Weekend News Roundup - Newsquawk Asia-Pac Market Open

- US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be done by Thanksgiving, according to Fox News.

- US President Trump said he does not think more tariff rollbacks will be necessary; he said top US officials spoke with their Chinese counterparts on Friday and that he is speaking to China about soybeans, according to Reuters.

- Apple (AAPL) has intensified succession planning for CEO Tim Cook and is preparing for him to step down as soon as next year, according to FT.

- Chinaʼs Coast Guard said a Chinese coastguard ship formation cruised past the Senkaku Islands and that the cruise was to protect rights and in accordance with international law, according to Reuters.

- Japanʼs government is reportedly considering compiling a stimulus package of around JPY 17tln, with a supplementary budget likely to be sized around JPY 14tln, according to Nikkei.

- Looking ahead, highlights include Japanese GDP, 10-year I/L JGB Auction, Japanese Industrial Output.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

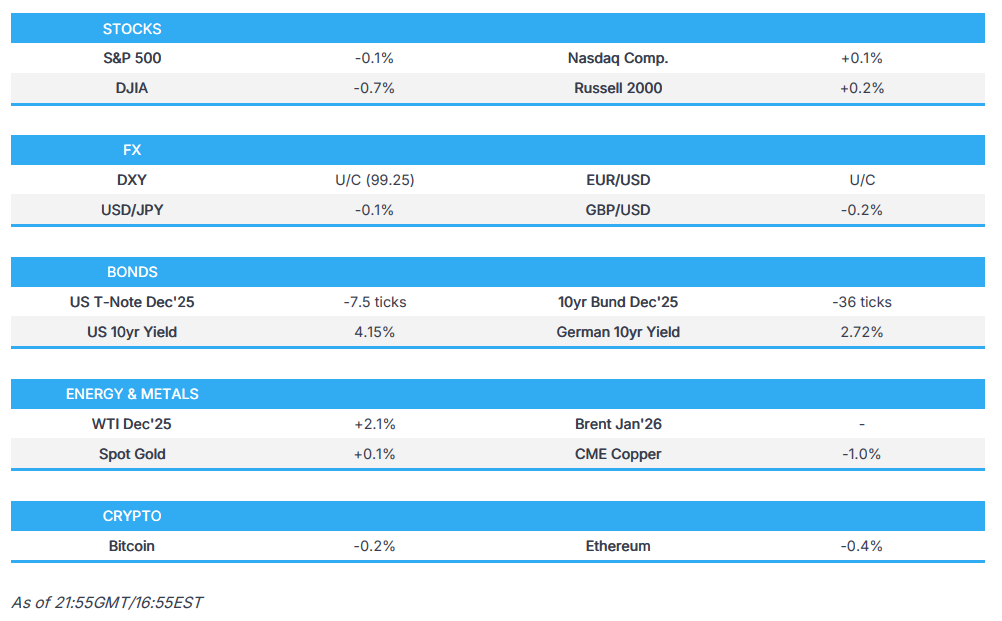

- US stocks were pressured with pressure attributed to further AI valuation concerns. However, US indices managed to pare the majority of its losses with SPX and NDX closing flat, while RUT outperformed, but DJI and RSP (S&P 500 Equal Weight ETF) lagged. Sectors were predominantly lower, with outperformance seen in Energy, Tech and Real Estate.

- SPX -0.05% at 6,734, NDX +0.06% at 25,008, DJI -0.65% at 47,147, RUT +0.22% at 2,388.

- Click here for a detailed summary.

US DATA UPDATE:

- The US Commerce Department said the US Q3 GDP second reading will be released on November 26th at 08:30 EST (13:30 GMT), with October PCE due at 10:00 EST (15:00 GMT) the same day; the October Trade report will be released on December 4th at 08:30 EST (13:30 GMT), and PCE — likely November — will be released on December 19th at 10:00 EST (15:00 GMT). The Department noted these releases are not part of the missed data, according to Reuters.

- The US BLS announced that September employment data (NFP) will be released on November 20th, 2025, with September real earnings due on November 21st.

