In Chaos We Trust… With Gold We Survive...

The markets have dubbed 2025 not a Jubilee, but a fog—thick with the unknown. Investors fumble through it, sensing chaos, yet naming it uncertainty without grasping its nature. So let’ dissect the case of the Jubilee Year of Uncertainty. Frank Knight, the economist-sleuth of the early 20th century, cracked the code in 1921. In Risk, Uncertainty, and Profit, he drew a decisive line: risk is measurable; uncertainty is not. Risk has odds. Uncertainty has shadows.

"Uncertainty," Knight wrote, "must be taken in a sense radically distinct from risk." The former can’t be tamed by statistics. It defies calculation, resists models, and mocks forecasts. And it is this unknowable element—this Knightian uncertainty—that grants the entrepreneur his profit. Not for taking chances, but for navigating the incalculable. Others, like Keynes and Davidson, followed his trail, deepening the theory. But the essence remains: when the future cannot be plotted, profit arises from daring to act anyway. In 2025, with the fog thick and logic thin, it’s not risk we face—but uncertainty. And that makes all the difference.

https://oll.libertyfund.org/titles/knight-risk-uncertainty-and-profit

This framework—Knight’s grand distinction between risk and uncertainty—is still hailed as foundational in economics and decision-making theory. Apparently, we must now build entire theories around things we can’t measure. As a trader, not an ivory tower academic, investors can take issue with this supposed “uncertainty.” Nothing is truly uncertain—unless you ignore about 5,000 years of human history. But that’s exactly what classical economists do. They dismiss ancient patterns as irrelevant or the data as “inconsistent.” Because, of course, if it doesn’t fit into their Excel spreadsheet, it can’t possibly exist. Add to that the utterly charming notion—first spun by Karl Marx and repackaged by Keynes—that the economy is a wild, random beast that governments must constantly tame. Yes, let’s put the most bloated, short-term obsessed institution in charge of managing “unpredictability.” What could go wrong?

Remember school? In economics class, they said the economy was random and required constant government steering. In physics, meanwhile, they insisted nothing is random. So, either Newton was wrong, or your econ teacher was blowing smoke. As a matter of fact, those who understand cycles know that it wasn’t Newton.

The truth is that the economists and politicians never bothered to study the cycle—they just assumed they could outsmart it. Now, the world gets to enjoy the consequences of that intellectual laziness.

Anyone who's cracked open a real finance book—or better yet, survived a few rounds in the markets—tends to raise an eyebrow at classical economist theory. You know, the type cooked up in faculty lounges far from anything resembling a trading desk.

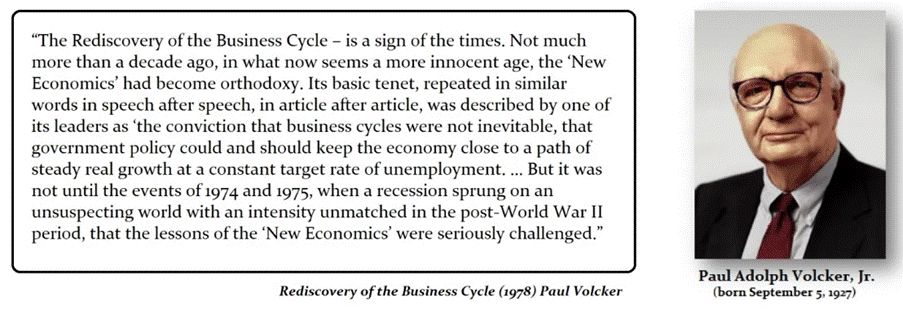

Take Arthur Burns, Fed Chairman when the Bretton Woods system fell apart. After watching the global monetary order collapse like a bad soufflé, he had a revelation: the business cycle exists… and it always wins. Revolutionary stuff, right?

