USD/JPY extends below 155 as PM Takaichi warns of government intervention; Spot gold climbs beyond USD 5,000/oz - Newsquawk EU Market Open

- APAC stocks were mostly subdued amid Japanese intervention concerns and US President Trump's latest tariff threat against Canada; Trump threatened 100% tariffs on Canada if it makes a trade deal with China.

- Japanese PM Takaichi warned that the government is ready to take action against speculative moves amid a weakening currency and surge in bond yields, according to Bloomberg.

- Spot gold climbed to a fresh record high after breaching the USD 5,000/oz level for the first time in history, amid a weaker dollar and a rally in silver, which briefly topped USD 109/oz.

- US Senate Minority Leader Schumer threatened a partial government shutdown over DHS funding following the fatal shooting of a Minneapolis man by a Border Patrol agent on Saturday.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.1% after the cash market finished with losses of 0.1% on Friday.

- Looking ahead, highlights include German Ifo (Jan), US Chicago Fed National Activity Index (Oct/Nov), Durable Goods (Nov), Atlanta Fed GDP, Supply from EU & US.

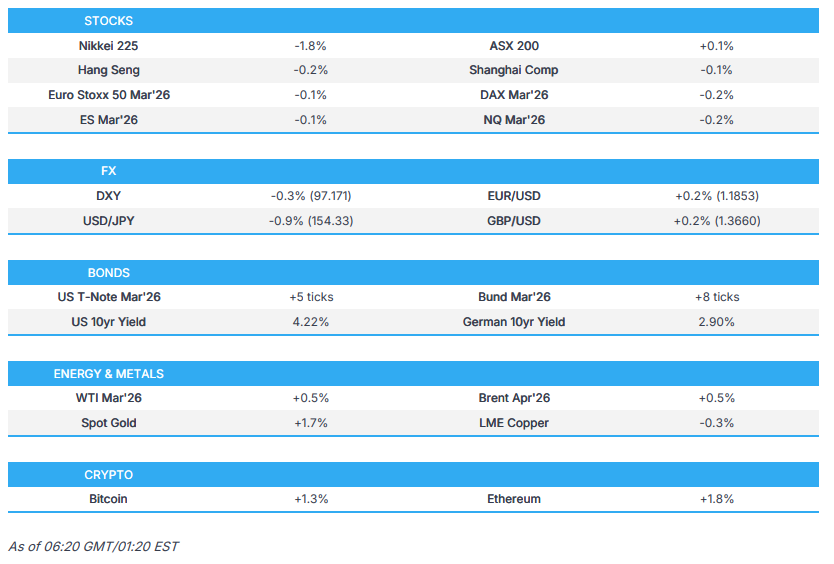

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were broadly lower on Friday, although the tech-heavy Nasdaq 100 outperformed and was supported by gains in NVIDIA (+1.5%) after China informed the biggest tech firms that they can prep orders for H200 chips, although Intel's (-17%) plunge after weak guidance capped gains.

- Sectors were mixed, as Financials and Industrials lagged, while Energy was the outperformer and buoyed by strength in the crude complex, given the US's continued punchy rhetoric surrounding Iran.

- SPX +0.03% at 6,916, NDX +0.34% at 25,605, DJI -0.58% at 49,099, RUT -1.82% at 2,669.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump threatened 100% tariffs on Canada if it makes a trade deal with China, while Trump separately commented that Canada is systematically destroying itself and the China deal is a disaster for them, which will go down as one of the worst deals, of any kind, in history. Furthermore, he stated that “China is successfully and completely taking over the once Great Country of Canada”.

- India is to reduce tariffs on cars to 40% in a trade deal with the EU, according to sources cited by Reuters.

NOTABLE HEADLINES

- US Senate Minority Leader Schumer threatened a partial government shutdown over DHS funding following the fatal shooting of a Minneapolis man by a Border Patrol agent on Saturday.

- US President Trump said the administration is reviewing everything about the Minneapolis shooting and that immigration enforcement officers will at some point leave the area, according to WSJ.

- US President Trump called for the US Congress to immediately pass legislation to end sanctuary cities.

