Weekend News Roundup - Newsquawk Asia-Pac Market Open

- US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week.

- Russia’s Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported.

- Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News.

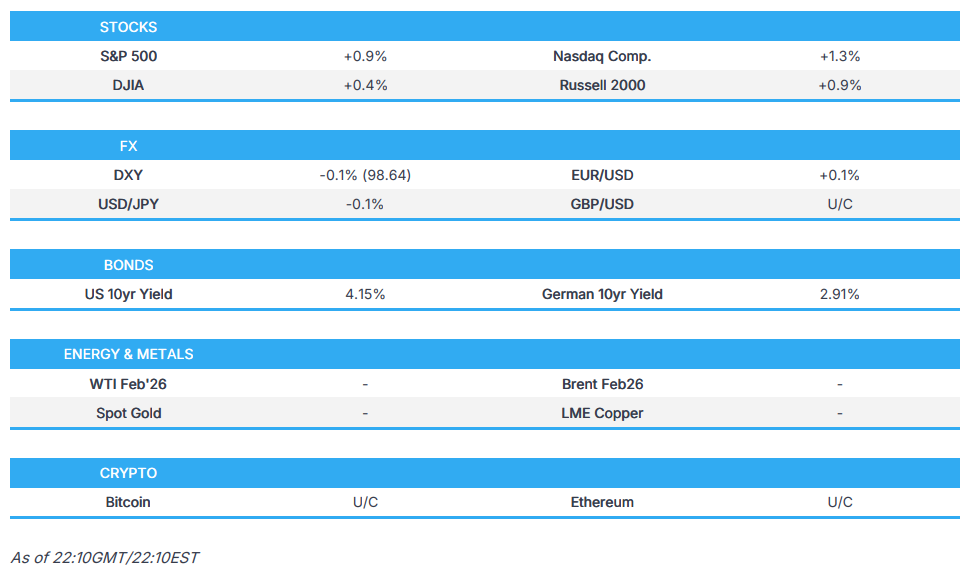

- Stocks were bid by the US afternoon on Friday, with Tech leading the gains, and as such, the Nasdaq outperformed.

- Looking ahead, highlights include PBoC LPRs.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- Stocks were bid by the US afternoon with Tech leading the gains, and as such the Nasdaq outperformance, which saw tailwinds from Oracle (ORCL) after reports TikTok is to sell its US entity. The haven sectors were lagging with Consumer Staples, Discretionary and Utilities all lagging. Discretionary names were weighed on by Nike (NKE) earnings which saw the stock plummet on weak China sales

- SPX +0.88% at 6,834.50, NDX +1.31% at 23,307.62, DJI +0.38% at 48,134.89, RUT +0.86% at 2,529.42.

- Click here for a detailed summary.

NOTABLE US HEADLINES

- US President Trump said the only reason unemployment ticked up to 4.5% because we are reducing the government workforce by numbers that have never been seen before.

- US President Trump on Friday said he would call a meeting of insurance companies in the coming weeks to push them to cut prices and stay in the system.

- US President Trump on Friday announced deals with nine pharmaceutical companies to cut prices on most drugs sold through Medicaid and lower cash-pay prices, while committing to most-favoured-nation pricing for future drugs, according to Reuters. The companies also pledged more than USD 150bln in US manufacturing and R&D investment, agreed to remit some foreign revenues to offset US costs, and received relief from US tariffs in return.

TARIFFS/TRADE

- "Beijing’s reaction to Trump’s approval of Nvidia (NVDA) H200 exports to China has been very cold. Chinese public opinion especially opposes purchasing them.", according to Chinese journalist Hu Xijin (cont). "China is now fully focused on developing independent semiconductor technology, completely excluding American chips from the Chinese supply chain. We are continuously making progress in this area.". "The RESTRICT Act introduced by the House make Chinese public opinion, especially netizens, very happy.".