Then came Paul Volcker—the man, the myth, the guy who brought interest rates to nosebleed levels just to break inflation’s kneecaps. He too concluded the business cycle was not just real but relentless. In fact, Volcker, probably the last Fed Chairman who actually understood economics (and owned a suit two sizes too big for comedic effect), famously said the cycle runs about every seven years. Which, of course, completely ruins the classical economist fantasy that recessions are optional and government interventions can sprinkle fairy dust on downturns. So yes, the business cycle exists. The only people who don’t believe in it are the ones still trying to publish another paper proving it doesn’t.

Ever since the Disruptor-in-Chief took the oath on January 20th, 2025, markets got the memo—loud and clear. That very day, the S&P-to-Gold ratio, one of the few indicators with a track record better than Wall Street’s spin doctors, broke below its 7-year moving average.

Translation? The economy isn’t heading for a soft landing—it’s bracing for impact. And no matter how many cheerful charts Wall Street tosses at their clients, the signal couldn’t be clearer: a darker chapter lies ahead.

S&P 500 to Gold ratio (blue line); S&P to Gold Ratio 7-Year Moving Average (red line).

Savvy investors aren’t new to chaos, but policy uncertainty has now soared past even Trump’s first-term drama—impressive, really. The latest anxiety boost? A “reciprocal” tariff plan so vague it might’ve been drafted on a cocktail napkin. Retaliation? Plot twists? More tariffs? Absolutely. The Economic Policy Uncertainty Index (thank you, Baker, Bloom, and Davis) is flashing red, thanks to newspapers stuffed with words like “economy,” “deficit,” and “White House”—basically, a financial horror story in daily instalments.

US Economic Policy Uncertainty Index since 1984.

Thanks to the current US administration’s Olympic-level flip-flopping on tariffs, market uncertainty has gone from a simmer to a full boil. The verdict? Investors worldwide are starting to see the U.S. not as the beacon of rule-of-law finance—but as that unreliable friend who borrows your car and returns it with no gas and a dent. As trust in U.S. institutions wobbles, savvy investors are quietly exiting stage left. Why? Because they understand counterparty risk—and they know there’s one asset that doesn’t need anyone’s signature, bailout, or central bank reassurance: PHYSICAL GOLD.

US Economic Policy Uncertainty Index (blue line); Gold price in USD (red line).

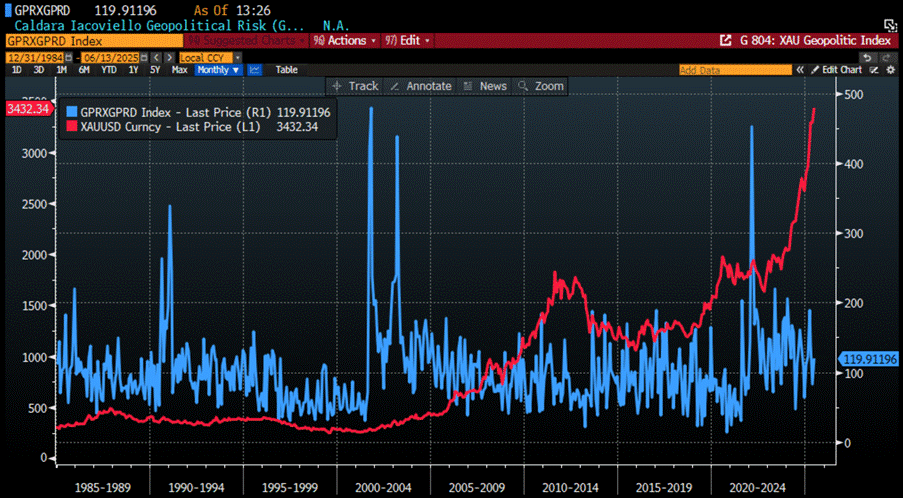

Gold doesn’t care about trade tantrums, legislative gridlock, or the next press conference gone wrong. In fact, it thrives on the chaos. Uncertainty and geopolitical drama? That’s its idea of a spa day.

