From Cycle to Chaos: The Power of Uncertainty

When future investors and historians look back at the “Jubilee Year” of 2025, they’ll likely note two things happened on January 20: the 'Disruptor in Chief' was sworn in as the 47th U.S. president, and the S&P 500-to-gold ratio broke below its 7-year moving average—for the first time since May 2020. Quite a cosmic alignment. The self-styled Mr. Nice Guy, also known as the Manipulator-in-Chief, seems to think he's some kind of messianic problem-solver like his ‘Tech Bros’ who have now filled the Washington Swamp but with a bigger ego and worse timing.

June 1st will go down in history much like Archduke Ferdinand’s joyride or Hitler’s casual saunter into Poland—brilliantly reckless. This NATO-approved strike on Russian nuclear bomber bases—yes, the ones not even involved in Ukraine’s so-called "Special Operation"—is exactly the kind of masterstroke historians will pinpoint as the opening scene of World War III.

Anyone who's spent more time reading actual finance books than doomscrolling Truth Social knows this kind of move rarely bodes well for the U.S. economy—or markets, for that matter. With the ‘Disruptor in Chief’ back behind the Resolute Desk, 2025 was always destined to be a chaos year. As a matter of fact, the world is deep in the chaos cycle now—where disruption, geopolitical drama, and policy U-turns are the norm. Risk isn’t priced in straight lines anymore; it’s priced in plot twists. Fundamentals have taken a backseat to narratives, and volatility isn’t a bug—it’s the main feature. In this new reality, the winners aren’t the optimists—they’re the ones who can zig when everyone else zags.