- USTR Greer said tariff plan is in good shape, via Bloomberg; Will do whatever needed to keep trade deals in place. TARIFFSIf countries do not comply with deals, "maybe we'll talk more."TIKTOKThe US expects approval by the Chinese government.CHINA. Need trade with China to be more balanced. NVIDIA H200 export is a 'standalone’ matter. Will make sure rare earths continue flowing from China. EU. Spoke with EU counterpart yesterday on tech regulation. Had a great conversation on the EU regulating US companies. INDIAThe US is still negotiating with India on trade.USMCAMexico is asking for reprieve on steel and aluminium duties.

- China and Australia hold strategic economic dialogue.

- Paris Court rejects French Government request to suspend Shein's website as a whole for three months, saying it would be "disproportionate". Court orders Shein not to sell adult products without age verification, set EUR 10k fine for any breach.

- US President Trump told NBC "We're making so much money with tariffs", people would start getting the payments "very soon". "Within the next few days, it’ll all be out".

- China's Commerce Ministry urges India to correct wrong practice on Telecom tariffs. China files WTO case against India over ICT tariffs and Photovoltaic subsidies.

- China's Commerce Ministry has launched an investigation into some rubber products from the US, South Korea and the EU. Adds to keep anti-dumping duty rate of up to 222%. Will terminate anti-dumping measures against UK rubber imports from December 20th.

- US lawmakers say DeepSeek should be listed as a Chinese military firm; Lawmakers seek Pentagon listing for some Chinese firms.

DATA RECAP

- US Employment Trends (Nov) 105.8 (Prev. 106.84, Rev. 106.24)

- US U Mich Sentiment Final (Dec) 52.9 vs. Exp. 53.4 (Prev. 53.3)

- US Existing Home Sales (Nov) 4.13M vs. Exp. 4.15M (Prev. 4.1M, Rev. 4.11M)

- US U Mich Expectations Final (Dec) 54.6 (Prev. 55.0)

- US U Mich Conditions Final (Dec) 50.4 (Prev. 50.7)

- US U Mich 5-Yr Inf Final (Dec) 3.2% (Prev. 3.2%)

- US U Mich 1Yr Inf Final (Dec) 4.2% (Prev. 4.1%)

- US Exist. Home Sales % Chg (Nov) 0.5% (Prev. 1.2%, Rev. 1.5%)

CENTRAL BANKS

- BoJ raised rates by 25bps to 0.75%, as expected, with the decision unanimous, while it stated interest rates are expected to remain at significantly low levels and will continue to raise policy rate if the economy and prices move in line with forecasts.

- BoJ Governor Ueda (post-policy press conference) said Japan's economy is recovering moderately, albeit with some weakness. Will make a decision on rate hike after checking the impact on the economy. Will conduct market operations swiftly, under exceptional circumstances in market. Delaying a rate hike could force a significant hike later. There is still some distance to lower the limit of neutral rate estimate. Several BoJ members mentioned that recent JPY weakness may affect prices going forward, and warrants attention. Members suggested that the weak JPY is possibly affecting underlying inflation.

- Japanese Economy Minister Kiuchi said they respect the BoJ's decision but they need to be mindful of economic outlook.

- Japanese Economy Minister Kiuchi said FX is affected by various factors, determined at markets. Important for currencies to move in stable manner reflecting fundamentals. Closely watching market moves with a high sense of urgency, including long-term yields.

- Fed’s Hammack (2026 voter) said rates should be held steady into the spring after recent cuts, warning she was inflation-wary, noting November’s 2.7% CPI likely understated 12-month price growth due to data distortions, and suggesting the neutral interest rate was higher than commonly believed, the WSJ reported.

- Fed's Williams (Voter) said CPI was encouraging and shows more disinflation; data was distorted in some categories which pushed down the reading. Data. Will need more data to get a good read on inflation. New jobs data shows steady private sector job gains. Unemployment may have been pushed up by distortions, but it is not a surprising read. Jobs data does not show sharp deterioration in the hiring market. Data broadly consistent with recent trends and recent Fed cut. Rate Projections. When asked about if recent data changes his rate outlook, said this is only a bit of data, there is a lot more data due. Doesn't have a sense of urgency on changing monetary policy.

