Open

- US stocks declined with the Nasdaq and big tech names leading the losses, seemingly driven by concerns over the US position in the AI race against China after a slew of positive updates from Chinese tech companies overnight. The SPX sold off by over 100 points at the close, while RUT and NDX clearly underperformed. Sectors were predominantly lower, with the homes of the heavy weights, Consumer Discretionary, Tech and Communications the laggards, while Energy, Consumer Staples and Healthcare outperformed, in which energy stocks tracked crude prices higher as Russia appeared frustrated with Ukraine's lack of negotiations although crude settled well off today's highs amid the downbeat risk tone and after inventory data saw a chunky build.

- USD was pressured as USD-denominated assets were hit hard with risk-off sentiment seen through the duration of the US session, while some of the reasoning for that was the bullish China tech updates overnight, which weighed heavily on mega-cap US names and continued to support the comments NVIDIA CEO Huang made last week that China “will win the AI race”. As the government shutdown has now ended, markets now await the delayed data, albeit with no schedule announced yet, while White House Economic Adviser Hassett said the jobs part will be released for one month, but not the unemployment rate, due to the shutdown. Furthermore, there were several Fed speakers and Fed pricing moved markedly hawkish today with only 12bps of cuts priced in by year-end vs. 16bps on Wednesday.

- Looking ahead, highlights include Chinese House Prices, Industrial Production & Retail Sales, Japanese Tertiary Industry Activity Index, Indian WPI, Supply from Australia.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Chinese House Prices, Industrial Production & Retail Sales, Japanese Tertiary Industry Activity Index, Indian WPI, Supply from Australia.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks declined with the Nasdaq and big tech names leading the losses, seemingly driven by concerns over the US position in the AI race against China after a slew of positive updates from Chinese tech companies overnight. The SPX sold off by over 100 points at the close, while RUT and NDX clearly underperformed. Sectors were predominantly lower, with the homes of the heavy weights, Consumer Discretionary, Tech and Communications the laggards, while Energy, Consumer Staples and Healthcare outperformed, in which energy stocks tracked crude prices higher as Russia appeared frustrated with Ukraine's lack of negotiations although crude settled well off today's highs amid the downbeat risk tone and after inventory data saw a chunky build.

