Stars, Stripes, & Soaring Debt

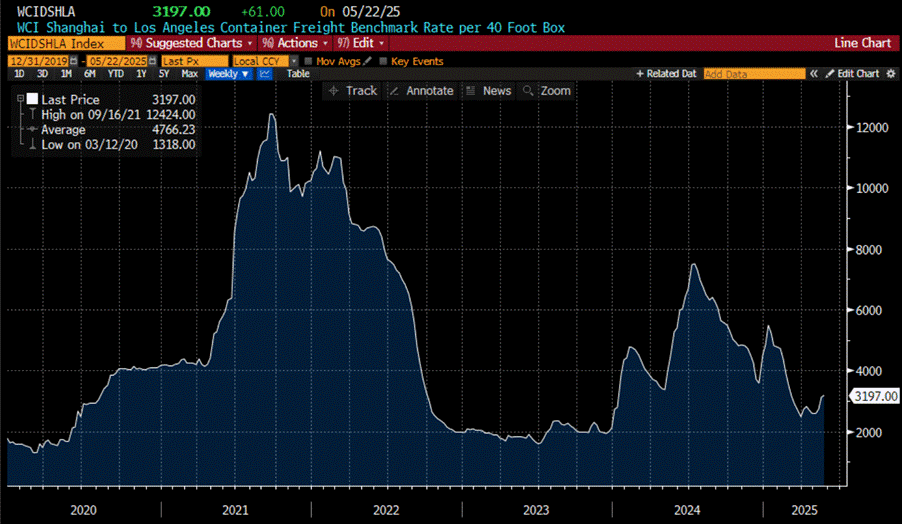

After calling a timeout in the trade war with China during a lakeside retreat by Lake Geneva—because nothing says diplomacy like overpriced fondue and passive-aggressive stares—the self-proclaimed ‘Treasurer in Chief’ spent the weekend spinning a tale that China had totally lost the trade war. Meanwhile, reality suggested otherwise: the U.S. President was practically bowing to Xi Jinping, perhaps after realizing that with global shipping grinding to a halt, Walmart shelves will soon start to look like a Soviet supermarket, and July 4th fireworks might resemble the pyrotechnic enthusiasm of Pyongyang on a budget.

WCI Shanghai to Los Angeles Container Freight Benchmark Rate per 40 Foot Box.

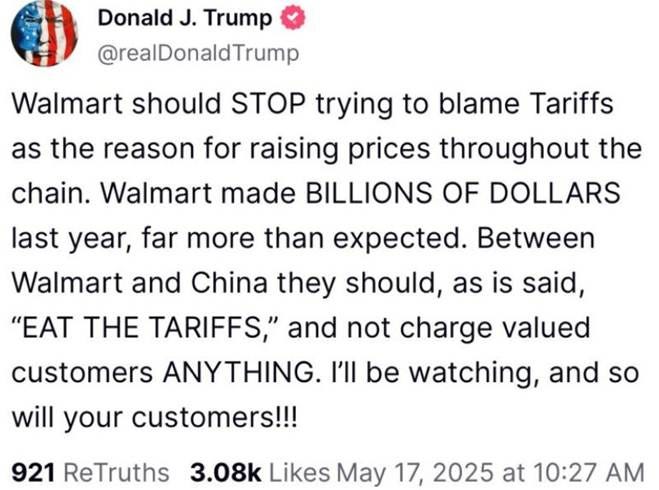

Anyone with a pulse and a basic grasp of economics knows tariffs are just taxes wearing a fake moustache—someone always pays, whether it’s the producer or the poor soul buying the product. But when producers can’t hike prices and the “Manipulator-in-Chief” decides to slap on price controls like a 1970s flashback, you’ve got to ask: is the U.S. auditioning for a guest role as Venezuela? Because last time we checked, price controls don’t create economic miracles—they create empty shelves, rationing, and a booming black market. And just when you think it can’t get worse, public confidence evaporates, prices skyrocket anyway, and suddenly everyone's nostalgic for when inflation only ruined your lunch bill.

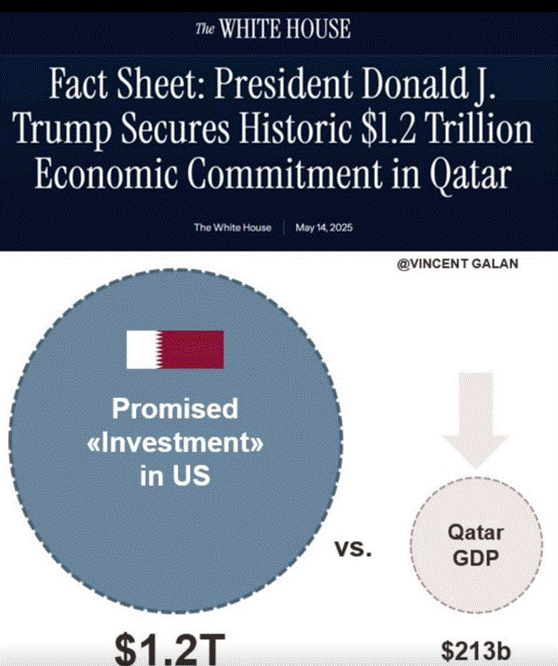

Fresh off his diplomatic smoke show, the ‘Disruptor-in-Chief’ jetted to the Middle East, where he was gifted a $400 million second-hand jet—an upgrade to Air Force One, since Boeing’s been too busy with DEI checklists to build new planes. The highlight? A straight-faced claim that Qatar, with a GDP of $213 billion, will invest $1.2 trillion in the U.S. economy. Yes, you read that right. Either Qatar just discovered a vault of magic oil, or someone’s been borrowing economic math from the Hogwarts School of Fiscal Wizardry.

On May 12th, while the usual ‘Cokeheads’ suspects from the European Union were busy squandering yet another chance at peace in Istanbul—presumably in search of the perfect false flag to kick off World War III and extend their Malthusian-Keynesian reign, on the other side of the pond, the House GOP quietly dropped the draft of “One Big Beautiful Bill.” It’s a legislative buffet combining tax cuts, immigration reform, and just about every domestic agenda item into one oversized reconciliation sandwich.