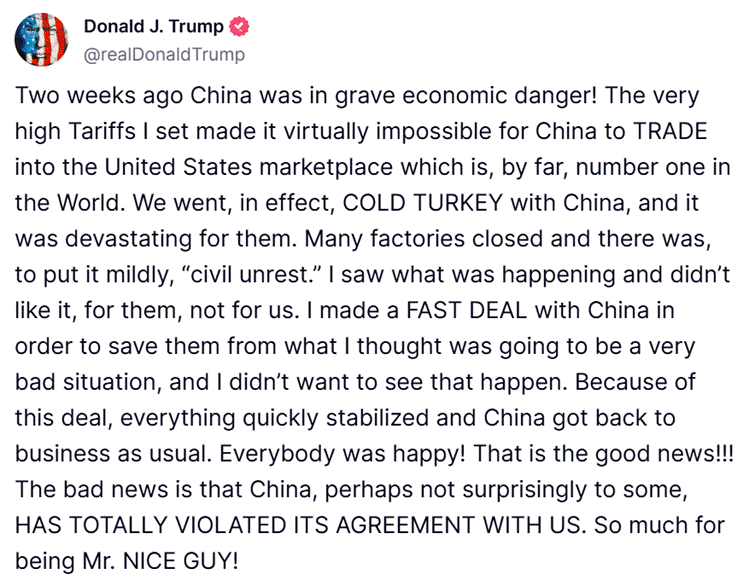

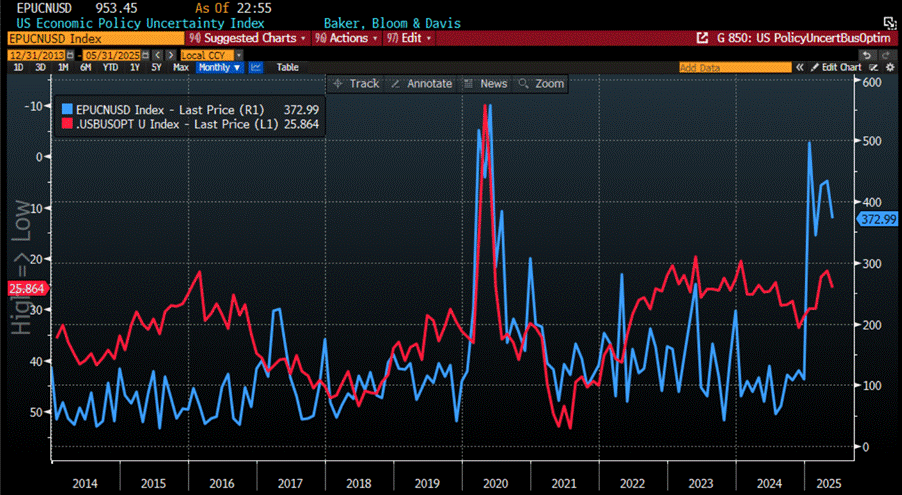

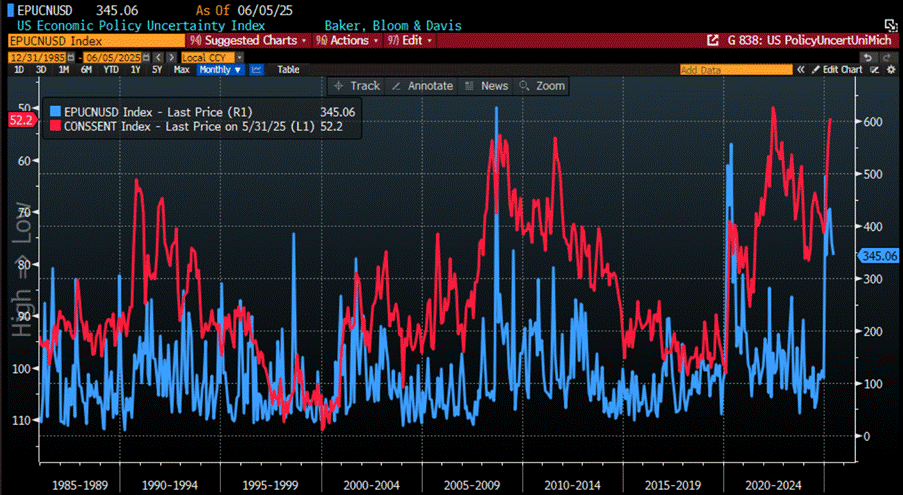

Policy uncertainty has now blown past levels seen during Trump’s first term—and yes, it could get even messier. The latest surge in anxiety stems from the “reciprocal” tariff plan, which, despite being unveiled, still leaves plenty of room for plot twists, retaliation from trading partners, and yet more tariffs. The Economic Policy Uncertainty Index (courtesy of Baker, Bloom, and Davis) confirms the mood. It's built by scanning U.S. newspapers for the usual suspects: “economy,” “uncertainty,” and government buzzwords like “legislation,” “deficit,” or “White House.” Without doubts, the headlines aren’t exactly soothing.

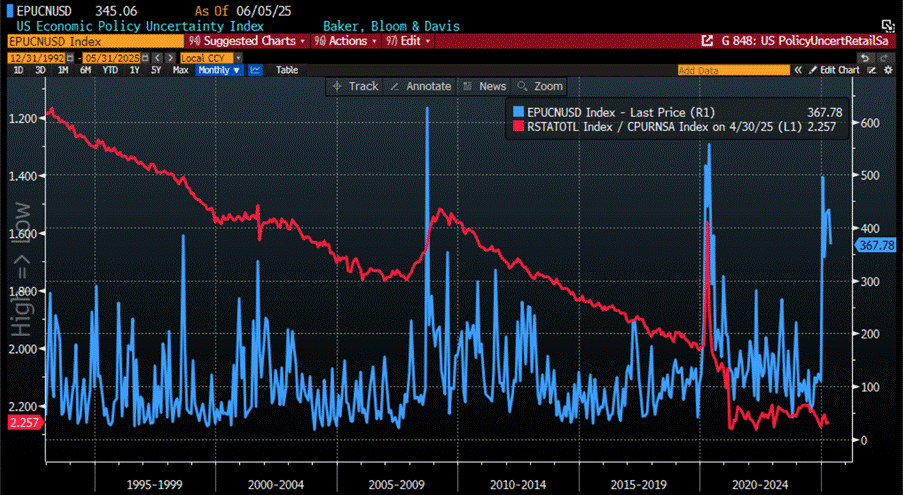

US Economic Policy Uncertainty Index since 1984.

