The GENIUS Stablecoin Playbook

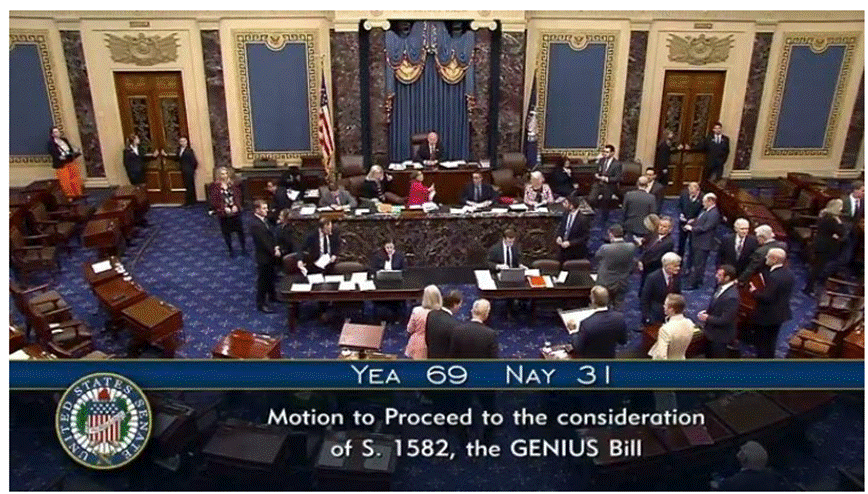

While the ‘Manipulator-in-Chief’ dazzled the masses with his signature propaganda flair—this time starring the ‘Big Beautiful Bill’—and investors threw yet another hissy fit over potential tariffs on the ‘Brussels Warmongers and poor Apple (which, let’s face it, spent the last decade recycling cash into buybacks instead of, say, innovating), the real headline slipped by unnoticed: the U.S. Senate quietly passed the GENIUS Act, giving stablecoins a greenlight for global institutional adoption.

https://cointelegraph.com/news/us-senate-moves-forward-genius-stablecoin-bill

Stripped of the D.C. jargon, the GENIUS Act is Congress’s first attempt at pretending they understand crypto. It's a bipartisan bill (yes, those still exist) aimed at protecting consumers from stablecoin shenanigans by finally giving these digital dollars a rulebook.

Key highlights:

100% backed by cold, hard U.S. dollars and Treasuries (no Dogecoin, no WeWork shares).

Issuers over $50 billion get the joy of annual audits—because nothing says "trust us" like a good spreadsheet.

Monthly reserve disclosures for your bedtime reading pleasure.

No pretending you're backed by Uncle Sam or the FDIC—because you're not.

To avoid another crypto faceplant, the bill bans risky reserves (sorry, corporate bonds), requires actual risk management (novel idea), and tells mega state-regulated issuers to play by federal rules or pack up. In a rare win for the little guy, if a stablecoin blows up, holders get dibs on the reserves—no waiting in line behind lawyers and yacht payments.

https://www.banking.senate.gov/imo/media/doc/genius_fact_sheet_-_consumer_protectionpdf.pdf

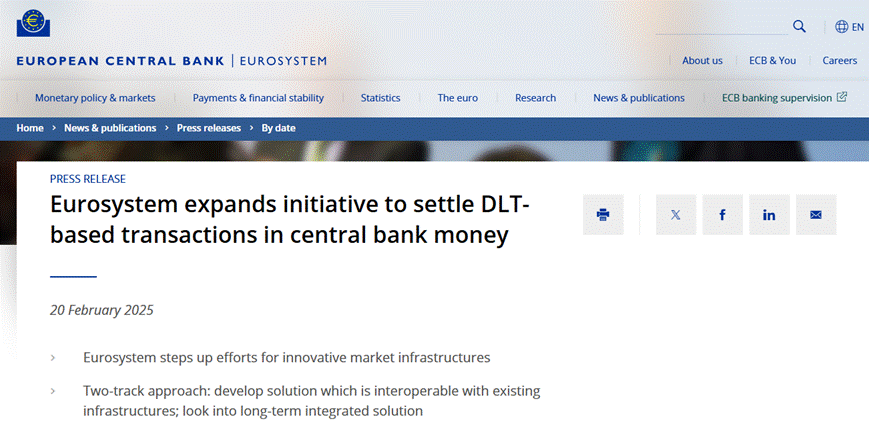

Across the pond, EU technocrats and bureaucrats—ever the visionaries—have been fast-tracking for quite a while a digital euro, not because it's needed, but because the looming war escalation and inevitable eurozone debt crisis might soon require some good old-fashioned capital controls. Convenient timing. The ECB, citing "U.S. progress" (read: excuse), plans to roll out a half-baked, Deutsche Bundesbank-led DLT workaround by October 2025. This is a “quick and dirty” fix—perfect for a system on the brink. The real goal? Shift to full-blown peer-to-peer "atomic settlement," pioneered by France, where your money never sleeps and Big Brother always settles. All in the name of keeping “public money” front and centre—because nothing says financial stability like programmable euros and sovereign debt implosions.

https://www.ecb.europa.eu/press/pr/date/2025/html/ecb.pr250220_1~ce3286f97b.en.html

