Gold is Screaming What's To Come

A tsunami of liquidity is about to hit the financial system.

Ignore what the academics say, tariffs are in fact highly deflationary as they trigger considerable fear for consumers. We’re already seeing this in the U.S. where a Redfin survey showed 24% of Americans scrapping plans to make a major purchase like a home or a car due to tariffs.

This a global phenomenon as economic uncertainty has skyrocketed following the Trump administration’s launching of a trade war in early April. The economic uncertainty index has spiked in the UK, Europe, China, Japan and the U.S.

This is HIGHLY deflationary. And the financial system knows it. The global bond ETF has skyrocketed in the last month. As I write this, it’s breaking out of a three-year consolidation period to the upside.

Central banks have only one option when it comes to stopping deflation: printing money. And with global trade breaking down, bonds catching a bid, and consumers pulling back on purchases, it’s only a matter of time before central banks fire up the printing presses again.

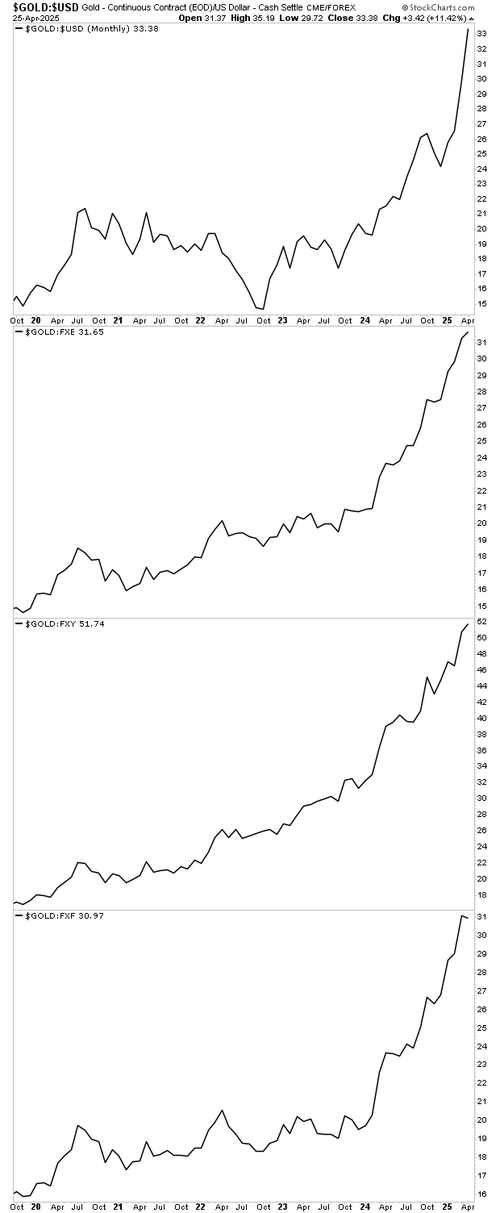

This is why gold has broken out against every major currency in the last month. The below chart shows gold priced in $USD, Euros, Yen and Francs. The signal is clear: there is a GLOBAL shift away from fiat currency for the safety of gold.

Put simply, that chart is SCREAMING that another round of money printing and inflation is coming shortly. The time to prepare for this is NOW before it begins.

We detail this situation, what’s to come, and THREE investments to profit from it in a Special Investment Report titled How to Profit a Inflation.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research