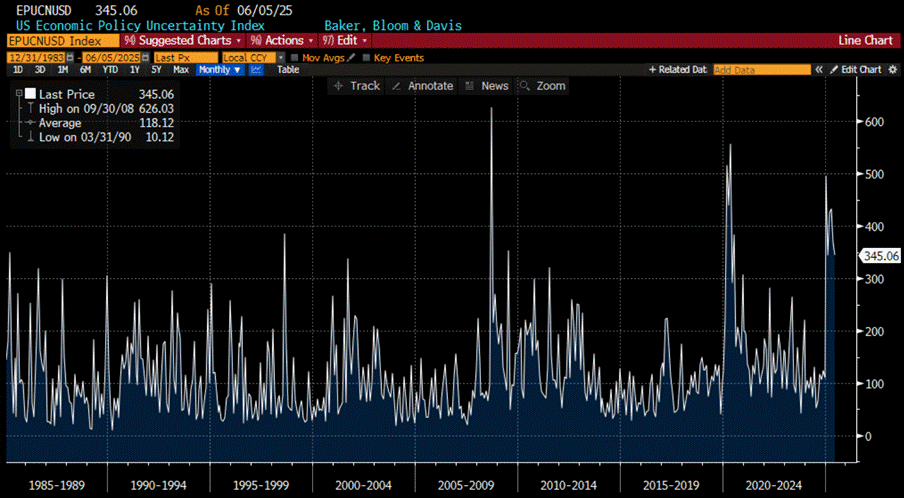

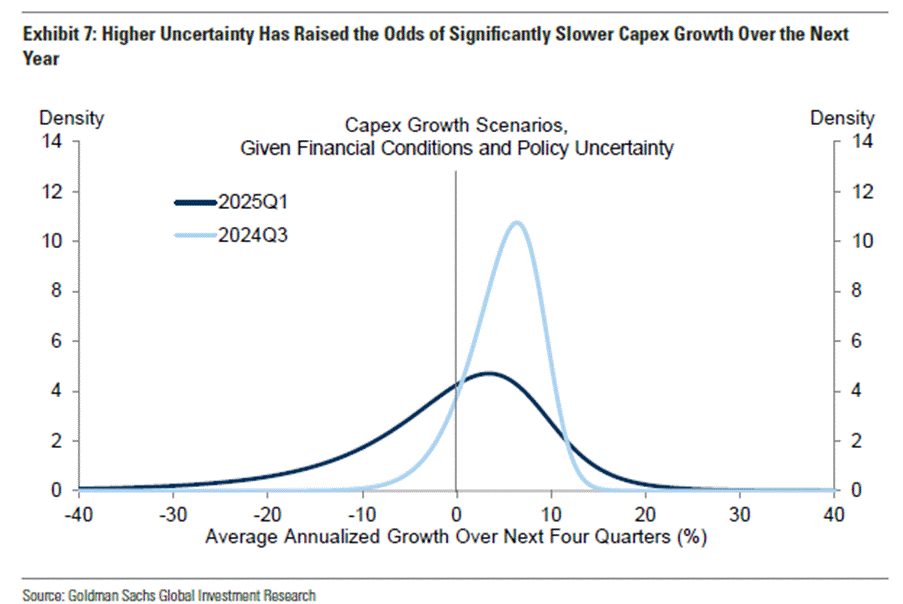

Using previous studies (and a dash of economic dread), this uncertainty is dragging business investment down by about 5 percentage points. In plain English: capex are expected to flatline, and there’s a 45% chance it actually shrinks over the next year. Why worse than round one? Because this time, way more U.S. companies are in the blast zone—not just from tariffs, but from fiscal and immigration policy fog as well.

US Economic Policy Uncertainty Index (blue line); US GDP Private Domestic Investment Index (axis inverted; red line).