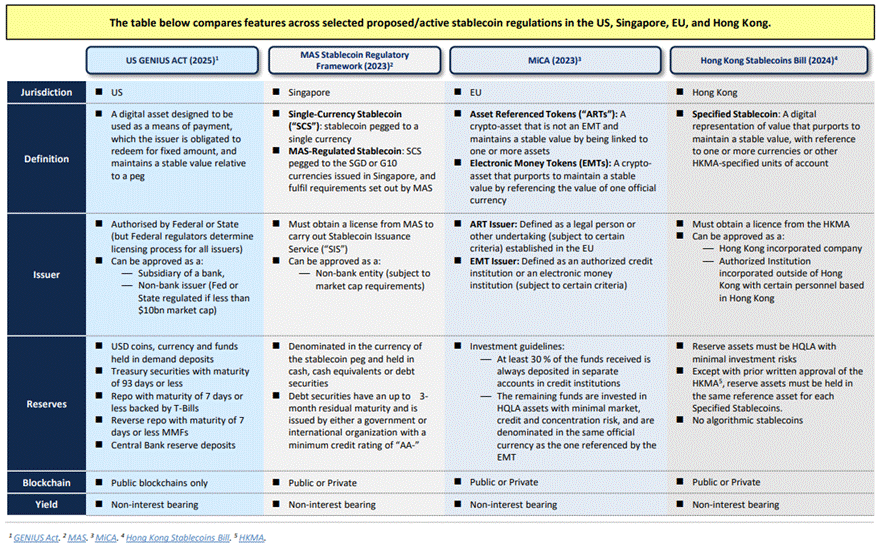

While the U.S. was not long ago still busy arguing over whether stablecoins are the next financial revolution or just digital Monopoly money, further East, Singapore and Hong Kong had already quietly put on their regulatory big-boy pants. Singapore’s MAS laid down the law: if you want to issue a stablecoin, you’d better back it with real money—not banana tokens—and be ready to cough it up on demand. Meanwhile, Hong Kong took one look at algorithmic stablecoins and said, “Nope, not on our watch,” insisting on boring old things like full reserves and real assets. In short, while Washington played crypto charades, Asia’s financial grown-ups were busy building actual guardrails for the digital dollar rollercoaster.

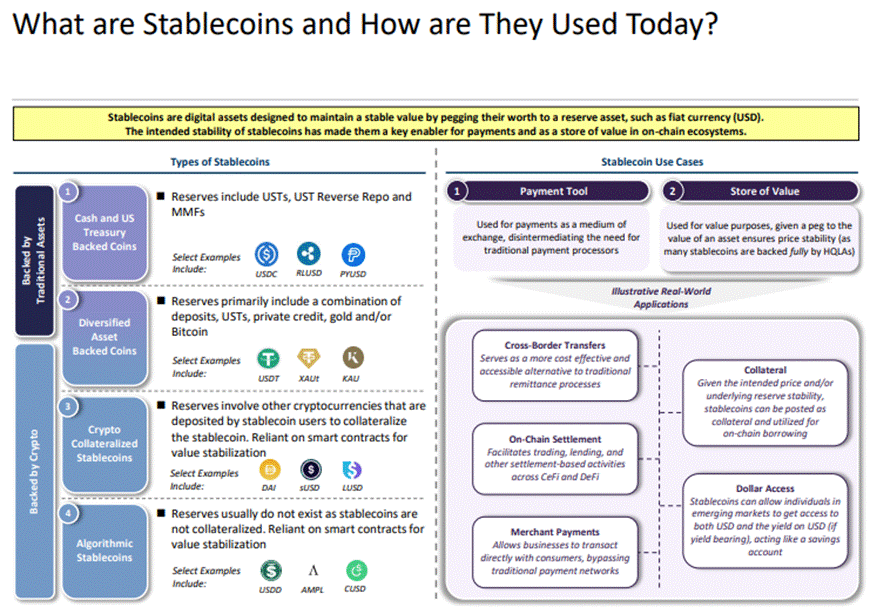

Coming back to the USA, to grasp what’s really at stake with the GENIUS Act, let’s start with the basics: what the heck is a stablecoin?

Think of it as crypto’s attempt at behaving like a grown-up. A stablecoin is a digital token that tries really hard to keep its value steady—usually by tying itself to something boring and reliable, like the U.S. dollar, or other financial instruments. It’s the designated driver of the crypto party. Unlike Bitcoin, which can swing like a caffeinated toddler on a sugar high, stablecoins aim for Zen-like calm. They're supposed to be usable for actual payments or saving without giving you a heart attack every time you check the price. But here’s the twist: not all stablecoins are actually… stable. Some issuers got a bit creative with what counts as “reserves” (spoiler: junk bonds don’t count), and a few have collapsed in spectacular fashion, leaving investors with nothing but regrets and memes.

So, the GENIUS Act can be summarized as the Washington’s attempt to stop stablecoins from doing their best impression of a house of cards.

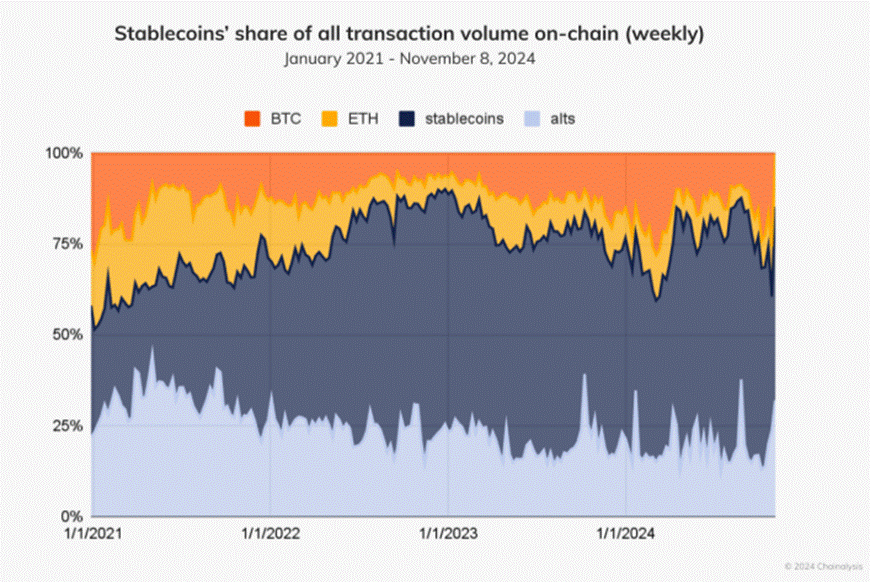

Once just a backstage pass for buying crypto on fiat-free exchanges, they’ve now graduated to lending, borrowing, and yes—buying stuff. Because nothing says financial revolution like using digital dollars to pay for your latte.

https://www.chainalysis.com/blog/stablecoins-most-popular-asset/

Before the GENIUS Act showed up with its rulebook, stablecoins were basically the Wild West of crypto light on regulation, heavy on sketchy promises. Unscrupulous developers jumped in, as they always do in tech booms, exploiting the lack of oversight and the FOMO-driven dreams of retail investors. The result? A parade of Ponzi-like “projects” that made their creators rich and left everyone else wondering how their “stable” coin vanished overnight. And let’s be honest—many still have no clue what actually backs a stablecoin… if anything at all.

https://www.wired.com/story/stablecoin-sanctions-violations-crypto-crime/

In January 2024, the FED decided it was time to stop pretending stablecoins were just a crypto sideshow and actually study them. Surprise: it turns out stablecoins are only kind of stable, and only if you squint.