Highlights include a 5% remittance tax to fund border security (complete with a refundable credit if you're a “verified” American), a rollback of Biden’s green tax credits (sorry solar panels, hydrogen dreams), and a tip-friendly tax deduction—assuming both you and your spouse have Social Security numbers and aren’t in an “untraditional” industry. Because nothing says “working class support” like a maze of red tape.

The bill also resuscitates Trump-era tax goodies—like higher estate exemptions and a modified SALT cap sure to annoy blue-state Republicans—while axing deductions for casualty losses, moving expenses, and other “miscellaneous luxuries” like living in a high-cost state. Other gems: a $4 trillion debt ceiling hike, tax-exempt MAGA accounts for kids, and an IRS crackdown that punishes leaks more harshly than fraud.

And yet, while the 47th president continues to campaign on slashing spending and debt—with the help of his Orwellian-sounding “Department of Government Efficiency”—the U.S. debt hasn’t budged an inch since January 20th. Not because spending stopped, but because Uncle Sam hit the debt ceiling 122 days ago and can't legally borrow a dime.

https://www.scribd.com/document/860741541/SMITMO-017-xml#download&from_embed

Behind the curtain, while the ‘Trade-in-Chief’ made headlines for flip-flopping on “liberation tariffs” that are supposed to Make America Great Again—but instead triggered a full-blown tariff tantrum on Wall Street—the ‘Treasurer In Chief’ has been quietly working its own magic act. The goal? Rebrand Treasuries, once known as the ultimate “risk-free” asset, now suspiciously risk-adjacent, and convince banks—and by extension, “We the People”—to keep trusting a wobbling financial system.

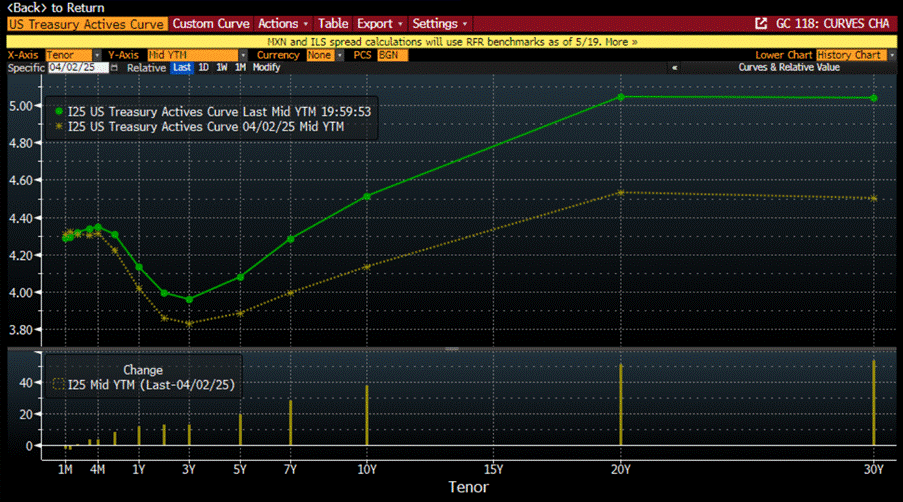

One of the latest tricks? A regulatory sleight-of-hand to carve out Treasuries from bank liquidity requirements, making them appear more desirable without actually reducing the risk. But reality, as always, ruins the illusion: since the so-called ‘Liberation Day’ announcement, long-term U.S. yields have marched 20 to 45 basis points higher across the 5- to 30-year curve. So much for market confidence.

US Yield Curve as of April 2nd 2025 (yellow line); May 26th 2025 (green line).

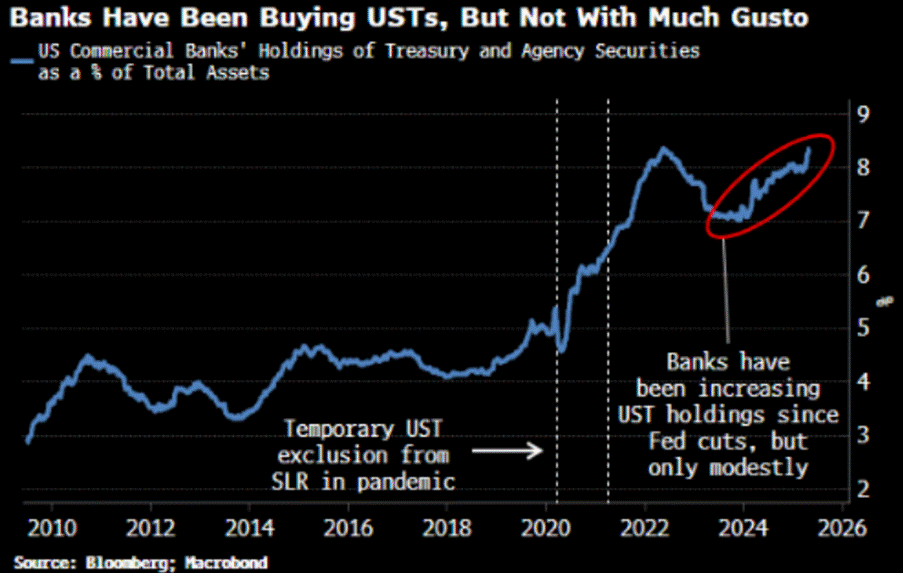

While everyone was watching the Istanbul Kabuki theatre, the real financial theatre was in Washington, where the U.S. Treasury pulled out its latest trick: lobbying to exempt Treasuries from the Supplementary Leverage Ratio (SLR)—because nothing says “risk-free” like begging regulators to pretend risk doesn’t exist. The SLR counts Treasuries in the denominator, making them less appealing for banks to hoard. So now, everyone from SIFMA to the ‘Central Banker In Chief’ is singing the same tune: ‘Let banks buy more Treasuries without penalty!’ Even House Republicans joined the chorus, suddenly discovering their love for ‘a highly liquid Treasury market.’ But here’s the punchline: for banks to really move the needle, they’d need to hold Treasuries like it’s 1972 again—back when bell-bottoms were cool and banking was still boring.