- US winter storm cut power to more than 230,000 customers as far west as Texas and prompted thousands of flight cancellations, while President Trump approved federal emergency disaster declarations for a dozen states on Saturday, and the US also declared a power emergency in Texas.

- World Health Organisation said it regrets that the US has officially withdrawn from the UN health agency and hopes that the US will return in the future.

- BlackRock Chief Investment Officer of Global Fixed Income Rick Rieder’s Wall Street bona fides and openness to making changes at the Fed have bolstered his candidacy for the central bank’s top job, according to a Bloomberg report on Friday citing people familiar with White House deliberations.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued amid Japanese intervention concerns and US President Trump's latest tariff threat against Canada, in which he threatened to impose 100% tariffs if it makes a deal with China. Risk sentiment was also not helped by the Democrats threatening a partial government shutdown in revolt against the fatal shooting of an ICE protester in Minneapolis, while market conditions were somewhat quieter owing to the holiday closures in Australia and India.

- Nikkei 225 underperformed with the index pressured by a firmer currency amid US-Japan joint intervention concerns after Japanese PM Takaichi said the government is ready to take action against speculative moves, and with reports last Friday that the New York Fed conducted rate checks on USD/JPY.

- Hang Seng and Shanghai Comp were indecisive with demand contained amid reports that China is likely to target growth of 4.5% to 5% in 2026, while stocks also failed to benefit from news late last week that China told the biggest tech firms they can prep NVIDIA H200 orders.

- US equity futures were pressured at the reopen in early risk-off conditions, but then gradually pared most of the initial losses.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.1% after the cash market finished with losses of 0.1% on Friday.

FX

- DXY was pressured as it gave up ground to the yen amid speculation of potential US-Japan intervention, while the greenback was also not helped by President Trump's threat to impose 100% tariffs on Canada if it strikes a deal with China, and with the Democrats threatening a partial shutdown over DHS funding following a fatal shooting in Minneapolis by a Border Patrol agent.

- EUR/USD benefitted from the softer buck but with further gains in the single currency capped by resistance just shy of the 1.1900 handle, while there were also recent comments from the Polish Finance Minister, who said they are in no rush to join the euro zone and that the case for adopting the euro had weakened as Poland has outpaced most euro zone economies.

- GBP/USD edged higher and gained a firmer footing at the 1.3600 handle, albeit with very little major UK-specific catalysts, although PM Starmer and Chancellor Reeves are set to visit China this week as the UK seeks to bolster economic ties with China amid transatlantic tensions.

- USD/JPY slumped to beneath the 154.00 handle with the Japanese currency bolstered by double intervention risk after Japanese PM Takaichi warned that the government is ready to take action against speculative moves amid a weakening currency and surge in bond yields, while it was reported on Friday that the New York Fed had conducted rate checks on USD/JPY.

- Antipodeans took advantage of the softer greenback and rising metal prices, although the advances are limited given the subdued risk appetite and quiet calendar, and with participants in Australia absent due to the Australia Day market closure.

- PBoC set USD/CNY mid-point at 6.9843 vs exp. 6.9292 (Prev. 6.9929)

FIXED INCOME

- 10yr UST futures were supported by an early haven bid to start the week after US President Trump's latest tariff threat against Canada if it makes a deal with China, and with the Democrats threatening a partial government shutdown over DHS funding in revolt against the fatal shooting of an anti-ICE protester. However, the gains were limited ahead of the FOMC mid-week and as markets continue to await Trump's Fed Chair pick.

- Bund futures eked mild gains in rangebound trade following last Friday's choppy performance, while German Ifo data and comments from ECB's Nagel are scheduled later today.

- 10yr JGB futures initially climbed after Japanese PM Takaichi warned that they are ready to take action against speculative market moves following the recent currency weakening and surge in bond yields, although most of the gains were eventually pared amid a 5-year climate transition bond issuance.

COMMODITIES

- Crude futures were rangebound and took a breather after last Friday's rally, with price action contained to start the week following reports of constructive trilateral talks between the US, Ukraine and Russia, while Libya signed a deal with TotalEnergies (TTE FP) and ConocoPhillips (COP) to more than double the production capacity of their Waha Oil venture. Conversely, natural gas futures surged around 16%, owing to the US winter storm, which had cut power to more than 230,000 customers as far west as Texas and prompted thousands of flight cancellations.

