Climbing the Wall of Worry

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Wall of worry 2.0

In markets, a “wall of worry” is when there are countless and persistent reasons to be bearish. For instance, right now we have: tariff uncertainty, geopolitics, recession, inflation, rising interest rates, government deficits, high stock valuations, AI capex overbuild, speculative retail buying, hedge funds shorting, etc. You can come up with an endless list of worries to keep you from investing.

Despite widespread concerns, bull markets tend to “climb” the wall of worry and keep rising. It is a very common psychological trap that smart money often fall victim to. Ironically, the more research they do, the more reasons they find to be bearish.

We protect against this by following price action. Let the market tell you you’re wrong. If the market is ignoring the negative headlines and still going up, you’re probably wrong to be bearish. Find out what the new narrative is, and adjust your priors. The worst thing you can do is fight the trend!

How does that apply to the current trend? Right now investors want the market to fall. Positioning, as we’ve discussed before, is bearish. We know this because Bank of America’s survey of global fund managers shows they favor cash over US stocks:

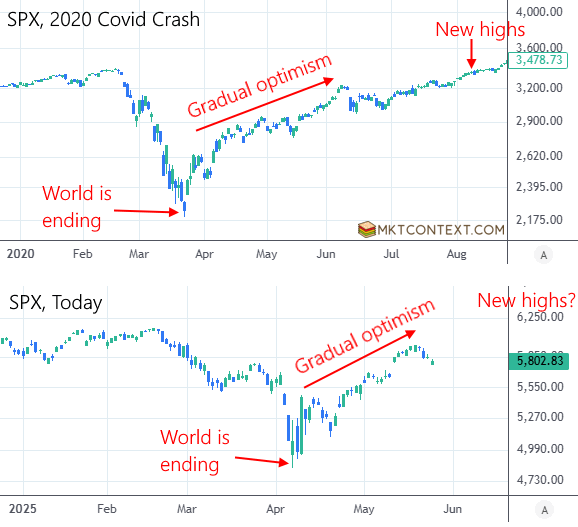

By the way, after the Covid lows when SPX started rallying, the majority of fund managers said it’s still a bear market. As the market shot straight up in a V-shaped rebound, news headlines were calling it “the most hated rally”. Today the same thing is happening! As we described last week, we’re tracing out the same V-shaped recovery as post-Covid — making this the Wall of Worry 2.0:

What is a better narrative?

Here are the facts: We are in a better environment today than at the beginning of the year. Trump has showed his hand, tariff risks are fading, and we know what comes next: fiscal support. With tax cuts and de-regulation on the way, and likely more Fed cuts by the end of the year (inflation is tame), the macro picture is on an upward trend — hence why stocks are also in an upward trend.

Companies are better positioned today than a year ago. The supply chain picture is improving and interest rates have come down. Global trade is resuming now that trade deals are coming and tariffs are easing. Company debt levels are low, and there is a chronic shortage of workers which means layoffs are not necessary.

As long as fiscal support continues (the federal deficit was $270B higher than this time last year, despite DOGE cuts) and consumers keep spending, a recession is unlikely. This is in stark contrast to other countries outside the US which may struggle due to the 10% tariff put in place. We expect US exceptionalism to become a theme once again in the near future — providing a boost to SPX.