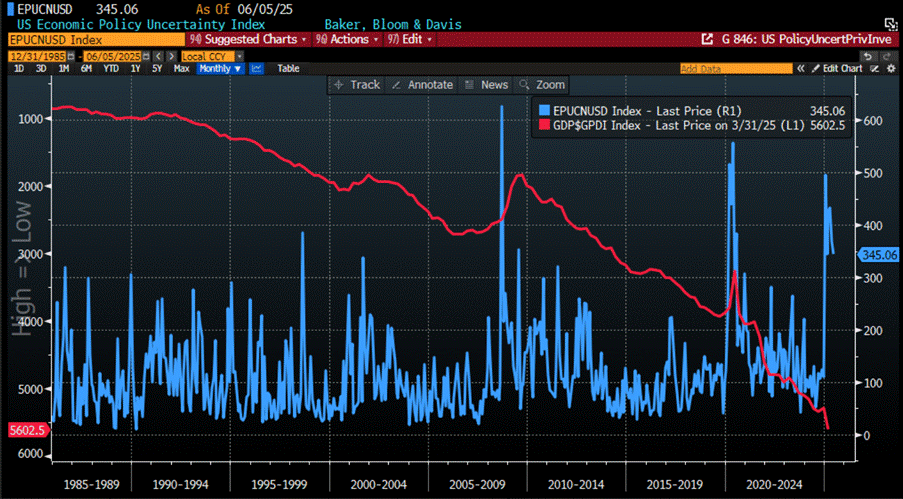

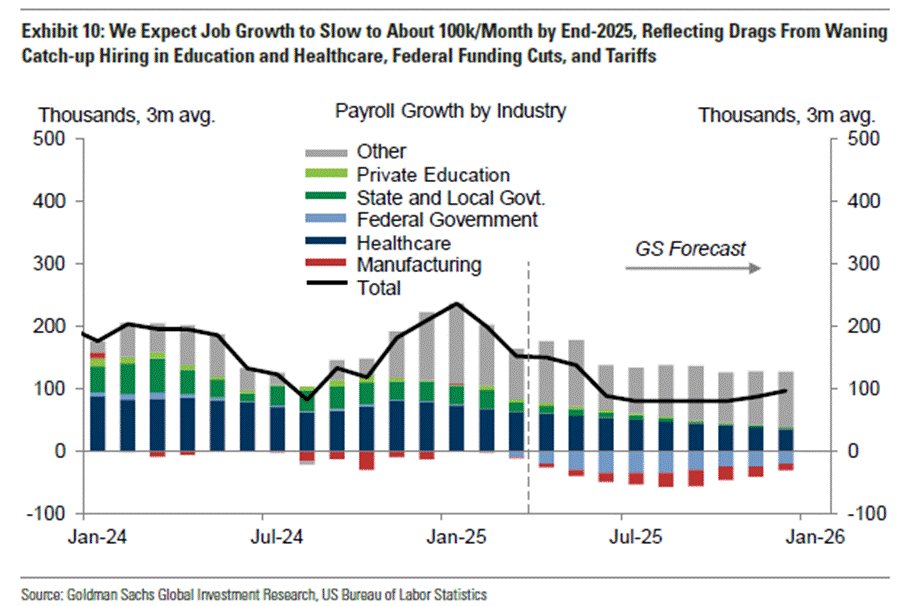

On the hiring front, trade war déjà vu could slash 20,000 jobs a month, while cosmetic federal spending cuts may chip away another 25–30k in government roles. Add in funding jitters in sectors like education and healthcare, and you’ve got another 35,000 jobs hanging in the balance. So far, the data hasn’t caught up—but don’t get too comfortable.

US Economic Policy Uncertainty Index (blue line); US Change in Non-Farm Payrolls (axis inverted; red line).

As for consumer spending, the slowdown is already baked in: slower job growth, real income hit by tariffs, and stock market woes turning last year’s feel-good wealth effect into a drag. If fear keeps climbing, savings rates might spike too—though let’s be honest, survey-based predictions and even government data are often as reliable as campaign promises.

US Economic Policy Uncertainty Index (blue line); US Retail Sales Index adjusted to US CPI Index (axis inverted; red line).

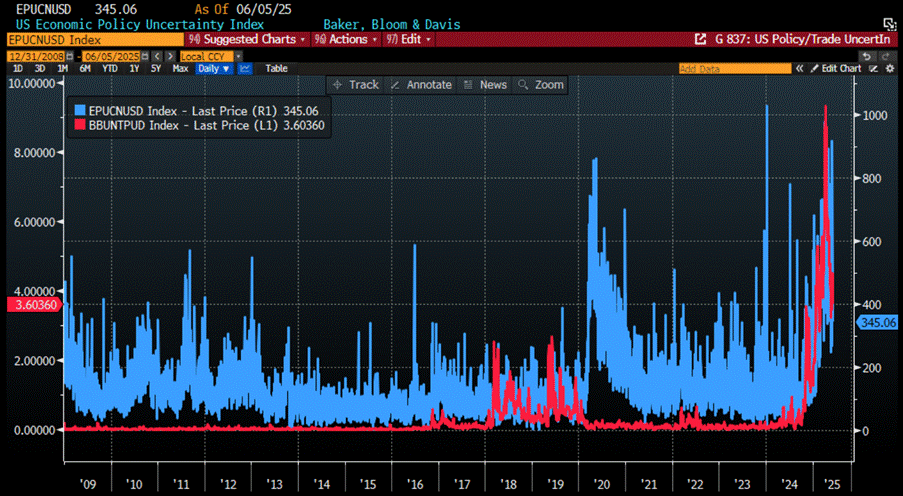

Since Inauguration Day, policy uncertainty—especially on trade—has spiked faster than a meme stock on Reddit. The US has recently hit levels above the chaos levels of Trump’s first term, with more turbulence ahead as new policies drop and global trade partners plot their revenge.

