American Gold is German Gold

American Gold is German Gold

Contents (1400 words)

- The Central Question: Why Is Gold Being Repatriated to the U.S.?

- Alternative Theories: Fort Knox, Remonetization, and Digital Gold

- Germany’s History with U.S.-Held Gold

- The Case for Germany Wanting Its Gold Back—Again

- The Core Thesis: Reshoring Payment Chains

- Addendum:

The Central Question: Why Is Gold Being Repatriated to the U.S.?

So here’s our core argument: one of the most likely candidates driving the gold repatriation to the U.S. is Germany’s desire and potential recalling to get it back onshore. Bringing it back in advance means no delays when/if Germany asks. To be honest, all these reasons fall under the same umbrella of Payment Chain Onshoring anyway

Authored by GoldFix, ZH Edit

One of the questions frequently asked in the gold space surrounds the massive repatriation of gold to the U.S.—a topic clouded with much misinformation.

There are several potential reasons for this move being discussed—many of which were covered in this space first. The leading candidate is this: gold is being brought back to the U.S. in response to Basel III going into implementation, with rollout scheduled for July 1, 2025.

Alternative Theories: Fort Knox, Remonetization, and Digital Gold

Other potential reasons, all to one extent or another, are also related to Basel III. For example, one possibility is preparation for an audit of Fort Knox. There have long been, and continue to be, concerns that Fort Knox doesn’t hold the gold it claims. We’ve raised this many times over the years, most recently in a piece poking fun at the idea that Fort Knox is empty, holding only IOUs. That would be another leading reason.

Another angle is that gold may be used for a gold-backed type of bond. Putting gold out on the yield curve—offering people a yield while securing it with gold—would make U.S. Treasuries more attractive. That’s the idea.

Lastly, still under the remonetization concept, the gold could be used to stake a stablecoin. A new stablecoin idea was floated near the proposed G.U.S.T. Act, which essentially aimed to create a gold-backed digital dollar.

The most likely reason for the gold to be brought back, on such a tight schedule and in such large amounts, may be—equally if not more plausibly—related to Germany.

Germany’s History with U.S.-Held Gold

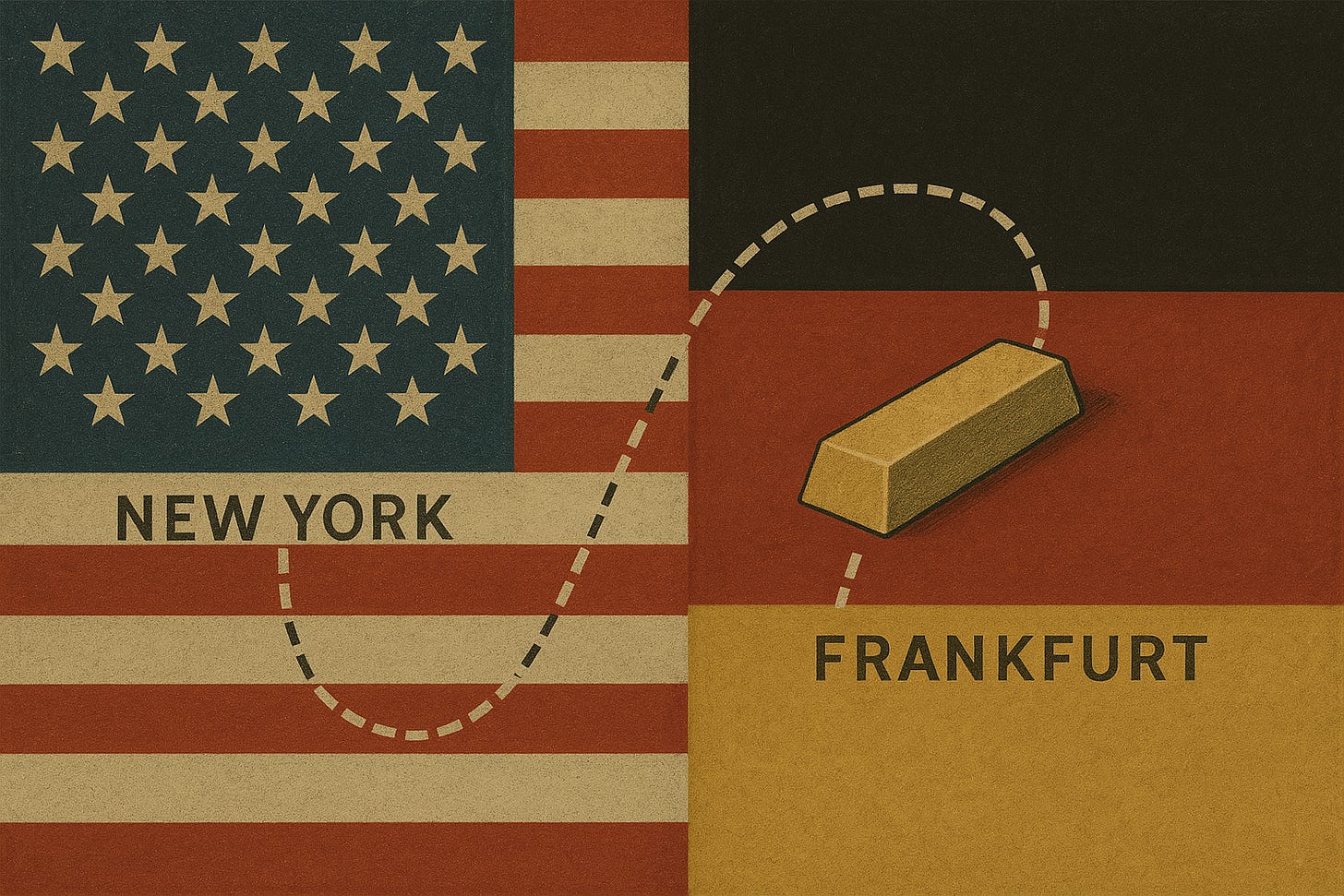

Here’s just a basic fact: in 2013, Germany requested the return of about half of the gold it had stored in the U.S. The U.S. did not—or could not, or would not—fulfill that request in a timely fashion. As a result, a seven-year window was granted to get the gold back. That’s not something a good trading partner does—unless they had no other choice.

In 2016–2017, that gold was finally returned. The media framed it as “three years ahead of schedule,” but in reality, it still took three to four years to get the gold to Germany. That delay happened because the gold wasn’t ready—it either wasn’t present or wasn’t in the right form. It had to be re-smelted.

Logically then, especially against the backdrop of what’s going on now, Germany is probably thinking about—if it hasn’t already done so—asking for the rest of its gold back, or at least asking that it be stored closer to home.

Let’s add some more color on why this makes sense.

The Case for Germany Wanting Its Gold Back—Again

Currently, Germany has had to lift its debt ceiling to allow for more spending—largely in response to the U.S. pulling back military support from Europe. That makes Germany very nervous. They are not fans of inflation risk, for obvious historical reasons.

The same conditions are forming today. And we’ll put it to you plainly: that’s likely why they’re asking for their gold back now. Let’s walk through the reasons one by one after first relisting them

- Germany Raised Its Spending Cap

- The World Has Moved Toward Mercantilism

- Trade Wars and Distrust

- The Fort Knox Question

For starters: If you’re Germany, and the President of the United States isn’t sure the gold is there—wouldn’t you be within your fiduciary responsibility to ask for it back? Of course you would...

Continues here

Free Posts To Your Mailbox