Weekend News Roundup - Newsquawk Asia-Pac Market Open

- US President Trump has imposed a 10% tariff on eight European countries, effective February 1st, over Greenland. The 8 countries include Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK. The tariff will be increased to 25% on June 1st, unless a deal is reached for the purchase of Greenland.

- The EU is preparing EUR 93bln of tariffs on the US or restrict American companies from the European market, in retaliation to the latest threat by US President Trump, as European leaders meet for an emergency meeting on Thursday, the FT reports.

- Iranian President Pezeshkian warned that any attack on Supreme Leader Khamenei would result in an all-out war and any military aggression will be met with a harsh and regrettable response.

- Looking ahead, highlights include Chinese House Prices (Dec), GDP (Q4), Industrial Production (Dec), Japanese Industrial Production (Nov)

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks ended the day largely rangebound on Friday, ahead of the long US weekend due to MLK Day on Monday. Sectors were mixed, with Real Estate sitting atop the pile and Health lagging, amid a lack of tier 1 US data.

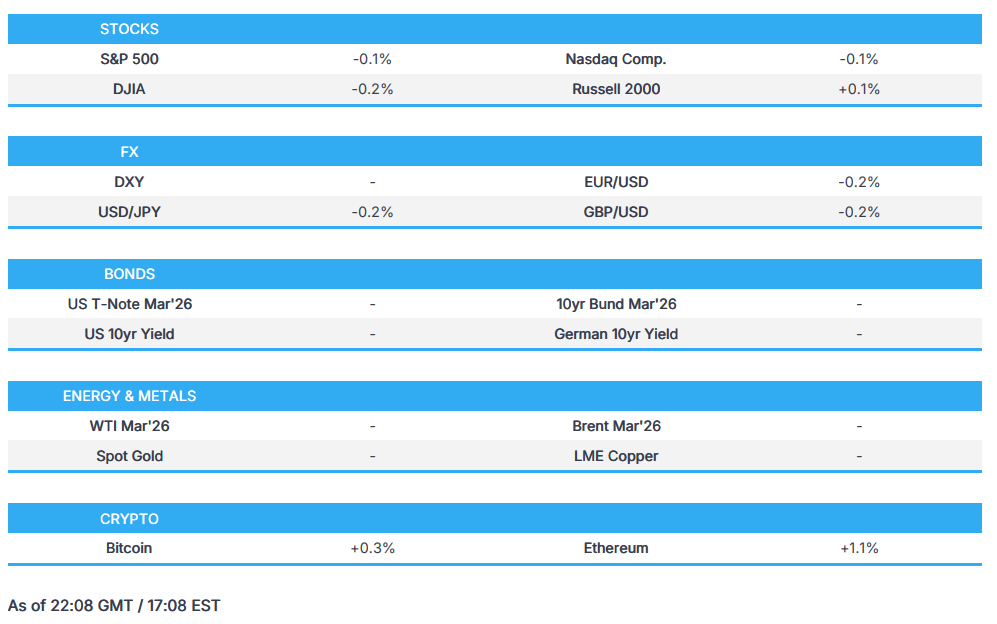

- SPX -0.06% at 6,940, NDX -0.07% at 25,529, DJI -0.17% at 49,359, RUT +0.12% at 2,678

NOTABLE US HEADLINES

- NEC Director Hassett said they have been in touch with big banks on credit cards, there will be great new "Trump Cards"; does not think legislation will be needed on credit cards. The idea behind the MBS plan is to get lower spreads on mortgages. Will be going to Davos with Trump. Trump to unveil plan for 401(k) for home down payments. Independence of the Fed is essential for economic stability. Hopes there is "nothing to see here" on DoJ Fed investigation. Expects there's nothing to see on Fed cost overrun, wish they had been more transparent. Warsh and Rieder would be great Fed Chairs. If he took the Fed job, he would commit to transparency. Thinks Trump can put 10% tariff on right away after SCOTUS rules. Trump is talking with Congress leaders on reconciliation.

TARIFFS/TRADE

- US President Trump, on Truth Social, has hit 8 European countries with a 10% tariff, effective February 1st, over Greenland. The 8 countries include Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK. The tariff will be increased to 25% on June 1st, unless a deal is reached for the purchase of Greenland.

- The EU is preparing EUR 93bln of tariffs on the US or restrict American companies from the European market, in retaliation to the latest threat by US President Trump as European leaders meet for an emergency meeting on Thursday, the FT reports.

- US President Trump on Carney in China, said its ok for him to get a deal with China and if he can get a deal with China, he should do that.

- The US is seeking a rare earth deal with Brazil as Washington looks for alternative sources away from China, the FT reports citing sources.

- The EU is proposing to phase out Chinese-made equipment from critical infrastructure in a move to revamp its security and tech policy, the FT reports.

- Top officials from the EU and Mercosur bloc have signed a free trade agreement after 25 years of negotiations.

- Brazil President Lula said wants to build new partnerships with Mexico, Canada, Vietnam, Japan, and China.

- US Supreme Court said it may announce opinions on January 20th.

