When bombs start flying, we start buying.

Subscribe to our research. www.gmgresearch.com

When bombs start flying, we start buying.

The S&P looks slightly overextended, especially with elevated geopolitical tension—but this sets up attractive buying opportunities. Tech and infrastructure remain leadership areas.

Let’s revisit our “3 MAJOR THEMES OF 2025”:

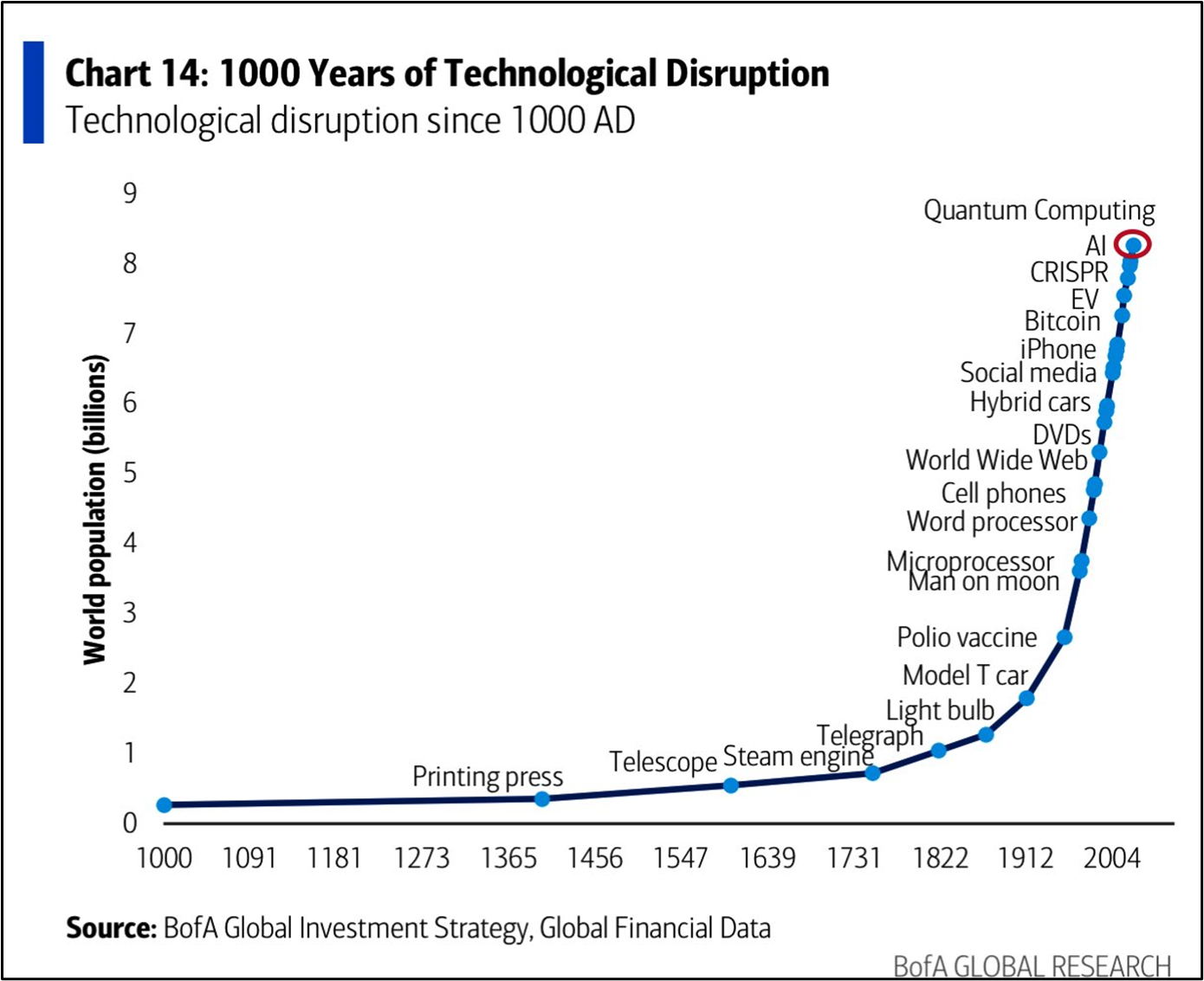

Underestimated AI Impact and Infrastructure Spending;

