Year-Over-Year Existing Home Sales Disappoint In November, Decline Most In 6 Months

With mortgage rates tumbling, housing market participants have been disappointed by the lack of enthusiasm by homebuyers to apply for mortgages (though there was a decent bounce in refi activity)...

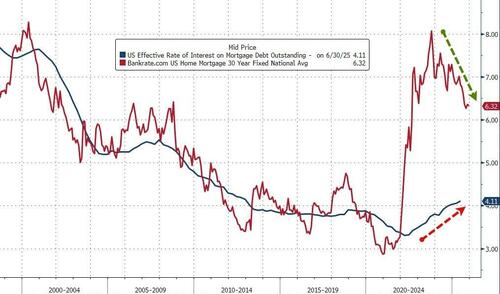

This morning's existing home sales data (admittedly for November) will give us a further glimpse into the reality oh home-buying vs home-selling as the gap between current mortgage rates and the average existing mortgage rates is narrowing (but remains vast)...

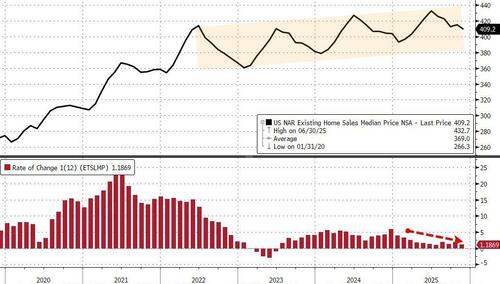

But, analysts (rightfully, given the slide in mortgage rates) expected the recent trend of existing home sales growth to continue in November and it did... but only a mere +0.5% MoM (vs +1.2% MoM exp). October was revised up to +1.5% from +1.2%. More problematically, the disappointment pulled existing home sales down 1% YoY (the first negative print since May)...

Source: Bloomberg

Meantime, the median sales price increased 1.2% from a year ago to $409,200. That was one of the weakest gains since mid-2023.

“Existing-home sales increased for the third straight month due to lower mortgage rates this autumn,” NAR Chief Economist Lawrence Yun said in a statement.

“However, inventory growth is beginning to stall.”

Source: Bloomberg

In November, the supply of previously owned homes on the market fell from the previous month to 1.43 million, roughly flat in recent months.

Source: Bloomberg

Yun said that’s because sellers aren’t desperate and are choosing to de-list and try again in the popular spring-selling season instead.

At the current sales pace, inventory is equivalent to 4.2 months’ supply, the weakest since March.

Sales rose in the Northeast and South, the nation’s biggest home-selling region. The pace of closings in those two regions were the highest since early this year. Activity was flat in the West and declined in the Midwest.

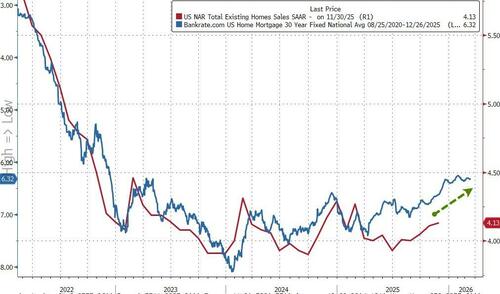

And, arguably, there is more room for existing home sales to run here as mortgage rates hit three year lows...

Source: Bloomberg

NAR sees sales rising 14% next year, higher than most other forecasts but a figure that Yun said he feels “confident” in. That assumes more inventory will come on the market, mortgage rates will hover around 6% and the Federal Reserve will cut interest rates another two times, compared to policymakers’ median projection for one.