- USTR Greer said Canada's decision to allow 49k Chinese EVs is 'problematic', according to an interview on CNBC.

- China Commerce Ministry has exchanged views with Australia regarding beef probe; China said it is willing to maintain communications.

- China's Ministry of Commerce said China will adjust anti-dumping measures on rapeseed and anti-discrimination measures against some of Canada's agricultural and aquatic products.

- China's Ministry of Commerce said Canada cutting EV tariffs is a step in the right direction.

- Ontario's Premier said China and Canada EV agreement will hurt workers.

- US Greenland envoy said believe there is a deal to be made on Greenland; Trump is serious; plan to meet officials, Fox News reported.

- US said EU is pushing for a cheese monopoly in Mercosur deal, FT reported.

CENTRAL BANKS

- US President Trump said he has someone in mind for Fed Chair.

- US Treasury Secretary Bessent said for Fed Governor Bowman, the best use is her existing job; Rieder was in with Trump yesterday, via Fox Business interview. Miran can continue at Fed past January 31st. Asked if Warsh is odds-on favourite, said we'll see. Will be Powell's decision to stay or leave post-May.

- Fed's Jefferson said do not want to prejudge January rate-setting decision. Some upside risks remain, but expect inflation to return to path back to 2%. Inflation somewhat elevated, climb in core good prices inconsistent with return to 2% inflation. Cautiously optimistic for 2026, though faces risks to both employment, price stability goals. Pleased to see increased use of standing repo operations when economically sensible. Expect 2% economic growth in near term, unemployment rate to hold steady this year. Fed rate cuts since 2024 have brought policy rate into range consistent with neutral. Current policy stance leaves US well positioned to determine how much and when to adjust policy rate.

- Fed's Bowman (voter) said Fed should be ready to cut rates again amid job market risks. On policy, she said the Fed should not signal a pause in rate cut campaign. Risks to Fed's mandate is asymmetric, and Fed should be ready cut again if labour market needs. Monetary policy is 'modestly restrictive' at the moment. Policy should forward-looking. On inflation, pressures are easing as tariff impact abates. Underlying inflation is close to the Fed's 2% target. Fed has made considerable progress lowering inflation. She is concerned about labour market fragility. Policy should be focused on supporting the jobs market. Sees solid growth and lower inflation, should stabilise the labour market. Economy has been resilient.

- Fed's Collins (2028 voter) said Congress is wise to set up an independent central bank.

- US President Trump said NEC Director Hassett was good on TV and wants to keep him where he is; on the Fed, will see how this works out.

- White House NEC Director and Fed Chair candidate Hassett said President Trump may well keep him at his current job and remove him from contention for the role as Fed Chair.

- Two Senior Administration Officials tell FBN that people in the room for the Fed Chair interview with Rick Rieder felt that him having no prior experience at the Fed is viewed "as a big positive". In the room for the meeting was President Trump, Vice President Vance, Sec Scott Bessent, Chief of Staff Susie Wiles, and Deputy Chief of Staff Dan Scavino. The final list of candidates is: Kevin Warsh, Kevin Hassett, Christopher Waller, and Rick Rieder. Rieder is the only person on the finalists list that has no previous Federal Reserve experience.

- BoE's Bailey spoke on “Global imbalances in a more fragmented world”

DATA RECAP

- US NAHB Housing Market Index (Jan) 37 vs. Exp. 40 (Prev. 39).

- US Industrial Production MoM (Dec) M/M 0.4% vs. Exp. 0.1% (Prev. 0.4%, Rev. 0.2%).

- US Manufacturing Production YoY (Dec) Y/Y 2% vs. Exp. 2.0% (Prev. 1.9%).

- US Industrial Production YoY (Dec) Y/Y 2% vs. Exp. 2.7% (Prev. 2.5%).

- US Manufacturing Production MoM (Dec) M/M 0.2% vs. Exp. -0.2% (Prev. 0.3%, Rev. 0%).

- US Capacity Utilization (Dec) 76.3% vs. Exp. 76% (Prev. 76.1%, Rev. 76%).

- NY Fed GDP Nowcast (Q4): 2.71% (prev. 2.62%).

FIXED INCOME

- Venezuela reportedly prepares to sell USD in local market.

- US Treasury reportedly considering quarterly 7-year note auctions with reopenings.

- Ecuador to issue USD bonds, making it the first time since 2019, according to reports.

COMMODITIES

- US President Trump said he didn't have to consult with anyone on taking Venezuelan oil Venezuela's oil now travelling to the US.

- US Energy Secretary Wright seeks to secure oil and minerals deals with Venezuela, Axios reported.

- Shell (SHEL) and Mitsubishi exploring potential sale of stakes in LNG assets. Mitsubishi has hired RBC capital markets to study a possible sale involving its stake later this year. Shell has marketed as much as 75% of its LNG Canada holding to buyers in recent weeks.

- Baker Hughes Rig Count: Oil +1 at 410, Nat Gas -2 at 122, Total -1 at 543.

- Sanctioned tanker Jamaica carrying Venezuelan oil cargo docked at the Curacao terminal, TankerTrackers reported.