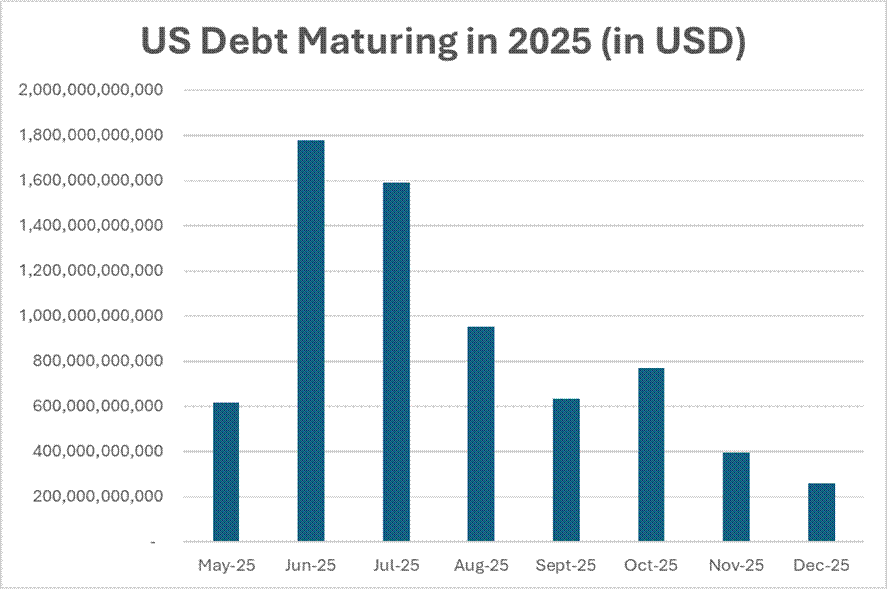

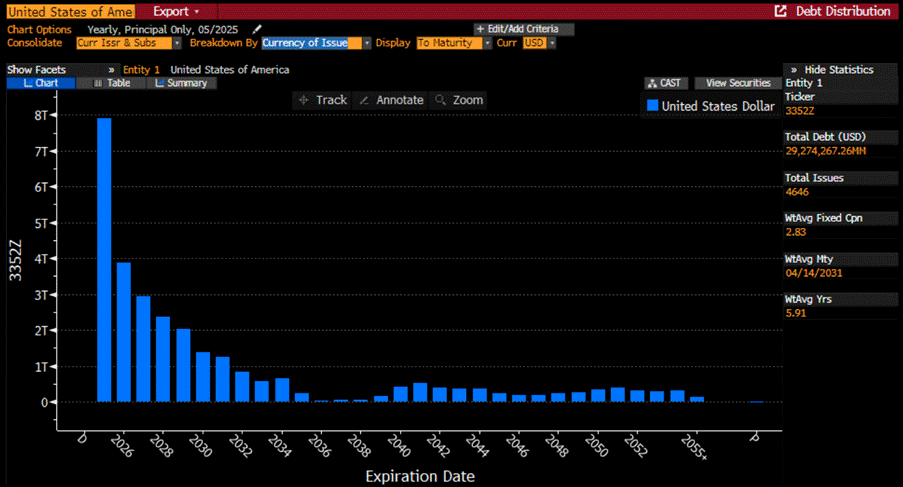

Regulatory smoke and mirrors might buy the U.S. government some breathing room, but savvy investors—those who’ve muted Twitter drama and ditched FOMO—know the real headache: refinancing a whopping $7.9 trillion in debt maturing before the Jubilee year’s end. The kicker? Nearly half of that, about $3.36 trillion, needs a summer makeover in June and July. If that rollout gets messy, we might be in for a fireworks show nobody asked for.

Needless to say, that’s just the opening act—another $29.3 trillion is waiting in the wings after the Jubilee year, assuming the U.S. government manages to actually deliver a fiscal budget in surplus later this year and beyond.

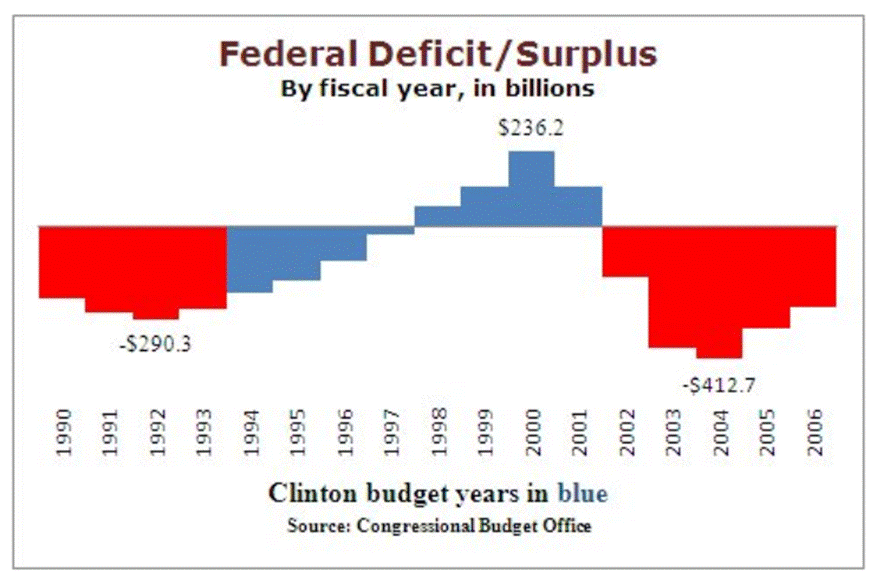

To put this fiscal miracle in historical context: it hasn’t happened since 2000, back when the Clinton administration rode the wave of strong economic growth, a booming stock market, and fat tax revenues—especially from capital gains and income taxes. Since then, the U.S. has been in the red every year, thanks to tax cuts, costly wars, the 2008 financial crisis, and, of course, the COVID-19 chaos.

