US stocks were ultimately mixed as the Nasdaq 100 was the one major index to close with gains - Newsquawk Asia-Pac Market Open

- US stocks were ultimately mixed as the Nasdaq 100 was the one major index to close with gains.

- Fed Chair Powell said the Fed was not currently seeing stagflation and did not consider it the base case.

- T-notes chop as Powell and Trump dominate the tape amid a lack of US data.

- Oil prices complex saw slight gains after two days of chunky losses as Middle East updates cooled.

- Looking ahead, highlights include weekly Foreign Bond Investment, 2-year JGB Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were ultimately mixed as the Nasdaq 100 was the one major index to close with gains and was largely buoyed by gains in the mega-cap names, highlighted by Tech and Communication, two of the only sectors, as well as Health, in the green. Real Estate, Consumer Utilities, and Consumer Staples lagged as the latter was weighed on by weak General Mills guidance.

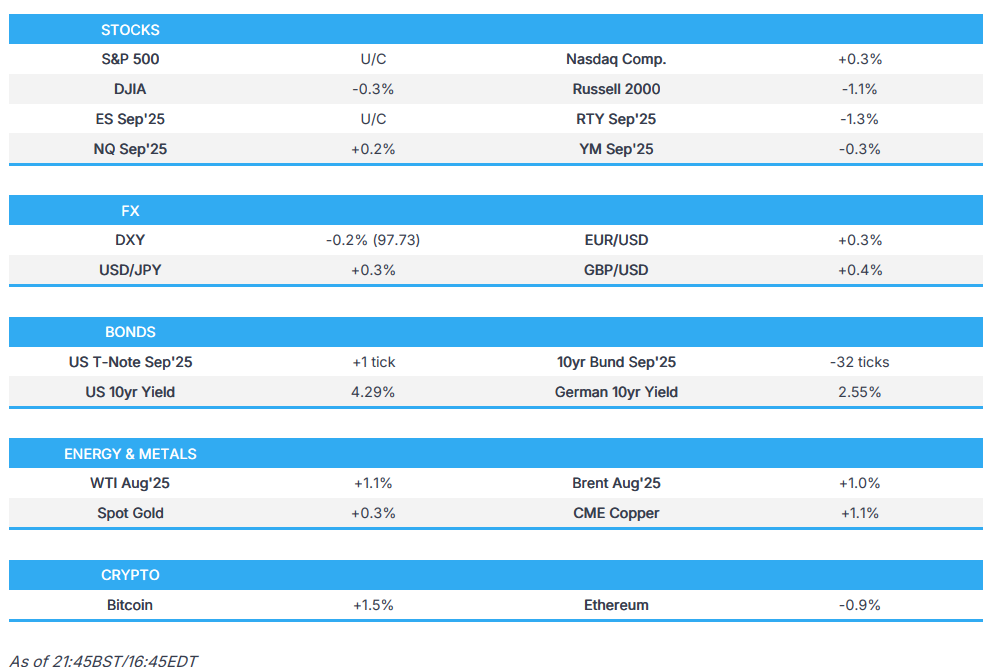

- SPX +0.00% at 6,092, NDX +0.21% at 22,238, DJI -0.25% at 42,982, RUT -1.16% at 2,136

- Click here for a detailed summary.

NOTABLE HEADLINES

- Apple (AAPL) is set to offer App Store changes to avoid additional EU fines, according to Bloomberg. The move followed the EUR 500mln fine in April over digital law. The EU had given a 26 June deadline to comply with DMA rules.

- Micron (MU) Q3 2025 (USD): Adj. EPS 1.91 (exp. 1.60), Revenue 9.3bln (exp. 8.81bln), Adj. net income 2.2bln (exp. 1.8bln); strong Q4 guidance. Q4 adj. EPS view 2.35-2.65 (exp. 1.97). Q4 revenue view 10.4-11bln (exp. 9.89bln). Fiscal Q4 revenue is projected to grow another 15% sequentially.