Geopolitical Risk Index (blue line); Gold price in USD (red line).

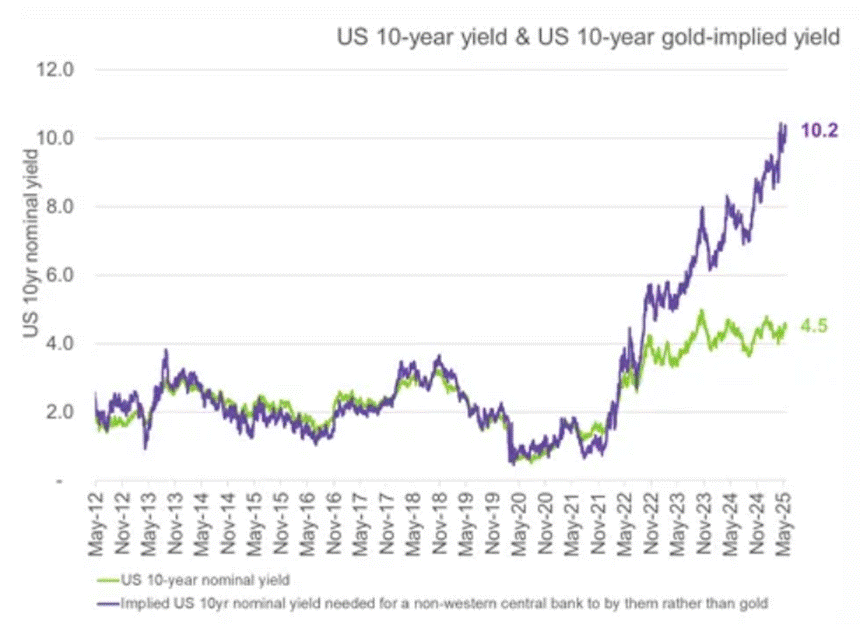

Once upon a time, US Treasuries (aka the 10-year yield) and gold danced a predictable tango—when one went up, the other went down. This neat inverse relationship made gold look like just a fancy inflation thermometer. Then came Q1 2022, when geopolitics crashed the party. The US and NATO decided to weaponize USD assets amid the Russia-Ukraine conflict (which as everyone who doesn’t believe the western propaganda know started thanks to Western proxy false flags). Suddenly, gold and Treasuries stopped playing by the old rules. The shocker? This wasn’t about economics—it was about power. The idea that sovereign reserves were untouchable—even without a default—went out the window. Welcome to the new risk: political confiscation.

Gold Price in USD terms (blue line); US 10-Year Yield (red line) & correlation since 1965.

Wall Street’s old line on gold? Since it pays no yield, the real cost of owning it is the real interest rate. Makes sense—until 2022, gold and real rates played a neat seesaw: rates down, gold up; rates up, gold down. Then came 2022, the USD got weaponized, and “Yellonomics” kicked in—aka the US government borrowing recklessly at the short end of the curve, ignoring the art of spreading out debt maturities like any sane borrower would. Investors started rolling their eyes as America went full banana republic —borrowing like there’s no tomorrow, with zero intention to cut deficits, let alone pay back creditors with ‘real money’. Instead, it just piles on more debt to keep fuelling the Washington swamp and its plutocrats, no matter who they back. Suddenly, the once “risk-free” US Treasury lost its halo. For anyone not a fan of Uncle Sam’s imperial financial soap opera, “risk-free” sounds more like a joke.

Gold Price in USD terms (blue line); US 10-Year Yield (red line) & correlation since 1965.

For reserve managers in Beijing, Riyadh, and beyond the cozy G7 club, the Russian reserve seizure was a wake-up call: access to U.S. Treasuries now depends on political loyalty to Washington. What used to be the world’s safest asset just picked up a shiny new feature—“confiscation tail-risk.”

No official default happened, but for all practical purposes, those frozen reserves might as well have vanished. In this sanctions-fuelled world, the traditional safe haven now comes with a big “terms and conditions apply” sticker.