The gist? Stablecoins are pegged to the dollar, but most of the action happens on secondary markets where retail traders buy in—since the primary market is basically an exclusive club for institutions. Arbitrage keeps the peg afloat, assuming there’s no panic and everyone plays nice.

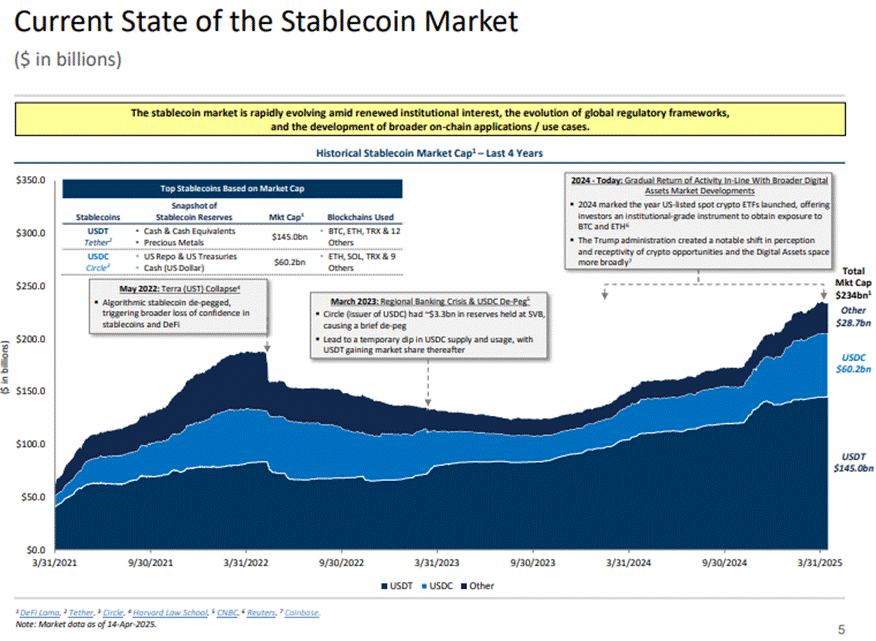

DAI lets anyone with internet and collateral pretend they’re the Fed. Tether, the heavyweight champ with a $152 billion market cap, is supposedly backed by reserves (whatever that means this week). USDC and BUSD play the same dollar-pegged game, each claiming to be the responsible sibling.

Altogether, stablecoins now total $250 billion in market cap—roughly the size of New Zealand’s economy or, if that’s too abstract, about the same as McDonald’s market capitalization. Because nothing screams financial innovation like reinventing the dollar... but with more risk and fewer guarantees.

