The Fed Screwed Up... Again.

The Fed has screwed up AGAIN.

For six months now, the Fed has refused to cut interest rates out of concerns that the trade war/ tariffs would introduce inflation. This is a massive mistake because tariffs are in fact DE-flationary, not inflationary.

Tariffs and trade wars cause fear and uncertainty. Companies and consumers react to fear/ uncertainty by pulling back on purchases. This is a fact. We saw it in April when companies ranging from McDonalds to Southwest Airlines to even Walmart warned that consumers were pulling back on spending in a major way.

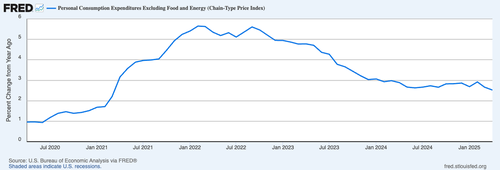

Fast forward to today and the Fed looks like a bunch of complete idiots. The Fed’s preferred inflation measure, Core Personal Consumption Expenditures (Core-PCE) or PCE without food and energy costs, just dropped to a FOUR YEAR low for the month of April.

Remember, we’re talking about APRIL, the month when the tariffs were highest and there were ZERO signs of inflation in the official data.

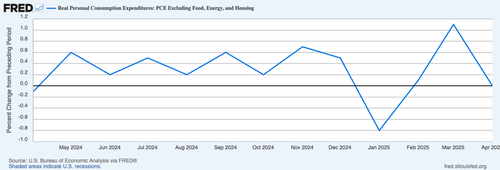

And when you exclude housing from the data, (AKA SuperCore-PCE) month over month the data went NEGATIVE. This is DE-flation, not the inflation the Fed has been prattling on about despite ZERO evidence of its existence.

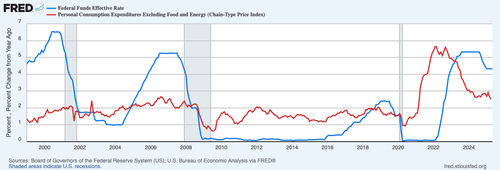

Again, the Fed has screwed up. Real rates are now positive 2% (Fed funds rate of 4.5%- Core-PCE of 2.5% = REAL rates of positive 2%). This is in fact HIGHLY restrictive. Indeed, during the last 25 years, whenever real rates have been this positive it’s only been a matter of time before something broke in the economy. See for yourself. The gray bars in the below chart market recessions.

Will the Fed’s mistake cause another recession/ crash for risk assets? It’s impossible to tell right now. And as investors are job is to play probabilities, NOT pretend to be psychic.

For that reason, we rely on proprietary metrics to tell us when it’s time to get out of the markets. We detail one of them that accurately predicted the 1987 Crash, the Tech Crash, and the 2008 Great Financial Crisis in a special investment report titled How to Predict a Crash.

This report explains how to this trigger works as well as what it's currently saying about the odds of another crisis hitting the markets in the near future. Normally this report would only be available to our paying clients, but in light of the Fed’s current policy screw up, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research