https://www.factcheck.org/2008/02/the-budget-and-deficit-under-clinton/

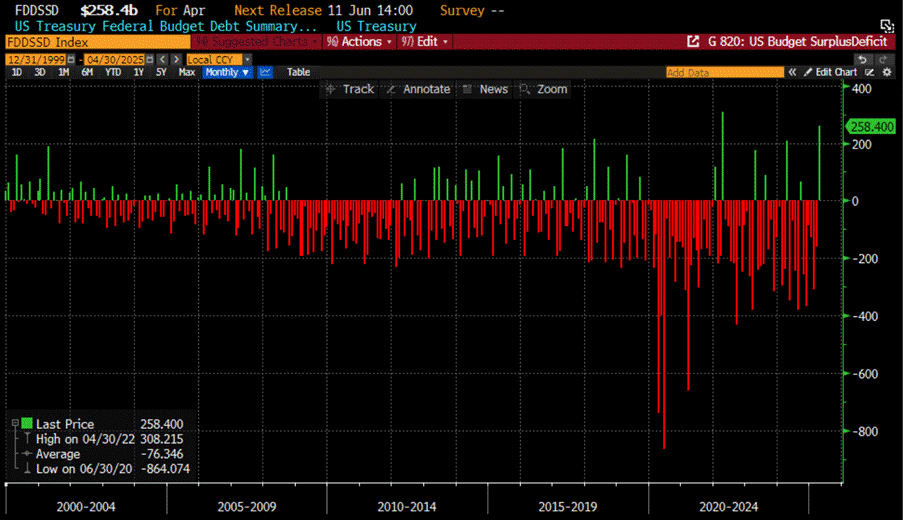

On the bright side—though not exactly from any belt-tightening by Uncle Sam—the Treasury’s end-of-April refunding threw investors a curveball: a $53 billion lower funding need than February’s gloomy forecast. We joked it meant “DOGE is working,” because, shocker, the U.S. actually needs less cash than expected. For a market used to Biden’s debt-fuelled, drunken sailor spending spree, this news was like finding a sober sailor on deck—yields dropped as investors realized less debt means less borrowing for the world’s most indebted government. The real kicker? The latest Treasury Monthly Statement showed a surprise surplus instead of the usual deficit. Yep, the U.S. actually brought in more than it spent and it was the second biggest monthly budget surplus since 2000.

US Budget Surplus (green histogram); Deficit (red histogram).

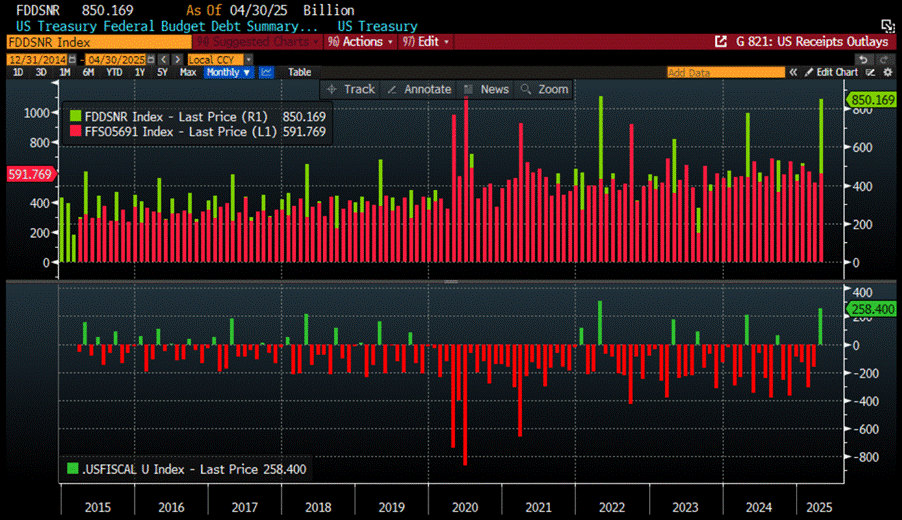

US surpluses are about as common as a polite Twitter debate—but April plays guest star, thanks to a tax windfall that briefly covers up the government’s never-ending spending spree. This April? Same story: the U.S. blew through $592 billion (more than March’s $528 billion and last year’s $567 billion), with a not-so-glamorous cameo—over $100 billion went straight to interest on the whopping $37 trillion debt, for the second month running. Meanwhile, Treasury’s tax haul swooped in like a superhero, pulling in a staggering $850 billion—just shy of April 2022’s record $864 billion—keeping the budget circus from tipping over.

Upper Panel: US Treasury Federal Budget Net Receipt (green histogram); US Treasury Federal Budget Total Outlays (red histogram); Lower Panel: US Net Fiscal Budget (Receipt-Outlays).

