Chinese Insurers Drive Goldman’s $4,500 Forecast Tail (Unlocked)

Goldman Sees $4,500 Tail Risk in 2025, Raises all Targets

- Structural Demand Surprises: The New Baseline

- Duration and Depth of Official Sector Buying

- Mar-a-Lago Accord Focus Enhances Gold’s Appeal

- Chinese Insurance Demand Will Be Massive

- What Causes a Spike to $4,500

- Unfreezing Russian Assets and Margin-Driven Liquidation are Temporary Risks

- Final View: Entry Points and Policy Risk Hedging

Authored by GoldFix exclusively for Scottsdale Mint

Last week Gold Soars 4% in 5 Days — Here’s Why was published describing Bank of America’s rationale for raising their 2025 price target for Gold. The following analysis, issued practically the same day, breaks down Goldman Sachs rationale for revising their own target.

[Edit- GoldFix identifies the catalyst for both BOA and GS bank upgrades as China’s launch of insurance industry gold-demand covered herein.]

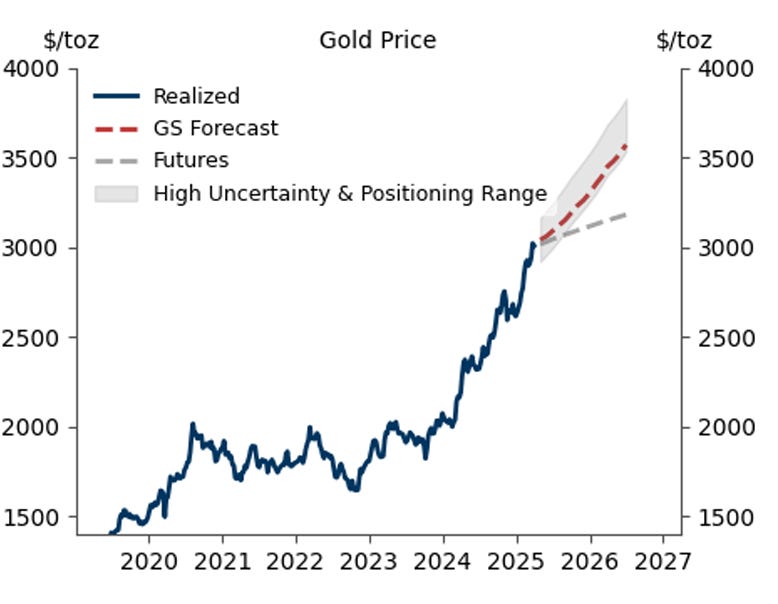

Goldman’s latest analysis revises upward its year-end 2025 gold price target to $3,300/toz, raising the upper boundary of its forecast range to $3,520/toz and introducing a tail-risk scenario as high as $4,500/toz.

Structural Demand Surprises: The New Baseline

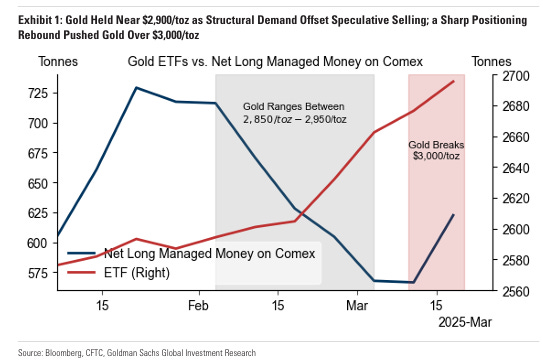

The analyst notes that the breakout above $3,000/toz on March 14 was catalyzed by a rebound in speculative positioning, as well as sustained ETF inflows and official sector purchases. In the six weeks leading to the breakout, speculative length fell by 150 tonnes, yet gold prices remained firm—a testament to the strength of structural demand. As positioning rebounded by 60 tonnes in response to tariff and “Mar-a-Lago accord” headlines, the price surged.

The bank’s baseline assumption is that central bank buying will average 70 tonnes/month, up from the prior 50 tonnes/month forecast. This estimate is based on:

A 109-tonne average pace in November-January.

Strategic diversification needs of EM central banks, particularly China.

Duration and Depth of Official Sector Buying

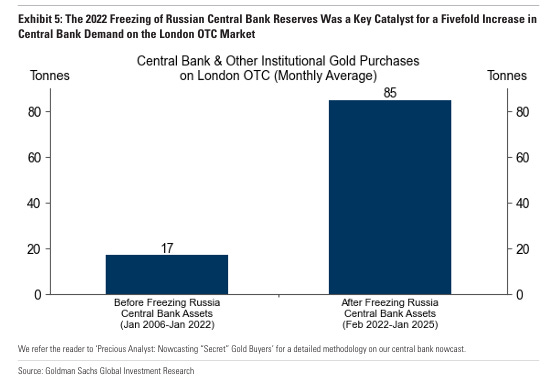

“The geopolitical hedging motive has gained relevance since the freezing of the Russian central bank assets in 2022.”

The analyst identifies central bank buying as a structurally persistent force. Since the 2022 asset freeze targeting Russian reserves, official buyers—especially in EM—have increased gold purchases roughly fivefold. The report argues that this represents a permanent shift in reserve management behavior.

Mar-a-Lago Accord Focus Enhances Gold’s Appeal

“Gold, unlike FX reserves, cannot be frozen or confiscated when held domestically.”

The report devotes a critical section to the November 2024 publication titled “A User’s Guide to Restructuring the Global Trading System” by Stephen Miran. Miran’s recommendations—including revaluing the dollar through tariff packages and terming out U.S. debt—carry tail-risk implications for gold.

While Goldman is skeptical of the political feasibility and market coordination required for such proposals, it acknowledges the hedging utility of gold amid rising focus on U.S. policy tail risks. Historical patterns suggest that even the discussion of reserve asset vulnerability enhances gold’s appeal to central banks.

Chinese Insurance Demand Will Be Massive

China’s policy shift allowing insurers to invest up to 1% of their AUM in gold—equivalent to ~280 tonnes—has not yet translated into significant flows. However, the analyst expects this latent demand to emerge during price corrections, providing a stabilizing effect on dips.

Two transmission channels are outlined:

- Import-driven support for global gold prices (regulated by quotas).

- Widening Shanghai premium if import constraints bind, signaling localized tightness.

China’s Gold-Insurance Program Begins…

The structure of China’s gold market, especially inventory levels and import quotas, will determine the precise mechanism by which insurance-driven demand expresses itself. Current Shanghai Gold Exchange inventories remain adequate due to weak jewelry demand, but the situation may evolve.

What Causes a Spike to $4,500

Goldman’s base case of $3,300 assumes:

- 70 tonnes/month central bank buying

- Gradual ETF inflows

- Normalizing speculative positioning

However, should the following materialize simultaneously:

- Central bank buying hits 110 tonnes/month

- ETF holdings return to COVID-era highs

- Positioning exceeds historical peaks