- US reportedly explores plan to swap heavy Venezuelan oil for US medium crude to fill SPR, according to reports.

- US Technologies is to invest USD 1.38bln in Oak Ridge, Tennessee; will create 200 jobs in the uranium enrichment facility.

- CPC raises oil exports to record-high 70.5mln T in 2025 (prev. 63mln T in 2024) and exports via CPC declined to 3.98mln T in December (prev. 5.09mln T in Nov), via source reported.

- Endeavour Silver (EXK) 2026 guidance: Silver production from Terronera, Guanaceví, and Kolpa is projected to range between 8.3 and 8.9mln ounces (oz), while gold output from Terronera and Guanaceví is expected to range between 46,000 and 48,000 oz. Kolpa is anticipated to contribute significant base metal production, including 22,000 to 24,000 tonnes of lead, 16,000 to 18,000 tonnes of zinc, and 650 to 750 tonnes of copper. Together, these three mines are forecast to deliver 14.6 to 15.6 million silver equivalent ounces (“AgEq”).2026 Production Guidance.

- China is adjusting trading limits for silver and nickel futures, the maximum number of intraday positions for silver has been reduced to 3k lots (prev. 7k) , as of January 20th.

GEOPOLITICAL

RUSSIA-UKRAINE

- Ukraine's Security of National Security Umerov said that the US and Ukraine will hold additional talks in Davos after the two sides discussed security guarantees for Ukraine over the weekend in Florida.

- IAEA said secured agreement between Russia and Ukraine to implement ceasefire for repairs to begin on last remaining backup power line to Zaporizhzhya plant.

- Ukraine President Zelensky said air defences supplies are insufficient and warns of new Russian massive strikes.

- Ukraine and US to hold talks in Miami on Saturday, AFP reported.

- Danish Arctic Commander said have today invited US to join military exercise in Greenland, and awaiting reply; there are no Chinese or Russian ships observed near Greenland.

- Ukrainian President Zelensky said Ukrainian delegation heading to US for talks on security guarantees and prosperity package; if agreement is reached, documents can be signed in Davos. Ukraine hopes to get clarity on Russian stance regarding peace talks. Russia is stalling peace efforts. Ukraine needs Security guarantees that last longer than Trump’s term. Ukraine was lacking missiles for several air defence systems up until Friday morning. Ultimatums are not way to do diplomacy. Electricity generation capacity at 11 gigawatts with demand of 18 gigawatts.

- Russia's Kremlin said they are expecting US envoys Kushner and Witkoff to visit Moscow, although no official date has been set yet.

MIDDLE EAST

- Iranian President Pezeshkian warned that any attack on Supreme Leader Khamenei would result in an all-out war and any military aggression will be met with a harsh and regrettable response. This comes following comments by US President Trump, in an interview with Politico, calling for the end of Khamenei's reign and called him "a sick man who should run his country properly and stop killing people."

- Iranian Supreme Leader Khamenei said those linked to Israel and the US have caused massive damage and have killed thousands in the protest, blaming US President Trump for inflicting casualties, damage and slander on Iranians.

- The attack on Iran is only a matter of time and Washington is preparing to act, Israel's Channel 12 reports citing US officials.

- US President Trump on Truth said "I greatly respect the fact that all scheduled hangings, which were to take place yesterday (Over 800 of them), have been cancelled by the leadership of Iran. Thank you!".

- US President Trump and Netanyahu discussed Iran in a 2nd phone call, according to Axios. The White House and the prime minister's office declined to comment. During their first call on Wednesday, Netanyahu asked Trump to hold off on military action against Iran to give Israel more time to prepare for potential Iranian retaliation. It was one of the reasons Trump decided to delay orders for the U.S. military to move forward with a strike against Iran. U.S. officials say military action is still on the table if Iran resumes killing protesters. Israeli officials think that despite the delay, a U.S. military strike could take place in the coming days.

- US did not have enough forces in the region to undertake a significant blow to Iran and deal with retaliation, WSJ reported citing sources; instead, Trump held off until "firepower" could be brought forward. Gulf officials still think a strike is likely. POTUS has not decided whether or not to undertake a military option. Also been advised on various options, incl. cyber and sanctions. Gulf officials still think a strike is likely once the US has forces in place.

- Israel's Mossad Director Barnea arrived in the US on Friday for discussions relating to Iran, Axios reported citing sources. US is sending additional military capabilities to the region, to be prepared in case POTUS orders a strike, sources add.

ASIA-PAC

NOTABLE HEADLINES

- China Securities Regulatory Commission is looking for public feedback on draft derivative trading rules.

- China Cabinet Meeting studied measures to boost service consumption and pursue growth points; China called for enhancing driving force of resident consumption. Will issue special bond quotas as soon as possible to support payments of overdue arrears.

- China is adjusting trading limits for silver and nickel futures, the maximum number of intraday positions for silver has been reduced to 3k lots (prev. 7k) , as of January 20th.

EU/UK

NOTABLE HEADLINES

- Morningstar confirms Switzerland at AAA; stable.