Technical analysis

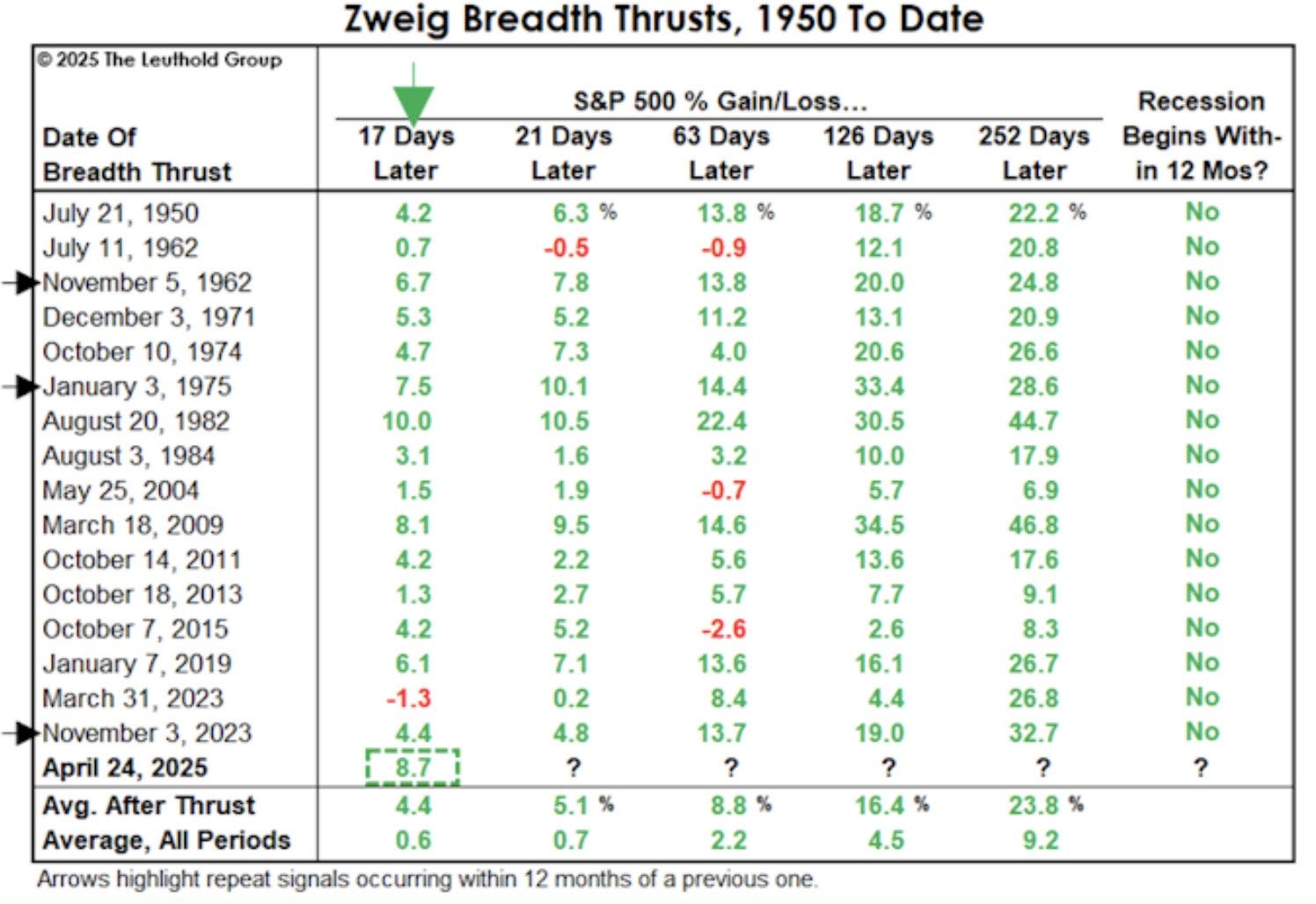

We came close to getting another breadth thrust on Tues. That was the day the markets soared on news that Trump would delay tariffs on Europe, as well as some easing much-needed easing in bond markets. Advancing/declining issues soared to 86%. From the chart below you can see the repeated breadth thrusts we’ve had lately, which simply doesn’t happen unless in bull markets.

The original breadth thrust that marked the bottom of the selloff occurred on April 9th. There were a few more immediately after that as well. The backtest below shows that performance after a breadth thrust are very positive. In fact, we have seen one of largest short-term gains since the April 24th thrust. We expect 12 month performance to be very strong as well.

One of the ways to gauge the strength of the market is through the cyclical/defensive ratio. Cyclicals are high beta or economically sensitive stocks, which outperform safe havens in bull markets. That’s how you know we’re in one right now:

One of the ways to gauge the strength of the market is through the cyclical/defensive ratio. Cyclicals are high beta or economically sensitive stocks, which outperform safe havens in bull markets. That’s how you know we’re in one right now:

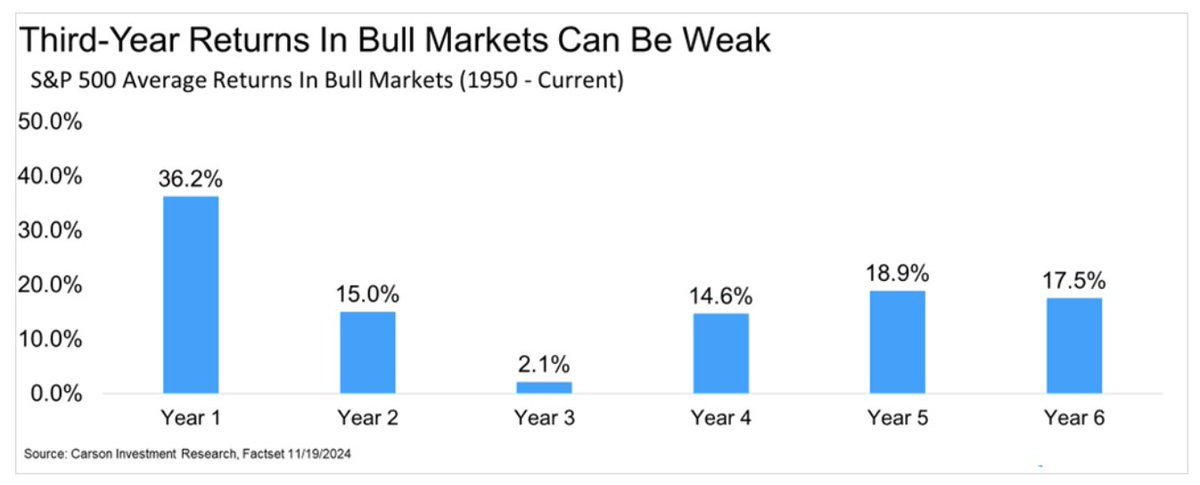

Zooming out for long-term investing, we can see that the third year of bull markets (the current one started in 2023) tends to be the weakest, with average returns a paltry 2.1%. But in the next few years, we can expect double digit returns, on average. This is important context for anyone who thinks the rally is over or that we are late in the stock market cycle. With this in mind, our bias for the next few years will be to stay invested as much as possible.

To see our portfolios and sector picks, and get more market timing content, head over to MktContext.com and subscribe today!