What’s fuelling this mess? The return of the ‘Disruptor in Chief’ and his beloved “reciprocal” tariffs of course—basically a trade war with everyone at once. But let’s be honest: U.S. manufacturing wasn’t destroyed by foreign villains—it was gutted by platform giants (hello, Maleficent 7) who offshored production, exploited tax havens like Ireland, and funnelled their monopoly profits not into innovation but into boardroom bonuses and massive share buybacks. Real economic patriotism, Silicon Valley style.

US Economic Policy Uncertainty Index (blue line); US Trade Policy Uncertainty Index (red line).

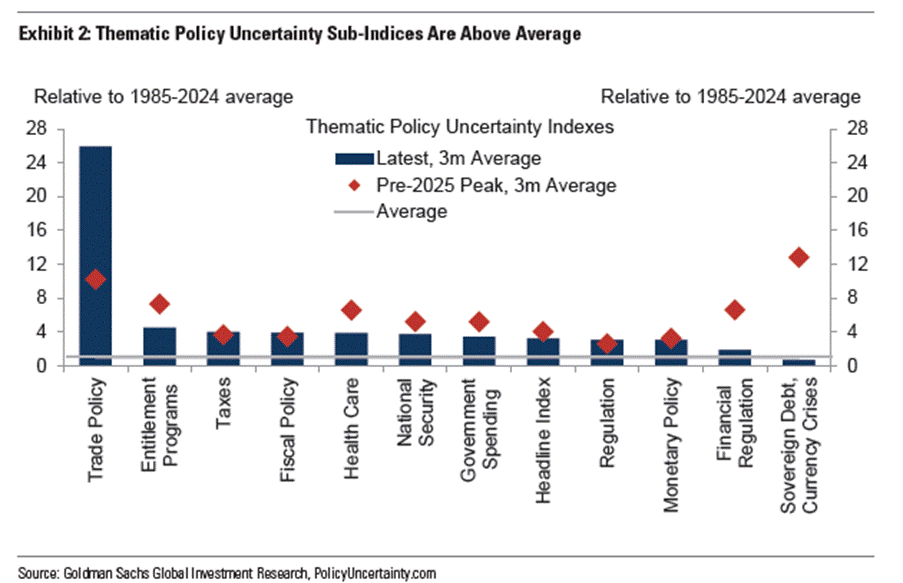

Interestingly, while trade policy uncertainty is off the charts, most other policy-related uncertainty indices are also running hot. Translation: even businesses that don’t import a single widget are in for a wild ride. Uncertainty isn’t just global—it’s gone domestic.

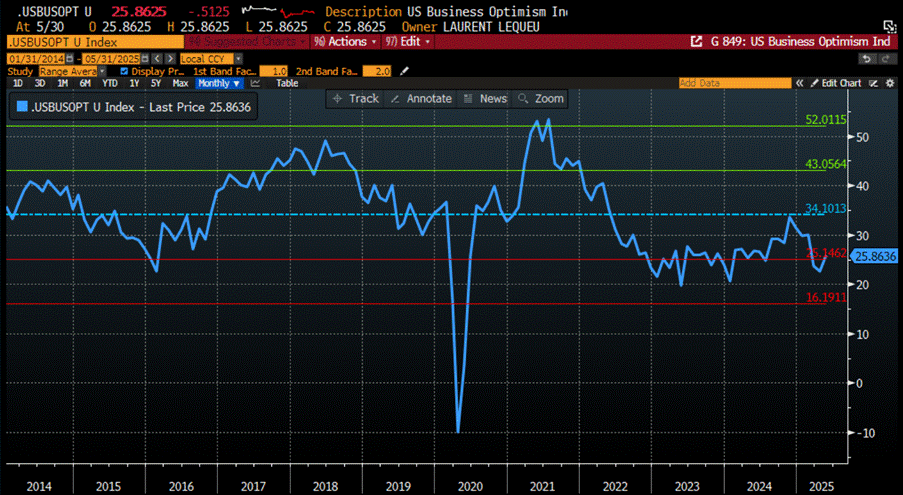

Indeed, policy chaos and looming tariffs are already souring the mood. The US Business Optimism index, a mix of 8 surveys from US ISM Manufacturing and Services sectors and regional FED business survey tanked below 1 standard deviation below the 10-year mean in March. And that was before the “reciprocal” tariff bombshell even dropped. Confidence, it seems, packed up early.