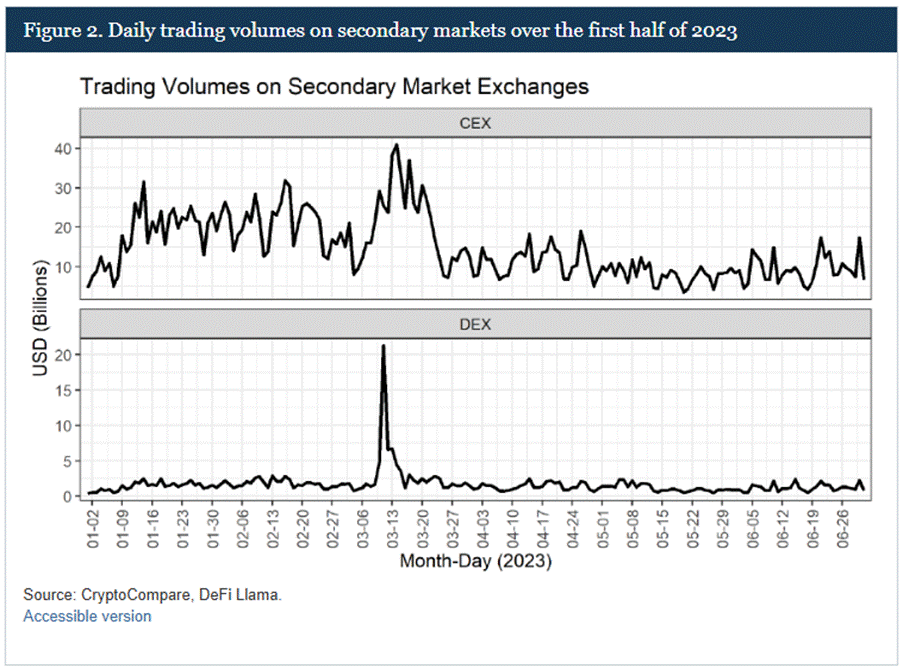

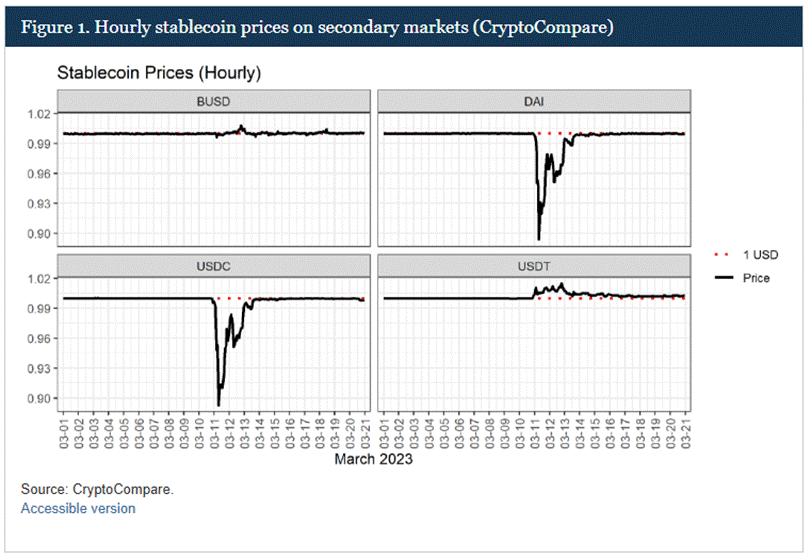

Secondary markets are where stablecoin prices actually come to life—at least for market watchers. After SVB’s collapse, prices for USDC and DAI both tanked below 90 cents and bounced back in near-perfect sync over three days. Anyone would think that meant both were sailing in the same storm, right?

Wrong. While DAI’s market cap grew post-crisis, USDC’s shrank by nearly $10 billion. Meanwhile, BUSD and USDT both traded above their dollar pegs—but BUSD’s market cap dropped and USDT’s shot up by $9 billion. So yeah, just looking at prices doesn’t tell the whole drama of what was really going on behind the scenes.

Centralized Exchanges (CEXs) are still the popular kid for crypto trading, but Decentralized Exchanges (DEXs) have been sneaking into the cool crowd lately. Both trade crypto, but:

CEXs let investors buy and sell with real cash; DEXs say, “Nope, no fiat here,” so stablecoins are their dollar substitutes.

CEXs use old-school order books; DEXs rely on automated market makers doing their own funky dance.

CEXs want your ID for KYC—privacy, gone. DEXs? No questions asked, but you better know your DeFi moves.

CEXs feel like a trading floor; DEXs feel like a hacker’s playground.

During the March 2023 chaos, DEXs went wild—$20B volume days vs. the usual $1-3B—while CEXs just shrugged with a modest bump. DEX volumes even spiked before CEXs joined the party. Despite the frenzy, prices stayed in sync. But how these two worlds handle panic? Still a crypto soap opera waiting to be unraveled.

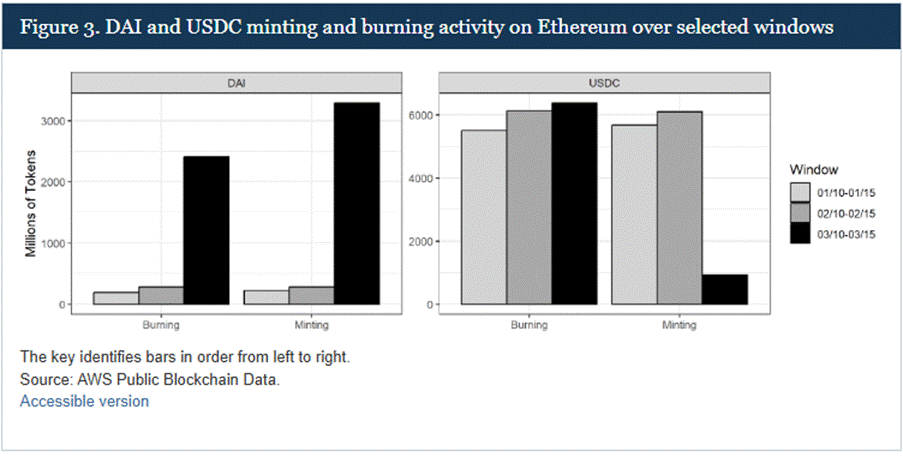

When the secondary market for stablecoins throws a tantrum—think frantic selling of de-pegged coins or a mad rush for those trading above dollar value—this pressure spills over to the primary market. In theory, lots of selling should trigger stablecoin “burns” (token destruction), while demand should spark fresh “mints” (token creation). Thanks to Ethereum’s public ledger (hello, transparency!), investors can peek behind the curtain at stablecoin mints and burns. Using Amazon Web Services Public Blockchain Data, investors can track token supply changes, including moves to and from the issuers’ Treasury wallets—the crypto equivalent of a piggy bank for holding extra tokens. Unlike others, DAI skips the piggy bank step and sends tokens straight from its smart contracts to holders. Looking at 2022 data, DAI and USDC were busy bees with frequent but smaller transactions, while BUSD and USDT prefer fewer, but heftier moves. So, not all stablecoins dance to the same primary market beat, even if they try to look similar. During the SVB meltdown in March 2023, DAI went into overdrive minting and burning tokens like there was no tomorrow. USDC, meanwhile, played it cool with ordinary burn activity but seemed reluctant to mint new tokens. Result? DAI netted gains while USDC lost ground. Both dipped in price, but their on-chain behavior couldn’t be more different.

No doubt the crypto craze — fueled by YOLO-greedy investors — has catapulted stablecoins into the spotlight. But behind the shiny promise of tokenization lies a not-so-hidden truth: it’s a golden ticket for tyrannical governments to tighten their grip and control how ‘We The People’ live, crushing any hope of independence. All in the name of a ‘One Size Fits All’ lifestyle cooked up by Keynesian planners and money-hungry multinationals who just love telling the world how to live. Meanwhile, investors keep piling into stablecoins that are anything but stable or antifragile.