- Fed Governor Waller had a "strong interview" for Fed Chair with US President Trump as Trump appears to turn focus to the job market, CNBC reported. BlackRock's Rick Rieder will be interviewed at Mar-a-Lago for the Fed Chair job the last week of the year. The Fed chair candidate list has narrowed to four: Kevin Hassett, Kevin Warsh, Waller and BlackRock’s Rick Rieder, who will be interviewed during the last week of the year. The positive description of the Waller interview by officials was not necessarily an indication that he was a favourite candidate for the job.

- ECB's Wunsch said no longer has a dovish bias as risks are broadly balanced, if outlook holds, then rates can remain where they are. Is not making bets on the next rate move.

- ECB's Santos Pereira said at this moment, inflation is at target and they expect it to remain so in the coming months.

- ECB's Sleijpen said policy is in a good place but we must maintain a data-dependent and meeting-by-meeting approach. Growth and inflation risks are large but fairly in balance.

- ECB's Escriva said there are no reasons for any change in interest rates in any direction. They are in a good place to have steady monetary policy. They don't know coming direction on next rate decision and could be either way.

- ECB's Muller said it is too early to speculate what will happen in six months, imagines a scenario that weaker growth and further disinflation could justify more easing but the opposite could also be imagined, via Econostream.

- ECB's Kocher said they have not decided what course to take on rates, when asked if there are no more rate cuts coming. Rates could be cut or raised, depending on developments.

- ECB's Kocher said there are many risks to growth and inflation to the up and downside. said they want to keep all options open to be able to react to the volatile situation. They are where they want to be on rates.

- ECB's Rehn said outlook for growth and inflation remains highly uncertain due to trade war and geopolitical tensions. Reiterates meeting-by-meeting approach and ECB maintains full freedom of action and optionality.

- BoE Governor Bailey said he is confident that inflation will be close to target by late spring, giving a good reason to expect a bit more downward path on rates.

- Russian Federation Central Bank Key Rate (Dec) 16.0% vs. Exp. 16.0% (Prev. 16.5%). Further decisions will be made depending on the sustainability of the inflation slowdown and the dynamics of inflation expectations.

GEOPOLITICS

COMMODITIES

- Exporters sell 134,000mT of soybeans to China for 2025/26 delivery, via USDA.

- CBR said gold reserves are at 74.8mln ounces as of 1st December (U/C from November).

- US Senator Wyden contacts seven tanker companies over carter-linked maritime fuel smuggling between the US and Mexico, according to Reuters, citing the letters.

- Ukraine has hit Russian shadow fleet tanker in the Mediterranean sea for the first time, according to Reuters citing SBU source. SBU's aerial drones hit the Qendil vessel, causing critical damage. However, vessel was empty at the time of the attack.

- Black Sea CPC blend oil exports set at 1.65mln BPD for January (prev. 1.7mln BPD M/M), via Reuters sources.

- Iraq’s state oil firm reaffirmed its commitment to the Kurdistan oil agreement, under which international oil companies in the region were required to hand over their output to the state. An official at Iraq’s state oil firm said the oil export deal between Baghdad and Erbil would continue without issues, Rudaw reported.

GEOPOLITICAL

US-VENEZUELA

- US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week. An official suggested that the tanker is subject to sanctions, according to several media reports.

- The Venezuelan government rejected the seizure of a new vessel transporting oil, it said in a statement.

RUSSIA-UKRAINE

Weekend

- US Special Envoy Witkoff said the Ukrainian delegation held productive meetings over three days in Florida with US and European partners, including a separate US–Ukraine meeting, with discussions focused on timelines and sequencing of next steps.

- Ukrainian President Zelensky said broader consultations with European partners should follow recent talks in the US.