US Business Optimism Index since 2014.

Elevated uncertainty tends to freeze decision-making—firms and households alike delay big, irreversible investments. Academic research back this up: when policy signals get murky, capital spending pulls back. During the last trade war, policy uncertainty chipped away albeit modestly.

US Economic Policy Uncertainty Index (blue line); US Business Optimism Index (axis inverted red line).

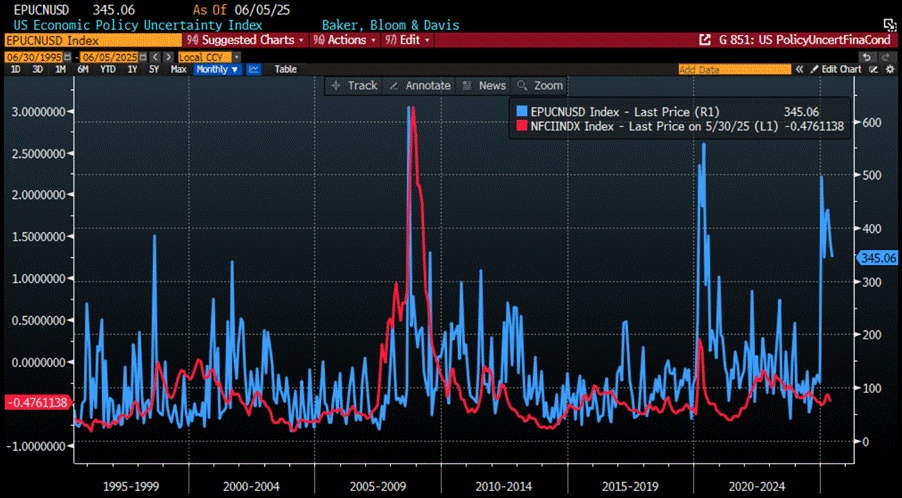

Now it’s not just policy uncertainty giving everyone migraines—financial conditions are tightening too. And with more tariffs likely (because why stop now?), investors should brace for further stress. U.S. financial conditions have long been the canary in the coal mine for banking trouble—so if that bird starts gasping, don’t act surprised.

US Economic Policy Uncertainty Index (blue line); Chicago FED Financial Conditions Index (red line).

Anyone with even a shred of financial literacy knows that tighter financial conditions mean slower economic growth—and a fatter tail of downside risk. The same logic applies to policy uncertainty: it doesn't just drag the baseline down; it makes bad outcomes more likely. To put numbers to it, computing quantile regressions of capex growth one year out, using inputs like financial conditions, policy uncertainty, unemployment, and past capex. The results show that not only has the average outlook for business investment nosedived, but the odds of negative growth have tripled—from 15% in Q3 2024 to 45% today. In other words, the floor just got a lot closer.

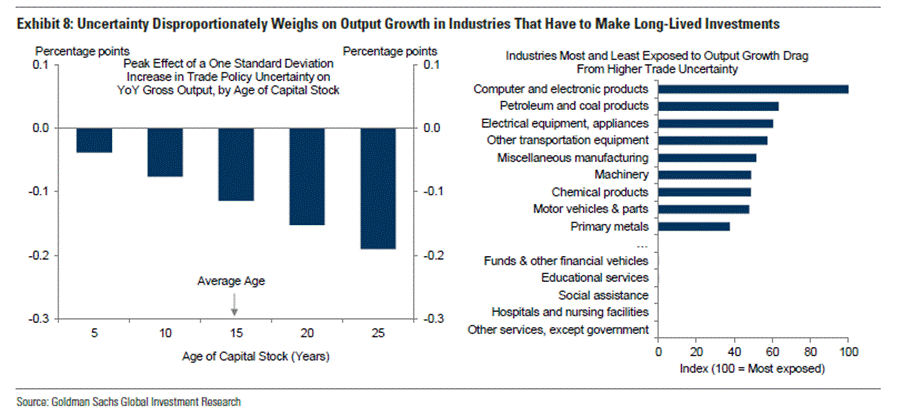

Turns out, uncertainty hits hardest where it hurts most—industries that rely on long-term investments and global trade. Shocking, right? Regression analysis confirms the obvious: the older and more capital-heavy the gear, the bigger the growth drag. On the bright side, if you're in manufacturing—especially in computers, electronics, appliances, or chemicals—you get to lead the race... to the bottom.