Rethinking Traditional Investment Approach, the 60/40 portfolio

Bitcoin higher in 2025

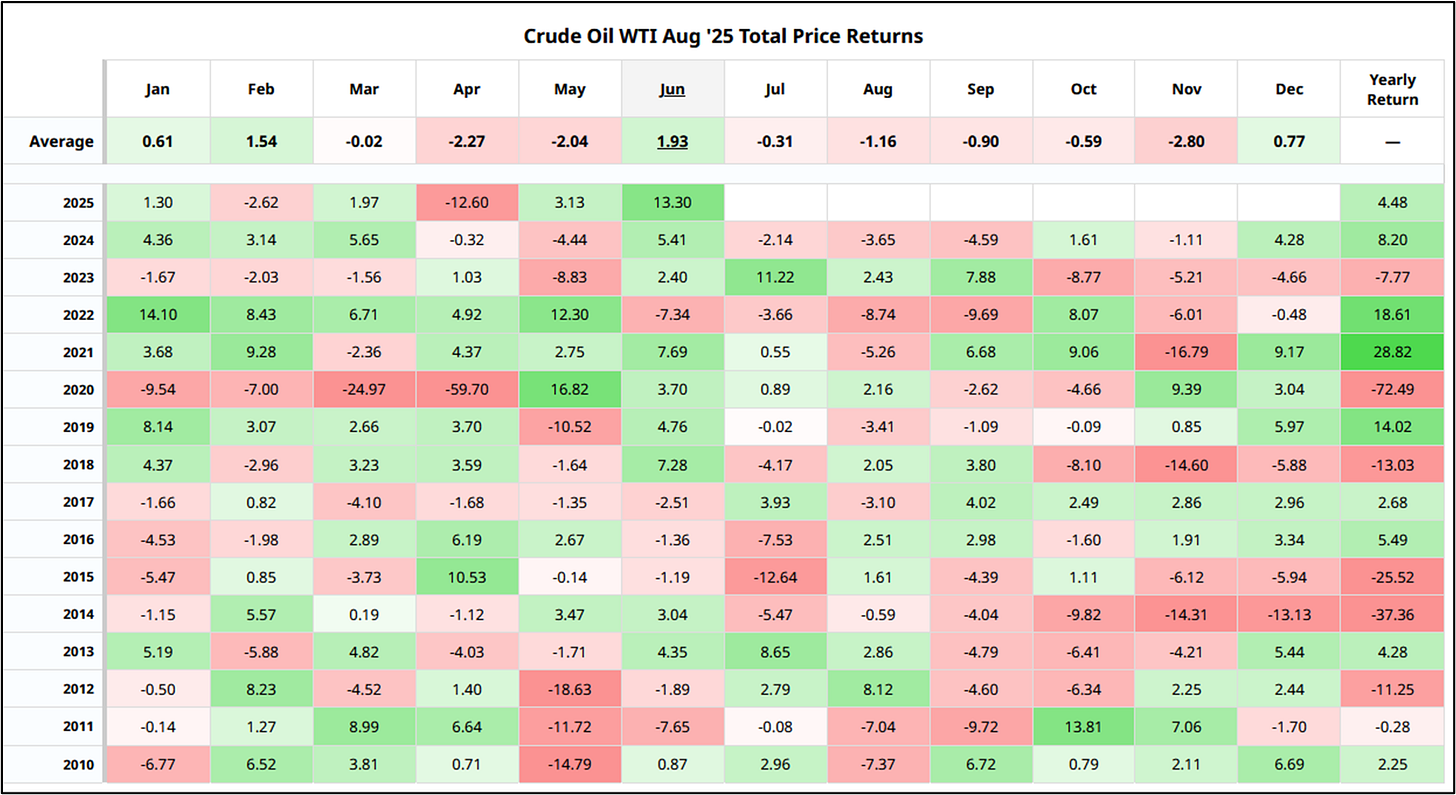

Oil is bid on middle-east tensions, but seasonality peaks in June, and this move likely fades. We’re not chasing crude here.