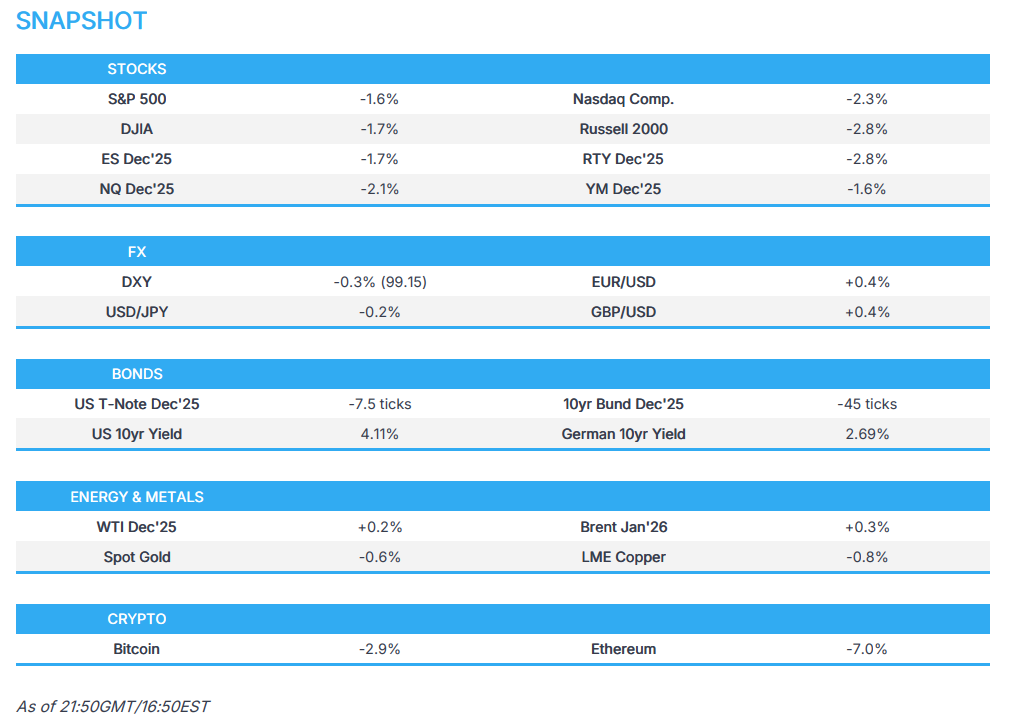

- SPX -1.64% at 6,739, NDX -2.05% at 24,993, DJI -1.65% at 47,457, RUT -2.78% at 2,383.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Senate Democrats asked President Trump to renew China export curbs and cited a national security threat, according to a letter.

- China's Foreign Ministry said G7 countries should also stop manipulating trade issues with China, and on trade, the foreign ministry adds that they need to stop politicising trade issues.

- China’s Commerce Minister said communication with the Dutch will continue in a rational manner and hopes relevant measures will be withdrawn by the Dutch, while it was also reported that China's Commerce Minister met with the Spanish Economy and Trade Ministers.

- European Commission President von der Leyen said ministers agreed to hike duties on small parcels.

- German Economy Ministry said in its monthly report that the recent threat of semiconductor supply bottlenecks and Chinese export restrictions on rare earths do not appear to pose an acute threat to the supply situation for the German industry in the short term, while it added that significantly weaker trade dynamics are widely expected for 2026.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter, hawk) said outside of data centres, business investment has been tepid and that businesses are learning how to run their firms in an uncertain environment. Musalem said he supported rate cuts so far to protect the labour market and need to proceed with caution now. Furthermore, he sees limited room to ease without becoming overly accommodative and said policy is closer to neutral than modestly restrictive, while he added they need to continue to lean against inflation.

- Fed's Hammack (2026 voter) said the US economy has been remarkably resilient and that she hears from contacts that inflation is too high and moving in the wrong direction. Hammack stated the employment side of the mandate is challenged amid job market softening, and inflation may be tariff-driven, but service inflation is a real concern, while she added that Fed policy needs to remain somewhat restrictive to push inflation pressures down.

- Fed's Kashkari (2026 voter) said inflation is still too high at 3%, while he added that there are mixed signals in the economy and that some sectors in the labour market look under pressure. Kashkari also commented that it seems like there are real pockets of weakness in the labour market and corporations are very optimistic about 2026, while he has no strong inclination yet on a December rate cut, but noted data suggests more of the same since the October meeting and that the resilient economy called for a rate pause in October.

- Fed's Daly (2027 voter) said unequivocally no to raising the 2% inflation target and that balance of risks had been highly on inflation until mid-2025 but started to shift and balance out, while she thinks risks are in balance at the moment, but still slightly higher on employment.

- White House Economic Advisor Hassett said the jobs part will be released for one month, but not the unemployment rate because of the shutdown, while he expects Q4 GDP to be 1.5% lower than what it would have been and doesn't see much of an argument to not cut rates. Furthermore, he said they could get the September jobs report next week as it's already been made.

- BLS said it is working on a plan to release the delayed data and stated "We appreciate your patience while we work to get this information out ASAP, as it may take time to fully assess the situation and finalise revised release dates", according to WSJ.

- Fox's Lawrence cited sources stating the September jobs report is expected to come out next week.

FX

- USD was pressured as USD-denominated assets were hit hard with risk-off sentiment seen through the duration of the US session, while some of the reasoning for that was the bullish China tech updates overnight, which weighed heavily on mega-cap US names and continued to support the comments NVIDIA CEO Huang made last week that China “will win the AI race”. As the government shutdown has now ended, markets now await the delayed data, albeit with no schedule announced yet, while White House Economic Adviser Hassett said the jobs part will be released for one month, but not the unemployment rate, due to the shutdown. Furthermore, there were several Fed speakers and Fed pricing moved markedly hawkish today with only 12bps of cuts priced in by year-end vs. 16bps on Wednesday.

- EUR benefitted from the weaker dollar and reclaimed the 1.1600 handle, while the latest ECB rhetoric provided very little incrementally.

- GBP was initially pressured by disappointing GDP data, but then recouped its losses and more, after rebounding off support at the 1.3100 level.

