Russia’s Gold Hedge Profits $96 Billion, Offsets Asset Freeze

Russia’s Gold Strategy Offsets Sanctions Freeze

Authored by GoldFix, ZH Edit

Two of the concepts championed at Goldfix for years have been vindicated:

Even so, the world still does not (or cannot) admit that the USD is being challenged, and that Gold, hated for decades, is actually keeping the world together right now. Presently, the empirical evidence is proving the concepts true by no less a journalistic stalwart as Bloomberg. Here is our write up of that news item sans paywall.

Bottom Line

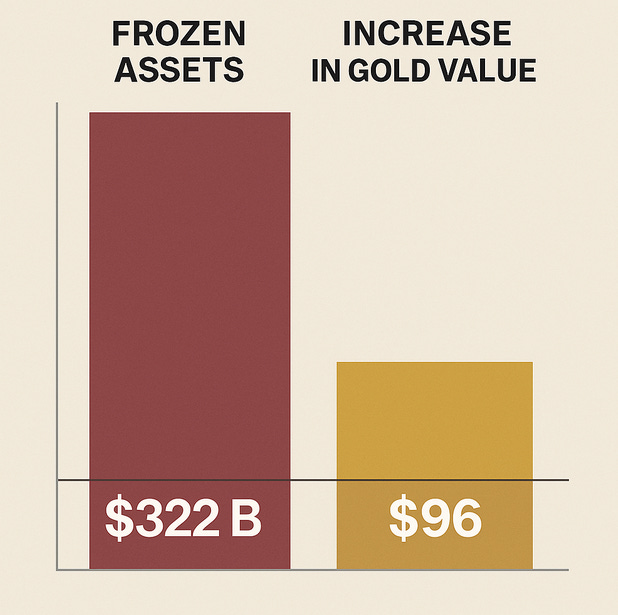

Russia’s longstanding accumulation of gold has become a strategic buffer against Western sanctions, offsetting nearly one-third of the central bank’s frozen reserves. Despite holding steady at around 75 million ounces since 2020, the surge in global gold prices has boosted the value of Russia’s gold by $96 billion since 2022. With over $229 billion in bullion, Russia now ranks among the top five global reserve holders. While gold remains less liquid than other assets, rising global demand strengthens its utility in a crisis. The strategy reflects a broader pivot away from Western financial exposure and toward monetary self-reliance.

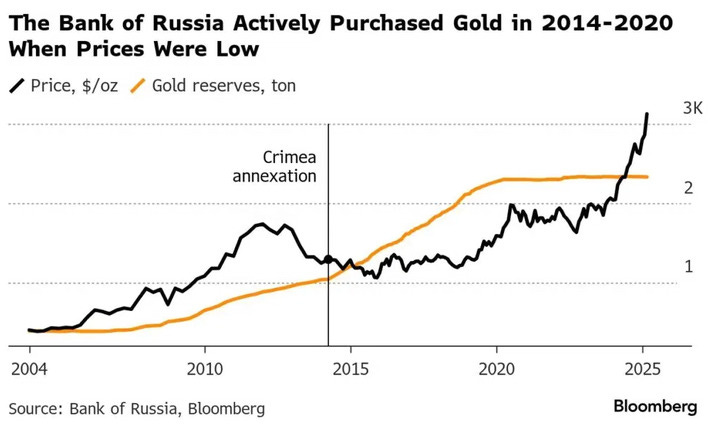

Strategic Gold Accumulation: From Crimea to Conflict

The current value of Russia’s gold stockpile reflects not a recent acquisition, but the product of a calculated accumulation strategy initiated in 2014 following the annexation of Crimea. In response to initial sanctions and removal from the G8, the Bank of Russia began diverting reserve growth into physical bullion. Between 2014 and 2020—when gold traded between $1,100 and $1,500 per ounce—it increased holdings by approximately 40 million ounces.

This reserve pivot has yielded a 72% surge in gold valuation since early 2022, according to Bank of Russia data. Though the physical quantity remains near 75 million ounces, the monetary value of these holdings has climbed by $96 billion. As of April 1, Russia’s total international reserves stood just shy of $650 billion.

A Hedge that Worked

The strategic rationale was threefold, as summarized by Bloomberg Economics’ Alex Isakov:

- Diversify reserves away from dollar, euro, and sterling risk.

- Bolster ruble liquidity via domestic bullion exchange.

- Support domestic gold producers with predictable demand.

In practice, the diversification has delivered. With roughly $322 billion of Russia’s foreign currency reserves frozen abroad following the 2022 Ukraine invasion, the appreciation of gold provides a partial offset—covering nearly one-third of the blocked funds.

Liquidity in a Geopolitical Bind

Still, selling appears unlikely. The Bank of Russia, constrained by sanctions and wary of counterpart risk, indicated in its March annual report that investment opportunities in foreign markets remain limited due to “risks inherent in their economies, currencies and financial markets.” For now, gold is to be held—not deployed.

The Golden Yuan Rises

Post-invasion, Russia’s central bank ceased disclosing the composition of its foreign reserves. But previous disclosures and Bloomberg analysis suggest a bifurcated structure: approximately half in Western currencies (now blocked), and the remainder in yuan and gold—both accessible.

Renaissance Capital’s Oleg Kuzmin confirms as much:

“There is no need to spend reserves now. The Bank of Russia has enough liquidity in yuan in case of any shocks.”

In this context, the yuan serves as transactional liquidity while gold functions as deep reserve collateral.

Bullion’s Bull Run and What It Means

Gold’s recent rally has compounded Russia’s strategic advantage. Since end-2022, gold has returns well above most asset classes.