Silver Supply Shortage To Persist Well Above $50- Copper Exec

Silver Supply Problems Aren't Likely To Get Help From Copper Byproduct Miners

"I saw a note recently it is possible every single ounce of silver will be 100% consumed by industrial need alone The other one is the insatiable need of copper which is only becoming more and more important for the same reasons." -Ian Harris CEO Copper Giant Resources

Authored by Chris Marcus for Arcadia Economics; Submitted by GoldFix

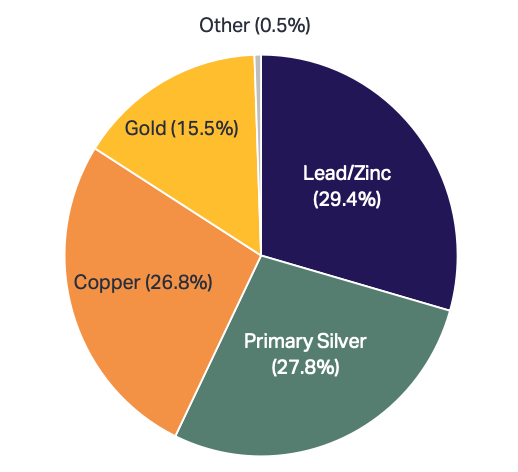

Silver supply remains critically tight, and hopes for relief from copper byproduct miners are misplaced. With nearly 27% of silver production tied to copper mining—and no incentive for base metal producers to increase silver output, even at higher prices—structural shortages persist. Both markets face underinvestment and unrealistic green energy demands. Lets look at how this might effect Silver.

Now that even some of the bulge-bracket investment banks are talking about the glaring issues facing the silver supply, the problem is starting to become slightly more known in the investment community.

Yet in terms of another market that’s of importance to the silver pricing, there’s the copper market. That has some supply and demand dynamics that aren’t all that dissimilar from what’s happening in silver.

Where there’s a deficit, and not really any known plan of how that’s ever going to be addressed (perhaps somewhat similar to the US debt load, and how or if actually repaying it will ever even be discussed). While simultaneously, the world is calling for what is likely unminable amounts of these metals in order to reach the global green agenda goals.

One way to think of the copper relationship, is to imagine that silver sits in the middle of copper and gold. Carrying some of the industrial properties of copper, while also retaining a monetary value like gold.

The copper market is further relevant to silver, because 26.8% of the annual silver production comes from copper mines. And while people who have never thought all that much about the production of commodities might figure that if the supply gets low, we can just dig out more, it doesn’t quite work that way. Especially with the junior portion of both the silver and copper markets still largely struggling to attract the necessary capital to move projects forward.

Also problematic for the silver supply is that your average copper (or lead or zinc) mining executive isn’t going to change a darn thing even if the silver price goes to $50 or $100. That’s just the nature of the way their business model operates.

Another similarity that silver shares with copper is that if the global governments are really going to attempt to meet some of these green energy mandates, that include calling for ‘a tripling of renewable energy capacity by 2030,’ it’s going to require the mining boom of our generation to even get close to those targets. And personally, I think the chances of that happening are about as realistic as Jerome Powell‘s plan to bring inflation down by continuing to cut interest rates.

Fortunately, I actually had a conversation with a copper miner on our YouTube channel today, and we talked more in depth about the problematic supply dynamics in both the copper and silver markets, and what investors would be well served to be aware of.

But hopefully the column, and the video can at least help put some of the key copper/silver dynamics in perspective.

As especially if the economic landscape continues in the current direction its headed, understanding the relationships between the metals will be an invaluable advantage in the years ahead.

Sincerely,

Chris Marcus

Read more at Arcadia Gold and Silver