Holding U.S. government bonds today means facing a real chance of getting locked out of your own money. So, if there’s a risk your savings could be frozen by a government that sometimes sets policy via Truth Social, investors deserve a political risk premium. Guessing the exact number is tricky, but a 5% premium sounds about right. Bottom line: for investors in the global south, US Treasuries need to yield closer to 10%—not the current 4.5%—to compete with good old-fashioned physical gold on a ‘confiscation’ risk adjusted basis.

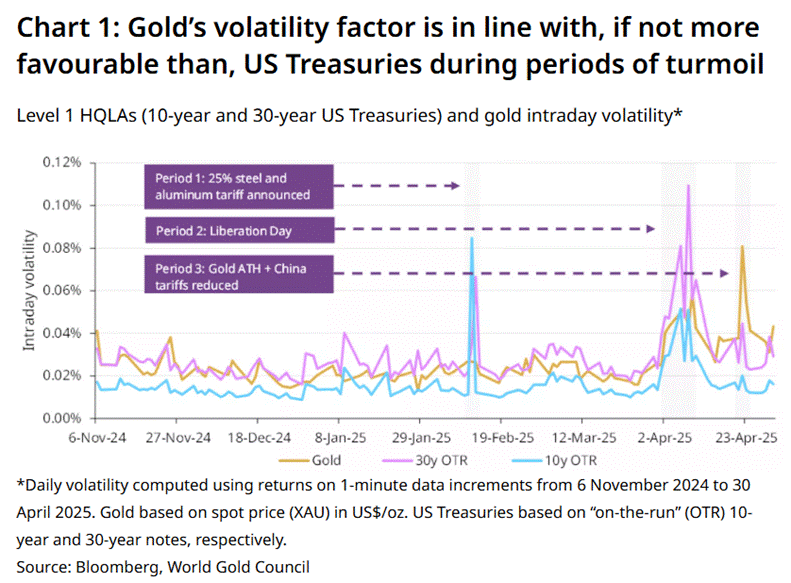

April 2025 was a market drama worthy of reality TV: stocks, bonds, and the dollar all tanking together—something we hadn’t seen since disco was king in 1977—while gold moonwalked to record highs. The culprit? The White House’s surprise “reciprocal tariff” plan, which was about as well-received as a skunk at a garden party. Investors panicked, pricing in stagflation and a recession faster than you can say “tariff tantrum.” Equities crashed, volatility spiked, and safe havens like U.S. Treasuries and the dollar sold off in perfect unison—more typical of emerging markets running for the exits than Uncle Sam’s backyard.

Performance of $100 invested in S&P 500 index (blue line); Gold (red line); USD Index (DXY Index) (green line); Bloomberg US Treasury Total Return Index (purple line) since December 31st, 2024.

Foreign investors are sitting on a whopping $30 trillion in U.S. assets, mostly unrealized gains—basically “house money” just begging to be cashed in when jitters hit. Even small tweaks in currency hedging could unleash a $280 billion flood of dollar selling, putting more heat on yields and the greenback. Bottom line: America’s financial throne isn’t crumbling—yet—but it’s definitely starting to wobble. Unless Uncle Sam gets his act together soon, brace for more headaches in Treasuries and the dollar... and a gold rally that shines brighter than ever.

Indeed, after hitting a peak of $3,500 on April 22, gold took a quick nosedive, triggering algorithmic selloffs by leveraged speculators. But don’t count gold out—Chinese physical demand surged, with their gold ETFs gobbling up over half of global inflows that month.

Meanwhile, in the U.S., managed-money positions are pretty much flat after early-April forced selloffs, meaning no fresh selling pressure from that camp. The structural tailwinds blowing gold’s way? A worsening U.S. fiscal deficit, a weakening dollar, climbing long-term bond yields, and stagflation brewed by the wild tariff bonanza. Gold’s still got its mojo.

