US stocks trended higher throughout Europe and the US sessions before paring slightly into the close - Newsquawk Asia-Pac Market Open

- US stocks trended higher throughout Europe and the US sessions before paring slightly into the close - the Russell led the gains.

- The Dollar was weaker on Monday, due to a lack of headline-driven newsflow and thin liquidity as participants count down the days to the Christmas break.

- T-Notes saw mild pressure overnight, tracking JGBs, with limited price action in the US trading session ahead of data.

- The crude complex was firmer to start the holiday-truncated week, amid a raft of geopolitical concerns.

- Looking ahead, highlights include RBA Minutes (Dec Meeting), New Zealand Broad Money (Nov), Japanese Chain Store Sales YY (Nov).

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

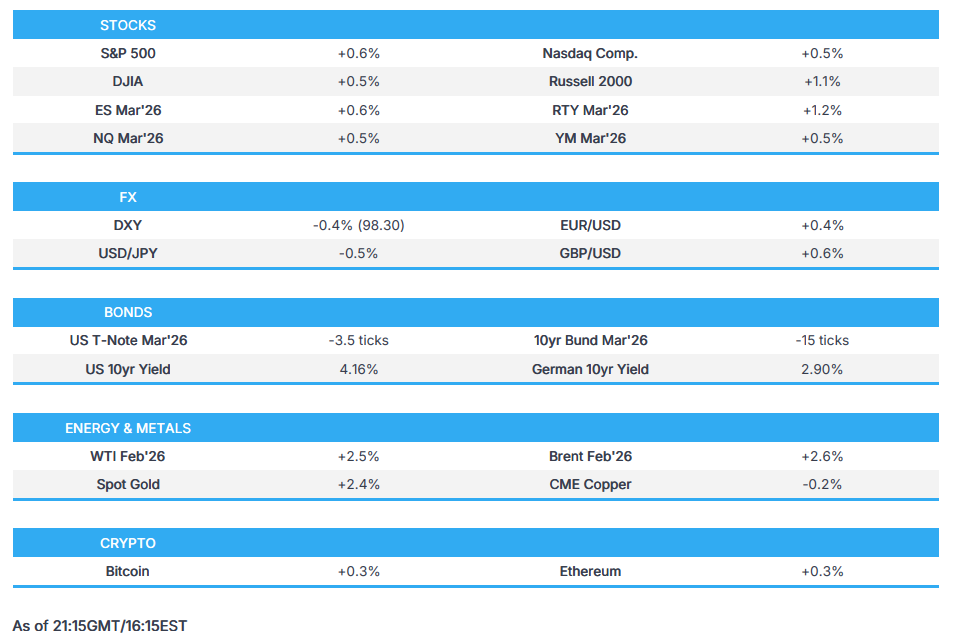

SNAPSHOT

US TRADE

- US stocks trended higher throughout Europe and the US sessions before paring slightly into the close - the Russell led the gains. Materials, Financials and Energy outperformed sector wise with Materials benefitting from upside in metals prices. The Energy sector was buoyed by gains in crude prices as geopolitical tensions mount.

- SPX +0.56% at 6,873, NDX +0.46% at 25,462, DJI +0.47% at 48,363, RUT +1.08% at 2,557.

TARIFFS/TRADE

- Chinese Commerce Ministry on Nexperia said they have exempted eligible chips exports; urges relevant firms to conduct talks over ownership and resuming supply chain. Also urges firms to resolve internal dispute as soon as possible.

- Exporters sell 396k metric tonnes of soybeans to China, of which 330k metric tonnes is for 2025/26 delivery and 66k metric tonnes for 2026/27, according to the USDA.

DATA RECAP

- US National Activity Index (Sep) -0.21 (Prev. -0.12, Rev. -0.31).

- Canadian Raw Materials Prices YY (Nov) 6.4% (Prev. 5.8%).

- Canadian Raw Materials Prices MM (Nov) 0.3% (Prev. 1.6%).

- Canadian Producer Prices YY (Nov) 6.1% (Prev. 6.0%).

- Canadian Producer Prices MM (Nov) 0.9% vs. Exp. 0.3% (Prev. 1.5%).

NOTABLE US EQUITY HEADLINES

- NVIDIA (NVDA) reorganises Cloud division, effectively ending direct competition with AWS (AMZN), according to The Information; DGX Cloud team shifts focus to internal NVDA engineering needs. Cloud division head Alexis Black Bjorlin seeks new internal role.

- NVIDIA (NVDA) plans to begin first shipments of H200 AI chips to China before mid-Feb, according to Reuters sources; initial shipments of H200 chips to China expected to be around 40-80k units.

- Paramount SkyDance (PSKY) has no immediate plans to raise its “hostile” offer for Warner Bros. Discovery (WBD) and will likely wait until its first shareholder tender date of January 8th before announcing its next move, via FBN's Gasparino citing sources.

- Warner Bros. Discovery (WBD) is expected to respond to Paramount SkyDance's (PSKY) latest offer later today, according to FBN's Gasparino.

- Alphabet (GOOGL) is to acquire Intersect for USD 4.75bln cash plus debt.

FX

- The Dollar was weaker on Monday, in a lack of headline-driven newsflow and thin liquidity as participants count down the days to the Christmas break. While scheduled events were thin for today, Tuesday sees the release of quarterly GDP and PCE data, as well as US Consumer Confidence.

- G10 FX was all higher and profited off the flailing Buck, as Antipodeans and GBP outperformed, and CAD ‘underperformed’, but still saw solid gains vs. the Greenback. In the G10 space, the main story was the Yen, where we saw some more jawboning from Top Currency Diplomat Mimura overnight; said he is recently seeing one-sided, rapid moves, will take appropriate action against excessive moves, and concerned about FX moves.