- Fed proposes changes to ease ESLR for large banks. Proposal would reduce aggregate tier 1 capital requirements for global systemically important banks by 1.4% or USD 13bln. The proposal would reduce capital requirements for depository institution subsidiaries of global banks by 27% or USD 213bln. The proposal would replace a 2% ESLR buffer with a buffer equal to half of each bank's GSIB surcharge. The proposal would replace a 3% ESLR buffer for global bank subsidiaries with half of each bank's GSIB surcharge. Fed Vice Chair Bowman says changes would build resilience in US Treasury markets and reduce market dysfunction. Fed chair Powell says it is prudent for the Fed to reconsider the rule given the stark increase in the level of relatively safe assets on bank balance sheets. Fed governors Barr, and Kugler to oppose proposed changes, according to prepared statements.

- US NEC Director Hassett said plenty of room for the Fed to lower interest rates right now.

TARIFFS/TRADE

- Vietnam expects "good results" from talks with the US in less than two weeks, according to Bloomberg.

- Switzerland expects US tariffs to stay at 10% after July 9 during talks, via Bloomberg. Swiss Finance Minister said the delay in the US trade deal is not the fault of Switzerland. Additionally, she spoke with US Treasury Secretary Bessent on Monday. Hopes for an in-principle agreement before July 9th.

- US CEA's Miran said expect there to be some stubborn holdouts on trade. Optimistic on a flurry of trade frameworks being announced.

DATA RECAP

- US New Home Sales-Units (May) 0.623M vs. Exp. 0.693M (Prev. 0.743M, Rev. 0.722M)

- US MBA 30-Yr Mortgage Rate w/e 6.88% (Prev. 6.84%)

- US MBA Mortgage Applications w/e 1.1% (Prev. -2.6%)

CENTRAL BANKS

- Fed Chair Powell said the Fed was not currently seeing stagflation and did not consider it the base case. He acknowledged that a one-time inflation shock could be a plausible scenario and must be approached carefully, especially as inflation remains above the 2% target. He stressed that any policy misstep could result in prolonged economic costs, and reiterated that the Fed was not committing to a firm outlook on inflation but was instead proceeding cautiously.

- Fed's Collins (Voter) said monetary policy is well positioned, the US economy is solid overall, time for patience and care. Expect to see more tariff impact over the coming months; tariffs are likely to push up inflation, and lower growth and hiring. Appropriate to lower rates later in the year, much depends on tariffs.

- Morgan Stanley expects the Federal Reserve to begin cutting rates in March 2026, and sees a total of seven cuts in 2026, bringing the terminal rate to 2.5-2.75%

- Czech CNB Repo Rate 3.5% vs. Exp. 3.5% (Prev. 3.5%)

FX

- The Dollar Index saw a third consecutive day of losses with the buck weakening against most major peers.

- G10FX largely strengthened against the buck with JPY and NOK weakening to varying degrees.

- JPY was the clear G10 laggard and erased some of its strength seen on Tuesday, as USD/JPY hit a peak of 145.94 against an earlier low of 144.62.

- EMFX was mixed against the Greenback. COP, MXN firmed, ZAR, Yuan, and CLP were flat, while TRY, and BRL weakened.

FIXED INCOME

- T-notes chop as Powell and Trump dominate the tape amid lack of US data.

- US sold USD 70bln of 5yr Notes; tails 0.5bps. High Yield: 3.879% (prev. 4.071%, six-auction average 4.183%). WI: 3.874%. Tail: 0.5bps (prev. -0.4bps, six-auction avg. -0.5bps). Bid-to-Cover: 2.36x (prev. 2.39x, six-auction avg. 2.39x). Dealers: 10.9% (prev. 9.2%, six-auction avg. 11.3%). Directs: 24.4% (prev. 12.4%, six-auction avg. 18.2%). Indirects: 65.7% (prev. 78.4%, six-auction avg. 70.5%).

COMMODITIES

- Oil prices complex saw slight gains after two days of chunky losses as Middle East updates cooled.