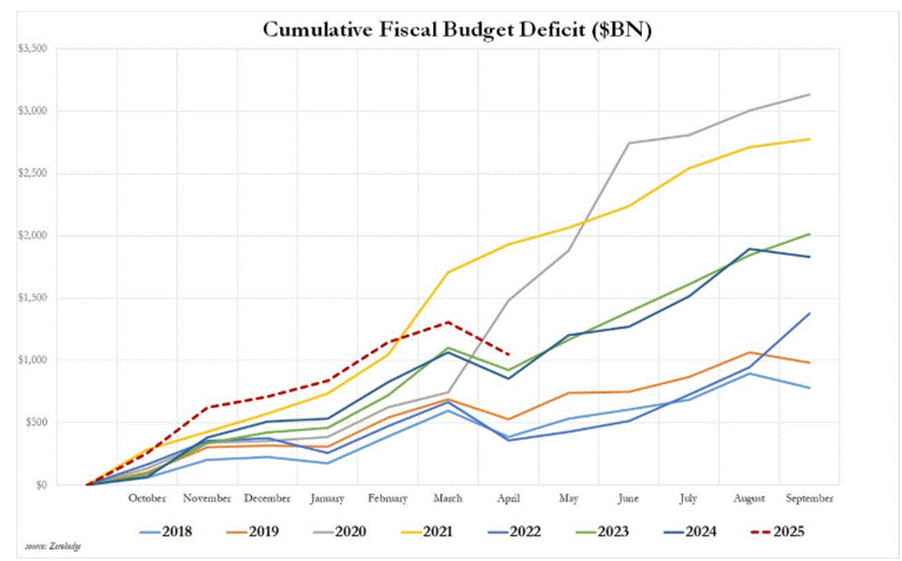

The surprise tax windfall and rare April surplus gave the fiscal 2025 deficit a much-needed makeover. Just four months ago, back in January—Biden’s final budgetary mic drop—the U.S. had already torched a record $840 billion, seemingly on track to smash all deficit records. But then came March, with an unexpected bout of restraint, followed by April’s tax tsunami. The result? The seven-month deficit actually improved (yes, really), ticking up to just $1.049 trillion—down from $1.037 trillion in March and running below the blowout pace of both 2021 and 2024.

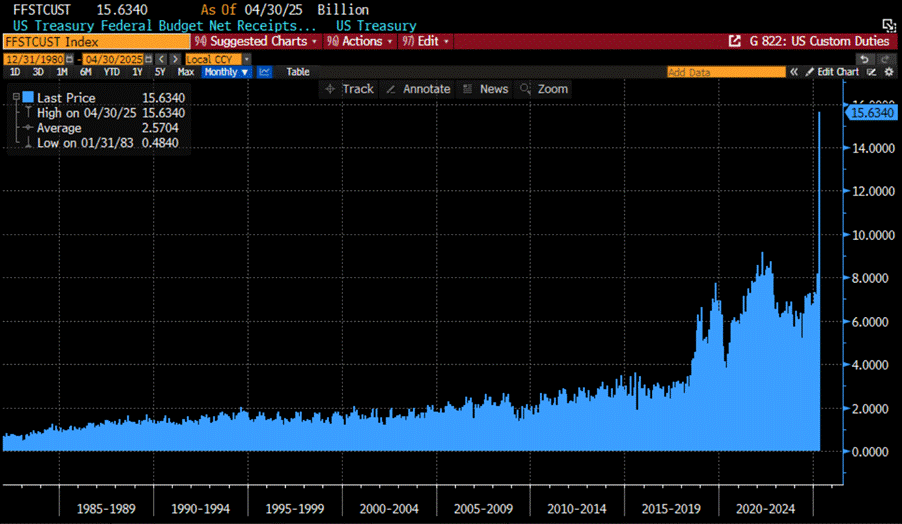

While the April surplus was mostly fuelled by a juicy tax haul—primarily capital gains, which might not repeat unless the S&P pulls off a year-end moonshot—there was another spicy contributor: tariffs. Yes, those Trump-era trade war specials are already doing some heavy lifting. In fact, Customs Duties doubled in April, jumping from $8.2 billion in March to a record-smashing $15.6 billion. Call it the “Art of the Tariff”—one more reason April felt like budget Christmas in D.C.

US Monthly Customs Duties.

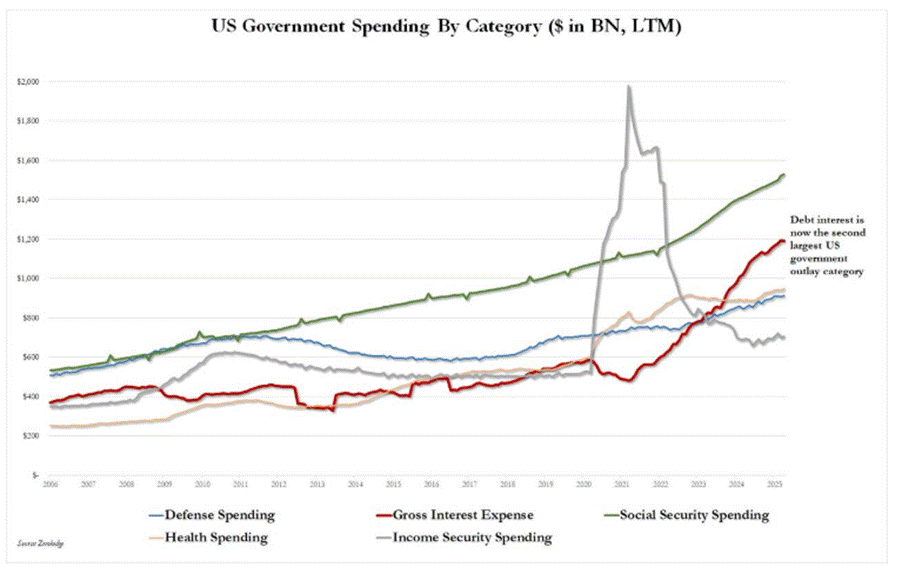

While April’s tax windfall was a welcome surprise and Trump’s early months brought a glimmer of fiscal hope, the broader picture still looks like a budgetary horror film on loop. The U.S. debt machine is chewing through $1.2 trillion a year in interest alone—just $300 billion shy of overtaking Social Security as the nation’s biggest expense. Worse, all five major spending categories are ballooning faster than revenue, and unless something drastic happens, the math simply doesn’t work.

Trump may be the only one bold (or crazy) enough to try rewiring the fiscal death trap, but as we’ve seen, every attempt at breaking the status quo is met with bipartisan pitchforks. And while DOGE might be barking up the right tree, its wins are pennies in a system bleeding trillions. Without serious reform—and some political spine—the U.S. fiscal path is less “sustainable recovery” and more “rollercoaster with no brakes.”