- Antipodeans were buoyed by the broader risk-on sentiment and the upside in underlying metals prices, which saw NZD/USD and AUD/USD hit peaks of 0.5801 and 0.6660, respectively.

- For the Euro watchers, ECB’s Kazimir, Vujcic, and Schnabel spoke, albeit with little market reaction. Vujcic said the next Deposit Rate move could be in either direction, while the latter remarked one should not expect a rate hike at present or in the foreseeable future, and at some point they will need to raise rates, but not in the foreseeable future.

FIXED INCOME

- T-Notes saw mild pressure overnight, tracking JGBs, with limited price action in the US trading session ahead of data.

- US sold USD 69bln of 2-year notes; tails 0.3bps. Tail: 0.3bps (prev. 0.0bps, six-auction average -0.4bps); WI: 3.496%. High Yield: 3.499% (prev. 3.489%, six-auction average 3.652%). B/C: 2.54x (prev. 2.68x, six-auction average 2.61x). Dealer: 12.7% (prev. 11.2%, six-auction average 11.2%). Direct: 34.1% (prev. 30.7%, six-auction average 31.7%). Indirect: 53.2% (prev. 58.1%, six-auction average 57.1%).

- US sold 3-month bills at high-rate 3.560%, B/C 2.86x; sold 6-month at high-rate 3.485%, B/C 3.18x.

COMMODITIES

- The crude complex was firmer to start the holiday-truncated week, amid a raft of geopolitical concerns.

- Cheniere Energy (LNG) completes Train 4 at the Corpus Christi liquefaction Stage 3 project in Texas.

- Petrobras P-40 oil platform resumed production on Saturday.

- China to cut retail diesel prices by CNY 165/T and gasoline by CNY 170/T, via NDRC.

- Russian gas exports to China, via Power of Siberia 1 pipeline, are expected to have risen by 25% Y/Y, according to Reuters sources.

CENTRAL BANKS

- President Trump could name new Fed chair by first week of January, according to CNBC citing sources.

- Fed's Miran (voter) said there were some anomalies in the inflation data from the shutdown. The data suggests the Fed should be moving in a dovish direction. Does not see a near-term recession. The neutral rate has shifted lower, policy needs to reflect this. Important that the policy rate continues to be adjusted down. If not, the risk of recession increases. Potential for tariff/tax refunds to boost economic growth. But, need to wait and see what the policy is before making adjusting the forecast. When questioned on cutting by 50bps at the next meeting: said, given policy moves thus far, the need for him to dissent and vote for 50bps again has become a bit less. Adds, that he needs to see the data before making a decision. Can get to a point of 'micro managing' the policy rate when they get closer to neutral, but not there yet. Unsure if he will stay on at the Fed. If no one is confirmed for his seat by end-January, will assume he is staying on.

- ECB's Schnabel said one should not expect a rate hike at present or in the foreseeable future, according to Faz; believes there are more inflationary than disinflationary forces at work. At some point will need to raise rates, but not in the foreseeable future.

- ECB's Vujcic said the next Deposit Rate move could be in either direction.

- ECB's Kazimir said that the ECB remains flexible and will be ready to step in if needed. He is concerned about the long term growth prospect of the Eurozone.

GEOPOLITICAL

MIDDLE EAST

- US and its allies are renewing their push to hold a conference on Gaza reconstruction, via Bloomberg.

- Israeli PM Netanyahu said Israel knows Iran is conducting 'exercises' recently and basic expectations from Iran have not changed. Iran's nuclear activities will be discussed with Trump.

RUSSIA-UKRAINE

- US VP Vance said he doesn’t have “confidence” there will be a peaceful solution to the Russia/Ukraine conflict, said but negotiations will continue and thinks progress has been made.

- Ukraine's military hits Russian oil terminal in the Krasnodar region, according to a Ukrainian General staff.

- Russia's Deputy Foreign Minister Ryabkov said Russia is not going to attack EU or NATO and is ready to put it down in a legal document, according to Ria.

ASIA-PAC

NOTABLE APAC EQUITY HEADLINES

- Japanese Finance Minister Katayama said they have a "free hand" to take bold action on the JPY, via Bloomberg. JPY immediately strengthened, with USD/JPY knee-jerking lower from 157.31 to 156.87, before paring back towards 157.16.

- Vanke averts default as bondholders approve longer grace period, according to Bloomberg.

- Vanke averts default as bondholders approve longer grace period, according to Bloomberg.

- China to cut retail diesel prices by CNY 165/T and gasoline by CNY 170/T, via NDRC.

- China's Premier said China State Council is studying drafting a 5-year plan, which is to include major projects, via Bloomberg.

- Russian gas exports to China, via Power of Siberia 1 pipeline, are expected to have risen by 25% Y/Y, according to Reuters sources.

EU/UK

NOTABLE EUROPEAN EQUITY HEADLINES

- Mercedes-Benz (MBG GY) agrees to pay USD 150mln settlement with US states over diesel emissions probe, via NY Attorney General. Reached USD 120mln agreement with multiple US states to resolve remaining diesel gate proceedings in US. The firm notes EBIT remains unaffected due to sufficient prior provisions. Settlement includes more than USD 00mln in potential consumer relief.

- Equinor (EQNR NO) said they are aware of US Department of Interior stop work order involving five wind projects under offshore construction in the US and are evaluating the order and seeking further information from the federal government.

NOTABLE GLOBAL EQUITY HEADLINES

- AMD (AMD) is reportedly approaching a commercial rollout in China for the MI308, via MLex; Alibaba (BABA) is reportedly considering a significant purchase of c. 40-50k units of the MI308.

- ByteDance valuation reportedly surges to USD 500bln, according to SCMP.