LBMA Silver Short Position Now 2nd Largest In History

If COMEX Silver Shorts Are Really Hedged, Then London 'Free Float' Is Only 7.5 Million Ounces

Authored by Chris Marcus for Arcadia; Submitted by GoldFix

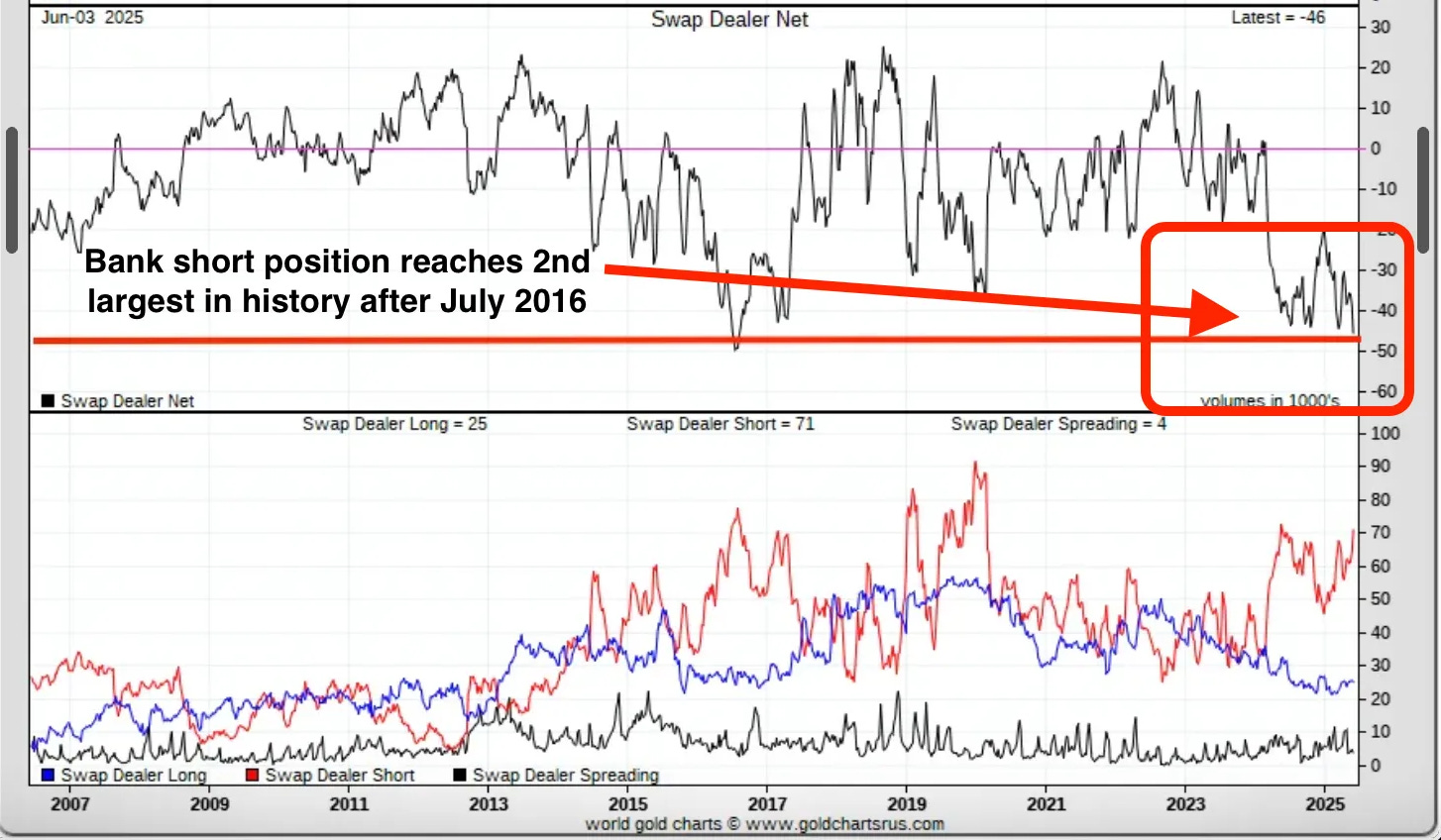

In yesterday's recap I mentioned how the banks short position in the silver market had reached the second highest level in history, and remains only 4,000 contracts away from the all-time record set in July of 2016. And given how the price has risen $2 since the cutoff from last week's report, which extends to the end of today's trading, there's a good chance that the banks once again increased their short position in this week’s reporting period.

LBMA Reported "Free float" (Green) versus Comex Price...

However there was something else that was mentioned yesterday, which I just felt was worthy of taking a closer look at.

Because if you assume that the banks are hedged one-to-one, as you will often hear LBMA market participants say, and compare the amount of silver the banks are short to the LBMA’s vaulted supply in London, that leaves a free float of 7.5 million ounces.

In a market that ran a 210 million ounce deficit last year (when including the ETF inflows).

Of course, those calculations are based on a key premise, which I don't think is likely accurate. I'm referring to the assertion that the London physical holdings and the COMEX contracts are hedged one-to-one. And while I do think there are some offsetting positions, I don't personally believe the positions are completely hedged neutral.

But they’re either offsetting and there's only 7.5 million ounces truly available, or they're not offsetting, and that confirms that at least some banks have a short exposure as we're watching the price go up.

I also referenced former JP Morgan precious metals managing director Robert Gottlieb’s comment about how ‘someone may be taking a huge position and be very exposed.’

[GoldFix Edit- Chris elaborated more on this on his YouTube show. That video is free to all at Bank Silver Short Position Grows To 2nd Largest In History! - VBL]

And I’ll reiterate my same comment from yesterday about how if the banks are fully hedged, what is it that one of them would have been so exposed to?

All of which speaks to what I would suggest remains a rather fragile arrangement in the physical silver market.

I watched a video by Jeff Christian of CPM Group yesterday where he talked about how the main driver for the last part of the spike in 2011 was that there was a large short position that had to be covered before the contract expiration. Which is not to say that we're necessarily about to see a repeat of that, but that those same conditions are also in place right now.

Arcadia Analysis continues here

More GoldFix here