Analysis: Gold’s Pricing Implies Treasuries Are Junk

Why Gold Is Replacing Treasuries in Reserve Portfolios

Authored by GoldFix, ZH Edit

SEB (Skandinaviska Enskilda Banken), is a leading financial services group in Northern Europe. They published an interesting (if aggressive) comment on Gold vs Treasuries. Here is that analysis broken down with their original comments attached.

Contents

- The End of a Longstanding Correlation

- Treasuries Now Carry Political Risk

- Quantifying the Risk: A 5% Political Discount

- Gold’s Implied Risk Premium Is 5.7%

- Strategic Drivers Ahead: US–China Conflict, Powell’s Successor

- Gold as Core, Treasuries as Conditional

The End of a Longstanding Correlation

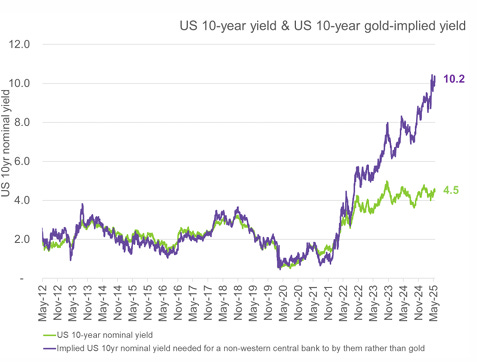

Historically, gold traded inversely to U.S. 10-year real yields. That relationship held for years, reinforcing the idea that gold was a simple reflection of inflation expectations. But the correlation broke decisively in Q1 2022. The turning point wasn’t a macroeconomic event—it was geopolitical.

Following the Russian invasion of Ukraine, Western central banks froze approximately $600 billion in Russian FX reserves, the majority of which were held in U.S. dollars and euro-denominated assets. The move shattered the assumption that sovereign reserves—even in the absence of default—were untouchable. It introduced a new axis of risk: political confiscation.

Treasuries Now Carry Political Risk

To reserve managers in Beijing, Riyadh, and elsewhere outside the G7 framework, the seizure of Russian reserves was a warning. It indicated that access to U.S. Treasuries is contingent on political alignment with Washington. From a portfolio construction standpoint, this amounts to introducing a “confiscation tail-risk” into what was once considered the world’s safest asset.

No formal default occurred. Yet for all practical purposes, the reserves failed. In a sanctions-driven world, the traditional safe haven becomes a conditional one. Holding U.S. government bonds now includes a non-trivial probability of being locked out of your own assets.

Quantifying the Risk: A 5% Political Discount

How do non-Western central banks internalize this new environment? The report offers a plausible scenario: they may now price in a 5% chance (1-in-20 odds) of bond confiscation. If such an outcome carries irreversible consequences, a rational actor would demand at least a 5% additional yield to offset the risk.

Continues here

Free Posts To Your Mailbox