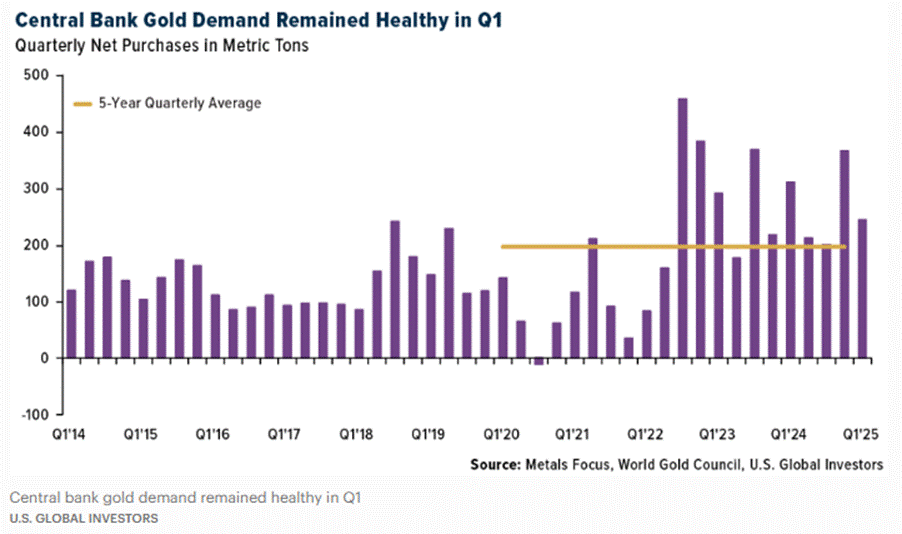

While the ‘Manipulator-in-Chief’ keeps luring YOLO MAGA investors into crypto schemes that conveniently enrich his inner circle, central banks—especially in the Global South—haven’t fallen for the digital snake oil. They know real money doesn’t glitch or tweet. Gold has been their safe haven for decades. In fact, they’ve been leading the charge: in Q1 alone, central banks snapped up 244 metric tons of gold—24% above the five-year quarterly average, according to the World Gold Council. Looks like someone’s preparing for a even more chaotic post-dollar world.

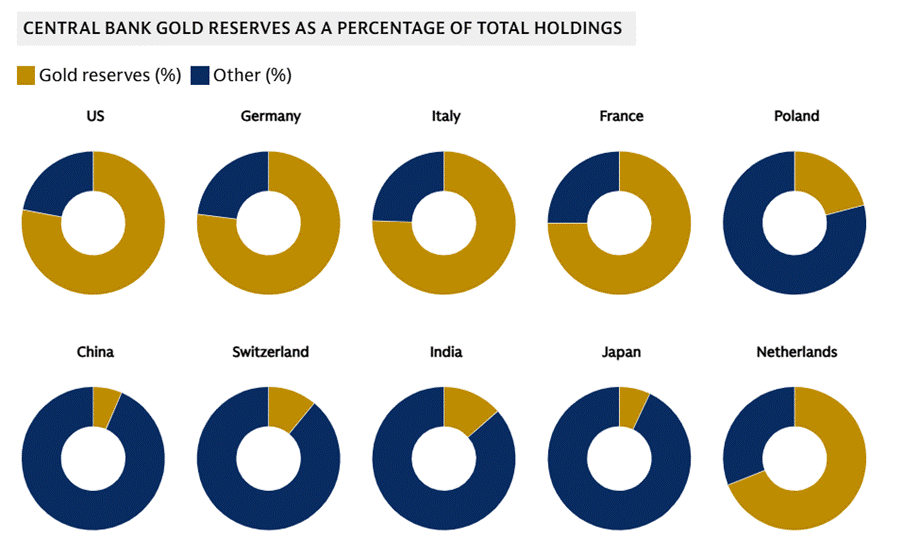

Central banks sit on over $12 trillion in foreign exchange reserves, mainly to diversify, fight inflation, and prop up their own currencies in a pinch. Most of it’s in U.S. dollars—because old habits die hard—but euros and other majors are in the mix too. Gold? That’s where things get interesting. Emerging market central banks are still playing catch-up. China, for example, has less than 10% of its reserves in gold, while the U.S., Germany, France, and Italy sit comfortably with 70% or more. Chalk that up to the hangover from the gold standard days—when money was still backed by something real.