- The US Census Bureau said it will release the August International Trade report on November 19th, while August construction spending will be released on November 17th and August manufacturers’ orders on November 18th

- The BEA will also release August US International Trade in Goods and Services on November 19th.

TARIFFS/TRADE

- The US and China are reportedly still negotiating key details on how China will free up sales of rare earths, with both sides having set an end-November deadline to agree on the general licences, according to Bloomberg.

- US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be done by Thanksgiving, according to Fox News. Treasury Secretary Bessent said he is confident China will honour the agreement after the upcoming meeting between Presidents Trump and Xi, and emphasised that Washington has “many levers” if Beijing does not comply.

- US President Trump said he does not think more tariff rollbacks will be necessary; he said top US officials spoke with their Chinese counterparts on Friday and that he is speaking to China about soybeans, according to Reuters.

- US Treasury Secretary Bessent said US President Trump’s proposal to send USD 2,000 “dividend” payments from tariffs to US citizens would require congressional approval, according to Reuters.

- The White House released a framework agreed between the US and Switzerland, noting that under the President’s leadership billions of dollars of investment by major Swiss companies such as Roche (ROG SW), Novartis (NOVN SW), ABB (ABBN SW) and Stadler (SRAIL SW) have already been announced, with more on the way; Swiss and Liechtenstein companies will invest at least USD 200bln into the US, including USD 67bln in 2026. The trading partners will pay a cumulative reciprocal tariff rate of no higher than 15%, matching the European Union’s treatment. Switzerland and Liechtenstein intend to remove a range of tariffs across agricultural and industrial sectors — including various fresh and dried nuts, fish and seafood, certain fruits, chemicals and spirits such as whiskey and rum — while Switzerland will also establish tariff-rate quotas for American poultry, beef and bison; both countries also plan to address non-tariff barriers that have long prevented US goods from entering their markets.

- USTR Greer said the US is very close to securing trade deals with other Western countries, according to Reuters.

- The White House is modifying the scope of reciprocal tariffs with respect to certain agricultural products and said the change will be effective for goods entered for consumption, or withdrawn from warehouse for consumption, on or after 00:01 ET on 13th November 2025, according to Reuters.

- Tesla (TSLA) is now reportedly requiring its suppliers to exclude China-made components in the manufacturing of its cars in the US, a fresh example of the fallout from Washington–Beijing tensions, according to the WSJ.

- Brazil’s Vice President Alckmin said Brazil will continue working to reduce US tariffs further; he noted that progress has been made but there is still a long way to go, expressed optimism about further progress, and said the US government has taken a step in the right direction to reduce costs for its consumers, according to Reuters.

NOTABLE US HEADLINES

- US President Trump posted that “Thanksgiving costs are 25% lower this year than last”, via Truth Social.

- Fed’s Schmid (2025 voter, hawk and October hawkish dissenter) said further rate cuts will not patch cracks in the job market and could do damage to inflation; he reiterated that the rationale for his October dissent continues to guide him into the December meeting. He said policy is modestly restrictive and appropriately so, that monetary policy should lean against demand growth, and that neither financial markets nor the real economy are showing signs of being overly restricted. He said inflation is too hot, the labour market is cooling but largely balanced, and that concerns on inflation are much broader than tariffs alone; he prefers to focus on the overall inflation rate when setting policy and sees no room for complacency on inflation expectations. Schmid added that the cooling in the labour market likely reflects structural changes and will be monitored for signs of more significant deterioration. On the balance sheet, he supports the decision to stop shrinking the Fed’s holdings and noted the Fed could lower the rate paid on reserves, ease access to the standing repo facility, or shift the portfolio to shorter-duration securities, while saying there is little reason to think reserve demand will grow steadily with nominal GDP, according to Reuters.

- Fed’s Logan (2026 voter) said she supported the September rate cut but would have preferred to hold steady in October; she added that for the December meeting it would be hard to support another cut and she would need to see convincing evidence of inflation coming down or the labour market worsening, while noting it is not appropriate to deliver more pre-emptive insurance to the labour market via a rate cut, according to Reuters.

