Singapore Gold Takes Direct Aim at Comex, LBMA

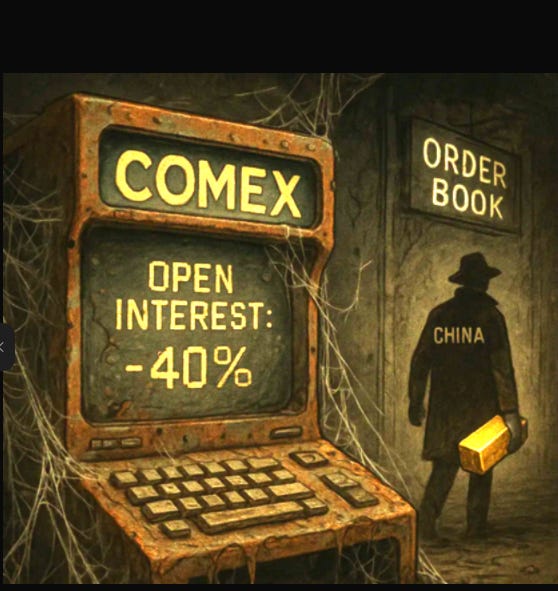

Comex Deathwatch Update

Authored by GoldFix, ZH Edit

As the global financial axis tilts eastward, a new front in the bullion market is opening—centered not in London or New York, but in Singapore. At this week’s premier gold summit, traders, refiners, exchange officials, and market builders assembled with one shared goal: to transform Asia from a physical gold consumer into a price-setting force.

“Asia is taking control — and Singapore is positioning itself as the chessboard on which gold’s next price moves are decided.”

Gold’s Traditional Structure Is Being Challenged

For decades, gold market infrastructure has remained largely unchanged. Physical delivery and vaulting have long been centered in London. Futures contracts—especially the benchmark COMEX contracts—are dominated by New York. This geography has given Western players pricing power, clearing control, and regulatory command.

But as Bloomberg reported in “Gold Market Competition Heats Up as Industry Meets in Singapore,” this balance is beginning to shift. Singapore is positioning itself as the leading contender in a long-awaited eastward pivot. While not the largest hub by volume, the city-state is emerging as a model for gold’s next generation of infrastructure—smaller, more nimble, and strategically located in the time zone where most physical gold is bought.

The Singapore Summit: Not Just Talk

This week’s gold summit in Singapore wasn’t simply a meeting of minds—it was a gathering of builders. Futures exchanges, logistics providers, and bullion banks came prepared to discuss real market architecture. As Bloomberg notes, the Abaxx Exchange is preparing to launch a 1kg deliverable futures contract, backed by investors like BlackRock and the CBOE. The message is clear: price discovery is no longer sacred to the West.

For Asian traders, vaulting in-region reduces logistical friction. For central banks, especially in emerging markets, it offers insulation from geopolitical risk and greater control over reserves. For gold market makers, it introduces competition into a two-center system that has seen little change since Bretton Woods collapsed.

The Structural Implications Are Substantial

The move toward Singapore is not a headline trend—it is a structural development.

Pricing Authority Shifts: Gold priced in Asia means market behavior begins to follow regional flow, not just U.S. rates or European monetary cycles.

Time Zone Advantage: Trading during Asian hours aligns price formation with the part of the world consuming the most physical gold.

Decentralization and Risk Management: Singapore offers a neutral, legally secure, and politically stable jurisdiction that is increasingly appealing to nations wary of dollar-based financial sanctions.

If successful, Singapore’s initiative would reduce the West’s monopoly on gold pricing and settlement. It also introduces new liquidity windows for bullion market participants that bridge the 24/7 cycle more cleanly than existing gaps between London and New York.

Gold Futures as a Geopolitical Weapon

Singapore’s approach is not merely technical. It is strategic. The launch of localized gold futures and vaulting infrastructure is a response to a broader trend: the weaponization of the U.S. dollar and the Western financial system.

As Bloomberg underscores, gold buyers in Asia are not just looking for better pricing—they are seeking autonomy. This is particularly important for nations in BRICS and the Shanghai Cooperation Organization that are either sanctioned or politically distanced from the West.

By reducing reliance on COMEX and LBMA systems, the regionalization of gold contracts becomes a form of financial self-defense.

Three-Stage Projection

This shift, if successful, could unfold across three distinct phases:

- Short Term: Launch of Asia-specific deliverable contracts attracts speculative and regional commercial interest.

- Mid Term: Gradual diversion of volume from Western exchanges toward Asia, especially as vaulting and clearing infrastructure expands.

- Long Term: Emergence of a dual-center gold market, with Asia as a co-equal—if not dominant—hub for pricing, delivery, and settlement.

Continues here unlocked