- Spot gold climbed to a fresh record high after breaching the USD 5,000/oz level for the first time in history, amid a weaker dollar and a rally in silver, which briefly topped USD 109/oz.

- Copper futures kept afloat and retained last Friday's spoils but with upside capped amid the mostly downbeat mood in Asia.

- Libya signed a deal with TotalEnergies (TTE FP) and ConocoPhillips (COP) to more than double the production capacity of their Waha Oil venture, with investments likely to reach USD 20bln over 25 years.

- US President Trump’s administration was reported on Friday to be weighing a naval blockade to halt Cuban oil imports, according to POLITICO.

- US President Trump’s administration is to take a 10% stake in USA Rare Earth under a USD 1.6bln debt-and-equity investment deal, according to sources cited by Reuters and FT.

CRYPTO

- Bitcoin rebounded overnight in a bounce-back from the brief dip beneath the USD 87,000 level seen during the weekend.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi warned that the government is ready to take action against speculative moves amid a weakening currency and surge in bond yields, according to Bloomberg.

- Japanese PM Takaichi said she would resign with immediate effect in the scenario that the ruling bloc does not attain a Lower House majority.

- PBoC Deputy Governor Zou affirmed they will continue efforts to enhance market connectivity between mainland and Hong Kong, while he pledged the continued backing and steady development of Hong Kong’s offshore RMB market. Furthermore, he said they are to coordinate with authorities to increase yearly offshore RMB government bond issuance.

- China purged top general Zhang Youxia and accused him of undermining President Xi Jinping’s authority, while it was separately reported that he was accused of leaking information about the country’s nuclear-weapons program to the US and accepting bribes for official acts, according to WSJ.

GEOPOLITICS

MIDDLE EAST

- US envoys Witkoff and Kushner met with Israeli PM Netanyahu on Saturday and urged that Israel move into the second phase of the Gaza ceasefire.

- Israeli PM Netanyahu's office said the Rafah crossing has been opened to the public only for the passage of individuals within a full Israeli control mechanism.

- Al Jazeera correspondent reported consecutive Israeli airstrikes on the Jabour Heights, Barghoz Valley, and Rayhan Heights in southern Lebanon.

- Turkey’s Foreign Minister said on Friday that there are signs Israel is still looking to attack Iran.

- Syrian Defence Minister said the ceasefire deal with Kurdish forces was extended by 15 days.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said trilateral talks with the US and Russia were constructive, while he added that further meetings could take place in the week ahead, and the US delegation raised the issue of formats to formalise parameters for ending the war. It was separately reported that Zelensky met with Lithuanian President Nauseda in Vilnius.

- Russia’s Defence Ministry said its forces took over the village of Starytsya in Ukraine's Kharkiv region.

- Russia’s Kremlin said the Russian military will attentively monitor US plans for the Golden Dome, including in the context of Greenland, according to IFX.

OTHER

- US President Trump praised the UK military and its sacrifice after UK PM Starmer urged Trump to apologise for downplaying the role of NATO troops in the war in Afghanistan.

- UK PM Starmer was reported on Friday to have pulled the Chagos deal after Trump backlash, while it was stated that plans to hand the islands to Mauritius ‘cannot progress’ amid concerns over a 1966 treaty between the UK and the US.

EU/UK

NOTABLE HEADLINES

- UK ruling Labour Party blocked PM Starmer’s potential party leadership rival Andy Burnham from standing in the Gorton and Denton by-election, while it stated that permission had been denied to avoid an unnecessary election to replace Burnham as mayor of Greater Manchester, according to the Independent.

- BoE is restructuring its monetary policy and analysis teams in a revamp that is seen as boosting the role of Deputy Governor Lombardelli.

- ECB’s Villeroy said the French government and parliament could have done more to reduce the deficit in the budget compromise adopted last Friday, according to Bloomberg.

- Poland’s Finance Minister Domanski said that they are in no hurry to join the euro zone and that the case for adopting the euro had weakened as Poland has outpaced most euro zone economies, according to FT.