- Fed’s Bostic (2027 voter) said that on both mandates the economy is not moving in the direction of targets, adding that he wants information to guide the appropriate policy and hopes a lot of data will come in ahead of the December meeting; he noted he was able to get behind the two most recent cuts.

- Fed Governor Miran (dove) said the data supports rate cuts and should make the Fed more dovish, not less; he again argued that shelter inflation points to weakening price changes, noted that wage gains have moderated, and said it is a mistake to let the job market get softer. He emphasized that monetary policy should be forward-looking and that it would be very appropriate to cut interest rates in December, according to Reuters.

- Fed's Williams (Voter) convened a meeting with banks over a key lending facility, according to the FT.

- Trump administration officials, including Health Secretary Robert F. Kennedy Jr., discussed scaling back the role of FDA Commissioner Marty Makary; RFK Jr. also considered installing a new leader to manage the agency day to day, according to the WSJ.

NOTABLE US EQUITY HEADLINES

- Apple (AAPL) has intensified succession planning for CEO Tim Cook and is preparing for him to step down as soon as next year, with John Ternus, Apple’s Senior Vice President of Hardware Engineering, widely seen as his most likely successor, according to the FT.

- Google (GOOGL) is to invest USD 40bln in new data centres in Texas, according to Reuters.

COMMODITIES

- US EIA- Nat Gas, Change Bcf w/e 45.0bcf vs. Exp. 34.0bcf (Prev. 33.0bcf).

GEOPOLITICAL

MIDDLE EAST

- On Friday, The Talara crude-oil tanker was taken toward the Iranian coast by Revolutionary Guards based on initial assessments, according to Reuters sources, while UKMTO reported an incident off the UAE’s Khor Fakkan — near the Strait of Hormuz — in which a vessel was seen transiting toward Iranian territorial waters and was believed to be involved in state activity; a US official later acknowledged that Iran seized the Talara tanker in the Strait of Hormuz, via AP, noting a US Navy drone observed the seizure for hours, and Iran’s Navy said it seized a ship for smuggling fuel, according to Reuters, AP and IRNA.

- Israel’s IDF said om Friday there has been another ceasefire violation in Gaza, according to Reuters.

- Israeli forces raided the city of Dura south of Hebron in the West Bank, according to Reuters.

- Israel’s Defence Minister said the multinational force led by the US will take charge of disarming Hamas in Gaza, according to Reuters.

- US Central Command said Iran’s use of military force to seize a commercial vessel in international waters is a violation of international law, according to Reuters. US Central Command said that on Friday it detected Iranian forces boarding an oil tanker flying the Marshall Islands flag in international waters, and that the tanker Talara was seized after Islamic Revolutionary Guard Corps forces boarded it via helicopter.

- Iran’s foreign minister said the nation is no longer enriching uranium at any site in the country, via AP.

- Israeli PM Netanyahu said there will be no Palestinian state and that Hamas will be disarmed — by force, if necessary, according to Reuters.

- Iran’s Foreign Minister Araqchi said the current US approach in no way indicates readiness for equal and fair negotiations; he added that Iran will always be prepared to engage in diplomacy but not negotiations meant for dictation, according to state media.

- Lebanon will file a complaint to the UN Security Council against Israel for constructing a concrete wall along Lebanon's southern border that extends beyond the “Blue Line”, according to the Lebanese presidency.

RUSSIA-UKRAINE

- Ukrainian drones damaged two oil berths at Russia’s Novorossiysk Black Sea port and also damaged the tanker Arlan, according to Reuters citing sources.

- Russia's Novorossiysk Black Sea port resumed oil loadings on November 16, according to Reuters sources and LSEG data.

- Ukraine's military says it struck an oil refinery in Russia's Samara region, according to Reuters.

- Russia’s Defence Ministry said Russian forces took control of Yablukove in Ukraine’s Zaporizhzhia region, according to TASS.