- Ukrainian President Zelensky said allies had started to slow supplies of air defence missiles and said Kyiv should stand by the US as mediator on talks with Russia, commenting on French President Macron’s proposal.

- Ukrainian President Zelensky said the situation in the Odesa region was harsh after Russian strikes and said Russia was trying to restrict Ukraine’s access to the sea.

- The Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported. It said Dmitriev was still in Miami meeting with Americans and would report on the results upon his return to Moscow. Kremlin aide said a trilateral Russia–US–Ukraine meeting was not being discussed.

- Ukrainian President Zelensky said elections could not be held in Russian-occupied parts of Ukraine, could only take place once security was guaranteed, and said Kyiv was working with the US on a stable peace while preparing voting infrastructure for Ukrainians abroad, Reuters reported.

- Ukraine’s deputy prime minister said Russia attacked the Pivdennyi port and was deliberately targeting civilian logistics in the Odesa region.

- Russia’s Defence Ministry said Russian troops had captured Vysoke in Ukraine’s Sumy region and Svitlie in the Donetsk region, according to IFAX and TASS.

Friday

- White House Envoy Witkoff & Ukraine National Security Adviser to meet with National Security Advisers of Germany, France and UK in Miami on Friday, via Axios.

- Russia's President Putin said they are ready to think about ensuring security in Ukraine during possible election. Ukrainians who live in Russia should have the right to vote.

- Ukrainian drones hit Russian oil rig in Caspian Sea, according to SBU.

- Russian President Putin said Ukraine's attacks on tankers won't hurt oil supplies; said Russia will always retaliate when asked about Ukraine's strikes on Russian vessels and civilian targets.

- Russia's President Putin restates that Russia will not attack Europe. said Russia is ready to work with Europe and the US but on equal terms. Will be no more special military operations if the West respects Russia's interests and does not threaten its security, via Al Jazeera. Russia is ready to stop the conflict in Ukraine immediately if we get security guarantees.

- Ukraine has hit Russian shadow fleet tanker in the Mediterranean sea for the first time, according to Reuters citing SBU source. SBU's aerial drones hit the Qendil vessel, causing critical damage. However, vessel was empty at the time of the attack.

- Russia's President Putin said US President Trump is making frank efforts to end the conflict in Ukraine. said Russia has been asked to make compromise on Ukraine, in which Russia agreed to. The ball is on the West and Ukraine's court.

- Russian Federation Central Bank Key Rate (Dec) 16.0% vs. Exp. 16.0% (Prev. 16.5%). Further decisions will be made depending on the sustainability of the inflation slowdown and the dynamics of inflation expectations.

- Russian President Putin said inflation will be below 6% by year end.

- Russian President Putin said we do not see Ukraine being ready for talks, ready and want to end the conflict via peaceful means. Continue to create a safe zone on the border with Ukraine.

- Belarus said "We are preparing to start the combat shift of the Russian Oryshnik missile system", via Al Arabiya.

MIDDLE EAST

Weekend

- Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News. Israeli officials believe Iran is expanding its ballistic missile program. They are preparing to make the case during an upcoming meeting with Trump that it poses a new threat. Israeli officials have announced a Dec. 29 meeting.

Friday

- A senior US official stated that the possibility of a renewed war in Israel is high, according to Israeli press cited by Al Jazeera.

- Contacts between Israel and Syria have not made much progress, according to Al Arabiya quoting US sources.

- Germany's Competition Authority approves the merger of Palo Alto (PANW) and Israel's Cyberark software.

- US ambassador to Israel said the US is not considering supplying Turkey with F-35 jets (LMT), which is not on the table under current US laws, via Sky News Arabia.

EU/UK

NOTABLE HEADLINES

- Bank of Italy confirms Italian 2025 HICP inflation forecast at 1.7%, marginally lowers 2026 to 1.4% from 1.5%; confirms GDP growth at 0.5% in 2025 and 0.7% in 2026.

