L3Harris Rockets Higher On "First-Of-It's Kind" Pentagon Investment Into Missile Unit

L3Harris Technologies (our top stock for the Hemispheric Defense Theme) announced on Tuesday a "first-of-its-kind" proposed partnership with the Department of War (DoW) to significantly boost solid rocket motor production.

The DoW will inject $1 billion into L3Harris' Missile Solutions unit through a convertible preferred investment, creating a direct link between the federal government and a major weapons manufacturer as the US races to increase missile production. The investment would automatically convert into common equity upon an initial public offering.

Under the plan, L3Harris' Missile Solutions unit will go public in the second half of 2026, creating a pure-play missile propulsion company built around the former Aerojet Rocketdyne business. L3Harris will retain control.

"Since its acquisition of Aerojet Rocketdyne, L3Harris has significantly invested to transform and grow its production operations, and recently created the Missile Solutions business, combining all aspects of its capabilities in support of offensive and defensive missile systems," L3Harris wrote in a press release, adding the investment will help expand capacity for the DoW's missile systems, such as PAC-3, THAAD, Tomahawk and Standard Missile.

L3Harris CEO Christopher Kubasik stated, "We're taking action to build today's 'Arsenal of Freedom' by launching a pure-play missile solutions provider. Recent Trump Administration actions have placed renewed emphasis on strengthening the defense industrial base and reinvigorating competition following a 30-year wave of consolidation. Building on several years of sustained investment and operational improvements by L3Harris, this new company will serve as a key partner to the DoW in supporting efforts to deter and defeat America's adversaries."

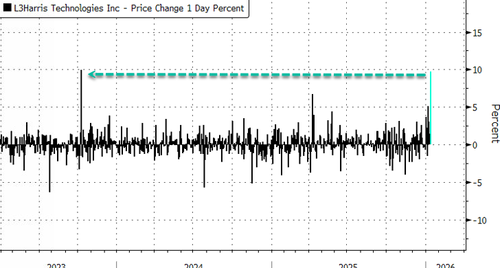

In premarket trading, L3Harris shares are up nearly 10%.

If those gains are held into the cash session, this would mark the largest intraday up move since October 2023.

L3Harris has been a top pick in our Western Hemisphere Defense theme since late May, mostly based on the fact that DoW's reposturing and fortifying the hemisphere would take new investments where L3Harris would stand to greatly benefit. L3Harris is up more than 50% since our report.

Read the report (May 2025):

Last week, Trump called for a 50% increase in U.S. military spending by 2027. The race to fortify the Western Hemisphere is well underway, and L3Harris stands out as a defense contractor poised to benefit from those trends.