Independent but Impotent: The FED Fiddles While The Cycle Burns.

What’s behind the numbers?

As expected, the Federal Open Market Committee played it safe and left the federal funds rate sitting comfortably at 4.25%–4.5%, like a guest who refuses to leave the party. In their post-meeting press release, FED officials warned that risks are now popping up from every direction—basically, it's a choose-your-own-adventure between inflation and stagnation. And just to spice things up, they added a special shout-out to trade’s drag on GDP in Q1—because why not blame tariffs while you're at it?

Adding yet another log to the bonfire of economic uncertainty, the Fed cheerfully announced it’ll keep trimming its balance sheet by $5 billion a month—because nothing says “we’ve got this under control” like slowly backing away from a $7 trillion pile of IOUs.

FED Balance Sheet (blue line); US Unemployment Rate (red line).

In his press conference, Powell opened with the usual nod to the FED’s dual mandate, but when pressed on whether inflation or unemployment would take priority, he gracefully admitted he has no idea—which, in central banker speak, is as close as you get to waving a white flag.

He also added that the committee doesn’t need to rush into any rate changes—mainly because the FED still hasn’t quite figured out where the economy is going.

Asked whether recent comments from the White House had influenced the committee’s thinking, Powell politely dodged any hint that outside pressure might affect monetary policy.

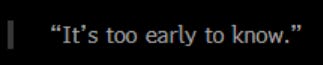

Powell’s opening remarks stuck to the middle of the road, with the Bloomberg Rate Strategy sentiment gauge clocking in at 1.95—down slightly from 2.05 last month. Since anything between +5 and -5 is considered neutral, it’s safe to say the FED chair remains firmly in Zen mode.

At the end of the day, the May meeting confirmed what many already suspected: the FED is increasingly impotent to steer the economic ship and is likely to lose the looming battle with “Tariff-Stoked Stagflation.” As for the market’s reaction? Less bullish than in January and March—because investors know the score: it’s the business cycle that’s in charge now, not the FED’s press releases.

Thoughts

While Wall Street clings to the fantasy that the FED can control business cycles, a look at the FED Funds rate and the S&P 500-to-oil ratio reveals a clear pattern: rate cuts often mark the peak of this ratio, and no rate cycle has ever stopped it from falling below its 7-year moving average, signalling the shift from boom to bust.

Upper Panel: FED Fund Rate (purple line); Lower Panel: S&P 500 to WTI ratio (green line); 7-Year Moving Average of the S&P 500 to Oil ratio (red line).

Investors will remember that despite Wall Street's belief that lower rates boost corporate America and equities, reality shows that S&P 500 forward EPS rose when the FED was hiking, not cutting rates, and the S&P 500's best returns came 6 to 9 months after the first-rate hike in past cycles over the last 35 years.

Upper Panel: FED Fund Rate (blue line); S&P 500 12-month Fwd EPS (red histogram) ; Lower Panel: S&P 500 Index 12-Month Rate of Return (Yellow Histogram).

This should come as no surprise to those who understand that equity market performance is driven by the business cycle, which affects corporate America's profitability. Over time, when the S&P 500 to Oil ratio trends downward and breaks below its 7-year moving average, corporate earnings typically decline, aligning with the FED's decision to cut rates.

Upper Panel: S&P 500 to Oil Ratio (green line); 7-Year Moving Average of S&P 500 to Oil Ratio (red line); Lower Panel: FED Fund Rate (blue line); S&P 500 Index 12-Month Forward EPS (red histogram).

It is not a secret to anyone that the relationship between the ‘Disruptor In Chief’ and the ‘Central Banker In Chief’ are particularly tense. As a reminder, The President nominates the Chair of the Federal Reserve, and the Senate confirms them. The term for the Chair is four years, but they can be reappointed. For example, Jerome Powell was nominated by Trump and then reappointed by Biden. But can a President remove the Chair before their term is up? The Federal Reserve Act established the Federal Reserve System. Members of the Board of Governors, which includes the Chair and Vice Chair, serve 14-year terms, but the Chair’s term is four years. Recently, the key question was: can Trump remove Powell? The Act states that a President can remove a Federal Reserve Board member “for cause,” but what does “for cause” mean exactly? That’s a bit vague. It probably means something like misconduct or neglect of duty, not just policy disagreements.

Back in the day, Nixon tried to fire FED Chair Arthur Burns for not lowering rates, but guess what? He couldn’t. Turns out, "policy disagreement" isn’t a legal reason to fire someone—who knew? Fast forward to Reagan, who almost didn’t reappoint Paul Volcker, but Volcker bailed out early, so Reagan handed the reins to Alan Greenspan instead. Bottom line: Presidents can’t just fire the Fed Chair over a bad mood or a rate hike they don’t like. The law keeps it tough, ensuring the Fed’s independence stays intact—because if Presidents could toss out the Chair like a bad date, we'd be looking at a U.S. economy with all the stability of a banana republic.

In a nutshell, the President can’t just fire the FED Chair without a solid reason, and that’s by design to protect the FED’s independence. After all, monetary policy should be about economic stability, not political whim. A common myth is that central banks control interest rates, but history shows otherwise. Back in 1927, Europe convinced the NY FED to lower rates to curb capital inflows, but that backfired. Over the next couple of years, the FED adjusted rates multiple times, but despite their efforts, the economy crashed into the Great Depression. This proves that even the Fed can’t control the market's natural ebb and flowrates rise and fall based on real demand, not just central bank tweaks.

The Federal Reserve, the ultimate financial rock star, manages to fund itself through interest on government securities and payment processing—basically, it’s like a rich uncle who doesn’t need to ask for money but still spends it on fancy new digs. No need to bother Congress for approval—because, hey, public funds are the real sponsor here. The FED’s got its own swag, building luxury headquarters while running programs like the Main Street Lending Program and buying state debt without it even touching the national debt. It's like they're hosting an open bar while Congress is still trying to figure out who’s paying the tab. Unlike the Bank of Japan or the ECB, which are more like public institutions, the FED runs like a quasi-private club, handing 90% of its profits to the US Treasury (because, why not?). That’s why it’s essential to keep the Fed independent. Nobody wouldn’t want Congress having a say in monetary and fiscal policy at the same time—they’d probably make it rain to win the next election. Just look at Turkey—a central bank controlled by politicians is like letting a toddler run the candy store.

https://www.federalreserve.gov/aboutthefed/files/combinedfinstmt2024.pdf

In classic Trump fashion, he flip-flopped again, saying he had no intention of firing FED Chair Jerome Powell—despite his earlier claim that he'd boot him "real fast" if he wanted to. Maybe Trump realized, as we all know, the president doesn't actually have that power. White House economic advisor Kevin Hassett even floated the idea of finding loopholes to fire Powell. Meanwhile, Powell, appointed by Trump, has been caught in the crossfire of presidents pushing their fiscal agendas on the FED. Trump’s been begging Powell to lower rates have already flopped. Powell, probably eyeing his retirement in 2026, isn’t likely to cave to pressure. But while Trump can’t fire Powell, he can appoint the next one, and Kevin Warsh, Art Laffer, and Larry Kudlow are all in the mix. Warsh, the hawk on inflation who’s never exactly been a fan of Trump’s FED ideas, could be the front-runner. Fun fact: Warsh was part of the crew that let Lehman Brothers fail, causing global panic, and he’s still convinced the FED’s policies were a big part of the mess.

https://en.wikipedia.org/wiki/Kevin_Warsh

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/independent-but-impotent-the-fed

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.