Mag 7 Encroachment and Tech Dominance

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Mag 7 Encroachment

We have written in the past about Mag 7 encroaching on each others’ businesses and competing directly against each other. This will be a major theme in the coming years as addressable markets are becoming too small to sustain the hypergrowth of these juggernauts. Another domino fell this week as Apple expects to one day replace Google Search with AI Search on its Safari browser.

In the future, Apple could offer multiple options like ChatGPT, Perplexity, and Claude instead of defaulting to Google. Potentially even their own “Apple Intelligence” search. It is absolutely in Apple’s interests to absorb Search because of the wealth of data it provides but also to create a holistic “AI agent” experience to users. The economic benefit that accrues to the dominant search provider is vast, as Google has proved, and Apple does not want to miss that party again in the AI era.

This is a big deal for Google since its Search is a de facto monopoly on the internet. Now, it is being replaced by AI, and since AI is becoming commoditized, that means Search is becoming commoditized. And it is no secret that people are making a habit of asking AI instead of Google for everyday searches. The only way for Google to retain their dominance is to expand their suite of Android devices (notably wearables like AR/VR, glasses, etc) but they are trailing in this regard as well.

Longer term, expect more encroachment and more competition. The next battlegrounds are VR glasses, semiconductors, vehicles, healthcare, and possibly banking. Coincidentally, Apple announced this week they are attacking smart glasses, in competition against Meta’s wildly successful Ray-Ban glasses. Note also that profit margins for these frontier markets are likely to be slimmer than the existing businesses. The era of peak profitability for Mag 7 may well be behind us.

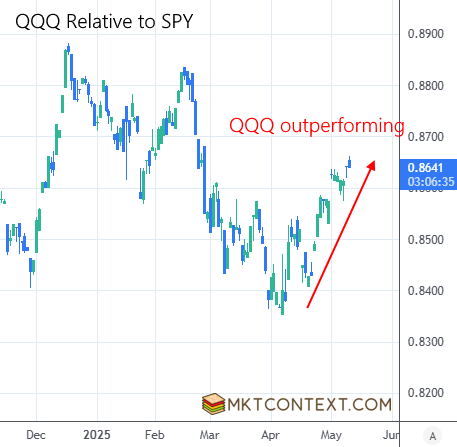

Tech stocks still outperforming

Since the market bottom on Apr 7, QQQ has outperformed SPY. The tech sector has been ripe for recovery given the deep selloff in Mag 7, software, and semi stocks. Software in particular has rebounded strongly on the back of resilient earnings (witness MSFT gapping up 9% on Q3 earnings). We are overweight in QQQ which has been adding alpha to the portfolio.

On the other hand, small cap stocks (Russell 2000 or IWM) continue to trail the broader market, as expected. As we wrote in Jan, small caps need a strong economic growth impulse to start rebounding, and right now the economy is not in a state to deliver that outcome. From a technical perspective, there could be an oversold bounce at these levels, but we wouldn’t hold our breaths.

And as we predicted, international stock markets are starting to falter as the US bounces back from oversold levels. Optimism on European fiscal impulse is giving way to concerns about timing and execution. As the Bank of England demonstrated, those economies are starting to feel the heat from trade disruption and uncertainty. We continue to think that the US is the best place for investment, but the market has not yet come to the same conclusion as they are worried about geopolitical risk from Trump policies.

To see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!