We've Seen This Market Before and We Know How It Plays Out

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Tariff war repeat

Let’s get Friday’s news out of the way first. Trump announced on Truth Social that if Europe doesn’t settle on a deal soon, he would impose a 50% tariff on the bloc. He also announced a 25% tariff on Apple if they don’t start making iPhones in the US. SPX initially sold off on the news, but recovered throughout the day.

After seeing the tariffs on China play out (i.e. big initial threats to spur action, then walking it back later) markets are now calling Trump’s bluff. Markets have figured out Trump’s pattern, and that he has no intention of keeping tariffs high. He just wants to apply pressure and bring people to the table.

So we saw a tepid response to this announcement compared to the Apr 2 tariff announcement. All of this is well understood. But the bigger worry in our minds is that Trump feels emboldened to act aggressively again now that SPX has recovered to higher levels. Conversely, when the market was selling off, Trump backstopped the market with positive announcements. In options terminology, we call this a strangle.

He did something similar in 2019 during his first term. When the market would recover he’d escalate again. We are now on the high part of the cycle, which means we should expect more anti-cyclical, anti-fiscal, or anti-trade rhetoric in the coming weeks.

Unsustainable US debt... again

US fiscal matters have dominated news headlines again over the past week, as investors continue to grapple with unsustainable future debt levels.

Trump’s One Big Beautiful tax bill passed the House this week. It is expected to make the US deficit even larger, meaning they spend more than they collect in taxes, so they’ll need to issue a lot of debt to fund it. For this reason, Moody’s downgraded the US government’s credit rating.

Investors are seriously worried about the US government’s debt level, so they want higher interest payments to compensate for the risk. The 20-year bond auction on Thurs priced the yield above 5%.

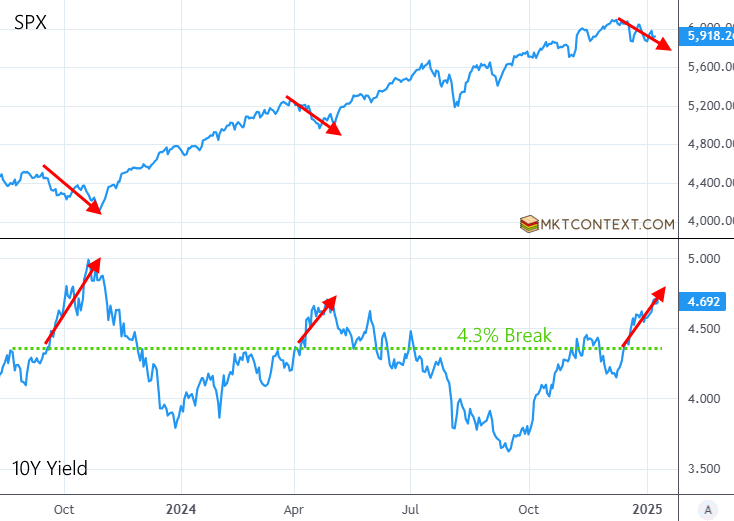

It’s been a while since we showed this chart of 10-year interest rates and SPX. As a reminder, when the 10-year breaks above the 4.3% level, typically equities start to panic. Weds’ auction was no different as the spike in yields sparked a sharp one-day selloff in stocks.

Foreign investors have also shied away from buying US government debt due to political risk, which contributes to higher interest rates. When rates go up, it becomes more expensive for companies and people to borrow money, which can slow down the economy and hurt the stock market.

However, we think this situation is not as scary as it sounds. The US has faced high deficits before and has always managed to pay its debts. The economy is strong, and Treasuries are still seen as one of the safest in the world. While higher interest rates can cause short-term pain for stocks, Trump has tools to manage the debt, such as adjusting spending or raising taxes. They can also run the economy hot to outgrow the debt (something Scott Bessent has suggested).

As we said back in November, one of Trump’s stated goals is to reduce the deficit. DOGE was merely the first attempt, but we think there will be more. Over time, markets will calm down as investors remember that the US is unlikely to default.

Another hated rally and V-shaped recovery

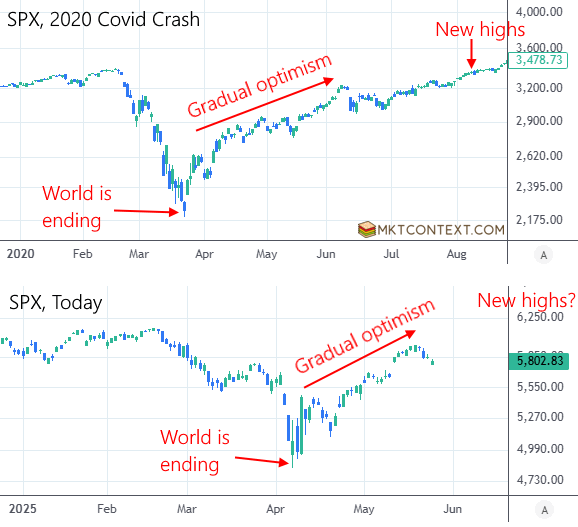

The market is mirroring the 2020 Covid selloff and V-shape recovery. Let’s discuss the similarities because there are useful lessons for us. 2020 was another instance of a “man-made” disaster where the selloff was created with the stroke of a pen (that time, it was lockdowns). The market rapidly priced-in a full blown recession, which caused SPX to drop from all-time highs to down -35%.

Because of the nature of lockdowns, investors hit max pessimism instantaneously. From there, the bad news gradually faded and turned into optimism. Vaccines came to the rescue and the lockdowns were eventually lifted. The market narrative positively shifted to stimulative fiscal support (debt forbearance, direct cash transfers from the government, wage subsidies, added unemployment benefits).

We’re in a similar setup today. Tariffs are a disaster from the stroke of a pen. Instant max pessimism and global recession. We are now in the “gradual optimism” phase as tariffs are lifted and the narrative is shifting positively to fiscal stimulus (tax cuts and deregulation).

Note that in 2020, like today, investors were bearish the entire way up. News media kept calling it “the most hated rally” because people refused to believe the recession was not happening. Eventually we made all-time highs and continued onwards to one of the greatest bull markets in history.

The takeaway: As long as the technicals continue to be supportive of a bull rally, we can ignore the headlines and recession noise, and remain fully invested in stocks as we are now.

To see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!