This week we look at S&P levels, oil, Meta, Tesla, Palantir, Apple and Philip Morris

S&P: % of stocks above their 50ma is a great indicator for overextended indices

S&P: Zooming in, here are the levels to watch closely for opportunity.

US 10yr yield is still trading sideways. Higher oil will bring this up a bit.

But oil is starting to top in its range.

Looking at seasonality, Oil’s best month is June. Fade the rally in oil.

New fresh relative highs for Palantir. Here is a link to our pre-IPO research from back in 2020

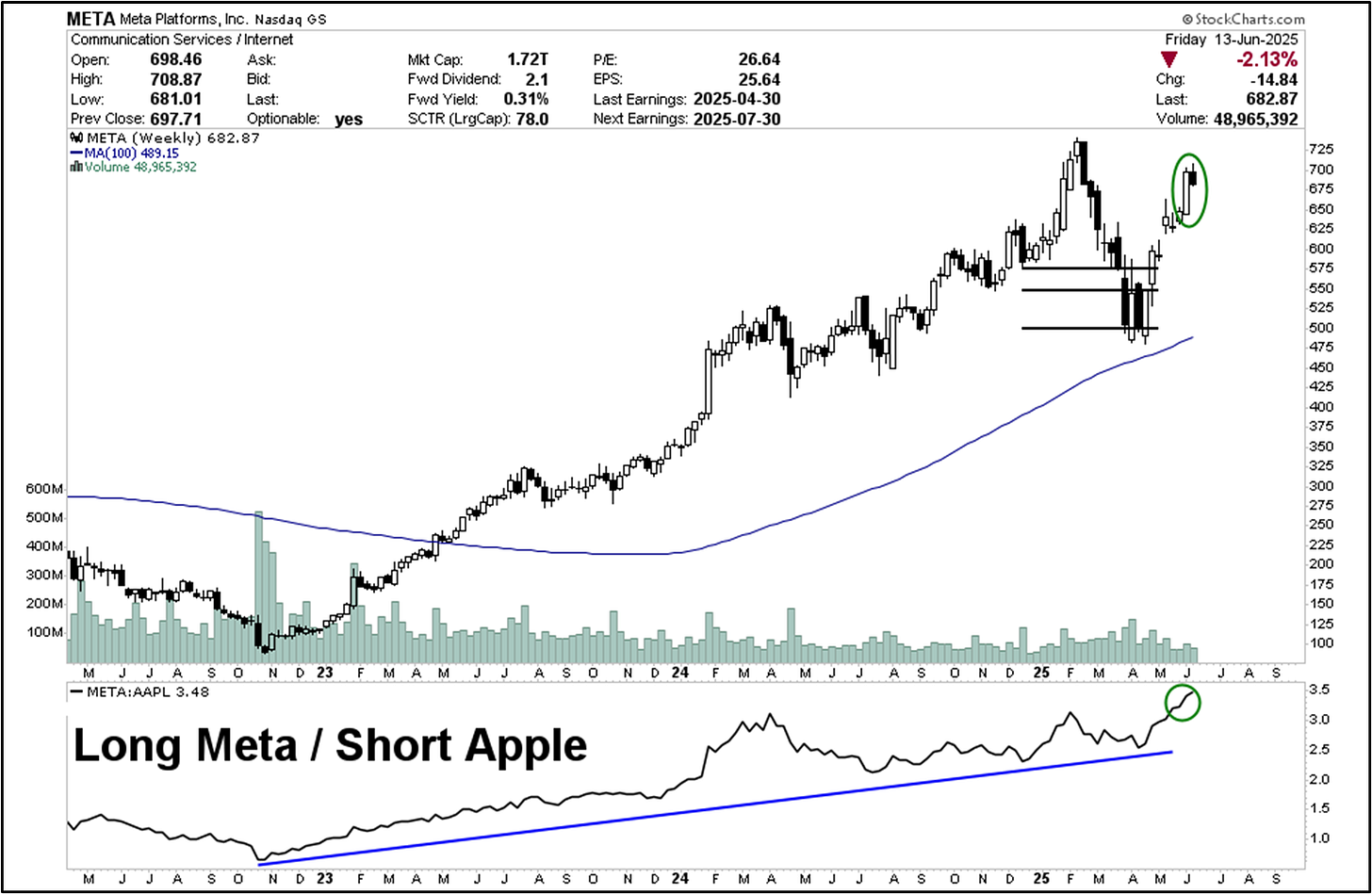

“Scale AI’s Alexandr Wang confirms departure for Meta as part of $14.3 billion deal”. Meta will continue to outperform its peers.