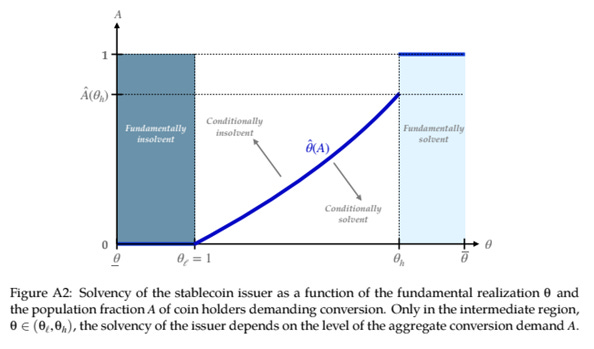

So, what’s the deal with all these stablecoin shenanigans and the bigger financial system? On May 9, 2025, the Federal Reserve Banks of Boston and New York threw a virtual “Conference on Stablecoins and Tokenization” — basically, a Zoom party for financial nerds. The headline? Stablecoins are like that sketchy bridge between the wild crypto jungle and the stuffy old-world finance. According to fancy math models, regulators aren’t just being paranoid about too many people jumping on the stablecoin bandwagon. Especially when newbies start freaking out and pulling their money out faster than you can say “crypto crash.” These investor panic attacks—aka “runs”—can shake not just stablecoins but the whole financial playground as we saw in the case of the SVB bank walk.

https://christophbertsch.com/data/Bertsch_StabelcoinRuns.pdf

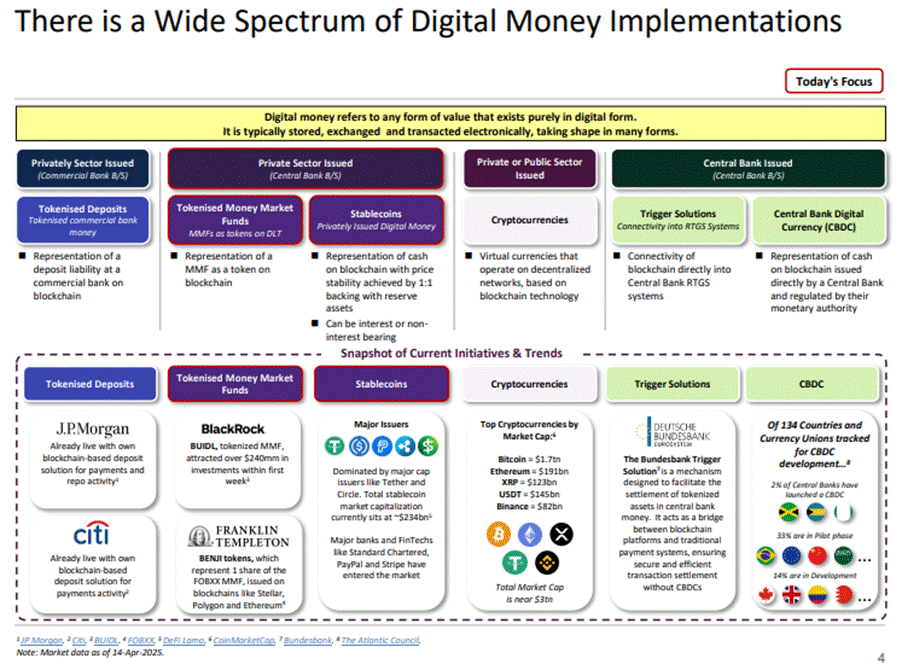

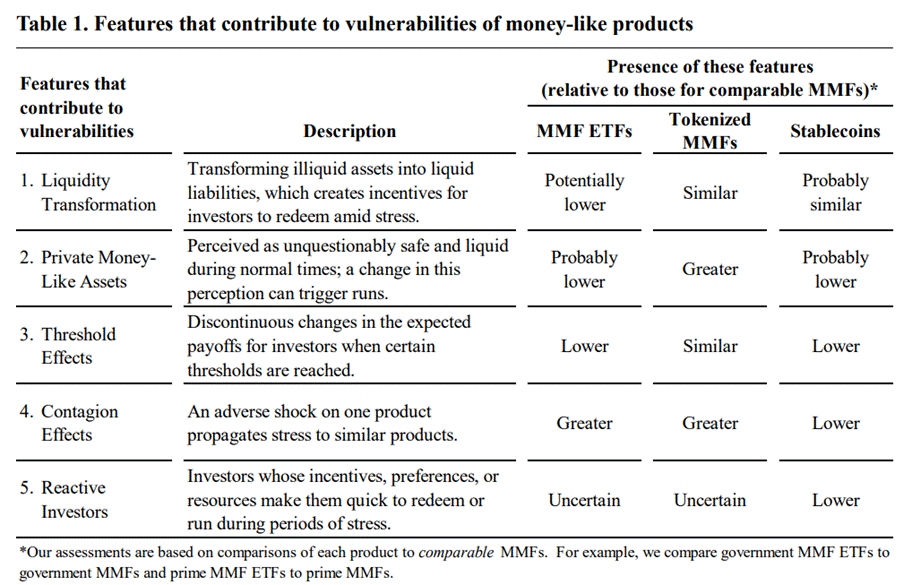

Money’s the lifeblood of finance, so new “nonbank” money-like products—think stablecoins, tokenized money market funds (MMFs), and MMF ETFs—could shake things up big time. They promise perks like better liquidity, higher returns, and cheaper transactions—from your latte to cross-border megadeals. But like all things money-ish (looking at you, uninsured deposits), they’re also prone to nasty runs that can rattle the whole system.

How to spot a financial digital troublemaker in 5 quick questions:

How slick are they at turning hard-to-sell stuff into “easy cash” promises?

Do people treat them like the dependable friend called “safe cash”?

Do their payouts do a cliff dive when things get messy?

If one party freaks out, does everyone else catch the panic bug?

Are their investors cool cucumbers or easily spooked squirrels?