One of the few “developed” countries with zero gold reserves? Canada—forever run by WEF puppets and proudly allergic to hard money. Ottawa dumped its gold over decades, citing high storage costs, no yield, and a preference for “more liquid” assets like U.S. Treasuries and euros. Because nothing says sovereignty like betting the farm on other people’s paper. The sell-off began in the 1980s and accelerated under Finance Minister Paul Martin and BoC Governor Gordon Thiessen. By 2016, the vault was basically empty—unless you count the 77 ounces still kicking around in 2022, which wouldn’t even cover a Toronto condo.

Canada Gold Holding In Million Troy Ounces since 1949.

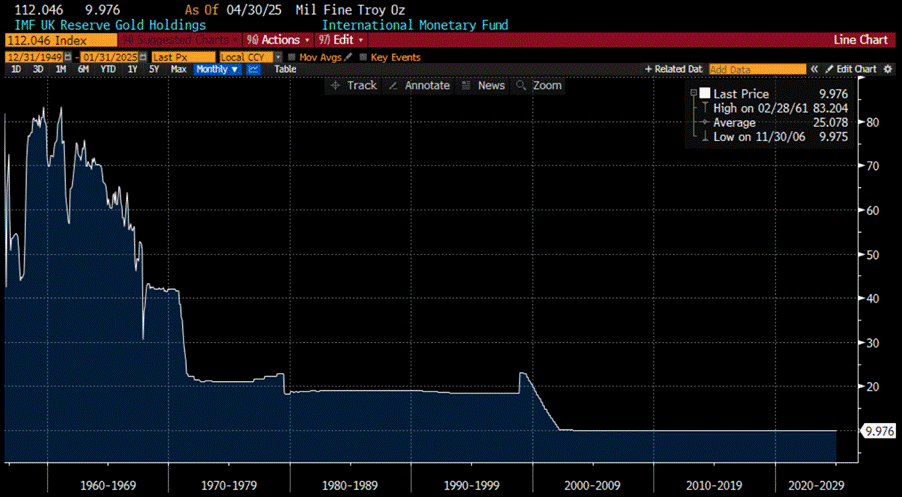

The UK—former empire, now another Davos outpost—hasn't just seen its global clout shrink; its gold reserves have too, thanks to a masterclass in financial self-sabotage. Enter Gordon Brown, Labour’s Chancellor (1997–2007), who decided gold was a barbarous relic best swapped for IOUs. Between 1999 and 2002, he sold nearly 400 tonnes—58% of Britain’s gold—right at the market’s 20-year low, around $275 an ounce. Not only did he dump the metal, he announced it in advance, helpfully crushing the price before the sale. The move was so spectacularly mistimed it’s now immortalized as the “Brown Bottom.” The proceeds? Parked in low-yield bonds and foreign currencies. Billions in lost value, and two decades later, the UK is still sitting on a meagre 9.9 million troy ounces. Strategic brilliance, courtesy of the men who know best.

UK Gold Holding In Million Troy Ounces since 1949.

Meanwhile, on the other side of Planet Earth, central banks in the Global South—tired of playing sidekick in the latest episode of ‘Tumperialism: The Empire Strikes Debt’—have been quietly hoarding physical gold like it’s the final season of fiat. Since 2022, they’ve been adding bullion to their vaults faster than you can say “de-dollarization,” all in a not-so-subtle bid to break up with Uncle Sam’s economic clinginess.

Russia (blue line); China (red line); India (green line) gold holdings in million Troy Ounces.