That said, Treasuries may be in for another rough ride—this time courtesy of tariff-driven inflation. Even if temporary, higher tariffs act like garlic to a vampire when it comes to attracting foreign buyers of U.S. debt. And while the public is busy digesting the administration’s daily buffet of headlines, the big picture is getting blurrier.

Sure, a 90-day ceasefire was signed with the Chinese—and with the rest of the world under different terms—but tariffs are still creeping toward levels not seen since the 1940s. Add to that the political fireworks of the administration’s early days—memorable, if not forgivable—and global investors are understandably wary.

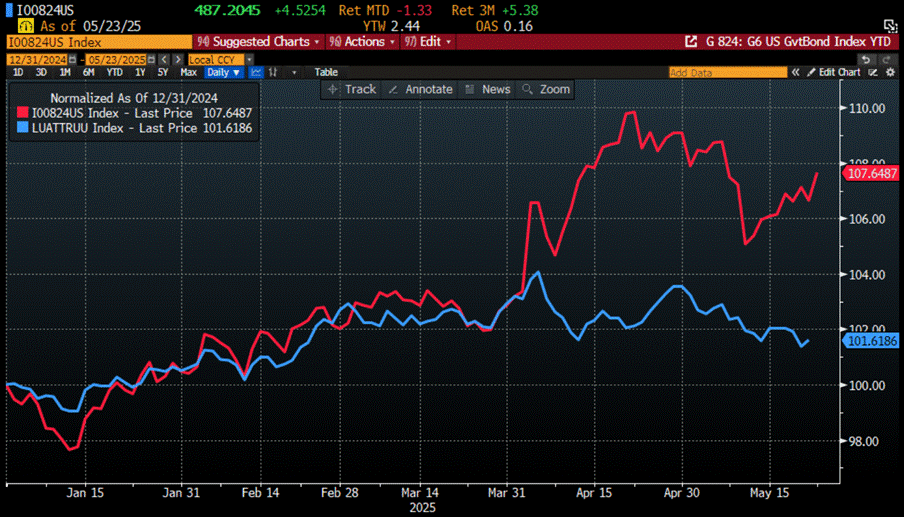

De-dollarization isn’t just a buzzword anymore. Reserve managers were already cooling on the greenback before COVID, and the weaponization of USD assets after the Russia-Ukraine war only accelerated the trend. Floating ideas like a Mar-a-Lago accord, 100-year bonds, or even a “user fee” to hold Treasuries hasn’t helped calm nerves either. No wonder U.S. bonds have lagged their G7 peers since April. It’s hard to sell “risk-free” when you keep changing the fine print.

Performance of $100 invested in Bloomberg US Treasury Index (blue line); Bloomberg G6 (G7 excluding US) Government Bond Index (red line) since 30th December 2024.

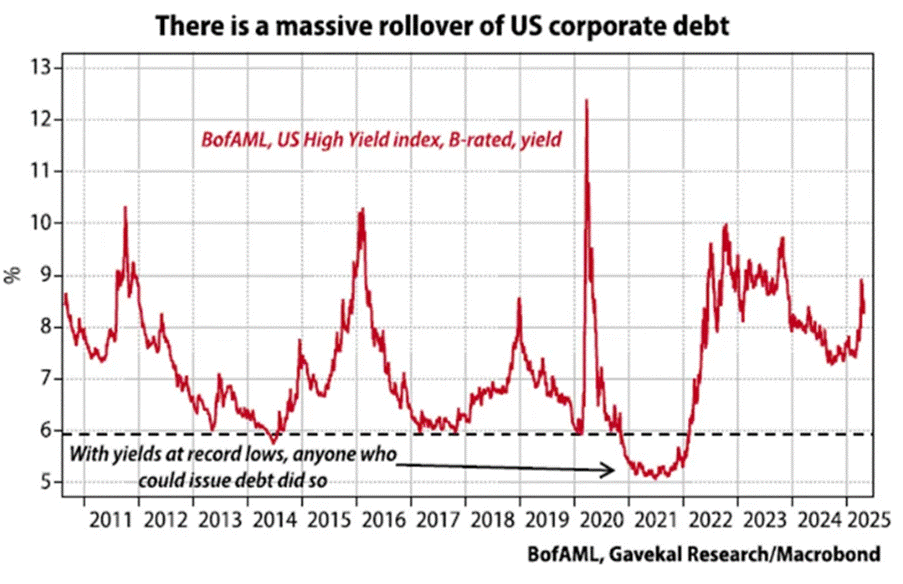

It's not just Uncle Sam sweating over a debt wall — Corporate America’s right there too, staring up the same Everest. One of the big stories in the second half of this not-so-boring Jubilee year will be the record corporate debt rollovers. And no, this isn’t a plot twist — it’s the hangover from the 2020 cheap-money binge, when companies loaded up on debt... then blew it on stock buybacks instead of boring stuff like growth. Now, with yields climbing like Monday headlines, refinancing looks set to hurt. If rates stay high, balance sheets will creak, margins will shrink, and investors will start asking the one question CEOs dread most: “So… what exactly do you do here?

