Is It all Fake?

Is It All Fake?

Sometimes finance and economics seem fake. Take these comparisons of America's economy and stock market versus Russia's, for example:

1. U.S. vs Russia: GDP (Purchasing Power Parity - PPP)

U.S. GDP (PPP): ~$28.8 trillion

Russia GDP (PPP): ~$5.2 trillion

Source: IMF World Economic Outlook Database (April 2024)

➡️ U.S. economy is about 5.5 times larger than Russia's on a PPP basis.

2. U.S. vs Russia: Total Stock Market Capitalization

U.S. Stock Market Capitalization: ~$51 trillion

Russia Stock Market Capitalization: ~$0.5 trillion (500 billion USD)

Source: World Bank, Bloomberg, and updated exchange data (2024-2025)

➡️ U.S. stock market is roughly 100 times larger than Russia's.

And then go to YouTube and take a look at any walking tour of Moscow, such as this one.

If you compare it to New York, it doesn't really seem like we're 100x richer than them, does it? It suggests the enormous size of our stock market is kind of fake.

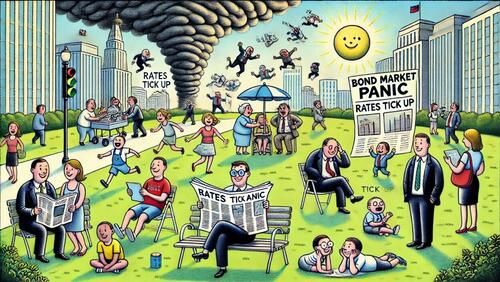

And of course, our bond market is much bigger than our stock market. And a lot of observers panicked this week, as yields on our Treasury bonds ticked up. Should they have? Our friend Charles Haywood suggested on X that most of them shouldn't have. Below his his post, followed by a brief counterpoint by us.

Authored by Charles Haywood on X

The Sky Isn't Falling (Except For Some Hedge Funders)

1) I have been hearing for thirty years about the debt markets and how they are the boogeyman—poorly understood even by experts, in the sense of unpredictability, yet requiring politicians and bankers DO EVERYTHING, EVERYYTHING, YOU HEAR ME??!!! and DO IT IMMEDIATELY, IMMEDIATELY, YOU HEAR ME??!!! because if they don’t THE SKY IS GOING TO FALL, FALL, YOU HEAR ME??!!!! This was true in the 90s with Clinton. It was true with Long Term Capital Management. It was true in 2008. And other times.

(TL; DR. A debt market system that is baroque and fragile, designed and implemented with government assistance to benefit a tiny handful of oligarchs, deserves to fail, even though failure not nearly as likely to as people always seem to think. That failure will not end the country; it will end the economic lives of people who (mostly) deserve it. The average American won’t care or notice, and will probably be benefitted.)

2) The exact mechanisms of this supposed catastrophe are never specified. Vague intimations are made, to be sure. The short-term commercial paper market will collapse, locking up the financial system, so by next week we will all be eating each other’s flesh. Short-term government interest payments will explode, or the government won’t be able to sell Treasuries at all. Other countries will dump their Treasuries. Poor Main Street won’t be able to get loans. Mortgages will be expensive.

3) Most of these are lies or fantasies. At best they are guesses with no real basis in any coherent and complete logic chain behind them.

4) In this most recent episode, in the evening we were told THE CHINESE ARE DUMPING TREASURIES!!! In the morning, we were told NO, THAT’S WRONG. SOMEBODY ELSE IS DOING IT!!! WE DON’T KNOW WHO!!! We then were told that, maybe, massive hedge funds trapped by the “basis trade,” a manipulation encouraged by the government, were afraid of getting screwed, and so were selling Treasuries (in all cases, sending short-term yields up, and potentially raising short-term financing costs for the government). Nobody actually knew or knows; perhaps it is impossible to know. 5) Who knows what was really going on? Who cares? The Chicken Little routine is silly. If the debt markets have some kind of catastrophic event, a bunch of people will get wiped out, as they should be. As I always quote Luigi Zingales about Henry Paulson in 2008: he “argue[d] that the world as we knew it would end if Congress did not approve the $700 billion bailout . . . to an extent he was right: His world—the world he lived and worked in—would have ended had there not been a bailout. But Henry Paulson’s world is not the world most Americans live in—or even the world in which our economy as a whole exists.” It doesn’t matter what happens in the debt markets; people will route around it and everything will be fine—as long as we accept that some very powerful people need to lose everything.

“Fine” may, of course, mean squeezing the stupid out of the system. And that is risky, and yes, it could lead to some form of depression or collapse. That risk should have been taken in 2008. We are much further down the road. But the idea that the debt market in its current configuration, manipulated by oligarchs to line their pockets, is somehow sacred is not smart.

There have been debt market crises that lead to actual economic major problems, such as the Panic of 1837. But those related almost exclusively to private credit in a metallic system, and in any case the ability of systems two hundred years ago to readjust compared to today is not really comparable at all. This is true on myriad levels, but importantly, the tools of a system to route around problems in 1837, where communication took months, and today, are night-and-day different.

6) Some years ago, as an M&A lawyer, I worked on a deal for a collapsed consumer lender, which had borrowed short term and lent long-term, taking advantage of interest rates for the former being lower than the latter. Rates reversed. The company instantly went insolvent. It was sold off, and nobody cared, except the dumbasses who lost their shirts on a risky bet. That should just be writ large all over the markets.

7) As to Trump, the idea that he “caved because of the debt market” is bizarre. Trump didn’t say that at all; he made a nod to the debt market, and drew no real stated conclusion. Certainly he has people in his ear, those who will personally suffer, demanding he DO SOMETHING. What he really thinks is unclear and impossible to determine. In the past, he has often completely lacked discipline or a worked-out rationale. That seems to have improved somewhat, but maybe there’s little rationale. But his basic approach to tariffs is not incoherent at all (although it’d be nice to have a very clear industrial policy—but in today’s divided environment focusing on that would simply lead to distraction). Moreover, as others have pointed out, what has happened so far is all laid out by one of his advisors, or at least the core of it is. Whether it’s a good strategy I have no idea. But it’s certainly a change, and what the nation needs is change.

That is, nobody is claiming this is 12D chess. It’s Trump doing what he said he would, adjusting based on inputs, some expected, some not, and his usual personality. An objective observer would have predicted much of this. The success of it is impossible to determine right now, both because not enough time has passed and we lack facts. E.g., is it true that Trump is getting deals with 70 countries, or is that just a fantasy? Most likely it’s true in the sense that negotiations have been opened. And in every one of those, America is likely to get something it didn’t have before.

Counterpoint: If You're An Investor, It's Real To You

Those of you have all your money in gold and silver bullion or canned food can ignore what's going on with the bond market, but those of us who are invested in stocks can't. We can debate how accurately what's happening maps to the real economy, but as we saw this week, it definitely impacts the stock market.

With that in mind, remember that you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

And if you'd like a shot at profiting from the chaos, as we did on these two trades this week,

Puts on Apple ( AAPL -6.28%↓). Bought for $1.50 on 4/9/2025; sold (half) for $4 on 4/10/2025. Profit: 167%.

Puts on Nvidia (NVDA -6.09%↓). Bought for $1.56 on 4/9/2025; sold (half) for $4 on 4/10/2025. Profit: 156%.

You can subscribe to our trading Substack/occasional email list below.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).