- Bundesbank cuts growth forecast for 2026 to 0.6% (prev. 0.7%) and raises 2026 inflation forecast for Germany to 2.2% (prev. 1.5%). Nagel: "Starting in the second quarter of 2026, economic growth will strengthen markedly, driven mainly by government spending and a resurgence in exports." and adds that "....while progress will be subdued initially, it will then slowly pick up.".

- French Prime Minister Lecornu said parliament will be unable to vote on a budget for France before the end of the year. Starting on Monday, he will meet with key political leaders to consult with them on the steps to be taken.

- Joint Committee from French National Assembly and Senate cannot reach compromise text on 2026 budget, according to a Committee member.

- Swedish Think Tank NIER sees 2025 GDP at 1.6% (sept. fcst. +0.9%), 2026 GDP 2.9% (sept. fcst. 2.6%).

- UK Trade Minister Bryant confirms a hack of Government data.

DATA RECAP

- EU Consumer Confid. Flash (Dec) -14.6 vs. Exp. -14.0 (Prev. -14.2)

- UK CBI Distributive Trades (Dec) -44.0 (Prev. -32.0).

- UK PSNCR, GBP (Nov) 10.293B GB (Prev. 20.825B GB, Rev. 20.460B GB).

- UK Retail Sales YY (Nov) 0.6% vs. Exp. 0.9% (Prev. 0.2%, Rev. 0.6%); MM (Nov) -0.1% vs. Exp. 0.4% (Prev. -1.1%, Rev. -0.9%).

- UK Retail Sales Ex-Fuel YY (Nov) 1.2% vs. Exp. 1.6% (Prev. 1.2%, Rev. 1.6%); MM (Nov) -0.2% vs. Exp. 0.2% (Prev. -1.0%, Rev. -0.8%).

- UK PSNB Ex Banks GBP (Nov) 11.653B GB vs. Exp. 10.0B GB (Prev. 17.434B GB, Rev. 21.189B GB).

- Italian Industrial Sales MM SA (Oct) -0.5% (Prev. 2.1%).

- Italian Industrial Sales YY WDA (Oct) 1.7% (Prev. 3.4%).

- Italian Mfg Business Confidence (Dec) 88.4 vs. Exp. 89.3 (Prev. 89.6, Rev. 89.5).

- Italian Consumer Confidence (Dec) 96.6 vs. Exp. 96.0 (Prev. 95.0).

- EU Current Account NSA,EUR (Oct) 32.0B (Prev. 38.1B).

- EU Current Account SA, EUR (Oct) 25.7B (Prev. 23.1B).

- Swedish Overall Sentiment (Dec) 103.7 (Prev. 101.7).

- Swedish Consumer Confidence SA (Dec) 95.8 (Prev. 96.1).

- Swedish Manufacturing Confidence (Dec) 103.8 (Prev. 100.9).

- Swedish Total Industry Sentiment (Dec) 107.4 (Prev. 105.8).

- Swedish Retail Sales YY (Nov) 5.6% (Prev. 3.4%, Rev. 3.5%); MM (Nov) 1.1% (Prev. -0.3%, Rev. -0.2%).

- French Producer Prices MM (Nov) 1.1%.

- Hungarian Gross Wages YY (Oct) 8.7% (Prev. 9.5%).

- Norwegian Reg'd Unemployment NSA (Dec) 2.1% vs. Exp. 2.2% (Prev. 2.1%).

- German Producer Prices YY (Nov) -2.3% vs. Exp. -2.2% (Prev. -1.8%).

- German GfK Consumer Sentiment (Jan) -26.9 vs. Exp. -23.2 (Prev. -23.2, Rev. -23.4).

- ECB Wage tracker suggests lower wage growth and gradual normalisation of negotiated wage pressures in 2026. ECB wage tracker with unsmoothed one-off payments at 3.0% in 2025 and 2.7% in 2026.