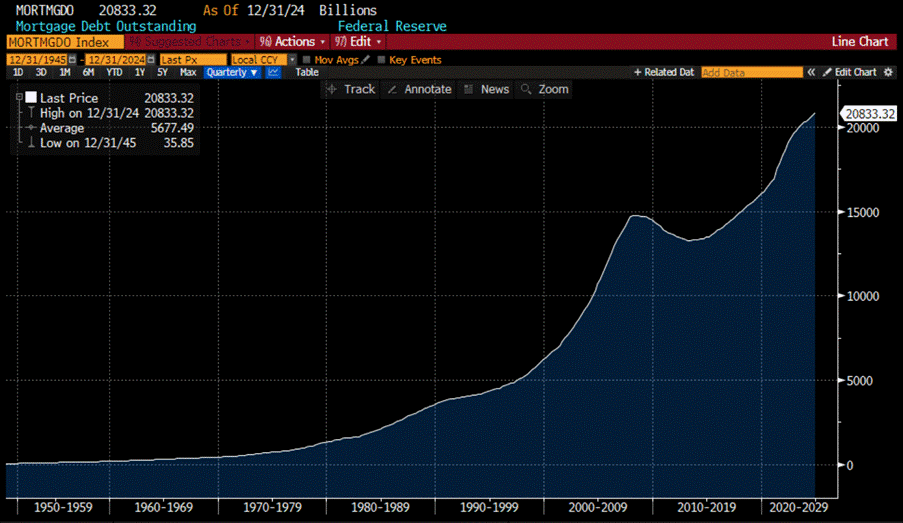

U.S. consumers aren’t far behind Uncle Sam and Corporate America in the debt race. According to a new WalletHub report, national mortgage debt has crossed the $20 trillion mark, with the average household owing $105,000. Blame rising rates and sky-high home prices for turning the American Dream into a 30-year financial commitment. Vermont, of all places, topped the charts with the biggest debt jump—up 2.63% to $208,730 as folks fleeing New York seem happy to swap city stress for Green Mountain mortgages… even if it means bigger bills.

US Mortgage Debt Outstanding since December 1975.

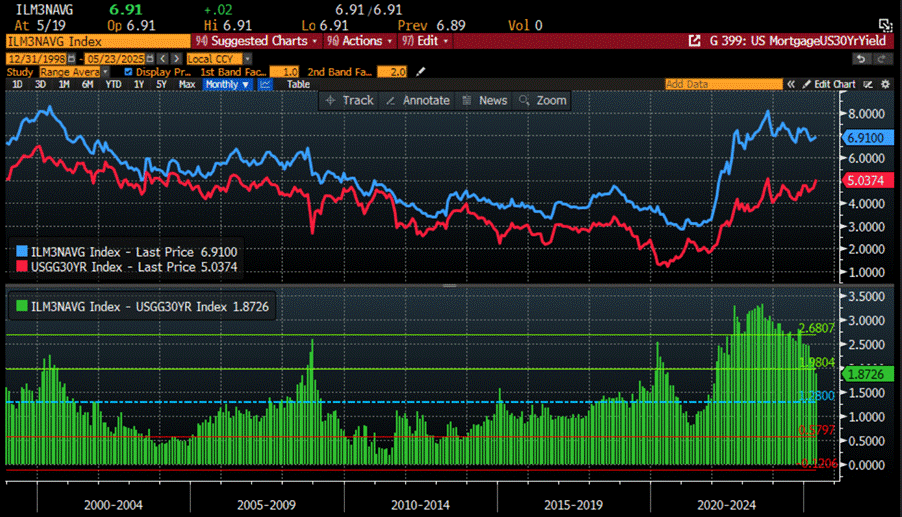

The 30-year fixed mortgage rate is hanging above 6.8%, according to the MBA, but don’t get too comfy—it could hit 7% by year-end or even higher if long dated US yields keep rising.

Upper Panel: US Bankrate 30-Year Mortgage Rates (blue line); US 30-Year Yield (red line); Lower Panel: Spread between US 30-Year Mortgage Rates and US 30-Year Yield (histogram).

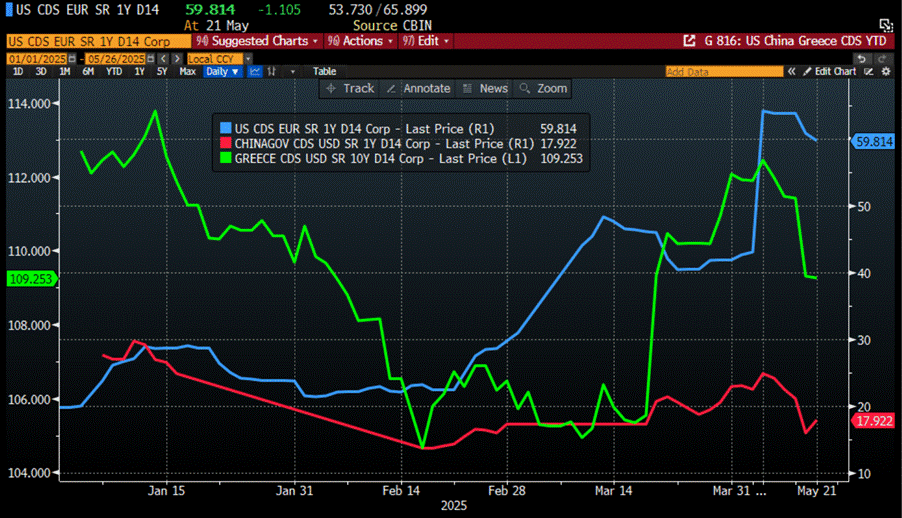

As anyone who trusts market data more than the bedtime stories on social media knows, it’s hardly shocking that short-dated U.S. sovereign CDS spreads have been wider than China’s—and yes, even Greece’s—ever since ‘Liberation Day.’

US 1-Year Sovereign CDS (blue line); China 1-Year CDS (red line); Greece 1-Year CDS (green line) Year To Date.

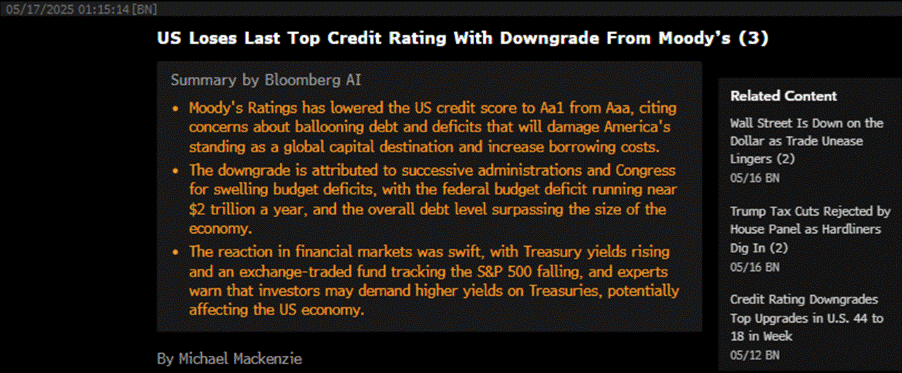

With the debt ceiling’s X-date looming like a sequel nobody wanted, Moody’s finally joined the downgrade party, shaving a notch off Uncle Sam’s credit score. Turns out even Moody’s couldn’t keep handing out AAA gold stars while the U.S. maxed out its 14-zero credit card. Now aligned with S&P and Fitch, Moody’s justified the move by pointing to America’s ballooning debt and interest bill—something most countries below AAA don’t even dream of. Still, they slapped on a “stable” outlook, because hey, the U.S. economy is big, the FED still has a decent batting average, and the dollar remains the world’s favorite addiction at least for now.