- Russia is open to a new output hike if OPEC+ decides that it's needed, Bloomberg reports.

- Goldman Sachs upgraded its H2 2025 LME copper price forecast to an average of USD 9,890/t (prev. USD 9,140/t), citing a tariff-driven reduction in ex-US stocks and resilient activity in China. The bank expects copper to peak at USD 10,050/t in 2025, before easing to USD 9,700/t by December. For 2026, it forecasts an average copper price of USD 10,000/t (prev. USD 10,170/t), reaching USD 10,350/t.

- Russia is open to a new output hike if OPEC+ decides that it's needed, Bloomberg reports.

DATA RECAP

- US EIA Weekly Crude Production Change, 0.03% (Prev. 0.02%)

- US EIA Weekly Crude Production Change, 4k bbl (Prev. 3k)

- US EIA Weekly Crude Production 13.435M (Prev. 13.431M)

- US EIA Weekly Crude Stocks w/e -5.836M vs. Exp. -0.797M (Prev. -11.473M)

- US EIA Weekly Dist. Stocks w/e -4.066M vs. Exp. 0.41M (Prev. 0.514M)

- US EIA Wkly Crude Cushing w/e -0.464M (Prev. -0.995M)

- US EIA Weekly Refining Util w/e 1.5% vs. Exp. 0.5% (Prev. -1.1%)

- US EIA Weekly Gasoline Stk w/e -2.075M vs. Exp. 0.381M (Prev. 0.209M

GEOPOLITICAL

- Spain's Economy Minister says when NATO's military capabilities are reviewed, Spain could revise its own military spending.

- US Secretary of State Rubio says US President Trump will buck Europe’s pleas to ratchet up sanctions on Russia, adding that the US still wants room to negotiate a peace deal, according to Politico.

- US President Trump says the NATO summit accomplished tremendous things. Will talk to Iran next week. May sign an agreement. Would ask for no nuclear.

- US President Trump says NATO will be very strong, but when asked about Article 5, says "We are with them all of the way". Thinks the Iran-Israel ceasefire is good. The last thing Iran wants to do is enrich (uranium), they want to recover. Thinks the US will have a relationship with Iran. Asked if the US would strike Iran again if the nuclear programme is rebuilt, says "sure" Progress is being made in Gaza.

- "Al-Akhbar reported this morning from its sources that Houthi attacks in Yemen against Israel are expected to intensify and escalate in the coming days in response to the Israeli escalation in Gaza", via Kan's Kais on X.

- Iranian Parliament approves bill to suspend cooperation with UN nuclear watchdog, according to Nournews.

- NATO allies have reaffirmed their commitment to collective defence enshrined in Article 5. Commit to invest 5% of GDP on defence and defence-related spending by 2035.

- US President Trump says "I stand with Article 5"

- French President Macron says they (the US) cannot ask us to spend more on defence while there is a trade war going on.

- Israel Media says the air force is working to intercept a drone attack launched from Yemen.

- Israel Media says the drone did not cross into Israeli territory.

- "[US] President Trump is meeting [Ukrainian] President Zelenskiy now. Press are not being taken in for the meeting. Trump will hold his press conference once it wraps", via Bloomberg's Wingrove on X

EU/UK

NOTABLE HEADLINES

- Shell’s (SHEL LN) spokesperson said that no talks were taking place regarding market speculation that Shell was considering buying BP (BP/ LN). This followed reports by the WSJ that Shell had held early talks to acquire BP, and subsequent reporting by CNBC sources indicating that BP could be split in a sale and was unlikely to be bought outright.

DATA RECAP

- Citi/YouGov: UK public inflation expectations for 5-10 years ahead 4.3% in June (prev. 4.2% in May)

- French Consumer Confidence (Jun) 88.0 vs. Exp. 89.0 (Prev. 88.0)

- Spanish GDP YY (Q1) 2.8% vs. Exp. 2.8% (Prev. 2.8%); QQ (Q1) 0.6% vs. Exp. 0.6% (Prev. 0.6%)