CHINA-JAPAN

- China’s Foreign Ministry issued a warning to Chinese nationals about travelling to Japan following comments by Japan’s Prime Minister regarding Taiwan, according to Reuters.

- China’s Defence Ministry warned that the Japanese side “will only suffer a crushing defeat” should it dare to take a risk, according to Reuters.

- China’s Coast Guard said a Chinese coastguard ship formation cruised past the Senkaku Islands and that the cruise was to protect rights and in accordance with international law, according to Reuters.

OTHERS

- US aircraft carrier has arrived in the Caribbean in a major buildup near Venezuela, via AP.

- Russian President Putin held a phone call with Israel’s PM Benjamin Netanyahu, according to the Kremlin.

- US President Trump said the US will test nuclear like other countries, according to Reuters.

ASIA-PAC

NOTABLE HEADLINES

- China’s Cabinet meeting studied policy measures to boost consumption, saying it will attract more private capital, balance demand and supply of consumer goods, draw private capital into major projects, meet demand with higher-quality supply, and continue expanding new forms of consumption, via CCTV.

- Samsung Electronics (005930 KS) has raised prices of server memory chips by up to 60% in November, according to Reuters citing sources.

- Japan’s FY25 extra budget is set to exceed the prior year’s JPY 13.9tln, via Kyodo.

- Samsung Electronics (005930 KS) will build a new chip production line in Pyeongtaek, South Korea, with mass production slated to begin in 2028; the company also said FläktGroup is considering building a factory in South Korea, according to Reuters.

- Japan’s government is reportedly considering compiling a stimulus package of around JPY 17tln, with a supplementary budget likely to be sized around JPY 14tln, according to Nikkei.

DATA RECAP

- Indian WPI Inflation YY (Oct) -1.21% vs. Exp. -0.6% (Prev. 0.13%).

- Hong Kong revises its 2025 GDP forecast to 3.2% (prev. 2-3%).

EU/UK

NOTABLE HEADLINES

- ITV’s Peston reported that the UK Chancellor “is NOT going to take greater risks with the public finances,” pushing back against investor concerns; citing sources, he wrote that the Chancellor will increase fiscal headroom from GBP 9bln at the last budget to GBP 15bln or more, and expects Chancellor Reeves and/or PM Starmer to make clear today that they will not weaken their commitment to the fiscal rules and to increasing headroom. The changes are attributed to improved data on current and expected wage growth boosting tax-revenue forecasts and reducing the need to raise Income Tax rates. Peston added that the new “tax masterplan” includes extending the Income Tax threshold increase by another two years and examining reductions to the thresholds at which the 40p and 45p tax bands apply, according to ITV’s Peston.

- ITV’s Peston reported that UK Chancellor Reeves’ fiscal hole “is now nearer GBP 20bln than the GBP 30bln–35bln she had expected only a week ago,” and said suggestions she will reduce the nominal thresholds at which income-tax rates kick in are wrong; Bloomberg’s Wickham separately reported that Chancellor Reeves will extend the freeze to income-tax thresholds at the budget but will not lower them, after previously considering cuts to the basic and higher-rate thresholds, according to ITV’s Peston and Bloomberg.

- UK Chancellor Reeves has reportedly ruled out targeting LLPs in the November Budget, with the original plan estimated to have generated around GBP 2bln in revenue, according to the Financial Times.

- German net new borrowing for 2026 is set to rise to EUR 98bln, up from EUR 89.8bln in the draft, according to Bloomberg.

DATA RECAP

- EU GDP Flash Estimate YY (Q3) 1.4% vs. Exp. 1.3% (Prev. 1.3%, Rev. 1.5%)

- EU GDP Flash Estimate QQ (Q3) 0.2% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.1%)

- EU Employment Flash QQ (Q3) 0.1% vs. Exp. 0.1% (Prev. 0.1%)

- EU Employment Flash YY (Q3) 0.5% vs. Exp. 0.5% (Prev. 0.6%)

OTHERS

- South Africa Foreign Currency Rating Raised To 'BB'; Local Currency Rating Raised To 'BB+'; Outlook Positive.