- JPY marginally strengthened against the dollar, albeit with the gains limited despite the broad risk-off mood.

FIXED INCOME

- T-notes were pressured amid Fed commentary and US government reopening.

COMMODITIES

- Oil prices were marginally higher, albeit settled well off today's peak after attempting to pare some of this week's extensive losses.

- US EIA Weekly Crude Stocks w/e 6.413M vs. Exp. 1.96M (Prev. 5.202M)

- IEA OMR (Nov) raised 2025 and 2026 demand growth forecasts with 2025 demand growth seen at 790k BPD (prev. 710k BPD) and 2026 at 770k BPD (prev. 700k BPD), while it raised the 2025 supply forecast to 3.1mln BPD (prev. 3mln BPD) and sees total world oil supply 4.09mln BPD higher than demand in 2026 in monthly report (vs 3.97mln BPD in previous report).

GEOPOLITICAL

MIDDLE EAST

- Israel is reportedly seeking a new 20-year security agreement with the US, doubling the usual term and adding "America First" provisions to win the Trump administration's support, according to Axios sources.

- US President Trump told Saudi Crown Prince MBS in a phone call last month that with the Gaza war ending, he expects Saudi Arabia to move toward normalisation with Israel, according to Axios citing officials.

RUSSIA-UKRAINE

- Russia's Kremlin said Ukraine must negotiate with Russia "sooner or later" and that its negotiation position is worsening by the day, while it believes that Russia and Europe will resume dialogue sooner or later. Kremlin said it remains open to reaching a settlement on Ukraine through political and diplomatic means, while it wants a peace settlement but will keep fighting in the absence of one to ensure its own security.

- Ukraine's military confirmed that it hit a Russian oil terminal in Crimea and an oil depot in the Zaporizhzhia region.

- EU's von der Leyen said the EU is working with Belgium on options to deliver on the commitment to cover Ukraine's financing needs.

OTHER

- US senior military officials on Wednesday presented President Trump with updated options for potential operations in Venezuela, including strikes, according to sources cited by CBS News.

- China summoned Japan’s envoy over Japanese PM Takaichi's remarks on Taiwan and said the remarks were extremely dangerous.

- China's Foreign Ministry said regarding Japanese PM Takaichi's remarks that, despite strong protest from China, the PM has stubbornly refused to take that back, and Japan must correct it and take the remarks back or else consequences must be borne by Japan. Furthermore, it stated that if Japan dares to intervene, that will constitute aggression and that Japan must stop interfering in Chinese internal affairs.

ASIA-PAC

DATA RECAP

- Chinese Aggregate Financing (CNY)(Oct) 810bln vs Exp. 1229bln (Prev. 3530bln)

- Chinese New Yuan Loans (CNY)(Oct) 220bln vs Exp. 500bln (Prev. 1290bln)

- Chinese Money Supply YY (Oct) 8.2% vs Exp. 8.1% (Prev. 8.4%)

EU/UK

NOTABLE HEADLINES

- BoE's Greene was reappointed as an external member of the MPC for a second term.

- ECB's Buch said markets are under-pricing geopolitical risk, while new regulatory frameworks are not needed and need commitment from legislators to not weaken current frameworks.

DATA RECAP

- UK GDP Prelim QQ (Q3) 0.1% vs. Exp. 0.2% (Prev. 0.3%)

- UK GDP Prelim YY (Q3) 1.3% vs. Exp. 1.4% (Prev. 1.4%)

- UK GDP Estimate 3M/3M (Sep) 0.10% vs. Exp. 0.20% (Prev. 0.30%, Rev. 0.20%)

- UK GDP Estimate YY (Sep) 1.10% vs. Exp. 1.30% (Prev. 1.30%, Rev. 1.20%)

- UK Manufacturing Output YY (Sep) -2.2% vs. Exp. -1.5% (Prev. -0.8%, Rev. -0.7%)

- UK Industrial Output YY (Sep) -2.5% vs. Exp. -1.2% (Prev. -0.7%, Rev. -0.5%)

- UK Services YY (Sep) 1.70% vs. Exp. 1.80% (Prev. 1.70%, Rev. 1.50%)

- EU Industrial Production MM (Sep) 0.2% vs. Exp. 0.7% (Prev. -1.2%, Rev. -1.1%)