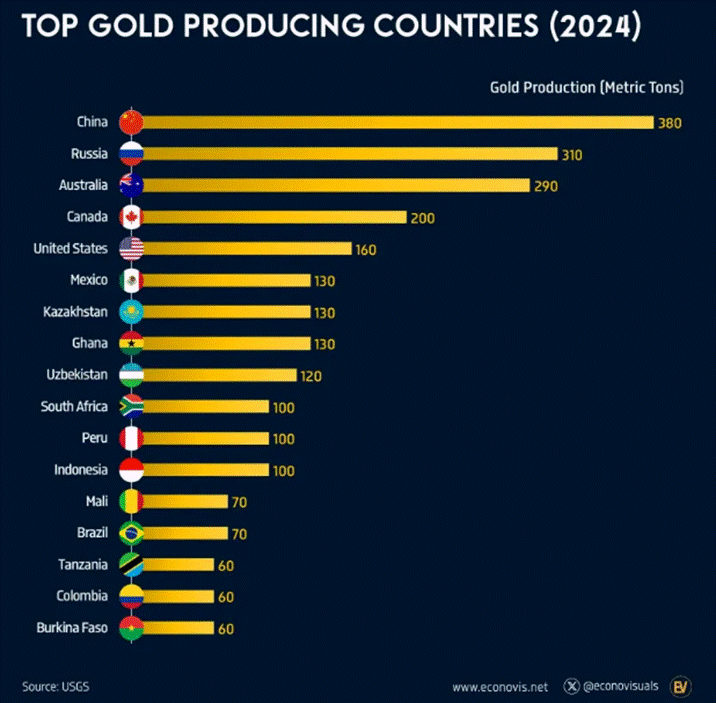

Needless to say, this gold-hoarding frenzy is happening while countries like China and Russia—already sitting on gold mines the size of Texas—are also among the world’s top producers. It's like running a bakery, buying up all the bread in town, and then locking the doors just to watch everyone else panic.

So while the Davos crowd keeps dumping gold like it’s grandma’s dusty China set—too old-fashioned, too shiny, too… un-woke—the real financial puppet masters at the Bank for International Settlements (BIS) just made a quietly hilarious U-turn.

Starting July 1, 2025 (assuming no more delays in this never-ending Basel saga), gold will officially become a Tier 1 high-quality liquid asset (HQLA) under Basel III. Yes, that gold—the one dismissed by Western central banks as a “barbarous relic”—will now sit in the same league as cash and government bonds when it comes to regulatory capital. Turns out the shiny rock isn’t so useless after all.

Basel III was cooked up back in 2010 after the banking system nearly nuked itself, but like any good regulatory soufflé, it’s taken years to bake. While most rules kicked in by 2019, the final act—dubbed Basel III Endgame (because "Final Boss Level" was apparently taken)—was set for July 2025. It's now facing delays, but not before triggering fresh buzz about what counts as real money in a pinch. Gold’s newfound Tier 1 status affects everything from capital requirements to collateral rules to liquidity buffers. Translation: the very people who write the global financial rulebook are quietly making space in the vault… just as the Davos gang keeps selling.

Who said irony was dead?

Of course, the LBMA had to crash the gold party with a dose of fine print. In an effort to swat away the usual online hype (looking at you, goldbugs with YouTube channels), they clarified that while gold does get the royal Tier 1 treatment for capital requirements—complete with a cushy 0% risk weight under Risk Weighted Asset rules—it’s not quite the liquidity superhero some claim it to be. Yes, it can be used as collateral (though it takes a 20% haircut, so not exactly full price at the pawn shop), but no, it’s not officially blessed as a High-Quality Liquid Asset (HQLA) under the Liquidity Coverage Ratio (LCR). And under the Net Stable Funding Ratio (NSFR), banks still need to bring 85% stable funding to the table if they want to hold onto their gold stash.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/in-chaos-we-trust-with-gold-we-su…

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.