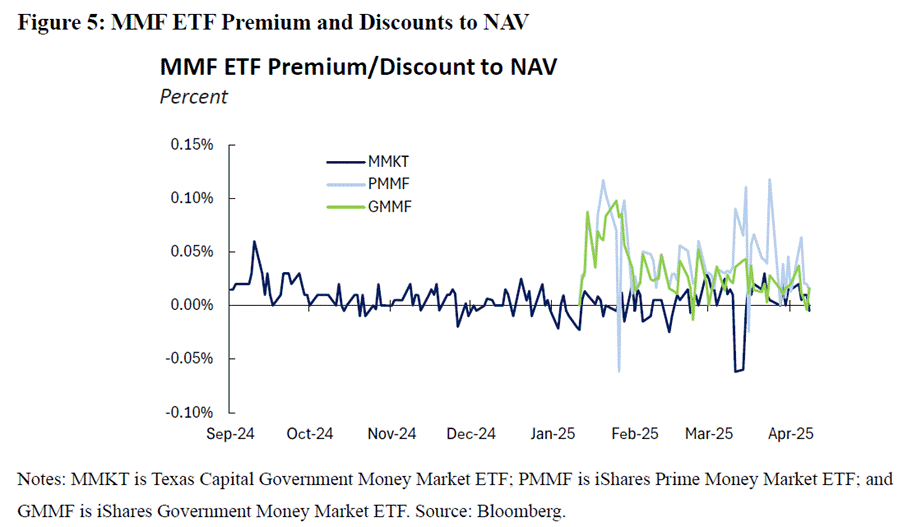

Turns out, these vulnerabilities show up in varying doses across MMF ETFs, tokenized MMFs, and stablecoins. For instance, MMF ETFs might play it safer with less liquidity transformation and have floating NAVs that keep them a bit more “real” than regular MMFs. But if their prices dip, watch out—panic could spread faster than gossip at a family dinner. And whether their investors are cool-headed or nervous? Well, that’s still a mystery.

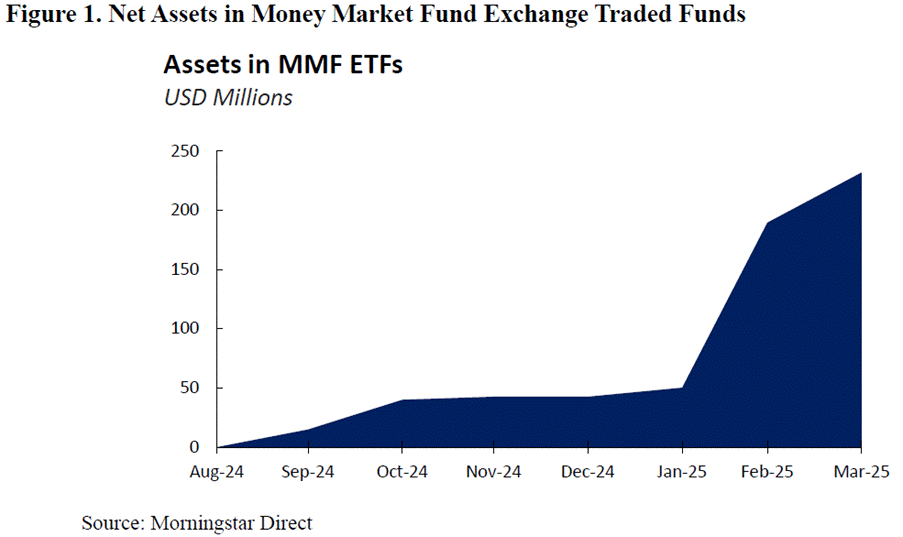

First launched in 2024, MMF ETFs are the hybrid offspring of money market funds (MMFs) and exchange-traded funds (ETFs), regulated by the SEC and subject to Rule 2a-7—think short maturities and plenty of liquidity. But unlike traditional MMFs where you deal directly with the fund, MMF ETFs only tango with “authorized participants” behind the scenes. Everyone else buys and sells shares on an exchange, like regular ETFs, all day long instead of waiting for a once-a-day update like with old-school MMFs. As of March 2025, these new kids on the block have gathered a modest $232 million in net assets—small but potentially mighty.

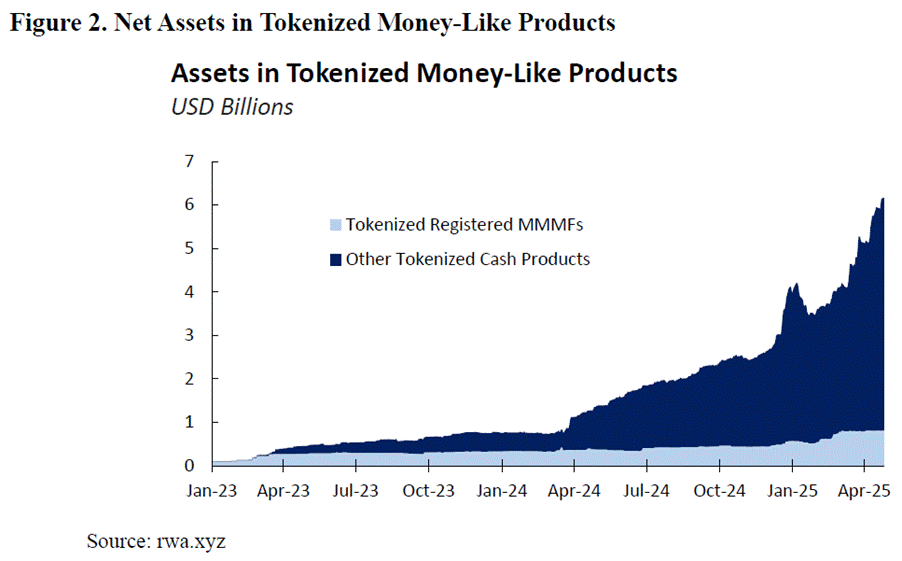

Tokenized MMFs are basically money market fund shares wearing a blockchain hoodie. These tokens represent ownership in a traditional MMF (which still plays by SEC Rule 2a-7), but with a digital twist: they could eventually let investors transfer ownership instantly, 24/7, at low cost—potentially doubling as payment tools or collateral in financial deals. Launched in 2021, they’ve already attracted nearly $815 million in assets as of April 2025. Not bad for something still finding its final form.

When it comes to new money-like products like MMF ETFs and tokenized MMFs, the Fed’s playbook starts with a classic: the old-school vulnerabilities of traditional money market funds (MMFs). These products look safe—until they’re not.

Liquidity transformation: Turning hard-to-sell stuff into "easy-to-spend" promises. Great in calm waters, disastrous in a storm.