The job market is also in for a reality check. Trade policy uncertainty alone is expected to drag down manufacturing jobs by 20k a month—call it the tariff tax on employment. Add in federal spending cuts, and Uncle Sam’s trimming another 25–30k jobs from his own payroll. And that's before you count the 35k monthly hiring freeze hitting healthcare, education, and local governments—the sectors that were doing the heavy lifting post-pandemic. Basically, sectors that bulked up on jobs after COVID are running out of gas, just as D.C. decides to play budget surgeon. Combine all this, and by end-2025, payroll growth could limp along at just 100k a month. Best-case scenario? Labor supply slows enough to cushion the blow. Worst-case? An abrupt hiring freeze and the unemployment rate gets a rude wake-up call.

When it comes to consumer spending, the slowdown is basically baked in. Slower labour supply growth plus rising uncertainty = weaker job and income growth. Tariffs add insult to injury by acting like a stealth tax, eroding real disposable income. But wait, there’s more. Uncertainty’s hitting portfolios too). On top of that, consumer mood is souring. Fear of layoffs is spiking, with the Michigan survey flashing post-GFC levels of anxiety. While these gloomy vibes haven’t had a huge statistical impact historically, common sense says people who think they might lose their job tend to spend less. So, yeah—between job jitters, tariff hits, and shrinking 401(k)s, don’t expect a consumer-led rally anytime soon.

US Economic Policy Uncertainty Index (blue line); University of Michigan Consumer Sentiment Index (axis inverted; red line).

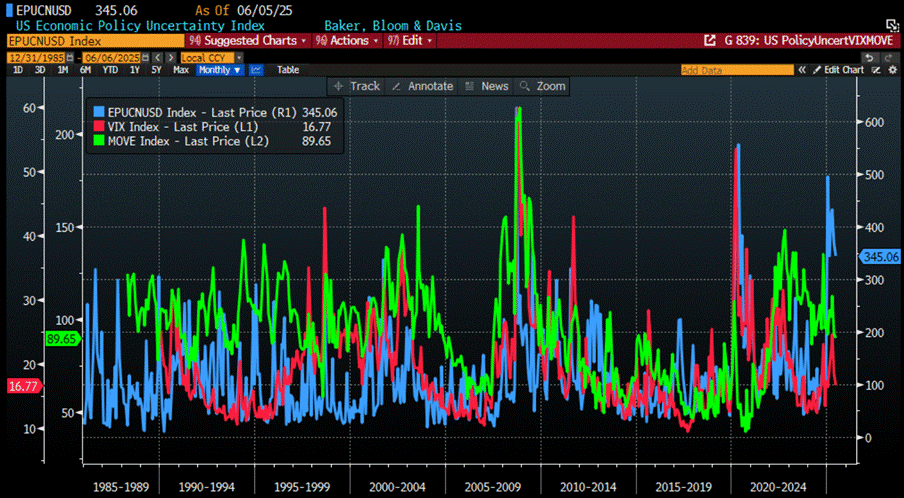

No PhD in economics, finance, or psychology needed here: higher policy uncertainty means one thing for investors—more volatility. And it’s not just stocks getting jittery; bonds take a hit too. When trust in public institutions and the rule of law starts to wobble, the very contracts governments issue—like those trusty Treasuries—start looking a lot less “trustworthy.”

US Economic Policy Uncertainty Index (blue line); CBOE Volatility Index (VIX Index) ( red line); ICE BofA Move Index (green line).

When it comes to the business cycle, rising policy uncertainty is like adding fuel to the inflation fire. Anyone who’s studied cycles knows inflation thrives on shortages—whether it’s demand outstripping supply or plain old distrust in public institutions. So yeah, uncertainty isn’t just noise; it’s pushing the economy deeper into inflation mode.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/from-cycle-to-chaos-the-power-of

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.