Cashing In On Face-Ripping Rallies

Rethinking Bear Market Rally Strategy

In yesterday's post ("Is This Still A Bear Market Rally?"), we mentioned why that question mattered:

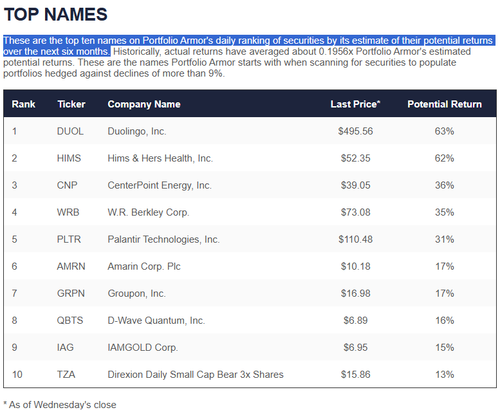

We've got a source of alpha that works well during market rallies: Portfolio Armor's top ten names. Since December of 2022, our weekly top ten names have averaged returns of 17.03% over the next six months, versus 10.75% for the SPDR S&P 500 Trust (SPY). If this is a new bull market, it makes sense to start buying those top names again now, or placing bullish options trades on them. But if this is a bear market rally, it makes sense to wait.

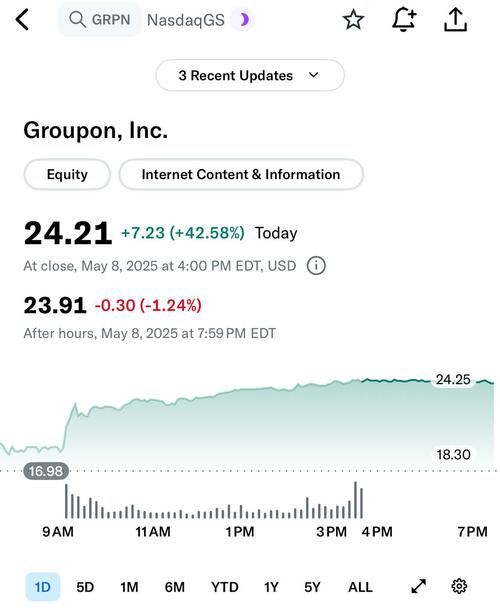

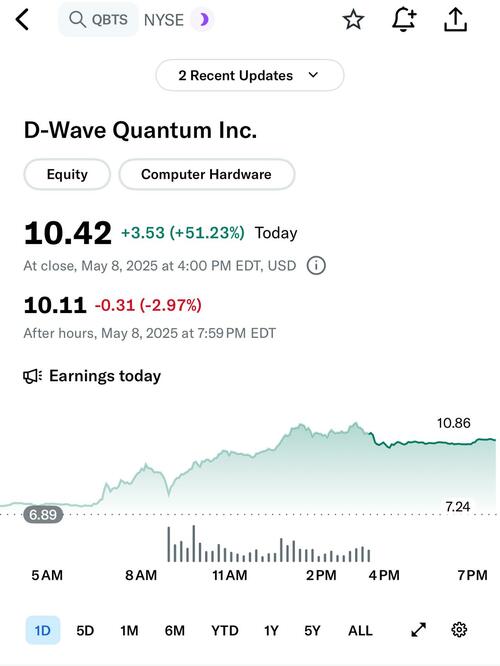

What happened on Thursday prompted us to rethink that. Two of Portfolio Armor's top ten names from earlier in the week, Groupon (GRPN) and D-Wave Quantum (QBTS)...

...Exploded higher on the day, up ~42% and ~51%, respectively. Both moves were tied to near-term catalysts: earnings reports.

Here’s what their charts looked like:

These weren’t lottery ticket plays. These were data-driven selections by the Portfolio Armor system, combined with catalysts.

Which brings us to a tactical update.

From Avoidance to Precision

If we are in a bear market rally—and signs still point that way—then broad, passive exposure is a blunt instrument. What we need instead is precision exposure: to names flagged by the model and poised to move on identifiable catalysts.

So, the revised approach:

🔍 Buy call options on top-ranked names from the Portfolio Armor system that have near-term catalysts, like earnings.

⏳ Time the entry in the days leading up to the catalyst, and select expirations a few weeks out to absorb IV crush and capture any momentum continuation.

This is key: we’re not chasing the move after earnings—we’re positioning for it ahead of time, using the system’s statistical edge to identify names likely to outperform, and catalysts as accelerants.

We had success with trading our top names during the bull market. It's time to apply it to the bear market rally.

Managing Volatility and Risk

Implied volatility tends to rise into events and collapse immediately afterward—a phenomenon known as IV crush. That’s what punishes short-term call buyers who target weekly expiries.

To reduce that damage, the answer isn’t avoiding the event—it’s buying a little time. Choosing expiries 2–3 weeks past the catalyst lets you:

Hold through the event without binary pressure, and

Potentially ride post-event continuation, if the name trends as it did with GRPN and QBTS.

This isn’t about gaming volatility—it’s about giving the trade room to work.

Why This Works—Even in a Bear Market Rally

Bear market rallies are notorious for their fragility. Breadth is thin. Participation is uneven. But that’s exactly why this works: the moves that do happen tend to be violent, especially when sparked by strong catalysts.

GRPN and QBTS weren’t just good picks—they were correctly timed good picks. The Portfolio Armor system surfaced them, but it was the earnings schedule that amplified the opportunity.

It’s not enough to know what names have edge—you need to know when that edge is likely to express itself.

From Passive to Surgical

Thursday’s action served as a reminder: even in a cautious market, there are trades worth taking. Not in bulk. Not indiscriminately. But selectively, where signal meets narrative.

This revised playbook doesn’t abandon caution—it refines it.

We’ll continue watching for top Portfolio Armor names with near-term events—earnings, guidance, product news. And we’ll be using options—not stock—to target those asymmetric bursts, minimizing downside while preserving explosive upside.

It’s not about ignoring the macro. It’s about executing tactically within it.

If you want a heads up when we place our next top names trade, you can subscribe to our trading Substack/occasional email list below.

And if you want to try your hand at trading our top names yourself, you can access them updated daily on our website and our iPhone app. You can download our app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).