“Moneyness” illusion: As long as no one asks tough questions, they seem as good as cash. But once doubts creep in, it’s exit time.

Threshold freak-outs: Products that keep prices stable via rounding can crash fast if they fall just a penny too far.

Contagion risk: If one fund stumbles, others holding similar assets might catch the flu—especially when they all fish in the same shallow pool of AAA-rated debt.

Jumpy investors: The faster they flee, the harder it is for funds to liquidate assets without triggering fire sales.

MMF ETFs, while shiny and new, don’t escape these issues. Their real-time prices might even broadcast panic faster. If ETF shares start trading at a discount, investors might assume MMFs are overvalued and stampede to the exits—like in 2008 when one fund “broke the buck” and others fell like dominoes.

In short: even if these new money-like assets offer 24/7 liquidity and a whiff of innovation, the old rules of panic still apply.

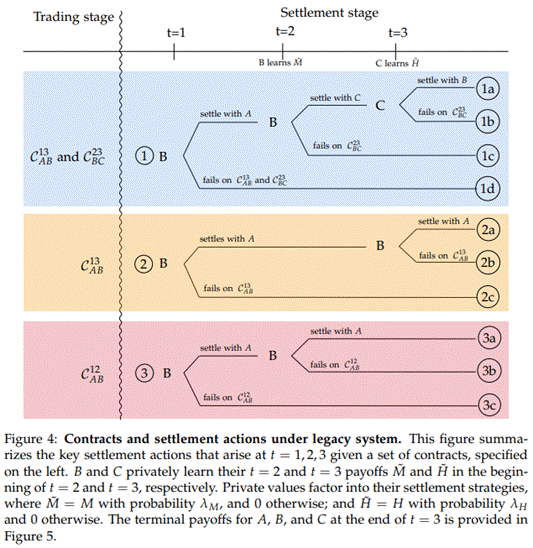

Tokenization promises lightning-fast settlements—blink and your trade's done. That’s a big deal, since it slashes the usual risk of deals falling through. But, as Lee points out, there’s a catch: instant settlement might mean instantly exposing your secrets. Traders may have to reveal info they’d usually keep close to the vest—like showing your poker hand before the other guy bets.

Bottom line? Tokenization is great if the plumbing (settlement protocols) actually fits the house (trading systems). Otherwise, you’re just speeding into a crash.

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr1121.pdf

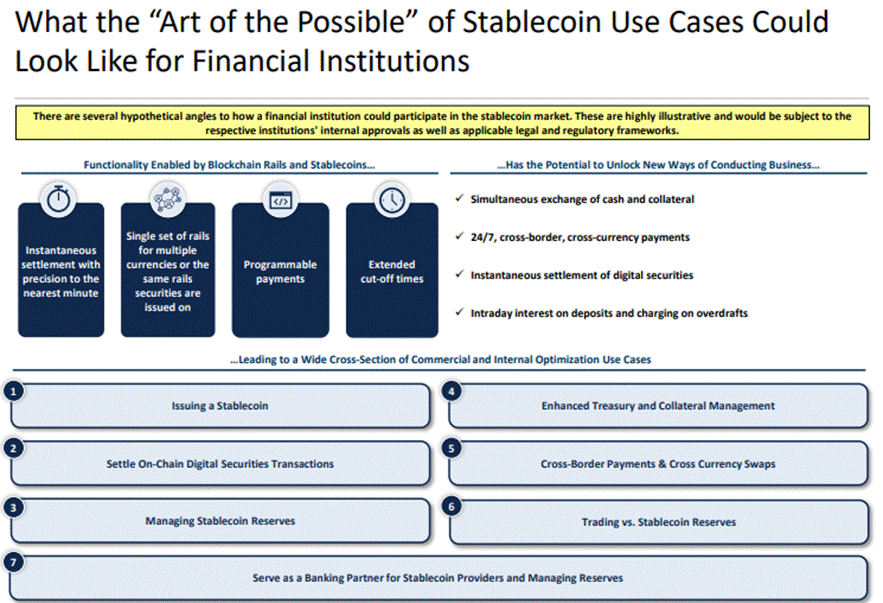

In a nutshell, the GENIUS Act may be the “first step” toward establishing a “unified digital financial system which is borderless, programmable and efficient. Regulatory clarity alone will not drive institutional adoption. Products offering stable and predictable yield will also be necessary. For example, Falcon Finance is currently developing a synthetic yield-bearing dollar product designed for this market.

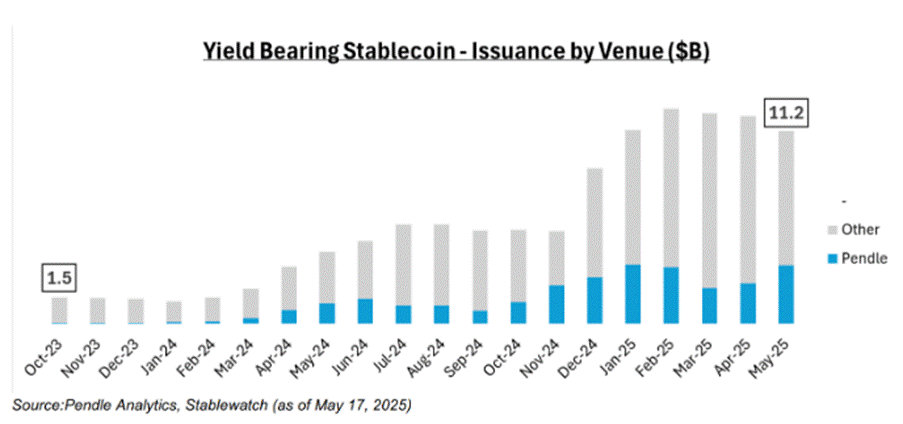

https://cointelegraph.com/news/yield-bearing-stablecoins-hit-11b-pendle-dominates-growth