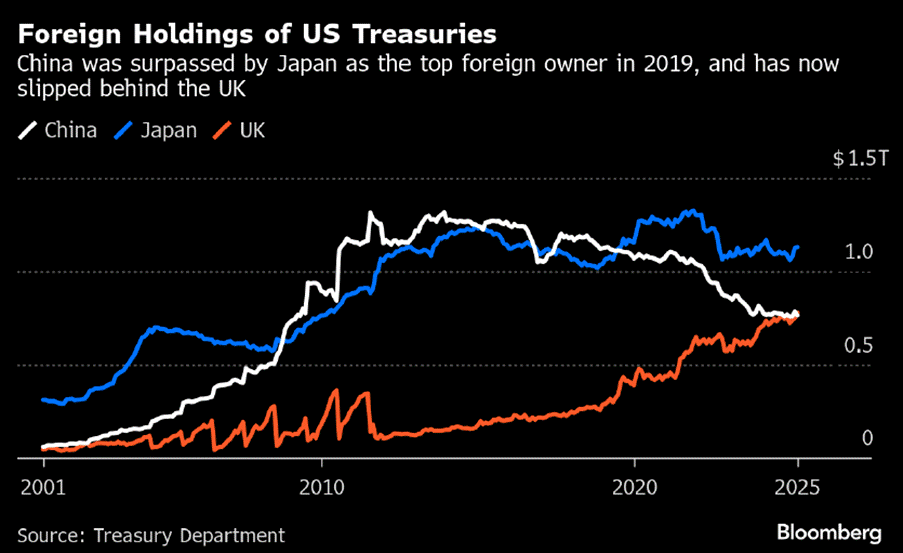

China, which likely understands better than any other country the consequences of a trade war escalating into a capital war—and ultimately a kinetic conflict—has been a structural seller of U.S. Treasuries since 2011. In March, it further reduced its holdings, with the UK overtaking China as the second-largest foreign holder for the first time in over two decades. This shift occurred just before April’s turmoil in the U.S. Treasury market. Meanwhile, foreign demand for Treasuries surged for a second straight month, with total overseas holdings rising by $233.1 billion to a record $9.05 trillion, according to Treasury Department data. China, once the top holder as recently as 2019 before being surpassed by Japan, continues to step back as geopolitical tensions simmer.

While debt keeps piling up like dirty laundry in a frat house, the real question is: how are borrowers planning to scale this Everest of IOUs?

Seasoned investors already know the dirty little secret—no government, anywhere, at any time, under any ideology, has ever seriously planned to pay back its debt. Instead, they’ve mastered the art of borrowing endlessly to fund reckless Keynesian-Malthusian experiments with one ultimate goal: to shrink public freedom and tighten control. How? Through ever-expanding regulations, digital surveillance, and the rollout of Central Bank Digital Currencies (CBDCs)—which are basically “spending trackers” dressed up as innovation.

Students of financial history know there are really only two ways out of a debt trap: default outright (not just for emerging markets—every fallen empire has done it) or take the scenic route via inflation and war. The U.S. seems to be eyeing the latter: turn up the inflation, weaken the dollar, and quietly erode the real value of debt while pretending it’s all under control.

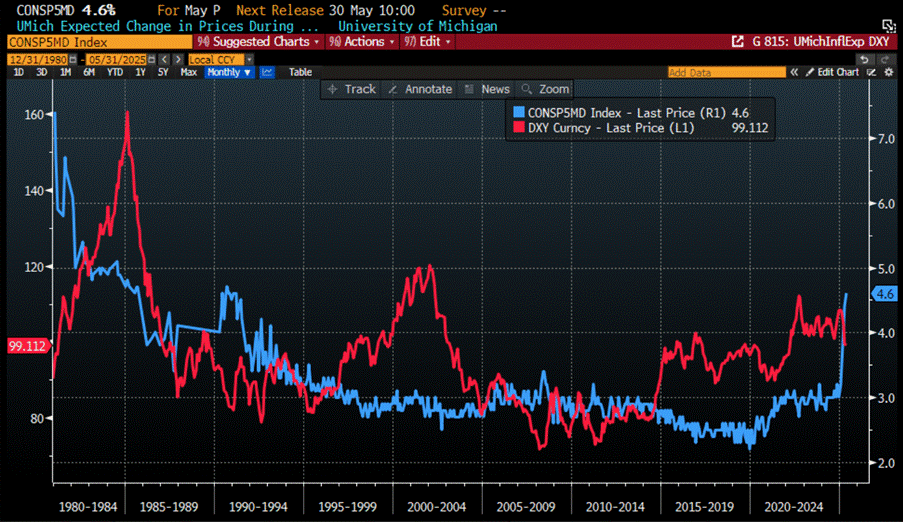

Recent U-turns—keeping Jerome Powell at the FED, softening the tone on China tariffs—have temporarily soothed markets. But the writings on the wall: unless policy clarity returns, we’re heading toward one increasingly unavoidable outcomes—more inflation.

University of Michigan 5-10 Years Consumer Inflation Expectations (blue line); USD Index (DXY Index) (red line).

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/stars-stripes-and-soaring-debt

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.