Top in ASTS Spacemobile.

Apple: Vulnerable stock at these levels. Tim Cook needs to go.

Platinum: Doesn’t get any coverage but look at that rally, $950 to $1300 quick.

Tesla continuing to strengthen relative to the overall market.

Philip Morris: Zyn is king.

AI will accelerate this chart 10x.

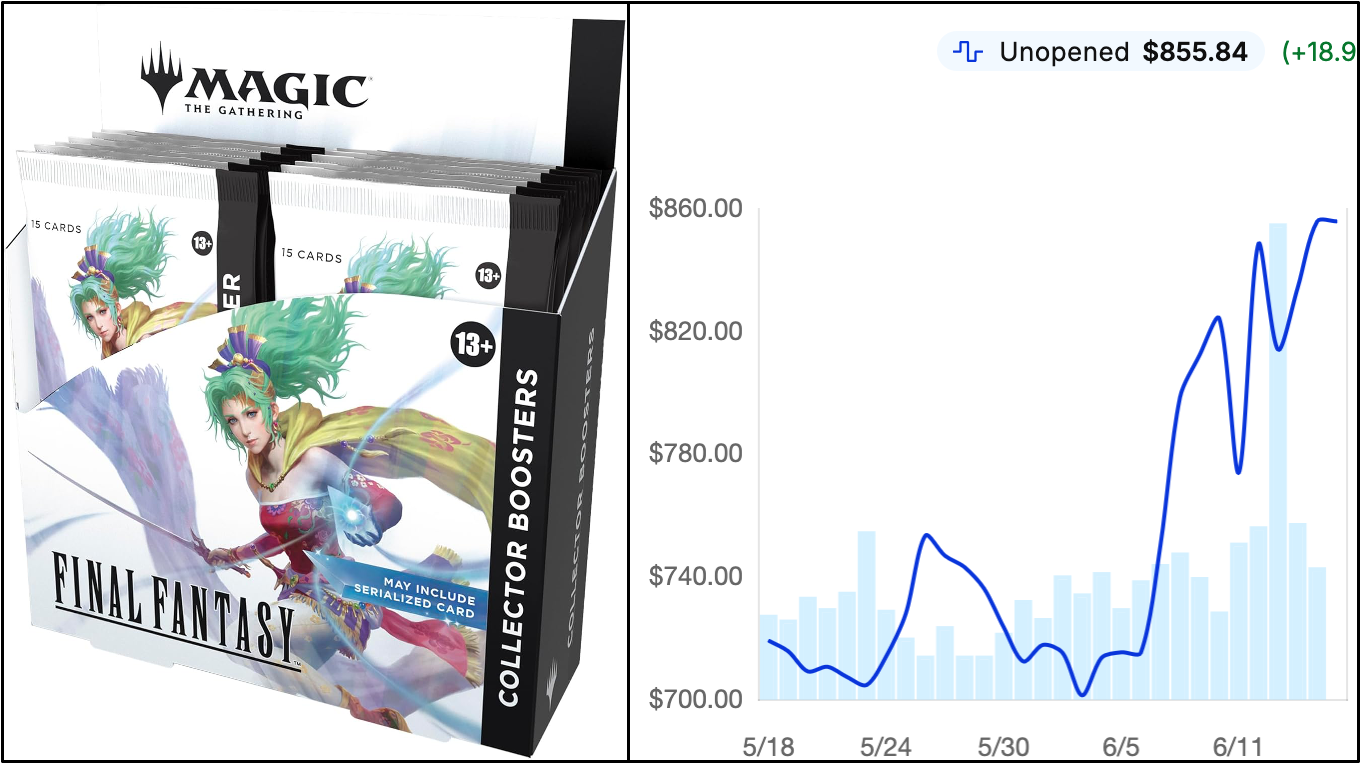

MTG’s Final Fantasy Collectors Box is already at $850.