What If The Fed's Hikes Are Actually Sparking US Economic Boom?

Authored by Ye Xie via Bloomberg,

As the US economy hums along month after month, minting hundreds of thousands of new jobs and confounding experts who had warned of an imminent downturn, some on Wall Street are starting to entertain a fringe economic theory.

What if, they ask, all those interest-rate hikes the past two years are actually boosting the economy? In other words, maybe the economy isn’t booming despite higher rates but rather because of them.

It’s an idea so radical that in mainstream academic and financial circles, it borders on heresy — the sort of thing that in the past only Turkey’s populist president, Recep Tayyip Erdogan, or the most zealous disciples of Modern Monetary Theory would dare utter publicly.

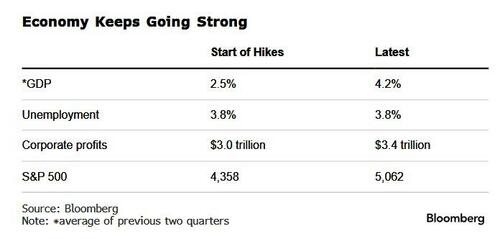

But the new converts — along with a handful who confess to being at least curious about the idea — say the economic evidence is becoming impossible to ignore. By some key gauges — GDP, unemployment, corporate profits — the expansion now is as strong or even stronger than it was when the Federal Reserve first began lifting rates.

This is, the contrarians argue, because the jump in benchmark rates from 0% to over 5% is providing Americans with a significant stream of income from their bond investments and savings accounts for the first time in two decades. “The reality is people have more money,” says Kevin Muir, a former derivatives trader at RBC Capital Markets who now writes an investing newsletter called The MacroTourist.

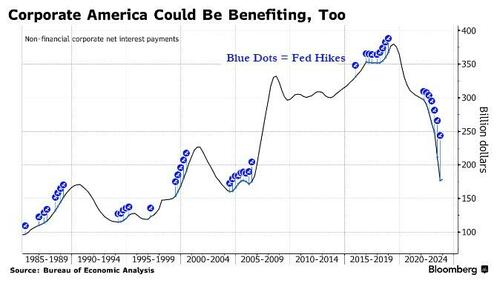

These people — and companies — are in turn spending a big enough chunk of that new-found cash, the theory goes, to drive up demand and goose growth.

In a typical rate-hiking cycle, the additional spending from this group isn’t nearly enough to match the drop in demand from those who stop borrowing money. That’s what causes the classic Fed-induced downturn (and corresponding decline in inflation). Everyone was expecting the economy to follow that pattern and “slow precipitously,” Muir says. “I’m like no, it’s probably more balanced and might even be slightly stimulative.”

Muir and the rest of the contrarians — Greenlight Capital’s David Einhorn is the most high profile of them — say it’s different this time for a few reasons. Principal among them is the impact of exploding US budget deficits. The government’s debt has ballooned to $35 trillion, double what it was just a decade ago. That means those higher interest rates it’s now paying on the debt translate into an additional $50 billion or so flowing into the pockets of American (and foreign) bond investors each month.

That this phenomenon made rising rates stimulative, not restrictive, became obvious to the economist Warren Mosler many years ago. But as one of the most vocal advocates of Modern Monetary Theory, or MMT, his interpretation was long dismissed as the preachings of an eccentric crusader. So there’s a little sense of vindication for Mosler as he watches some of the mainstream crowd come around now. “I’ve been certainly talking about this for a very long time,” he says.

Muir readily admits to being one of those who had snickered at Mosler years ago. “I was like, you’re insane. That makes no sense.” But when the economy took off after the pandemic, he decided to take a closer look at the numbers and, to his surprise, concluded Mosler was right.

‘Really Weird’

Einhorn, one of Wall Street’s best-known value investors, came to the theory earlier than Muir, when he observed how slowly the economy was expanding even though the Fed had pinned rates at 0% after the global financial crisis. While hiking rates to extremes clearly wouldn’t help the economy — the blow to borrowers from a, say, 8% benchmark rate is just too powerful — lifting them to more moderate levels would, he figured.

Einhorn notes that US households receive income on more than $13 trillion of short-term interest-bearing assets, almost triple the $5 trillion in consumer debt, excluding mortgages, that they have to pay interest on. At today’s rates, that translates to a net gain for households of some $400 billion a year, he estimates.

“When rates get below a certain amount, they actually slow down the economy,” Einhorn said on Bloomberg’s Masters in Business podcast in February. He calls the chatter that the Fed needs to start cutting rates to avoid a slowdown “really weird.”

“Things are pretty good,” he said. “I don’t think that they’re really going to help anybody” by cutting rates.

(Rate cuts do figure prominently, it should be noted, in a corollary to the rate-hikes-lift-growth theory that another camp on Wall Street is backing. It posits that rate cuts will actually push inflation further down, not up.)

To be clear, the vast bulk of economists and investors still firmly believe in the age-old principle that higher rates choke off growth.

As evidence of this, they point to rising delinquencies on credit cards and auto loans and to the fact that job growth, while still robust, has slowed.

Mark Zandi, chief economist at Moody’s Analytics, spoke for the traditionalists when he called the new theory simply “off base.” But even Zandi acknowledges that “higher rates are doing less economic damage than in times past.”

Like the converts, he cites another key factor for this resilience: Many Americans managed to lock in uber-low rates on their mortgages for 30 years during the pandemic, shielding them from much of the pain caused by rising rates.

(This is a crucial difference with the rest of the world; mortgage rates rapidly adjust higher as benchmark rates rise in many developed nations.)

Bill Eigen chuckles when he recalls how so many on Wall Street were predicting catastrophe as the Fed began to ratchet up rates. “They’ll never go past 1.5% or 2%,” he intones, sarcastically, “because that will collapse the economy.”

Eigen, a bond fund manager at JPMorgan Chase, isn’t an outright proponent of the new theory. He’s more in the camp of those who sympathize with the broad contours of the idea. That stance helped him see the need to refashion his portfolio, loading it up with cash — a move that’s put him in the top 10% of active bond fund managers over the past three years.

Eigen has two side hustles outside of JPMorgan. He runs a fitness center and car repair shop. At both places, people keep spending more money, he says. Retirees, in particular. They are, he notes, perhaps the biggest beneficiaries of the higher rates.

“All of a sudden, all of this disposable income accrues to these people,” he says. “And they’re spending it.”