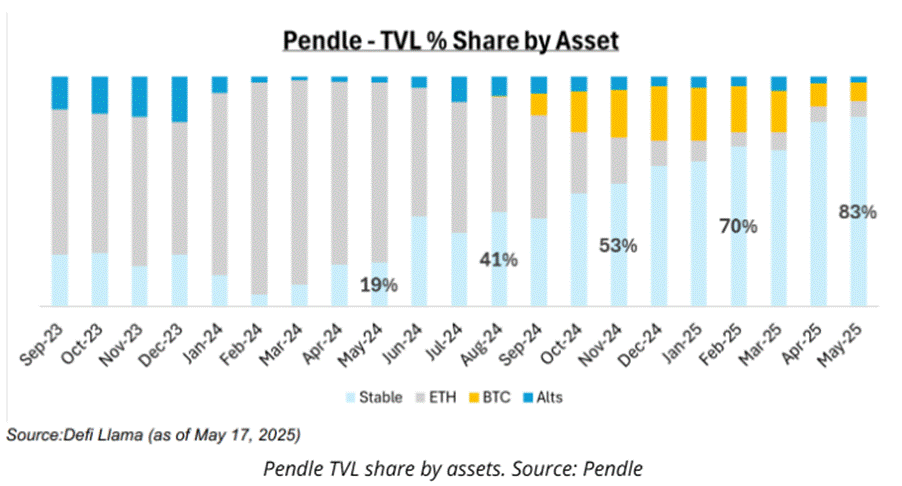

Yield-bearing stablecoins have exploded to $11 billion in circulation—up from just $1.5 billion at the start of 2024—now making up 4.5% of the stablecoin market. Not bad for a sector that basically didn’t exist last year. Leading the charge? Pendle—a DeFi protocol letting users lock in fixed yields or gamble on rate swings like it's Vegas-on-chain. Pendle now boasts about 30% of the total value locked in yield-bearing stablecoins, or around $3 billion. Turns out yield is the new crypto dopamine.

You don’t need a tinfoil hat to notice the GENIUS Act showed up just as Uncle Sam was struggling to find buyers for his ever-growing pile of IOUs. What a coincidence! With crypto fans swooning over the “Manipulator-in-Chief” last election, it’s no wonder the US government’s trying to lure them back in—now with digital wrappers and patriotic branding.

But behind the smoke and mirrors of crypto-politics lies an old problem: who’s going to keep funding America’s trillion-dollar deficits? Savvier investors have already done the math—inflation + bloated budgets = ditch the “contracts” (digital or not) and cling to real “property” if you want to preserve wealth. The “Manipulator-in-Chief” may dress it up as innovation, but it’s just another way to patch a broken funding model with fresh hype.

Upper Panel: Gold to US Treasury Bond Ratio (blue line); 7-Year Moving Average of Gold to US Treasury Bond Ratio (red line); Lower Panel: US Public Debt to US GDP Ratio (green histogram).

While the 47th U.S. president and his ever-smiling “Treasurer-in-Chief” talk up their vision to ‘Make America Digital’ (i.e. MAD), savvy investors aren’t buying the sales pitch. Behind the shiny talk of innovation and leadership in the “digital revolution” lies a more old-school motive: funding the government’s insatiable spending habit.

In the April Treasury refunding, the real headline wasn’t about reducing government debt and spending—it was about survival. Buried in the minutes was a telling moment: the Treasury asking bond dealers whether stablecoins might help soak up more T-Bills. Translation? Washington is eyeing the crypto crowd as the next big bag holder.

The Treasury Borrowing Advisory Committee even spelled it out: with stablecoins starting to act like money market funds and tokenized funds entering the scene, the lines are blurring fast. One key takeaway? If this trend continues, it could juice demand for Treasuries by $900 billion. That’s not a revolution—it’s a rescue mission in blockchain clothing.

In the end, it’s not about making finance more inclusive or efficient—it’s about keeping the dollar game going by wrapping IOUs in digital glitter and hoping the crypto crowd bites.

https://home.treasury.gov/system/files/221/TBACCharge2Q22025.pdf

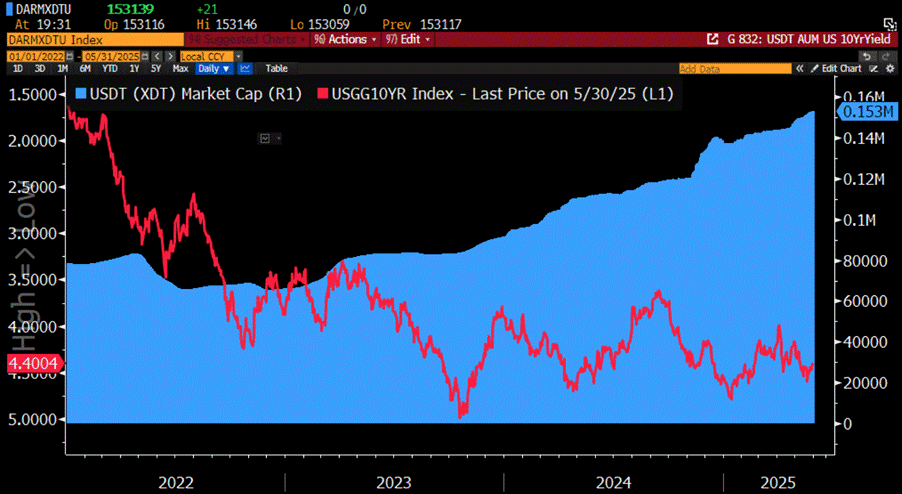

Despite all the buzz from the 47th U.S. president, it’s clear the crypto charm offensive isn’t about liberating digital finance—it’s about finding fresh buyers for an endless pile of Treasuries. The “Treasurer-in-Chief” isn’t courting crypto for innovation’s sake, but because traditional demand for government IOUs is fading fast. Since the Washington swamp got new management on January 20th, 2025, stablecoin market cap has ticked up—but not nearly enough to cap rising long-term yields. Anyone with a chart and a pulse can see the truth: wrapping old debt in digital packaging doesn’t make it any less toxic.

USDT Market Cap (blue histogram); US10-Year Yield (axis inverted; red line).

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/the-genius-stablecoin-playbook

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.